Fintechs have completely changed how business owners manage money. Instead of waiting in line at a branch or wrestling with clunky tools, owners now expect fast approvals, real-time insights, and banking that fits how they actually work.

In fact, a 2025 Financial Technology Association survey found that 98% of small businesses say fintech services meet their financial needs better than traditional banks.

This guide breaks down the top fintech players across business checking, payments, bill pay, and cash-flow management so you can quickly figure out which platform fits your needs. We’ll cover pricing, support, and key product features—plus where Bluevine stands out for everyday business banking.

What you need to know

- Fintech banking platforms vary widely in features, security, and customer support, so it’s crucial to match a platform to your business needs.

- Comparing platforms side by side can save time and prevent costly frustrations, helping you choose the best fit for smooth business operations.

- Bluevine stands out by combining the flexibility of fintech with robust features and support for small businesses and freelancers.

Top fintech banking platforms at a glance

Each digital business banking platform comes with its own strengths, features, plans, and pricing structures to suit different business needs. The table below provides a quick overview of some of the top fintech companies for business banking.

| Platform | Suitable for | Top features | Plans and pricing |

|---|---|---|---|

| Bluevine | All-in-one small business banking with high APYBVSUP-00147 | Standard: Free Plus: $30/month or free Premier: $95/month or freeBVSUP-00153 | |

| Mercury | E-commerce teams needing no-fee operating accounts | Basic: Free Plus: $29.90/month Pro: $299/month | |

| Brex | Venture-backed companies wanting spend controls | Essentials: Free Premium: $12/user/month Enterprise: Custom | |

| Relay | Multi-account cash management | Starter: Free Grow: $30/month Scale: $120/month | |

| Novo | Solo entrepreneurs who want free, simple checking without APY | No monthly fees | |

| Rho | Mid-market and funded startups | No monthly fees | |

| Lili | Managing business and personal finances in one mobile platform | Basic: Free Pro: $15/month Smart: $35/month Premium: $55/month | |

| NorthOne | Freelancers and independent contractors managing irregular income | Standard: Free Plus: $30/month | |

| Found | Banking, bookkeeping, and tax tools in one app | Basic: Free Plus: $19.99/month Pro: $80/month |

1. Bluevine

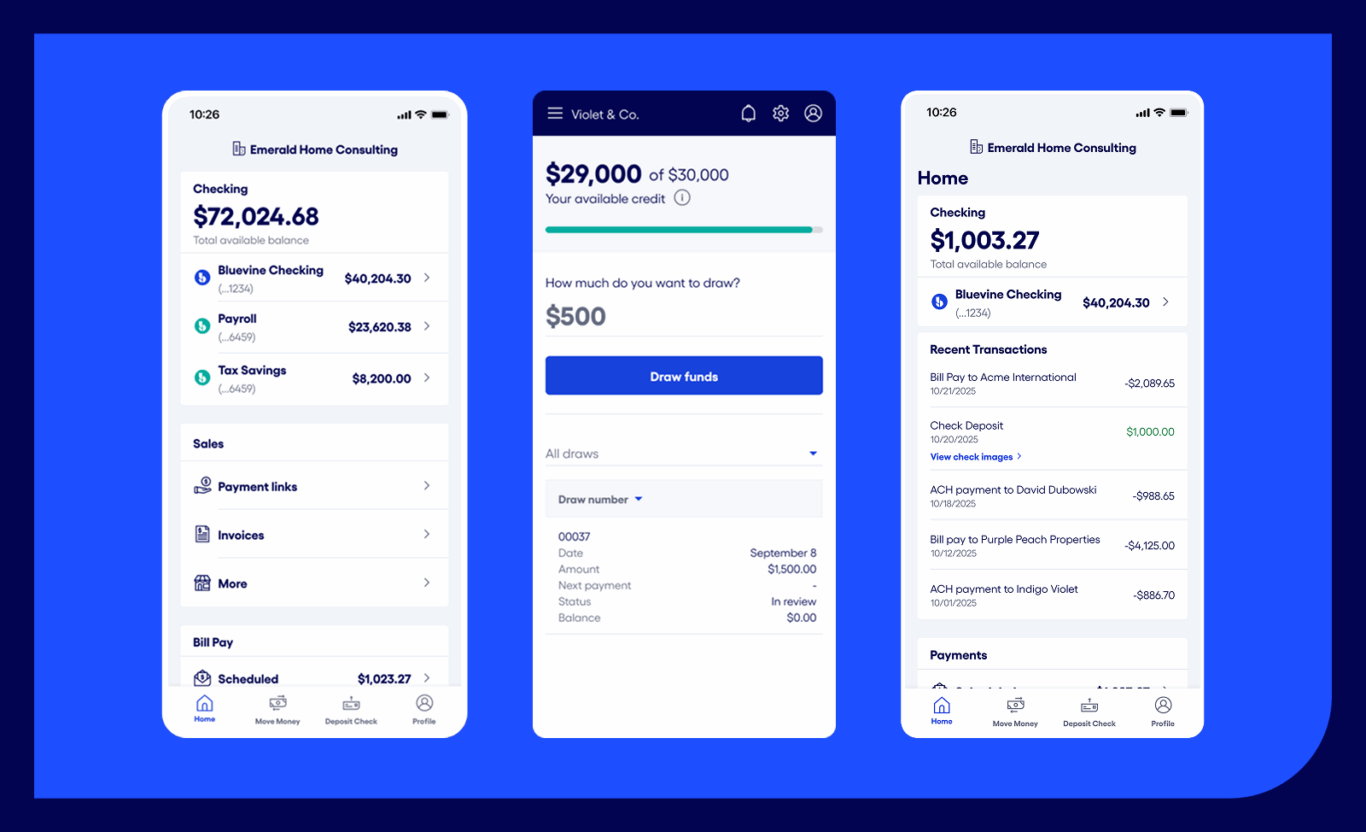

Bluevine is a fintech platform built for small and medium–sized businesses that need straightforward, all-in-one, digital-first banking and high-yield checking.BVSUP-00147 Bluevine Business Checking has no monthly fees on its Standard plan, offers free standard ACH transfers, and allows up to 20 sub-accounts for organizing cash by purpose and streamlining budgeting.

From one dashboard, you can pay vendors by ACH, wire, or check,BVSUP-00137 send invoices and accept payments online or in person,BVSUP-00192 and manage accounts payable. Deposits are FDIC-insured through Coastal Community Bank, Member FDIC and a network of program banks,BVSUP-00108 and the Bluevine Business Debit Mastercard® supports everyday spending for you and your team.

Bluevine also offers a revolving line of credit—up to $250,000—that lets business owners draw, repay, and draw again without a new application.BVSUP-00127

Top features

- Business checking built for SMBs: Manage checking, bill pay, and cash flow from one platform with no monthly fees on the Standard plan and unlimited transactions.

- Sub-accounts for smarter budgeting: Create up to 20 sub-accounts to separate funds for taxes, payroll, or projects, and get more clarity into where your company’s money is going.

- Integrated bill pay and payments: Pay vendors via standard or same-day ACH, domestic or international wire, and even check,BVSUP-00137 plus schedule payments and automate accounts payable directly from your dashboard—no extra software needed.

- Built-in accounts receivable tools: Generate and send invoices or payment links right from the platform to simplify receivables and keep cash flow moving. Plus, accept in-person payments via Tap to Pay.BVSUP-00192

- FDIC insurance: Deposits are insured up to $3 million through Coastal Community Bank, Member FDIC and a sweep network of program banks, offering 12x the standard coverage of $250,000.BVSUP-00108

- Access to Bluevine Treasury: Premier plan customers can access higher yields in a treasury account with no minimum balance. Standard and Plus customers with at least a $50,000 balance are also eligible.BVSUP-00129

- Fast access to working capital: Draw from a revolving line of credit up to $250,000, repay, and reuse funds without reapplying. When linked to a Bluevine checking account, access approved draws instantly.BVSUP-00127

Plans and pricing

- Standard: Free

- Plus: $30/month or free if requirements are met

- Premier: $95/month or free if requirements are metBVSUP-00153

Explore our checking plans to find your perfect fit.

2. Mercury

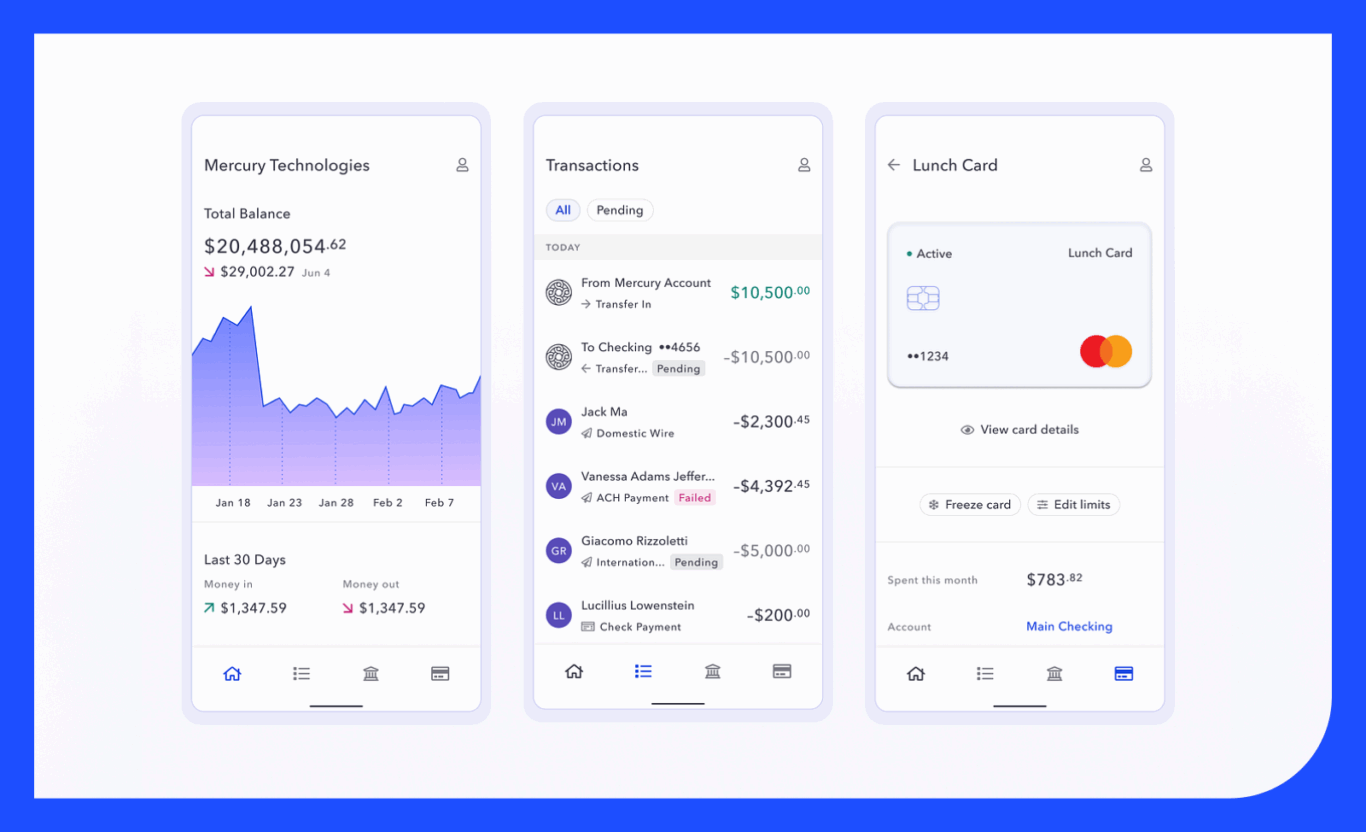

Mercury offers digital-first banking tailored to e-commerce startups and growing tech businesses. The platform combines intuitive design with practical tools such as checking and savings accounts, ACH transfers, domestic and international wires, and easy integrations with accounting and payroll software.

It has no monthly fees or minimum balances, and deposits are FDIC-insured through a network of partner banks.

Top features:

- No-monthly-fee accounts: No monthly fees or minimum balances across checking and savings.

- Integrated payments: Supports ACH, wire, and international transfers for smooth global operations.

- Accounting and payroll syncs: Connects with QuickBooks, Gusto, and other tools.

Plans and pricing:

- Basic: Free

- Plus: $29.90/month

- Pro: $299/month

Did you know?

Bluevine syncs seamlessly with your favorite financial tools, including QuickBooks Online,BVSUP-00056 Xero, Stripe,BVSUP-00180 and more.

3. Brex

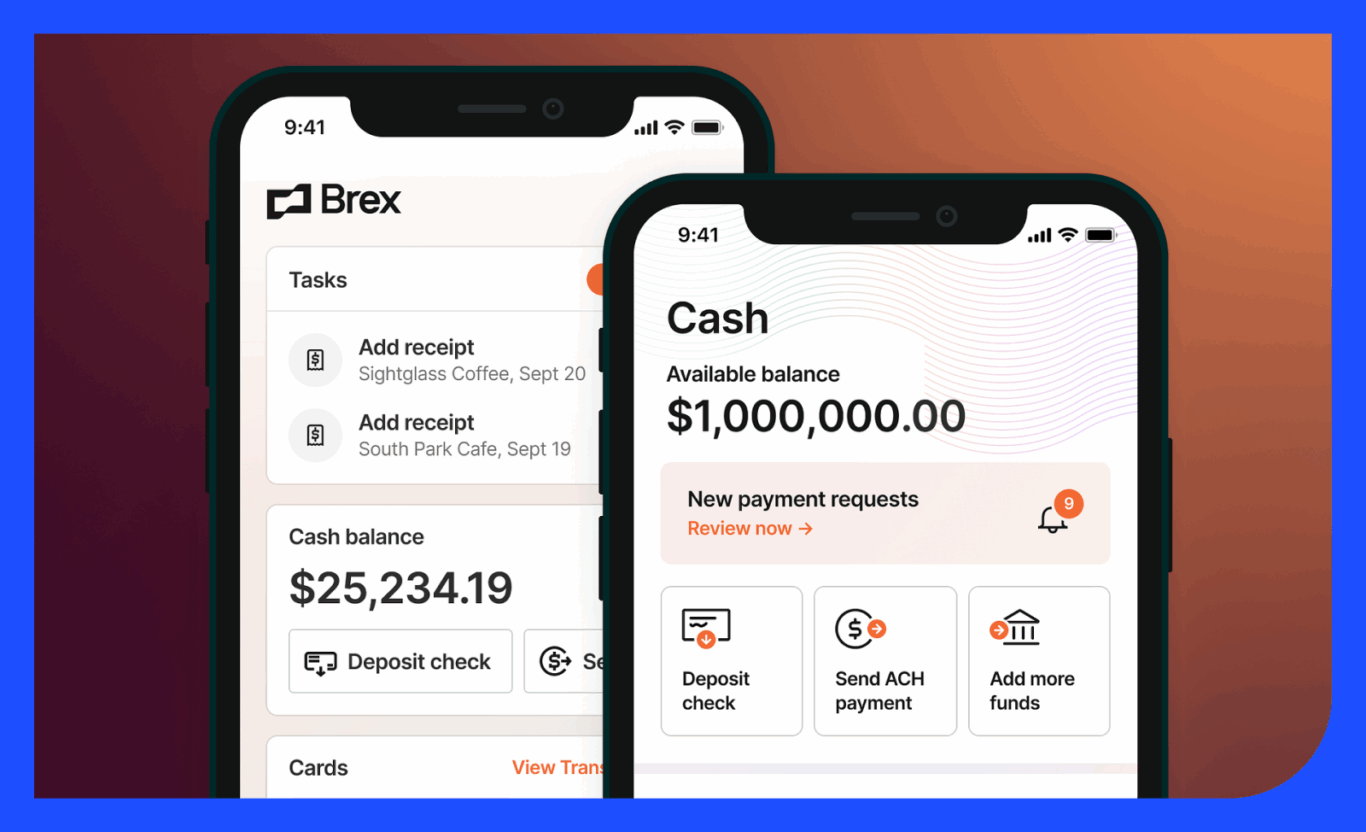

Brex offers a unified financial platform for startups and scaling companies that want to manage spend, banking, and cards in one place. It combines business checking, treasury, and vault accounts under one dashboard with expanded FDIC insurance through partner banks.

The platform supports multi-currency accounts, global payments, and automated expense management, making it a strong fit for companies that operate across markets or have distributed teams.

Top features:

- All-in-one financial platform: Combines banking, cards, and expense management in a single interface.

- Business checking and treasury accounts: Manage operating cash and invest excess funds with expanded FDIC coverage.

- Multi-currency support: Send and receive international payments in multiple currencies.

Plans and pricing:

- Essentials: Free

- Premium: $12/user/month

- Enterprise: Custom

Did you know?

Through Bluevine, you can send and receive international payments in as fast as 24 hours, with simple and competitive pricing.BVSUP-00137

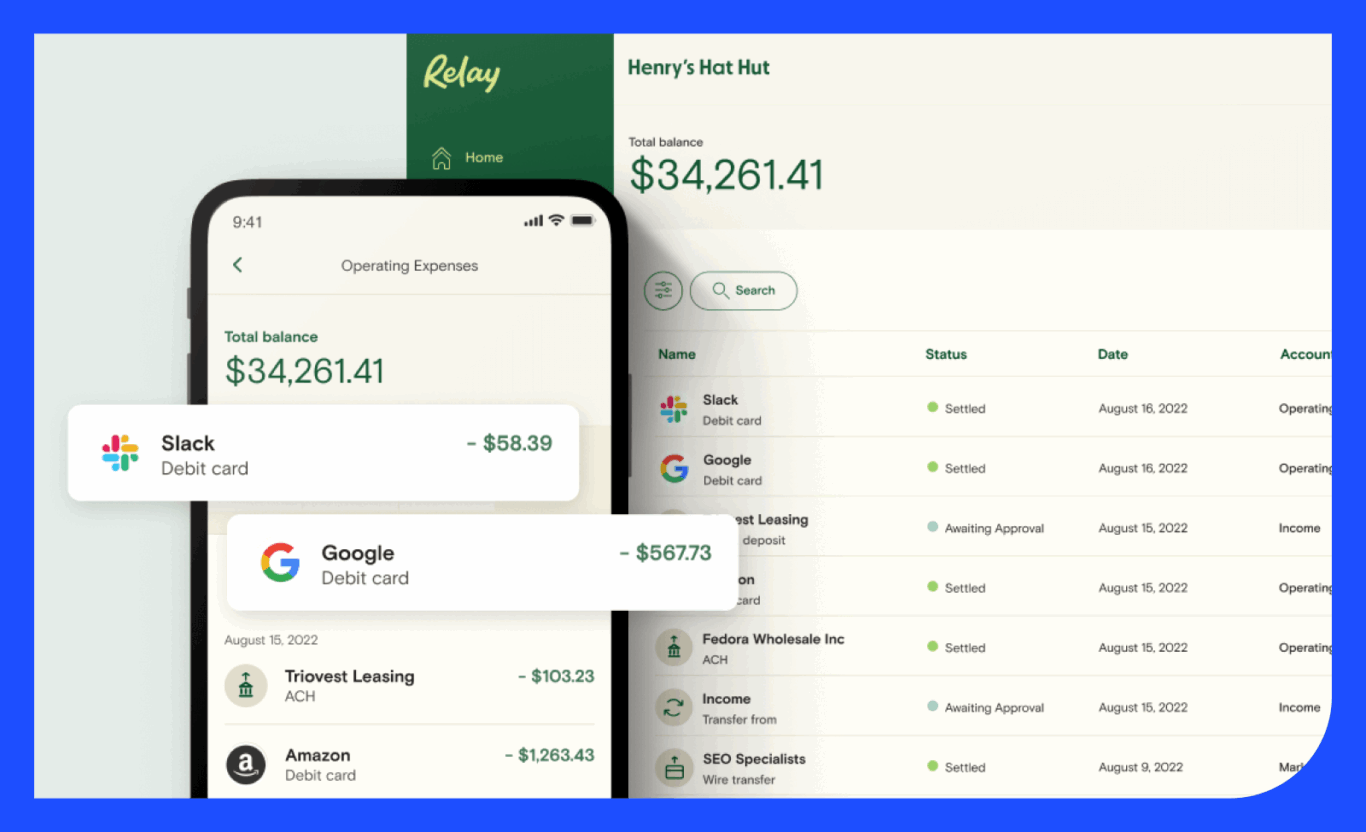

4. Relay

Relay is a digital banking platform built for small businesses that need clear visibility into their finances and control over cash management.

It lets users open multiple checking accounts under one business profile, automate transfers, and monitor spending across teams in real time. Relay also offers physical and virtual debit cards, role-based permissions, and simple integration with accounting tools, making it a practical choice for small teams that manage finances collaboratively.

Top features:

- Multiple checking accounts: Create and manage up to 20 accounts under one business entity for organized budgeting.

- Built-in expense controls: Assign user roles and card limits to keep spending aligned with budgets.

- Automated transfers: Set rules to move money between accounts for payroll, taxes, or savings.

Plans and pricing:

- Starter: Free

- Grow: $30/month

- Scale: $120/month

Did you know?

With Bluevine Business Checking, you can open up to 20 sub-accounts depending on your plan, then set up automatic transfer rules to allocate funds for payroll, savings, owner’s pay, emergencies, and more—basically putting your cash flow on autopilot.

5. Novo

Novo offers a simple business checking account designed for small business owners who want no-monthly-fee banking and easy money management.

The account includes unlimited transactions, no monthly fees or minimum balances, and supports unlimited ACH transfers, incoming wires, and mobile check deposits. Novo Reserves let users set aside funds for specific goals, like taxes or payroll, helping maintain better budgeting control.

Top features:

- Unlimited transactions: No limits on ACH transfers, incoming wires, or mobile deposits.

- Novo Reserves: Allocate funds toward specific goals or expenses directly within your account.

- Integrated tools: Connects with platforms like QuickBooks, Stripe, and Shopify for easier financial tracking.

Pricing:

- No monthly fees

6. Rho

Rho offers a digital banking platform designed for growth-oriented companies that need more than just basic checking. It pairs checking and savings accounts with corporate cards, expense management tools, and bill pay automation.

On one dashboard, you’ll find features like multi-entity cash visibility and up to ~$75 million of FDIC-insured coverage via partner banks (all tailored for teams focused on scaling).

Top features:

- High-limit FDIC coverage: Pools partner bank relationships to extend FDIC insurance far beyond typical limits, giving larger-balance businesses more peace of mind.

- $0 ACH and bill pay automation: Clear out vendor payments, pay multiple vendors, and reduce manual expense tasks with built-in automation.

- Cash management and yield tools: Idle cash can be sent into a treasury account that earns competitive market yields while remaining liquid.

Pricing:

- No monthly fees

7. Lili

Lili is a banking and finance app built for freelancers, contractors, and solo business owners who want straightforward, all-in-one money management.

It pairs fee-free business checking with tools for automatic tax savings, expense tracking, invoicing, and cash back on debit card purchases. Everything runs through a simple mobile experience, making it useful for solo operators who want banking and basic bookkeeping in one place.

Top features:

- All-in-one business banking: Fee-free checking, high-yield savings, up to $3 million in FDIC insurance, fast ACH and wire transfers, and virtual/physical debit cards—all under one account.

- Built-in bookkeeping and tax tools: Automatic expense categorization, invoicing, bill pay, and tax-saving automations that cut down the manual work.

- Integrated business credit building: Real-time credit monitoring powered by Dun & Bradstreet, plus a secured BusinessBuild card that helps you strengthen your business credit profile as you spend.

Pricing:

- Basic: Free

- Pro: $15/month

- Smart: $35/month

- Premium: $55/month

Did you know?

Bluevine reports your line of credit repayment activity to Experian, which helps you establish and build your business credit over time with consistent, on-time payments.

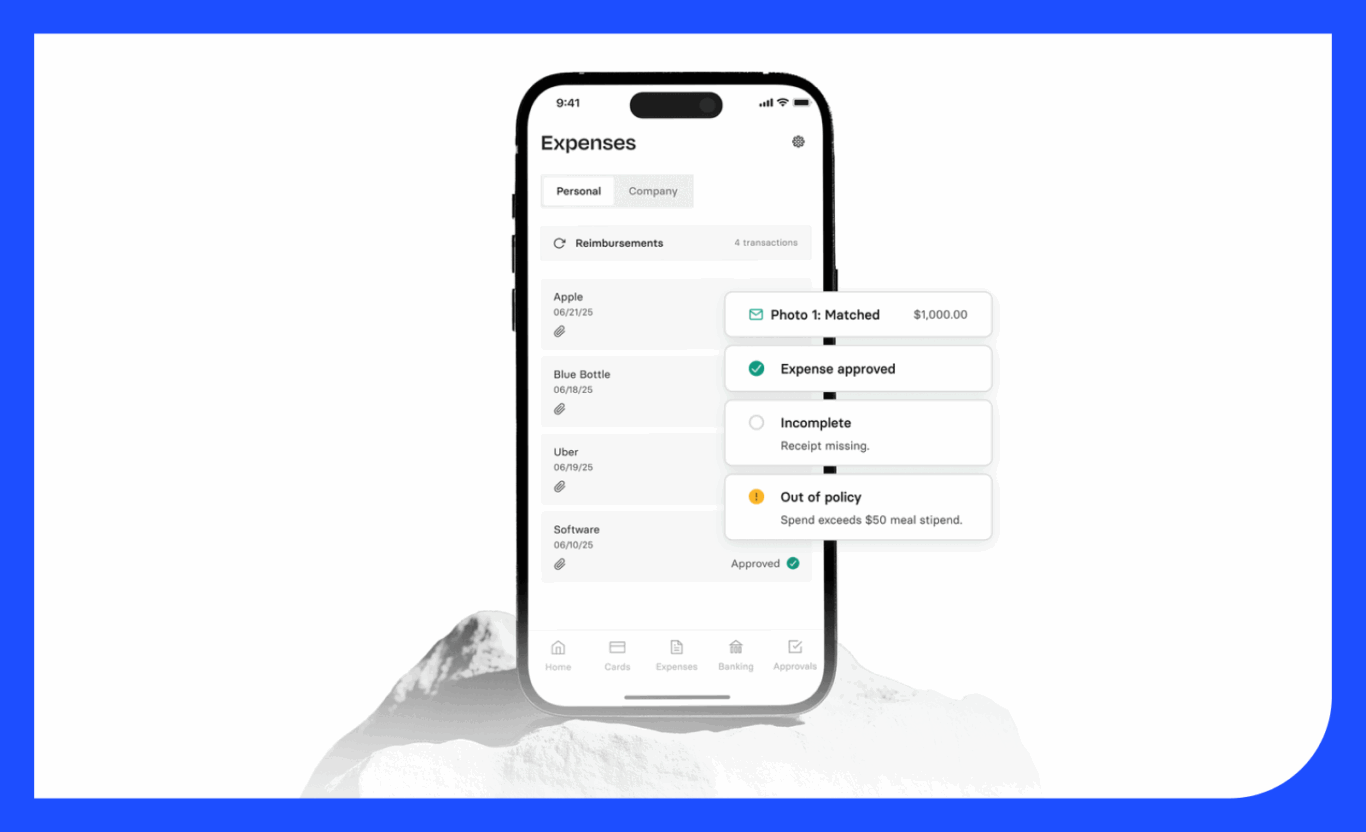

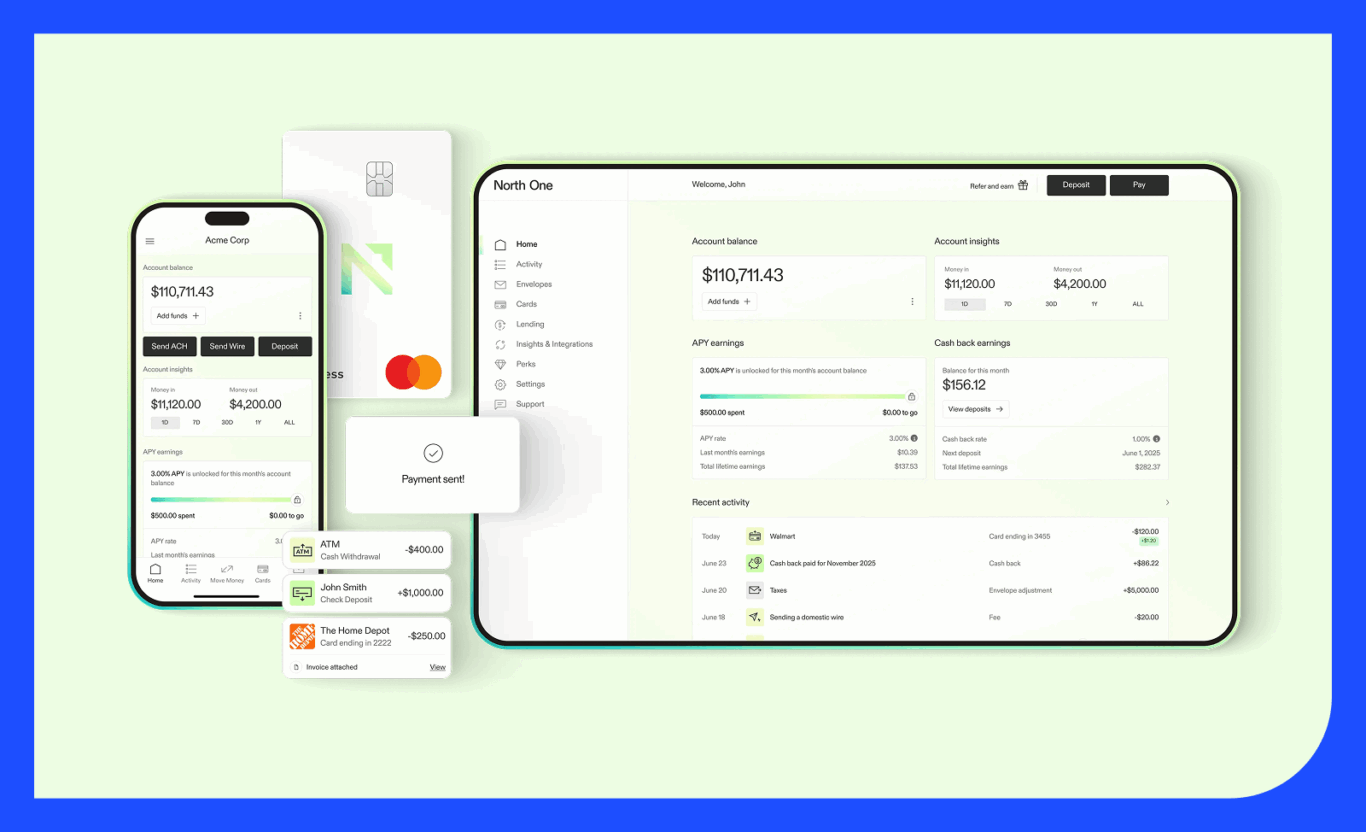

8. NorthOne

North One is a digital-first business banking platform built for startups, freelancers, and small teams. You get simple, no-monthly-fee accounts, no minimum balance requirements, and built-in expense tracking through unlimited “Envelopes.” It also plugs into 50+ popular tools such as QuickBooks, Shopify, Expensify, and more.

Top features:

- No-fee business checking with Envelopes: Unlimited transactions and flexible budgeting tools to organize taxes, payroll, and savings.

- Seamless integrations: Connects with QuickBooks, Shopify, Expensify, and other apps to sync payments and expenses automatically.

- Mobile-first account management: Handle transfers, deposits, and budgeting entirely through an intuitive mobile app.

Plans and pricing:

- Standard: Free

- Plus: $30/month

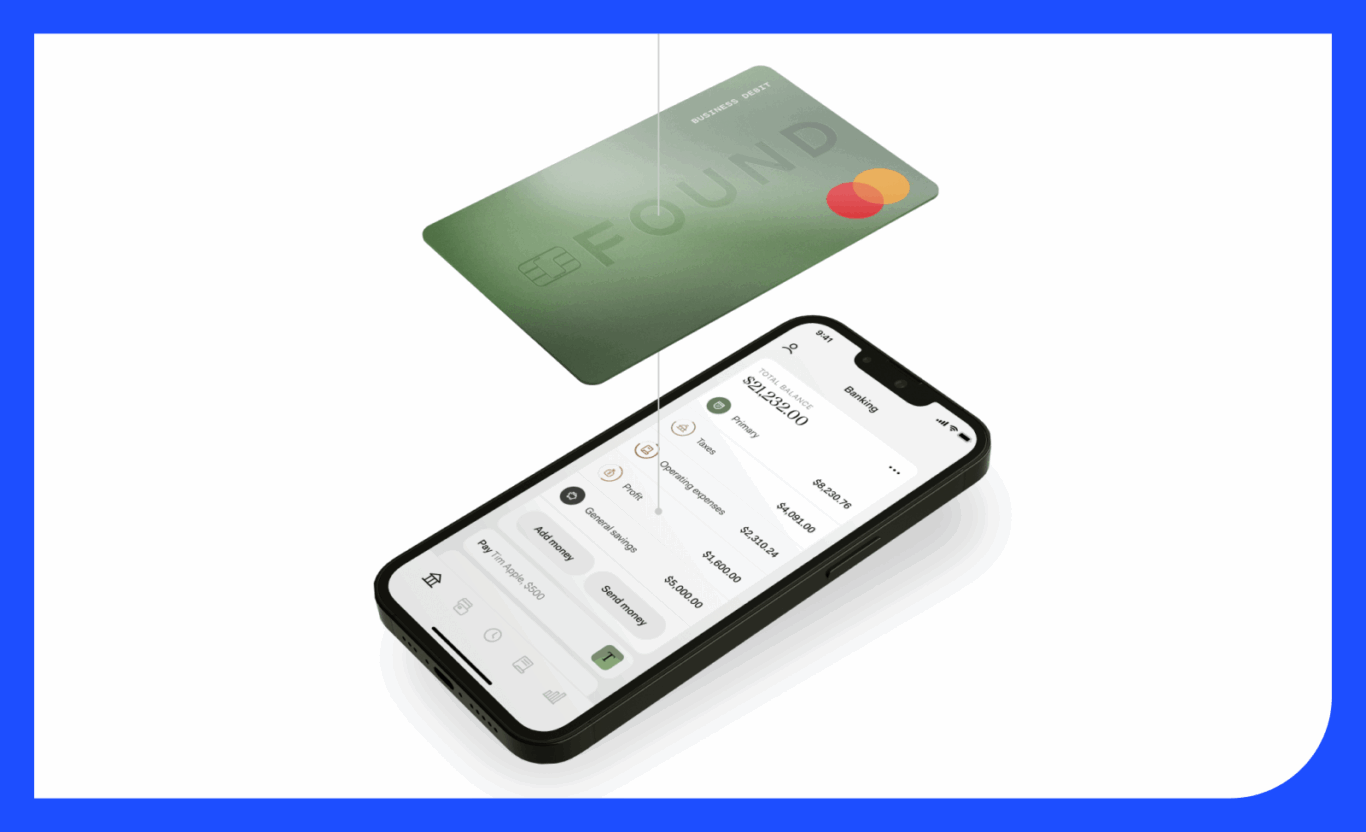

9. Found

Found is an all-in-one business banking platform built for freelancers and self-employed operators who want their finances, bookkeeping, and taxes under one roof. You get a full business checking account with physical and virtual cards, flexible money movement, and “Pockets”—sub-accounts with their own account numbers for budgeting and organizing cash.

It also handles the back office work most solo business owners dread: automatic expense tracking, real-time tax estimates (with money set aside for you), invoicing, and contractor payments.

Top features:

- Virtual cards: Full-featured checking account with a physical debit card plus up to 20 virtual cards, providing the flexibility to manage spending and assign cards to team members or contractors.

- Pockets for cash management: Sub-accounts with their own account numbers that let you save, track, and allocate funds for different business needs, making budgeting and cash flow management simple.

- Integrated bookkeeping and tax tools: Automatic expense tracking, real-time tax estimates with automatic tax savings, and unlimited invoicing, all built into the platform to reduce administrative work and keep finances organized.

Plans and pricing:

- Basic: Free

- Plus: $19.99/month

- Pro: $80/month

Did you know?

With Bluevine Business Checking, you can issue up to 50 physical or virtual debit cards for your main account and sub-accounts.

Why choose a fintech vs. traditional bank?

When deciding where to manage your business finances or access capital, it helps to understand how online business banking compares to traditional banks. Each type of financial provider has strengths and trade-offs depending on your needs:

| Traditional banks | Online lenders | Fintech platforms | |

|---|---|---|---|

| Approval speed | Can take days to weeks, often requires in-person visits | Funding typically within 1–3 days | Often same-day decisions for checking accounts and credit lines |

| Documentation and requirements | Extensive: business plan, tax documents, personal guarantees | Moderate: basic business info and financials | Minimal: streamlined forms, often digital-only, designed for freelancers and small businesses |

| Fees and interest rates | Monthly maintenance fees, overdraft fees, lower APY, variable loan rates | Higher interest rates on short-term loans | Transparent or tiered fees, lower overall costs, higher APY on checking accounts |

| Payment tools | Basic online banking, limited invoicing, slow transfers | Limited, focus is on loan disbursement | Advanced tools: invoicing, sub-accounts, automated transfers, team debit cards, integration with accounting/payment software |

| Access and flexibility | Branch-dependent, limited mobile features | Fully online but less integrated with accounting or payroll | Full mobile and web access, designed for easy and secure multi-device and multi-user management |

| Ideal users | Established small to medium businesses comfortable with traditional banking | Businesses needing rapid capital or loans | Small business, contractors, and freelancers looking for speed, flexibility, and integrated financial tools |

How to pick the right fintech for your business banking

The best fintech provider balances speed, flexibility, and financial tools that actually fit your day-to-day operations. If you want a broader view, consider evaluating other fintech options to see how features, fees, and support compare.

Here are the key things to look for when evaluating a fintech, so you can be sure it meets your business needs as you grow:

- Confirm FDIC insurance and partner bank details: Ensure the fintech partners with FDIC-insured banks so your deposits are protected, and check the maximum coverage limits.

- Separate checking APY from treasury yield: Don’t confuse checking account interest with investment or treasury returns. Verify how much you’ll actually earn on your checking deposits—some fintechs only offer interest earnings on savings accounts, while fintechs like Bluevine let you earn APY on checking.BVSUP-00147

- Calculate total cost of ownership beyond “$0/month”: Look for hidden fees, such as extra charges for wires, ACH transfers, debit cards, or deposits, so you know the real monthly cost.

- Match payment methods to your business: Make sure the platform supports all the ways you pay and get paid, including ACH, wire transfers, checks, and in-person payments—and integrates with the tools you use for invoicing or accounting.

- Check transaction and deposit limits: Confirm daily or monthly limits won’t block your business operations if you process many payments or deposits.

- Test mobile and web usability: Try the platform’s app and website for tasks like sending payments, checking balances, or reconciling accounts to make sure everyday banking is smooth.

- Select tiers that scale and offer waivable fees: Choose an account that can handle more transactions, sub-accounts, or additional cards as your business grows, and see if monthly fees can be waived with activity requirements.

- Look for responsive customer support: Pick a fintech company with fast, knowledgeable support—via chat, phone, or email—so you can resolve issues without losing time.

Choose a digital-first banking platform built for small businesses

Small businesses and freelancers don’t need to rely on traditional branches to manage their finances efficiently. By exploring small business digital banking, you can find platforms that combine speed, flexibility, and tailored financial tools to support growth and simplify daily operations.