Profitability can make all the difference for small businesses—it’s the engine that turns cash flow into sustainable growth. Thankfully, there are many different strategies you can use to improve profitability in the short- and long-term. By monitoring and working to increase net profit margin, business owners can make smarter spending decisions, and lay a solid foundation for long‑term success.

What you need to know

- Knowing your net profit margin helps you allocate funds responsibly for expansion, avoiding the trap of over‑spending on unaccounted expenses.

- A healthy profit margin protects your business from downturns, signals reliability to lenders and investors, and allows for reinvesting in employees and marketing.

- Growing your business requires several strategies for increasing profits—such as switching financial tools, automating operations, or reinvesting profits.

Why is increasing profits so important for small businesses?

Profits are just one part of your overall cash flow. Improving cash flow can increase profits, but you won’t know how much of your cash flow is going to expenses until you calculate your net profit margin (NPM), or the percentage of your net income that you’re receiving as profit.

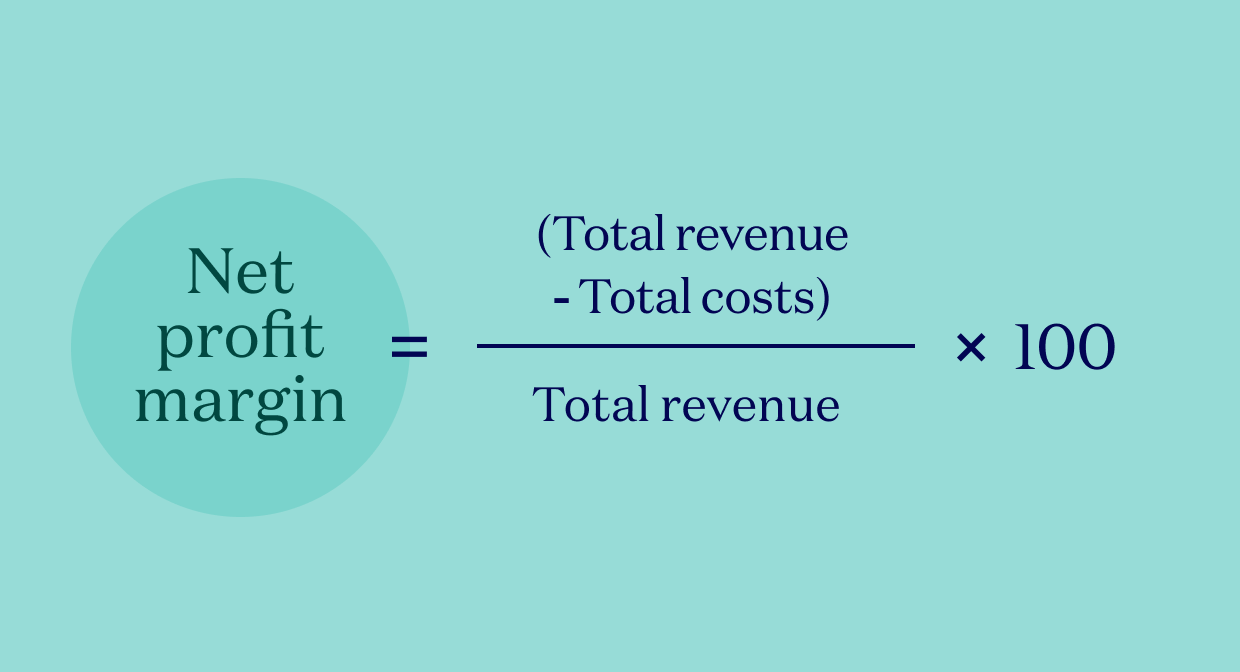

You can find your NPM by subtracting your total costs (cost of goods sold, operating expenses, loan interest, taxes, etc.) from your total revenue, dividing the difference by total revenue, then multiplying the result by 100.

Calculating net profit margin helps small businesses track the impact of financial, operational, or structural changes, and avoid the common pitfall of thinking increased cash flow means a proportional increase in profits. Knowing the difference between cash flow and profitability can help you avoid problems in the following areas:

- Funding growth and expansion: New business owners often make the mistake of racking up new bills when they see an increase in cash flow, then falling behind on repayments they didn’t set funds aside for. Calculating net profit margin requires you to acknowledge the cost of new bills and other expenses, and will show how much you can afford to invest in growth and expansion.

- Financial stability and security: Maintaining healthy profit margins creates a buffer against unexpected expenses, economic downturns, or seasonal revenue fluctuations. Healthier profit margins can be used to build cash reserves to weather turbulence, giving you an advantage over less profitable competitors.

- Attracting investment and financing: Profitability is a key metric that lenders and potential investors use to assess your company. Healthier margins can help your company secure better terms and conditions on business loans and lines of credit, more favorable payment terms with vendors, and greater investments from prospective partners.

- Rewarding owners and employees: Calculating your net profit margin gives you an idea of how much extra profit you can return to your employees in the form of pay increases, bonuses, and benefits.

Bluevine Tip

Browse our list of 24 financial KPIs every small business owner should track.

16 strategies to increase small business profitability

Price increases and cost-cutting might seem obvious starting points to improve profitability, but changes in workplace efficiency, customer demand, and the broader economy can derail these efforts with little warning. Successful small businesses use a combination of more complex strategies to ensure their profit margins remain competitive, regardless of circumstances.

The following strategies provide different paths to increasing profits. Some may deliver quick gains while others require long-term commitment. By choosing a few strategies to consistently guide your financial decision-making, you can increase your small business’s chances at long-term profitability.

1. Increase average order value

Walmart implemented this strategy by offering free delivery on orders over $35 made through its Walmart+ shopping platform. They also offer same-day and next-day delivery, so customers who need something fast are happy to add more items to their shopping carts. In this example, a business increased its average order value (AOV) by creating an order value benchmark for receiving additional perks.

Pricing tiers work similarly, such as when purchasing in larger quantities unlocks a lower per-unit price. For instance, a coffee shop might offer a loyalty card where the tenth drink is free, incentivizing customers to consolidate their purchases. You may have done this with your company vendors.

Here’s how increasing average order value helps increase profitability:

- Generates more revenue from your existing customer base

- Reduces per-transaction costs like payment processing and shipping

- Improves inventory turnover by moving more products per sale

2. Implement upsells and cross-sells

Upselling is encouraging customers to choose add-ons or a more premium version of what they’re intending to buy. The auto industry does this by offering additional features on base models, such as extended warranties that raise the vehicle price without increasing costs for the seller.

Cross-selling is offering products or services that are related to the item being purchased. Amazon Prime does this extremely well: Their product pages include items commonly purchased alongside the item you’re viewing.

Here’s how upselling and cross-selling help increase profitability:

- Increases revenue per customer interaction without significant marketing costs

- Improves customer experience by introducing them to relevant products

- Builds stronger customer relationships through personalized recommendations

3. Build recurring revenue streams

Setting up recurring revenue streams adds consistent monthly or annual revenue while increasing customer lifetime value, lowering the costs of customer acquisition, and boosting profit margins. Subscriptions are the most common example in daily life: to gyms, clubs, streaming services, transit, movie theaters, food delivery, and more. Common B2B examples include retainer agreements and vendor contracts.

Here’s how recurring revenue streams help increase profitability:

- Stabilizes cash flow and makes financial planning more reliable

- Reduces customer acquisition costs by extending customer lifetime value

- Creates predictable revenue that enables confident business investments

4. Expand into new locations and markets

Spending money to expand into a new location may not seem like a good way to increase profitability, but it will pay off if you research your new market ahead of time. Analyze demographic data, competitor presence, and local demand before committing resources to a new market, especially if you plan on local advertising.

There are several ways to do this. A retail business might expand by opening a new location or expanding its online product line. Service providers can target new industries that face challenges similar to those of their current customer base. Start with small test markets before making major investments in new territories.

Here’s how expanding into new markets can help increase profitability:

- Opens new revenue channels without cannibalizing existing business

- Diversifies income sources to reduce dependence on single markets

- Builds economies of scale as operations grow across multiple locations

5. Invest in marketing and branding

Marketing and branding can make a bigger impact on your sales than any change to your product. Innovative marketing can promote the value of your products and services to attract new customers and build loyalty. Strong branding that promotes the value of your products or services can justify higher prices, a clear path to higher profitability.

Here’s how investing in marketing helps increase profitability:

- Attracts qualified leads who are ready to purchase

- Reduces customer acquisition costs through more efficient targeting

- Strengthens brand equity that supports premium pricing strategies

6. Eliminate unprofitable activities

As we’ve established, increased revenue doesn’t automatically mean increased profitability, and some current revenue streams might actually be costing your company. Conduct regular audits of products, services, customer segments, and activities to identify what generates the lowest return on investment.

As an example, consider a manufacturing company that requires additional machines and utilities to customize its products. If the customized products aren’t selling for a premium, it’s best to eliminate, reprice, or restructure the offering, freeing up resources that can be put into higher-margin activities.

Here’s how eliminating unprofitable operations helps increase profitability:

- Redirects resources toward more profitable activities

- Simplifies operations and reduces complexity

- Improves team morale by eliminating unnecessary work

7. Adjust your pricing strategy

Raising your prices is one way to increase profitability without adding new customers, but it needs to be done carefully. Small business pricing strategies should be reviewed regularly to account for increased costs, brand reputation, and market demand. Price increases need to be done strategically after evaluating all relevant data.

There are several pricing models to consider. Value-based pricing reflects customer outcomes rather than costs. Tiered pricing for service providers allows customers to choose their desired service levels. Either of these can work well with the average order value, upsell, or cross-sell strategies listed above.

Here’s how adjusting your pricing can help increase profitability:

- Directly increases profit margins on every sale

- Better aligns pricing with the value delivered to customers

- Provides resources to invest in quality improvements and customer service

8. Cut overhead and waste

Overhead describes business expenses not directly related to producing goods or services, such as rent, utilities, administrative costs, insurance, and other expenses related to maintaining your business. Evaluate these carefully, along with your vendor contracts and cost of goods sold. You can dramatically cut costs by adopting lean manufacturing principles, renegotiating materials costs and supplier agreements, or offering remote work.

Here’s how cutting overhead can increase profitability:

- Lowers fixed costs and improves the break-even point

- Frees up capital for growth-oriented investments

- Improves operational efficiency across the organization

Did you know?

Nearly 4 in 10 small businesses say they have less than one month worth of cash on hand for operating expenses.

9. Improve productivity through automation

Modern efficiency—in both finance and manufacturing—depends on automation. For small businesses, investing in accounting software that automates bookkeeping, invoicing, and financial reporting can hugely reduce time spent on manual processes. For sales organizations, customer relationship management (CRM) can automate follow-ups and track customer interactions. Retailers can automate reordering and stock tracking with inventory management systems. Marketing companies use automated tools to handle email and social media campaigns.

Here’s how automation can help increase profitability:

- Reduces labor costs for repetitive tasks

- Minimizes human error in critical business processes

- Allows team members to focus on customer-facing and strategic work

10. Optimize inventory and procurement

Inventory management directly impacts profitability because it can raise or lower carrying costs and prevent stock shortages. Optimizing procurement processes has the same effect. Consider just-in-time (JIT) inventory strategies to minimize your storage costs by receiving goods only as needed. Inventory management software can help you manage that with sales tracking and automated reordering. Combine this with vendor price negotiations and bulk purchasing.

Here’s how optimizing inventory and procurement helps increase profitability:

- Reduces capital tied up in excess inventory

- Lowers storage and carrying costs

- Prevents lost sales from stockouts or delays

11. Use financial tools to lower expenses

Automating your business expenses with digital financial tools ensures you don’t miss any payments, and you’ll have a digital record of all your transactions. Start with a digital accounting software like QuickBooks or Xero, and a sync-compatible business checking account like Bluevine Business Checking.

Using automated payment systems to pay bills reduces late fees and takes advantage of early payment discounts. High-yield business checking accounts earn interest on operating funds. These tools require minimal setup but save time and money, especially at scale.

Here’s how online business checking and accounting platforms help increase profitability:

- Reduces transaction costs and banking fees

- Earns rewards or interest on necessary business expenses

- Improves cash flow management through better visibility and automation

12. Invest in employee growth opportunities

Investing in your employees’ studies, development, and training enriches their lives and adds value to your business, which will result in greater profit margins. Allowing your team to train in different fields and pursue their own projects creates operational flexibility, fosters innovation, and reduces dependence on specific individuals, all while increasing employee satisfaction, engagement, and retention.

Here’s how investing in employee growth helps increase profitability:

- Improves employee productivity and reduces costly errors

- Increases employee satisfaction and reduces expensive turnover

- Creates operational flexibility through cross-trained team members

13. Focus on your most profitable customers

To improve your net profit margin, focus on earning customers who generate high revenue at a low acquisition cost. Calculate the customer lifetime value (CLV) of different customer segments to identify your highest value customers, then dedicate some marketing and service resources to attract and retain them.

Here’s how increasing customer lifetime value helps increase profitability:

- Maximizes return on marketing and service investments

- Improves resource allocation across the customer base

- Reduces time spent on demanding, low-margin relationships

14. Improve customer relationships

Customer loyalty drives continued profitability through repeat purchases and referrals. You can build loyalty with exceptional customer service and loyalty programs that reward repeat business. For example, the CVS Extra Care Card offers savings on future purchases each time the customer buys something.

Conduct feedback surveys to understand customer needs and respond to their opinions. Personalized communication shows customers they’re valued as individuals, not transaction numbers. Strong relationships reduce price sensitivity and encourage customers to refer friends and family to your business.

Here’s how prioritizing customer experience helps increase profitability:

- Increases customer lifetime value through repeat purchases

- Reduces marketing costs by generating referral business

- Provides competitive differentiation beyond price

15. Seek and implement feedback

Ask for feedback from your employees and customers, as this can yield crucial insights for improving products, services, and operations. Regular surveys help identify pain points and unmet needs. Addressing those can make your brand more appealing and efficient.

You or your management team might miss operational inefficiencies or deficiencies that impede employee satisfaction and productivity. Create an atmosphere where workers feel comfortable providing feedback without fear of reprisal, and address their issues substantively and transparently.

Here’s how implementing feedback from customers and employees helps increase profitability:

- Identifies opportunities to better meet customer needs

- Uncovers operational inefficiencies before they become costly problems

- Builds stakeholder engagement by valuing input

16. Use business loans strategically

Taking out a business loan to cover expenses can work if your resulting profits exceed the borrowing cost. For example, taking out a loan to finance an expansion or new product line will turn a profit.

A business line of credit is another form of debt financing that provides working capital when you need it. This type of financing is often used to purchase seasonal inventory or cover expenses during slow times of the year. A line of credit is reusable after you repay it, so it can fuel growth when employed strategically.

Here’s how a business line of credit or term loan helps increase profitability:

- Provides capital for growth without diluting ownership

- Enables investment in profit-generating opportunities

- Improves cash flow management during expansion phases

Build a foundation for strong profitability with Bluevine Business Checking

Increasing small business profitability requires an array of strategies, and your business checking account should be their hub. With Bluevine Business Checking, you can pay bills, monitor transactions, and see where your money is being spent from one convenient dashboard. Bluevine also syncs with QuickBooks Online,BVSUP-00056 so you don’t have to manage your accounting more than once.

Bluevine also offers high APY on business checking balances, and organizational tools for growth, such as sub-accounts and team credit and debit cards. Open an account in minutes and start building your foundation for increased profits.