Money management is time-consuming. For small business owners, it can be difficult to prioritize your other responsibilities around day-to-day banking tasks, like making sure your money is in the right account so you can pay employees or vendors. One solution to this challenge is to create automatic transfer rules for your business checking account. Automating your money transfers not only saves time but also helps you effectively budget for predictable payments and expenses.

What you need to know

- Automatic transfer rules let you automate money movement between your main account and sub-accounts.

- You can create automatic transfer rules based on percentages and maximum/minimum balances.

- Many small businesses use auto-transfer rules to separate money for profit, expenses, payroll, and more.

What is an automatic transfer?

An automatic transfer is a movement of funds in which you prearrange a condition for the transfer to go through. You can automatically transfer funds within your business checking account—such as from the main account to a sub-account, or from one sub-account to another.

What’s a sub-account?

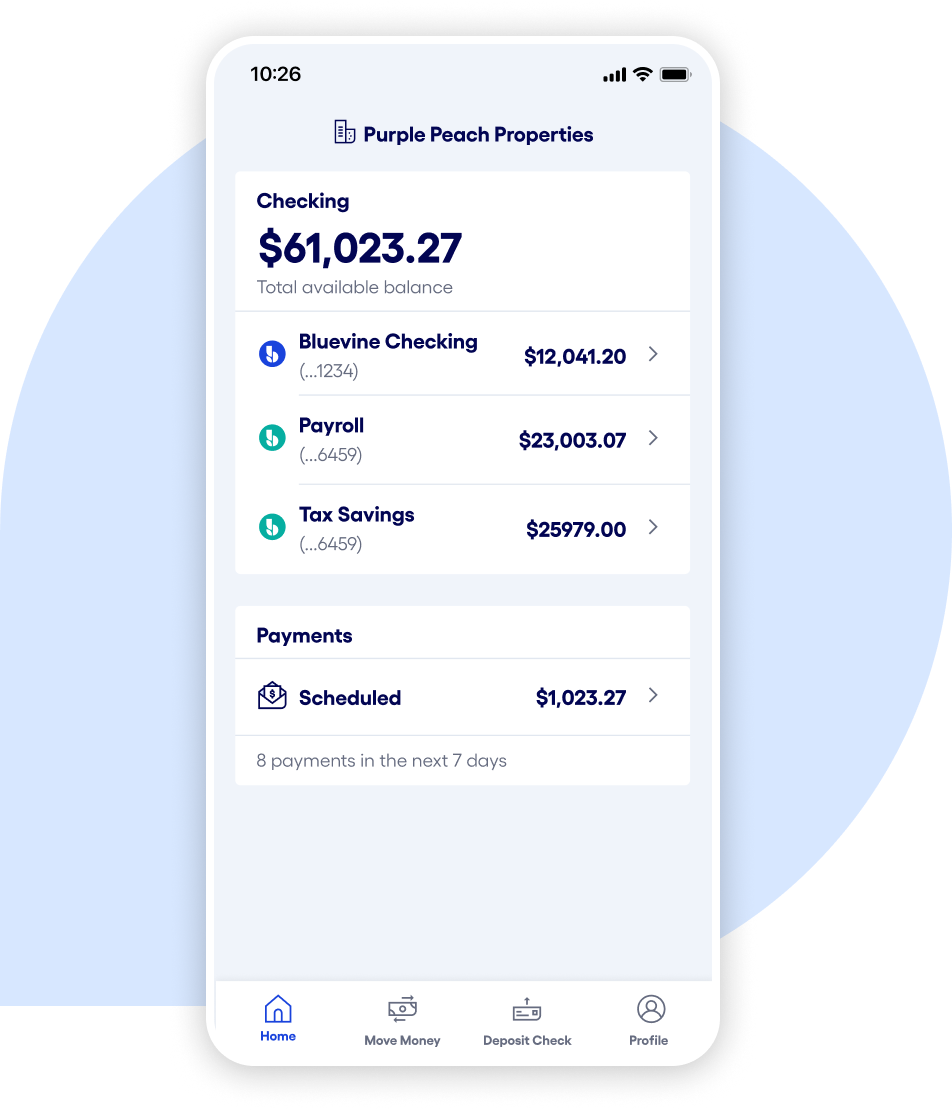

Some online banks allow business checking account holders to create sub-accounts that can be used to help manage and separate the company budget. Funds transferred to these sub-accounts appear separately on your bank statement but count toward your overall account balance. If you have an interest-bearing business checking account, you can earn interest on your total balances across your main account and sub-accounts.

There are several reasons to create sub-accounts. For example, a sub-account can ensure funds are set aside for quarterly tax deposits. You can also separate funds from the general operating budget for investments and profits. Sub-accounts for specific departments and categories can help allocate funds for marketing, travel, etc.

As a reminder, Bluevine Business Checking allows you to open up to 5 sub-accounts with the Standard plan, up to 10 with Plus, and up to 20 with Premier. Explore business checking plans and pricing.

What is an automatic transfer rule?

Automatic transfers require the account holder to set up rules within their business checking account. These rules define criteria—such as target balances, profit goals, or a percentage of revenue—that must be met before the transfer occurs.

3 types of auto-transfer rules that will save you time

Profitability-first method

If you operate under a strategy that prioritizes profits, you can set a certain percentage of each sale to remain in your main account, and automatically transfer the rest to sub-accounts designated for ‘Payroll,’ ‘Tax savings,’ ‘Operating expenses,’ etc. This way, your profits are deducted before your operating costs and other recurring expenses.

Did you know?

With Bluevine Business Checking, you can use automatic transfer rules to streamline your profitability strategy. Simply set up sub-accounts for ‘Payroll,’ ‘Operating expenses,’ and more, then create a ‘percentage-based’ rule that has the maximum balance set to $0. You can choose what percentage you want transferred from your main account (your profits) to your sub-accounts.

Target balance

Your need to maintain a target balance in your main business checking account, enough to cover operating costs and expenses. One auto-transfer rule you should consider is to have any amount above your target balance automatically transferred into a sub-account.

Zero balance

If your business bank account has no minimum balance requirement, you can set a zero balance rule. This means that each month on a specific date, the entire balance over $0 is transferred out of the account. Choose a date after your expenses for the month have been met.

Since you’re typically able to earn interest on deposits in your main account and sub-accounts, you’ll still capitalize on your sub-account balances with this rule.

Save time on everyday banking with Bluevine Business Checking.