Choosing the right banking partner can make managing cash flow and accessing business loans much easier, saving small business owners time and money, and reducing financial stress.

Bluevine offers business checking, lending, and payment products designed to simplify day-to-day banking for growing companies. Below, we compare Bluevine with traditional banks, other fintechs, and small business lending options available in 2026—and highlight the features that help Bluevine stand out, from annual percentage yield on checking balances to integrated financial tools.

What you need to know

- Bluevine offers businesses an all-in-one banking experience with an interest-earning checking account, no monthly fees for its Standard plan, and built-in fraud protection, invoicing, and accounts payable tools.

- Bluevine provides flexible lending options, including lines of credit and term loans via partners, all through one easy application.

- By choosing the right banking partner, you can streamline cash flow management and access much-needed financing to help you run more efficiently and grow the way you want.

Checking and lending options for small businesses with Bluevine

Bluevine offers a streamlined, all-in-one banking experience designed specifically for small and medium-sized businesses. Business owners can take advantage of interest-earning business checking accounts,BVSUP-00147 unlimited transactions, and a Standard plan with no monthly fees, making it easier to manage your money without worrying about hidden charges.

The platform also integrates with popular accounting and payment tools, such as QuickBooks OnlineBVSUP-00056 and Stripe,BVSUP-00180 which helps business owners save time and stay organized. Beyond checking, Bluevine provides a range of financing options, including lines of credit and term loans via partners, giving businesses access to the capital they need to grow.

Business checking: Fintechs

| Company | Pricing | How it compares to Bluevine |

|---|---|---|

| Relay | Free plan available, upgrades require monthly fees | Both Bluevine and Relay offer business banking accounts with built-in invoicing, but Relay only offers APY on its savings account while Bluevine lets you earn APY on checking balances.BVSUP-00147 Bluevine also offers free checkbooksBVSUP-00042 and lending options like a line of credit. |

| Novo | Free | Novo has a single checking plan with no APY. Bluevine offers multiple checking plans that earn APY, plus sub-accounts with debit cards, integrated AP solutions, and free checkbooks. |

| North One | Free plan available, upgrades require monthly fees | North One offers a simple money management tool called envelopes but no advanced features for growing businesses, while Bluevine offers sub-accounts with more control and functionality, easy ways to get paid, and AP solutions built to scale. |

| Mercury | Free plan available, upgrades require monthly fees | Mercury is optimized for venture-backed tech startups and does not offer APY on checking balances or checkbooks. Plus, its Treasury account is only available to those with $250K+ balances. Built for small business owners, Bluevine offers APY on checking, checkbooks, a more accessible Treasury account,BVSUP-00129 and a more affordable Premier checking plan.BVSUP-00117 |

| Lili | Free plan available, upgrades require monthly fees | Lili simplifies banking for freelancers with tax and expense tools, while Bluevine offers higher APY, bill pay, multiple sub-accounts, and business financing for growing companies. |

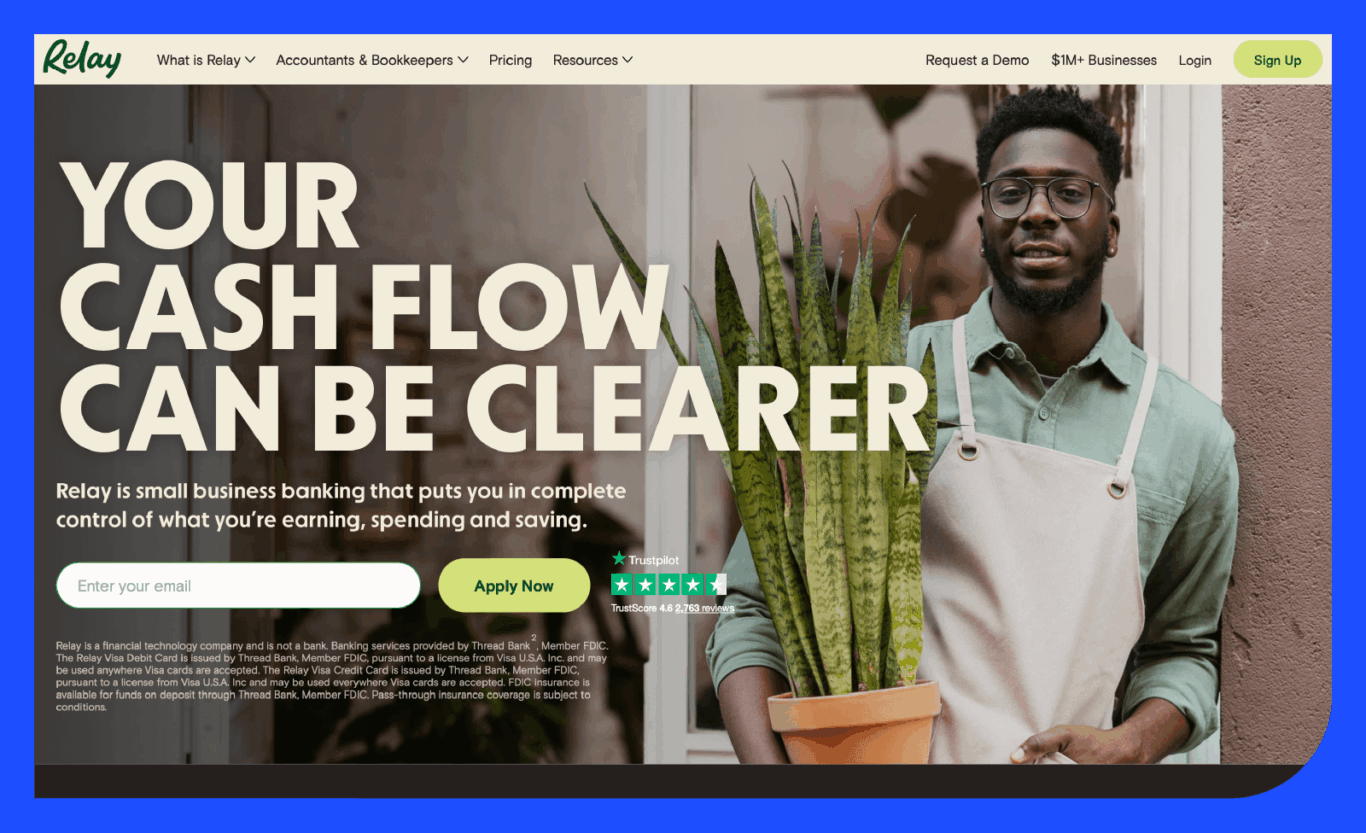

Relay

Relay vs. Bluevine:

- Both Relay and Bluevine have multiple business checking plans, invoicing and accounts payable tools, and FDIC insurance up to $3 million.BVSUP-00108 However, Bluevine offers the ability to earn APY on checking, while Relay only offers APY on its savings accounts.

- Relay customers do not have any advanced fraud protection tools at their disposal, whereas Bluevine customers can block ACH debits from their accounts, enable positive pay, and review transactions before payments get sent out.

- Relay offers some limited lending products through its lending partners, whereas Bluevine offers an integrated line of credit, plus terms loans via partners.

Pricing: Free plan available, upgrades require monthly fees

Relay is a digital banking platform for small businesses and startups, offering multiple checking accounts and a savings account under one business profile. It includes physical and virtual debit cards, customizable user permissions, automated transfers, and real-time cash flow insights.

Bluevine, in comparison, provides all of these core features plus the ability to earn interest on checking balances,BVSUP-00147 faster mobile check deposits, and access to business credit through lines of credit and term loans via partners—giving businesses more flexibility and smoother cash flow management.

Bluevine Tip

A Bluevine Line of Credit can help set your business up for growth. We report your repayment activity to Experian, so you can improve your business credit score for future financing opportunities with consistent, on-time repayments.

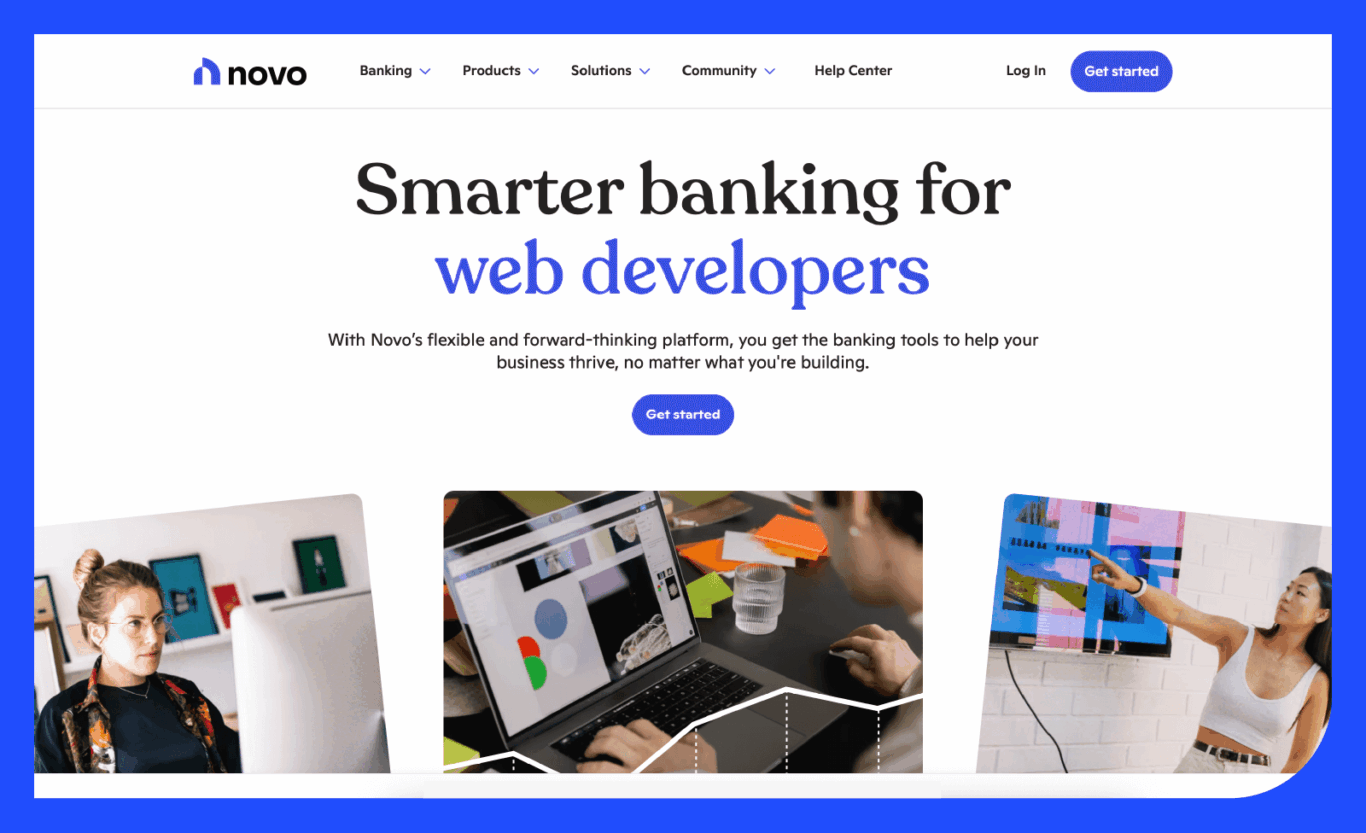

Novo

Novo vs. Bluevine:

- Bluevine offers multiple checking plans with competitive APY and sub-accounts that function like real accounts. Novo has a single plan with no APY and no sub-accounts, though they do offer “Reserves” as a budgeting tool.

- Bluevine provides lines of credit, term loans via partners, accounts payable tools, and lower-fee international payments.BVSUP-00144 Novo is limited to merchant cash advances and third-party payment tools.

- Bluevine includes free checkbooks,BVSUP-00042 same-day mobile deposits, customizable permissions, and multiple debit cards. Novo has fewer card options and longer deposit times.

Pricing: Free

Novo offers a straightforward business checking account with no monthly fees, no minimum balance, and unlimited transactions, along with unlimited ACH transfers, incoming wires, and mobile check deposits. It also includes Novo Reserves to help businesses set aside funds for specific needs.

Whereas Novo doesn’t pay interest on checking balances, Bluevine offers checking APYs up to 3.0%,BVSUP-00116 plus low payment fees and a full suite of money movement options. Bluevine also adds flexibility for team management with sub-accounts, automated transfers, and debit cards with spend controls.

An important difference to note is that Novo Reserves function like envelopes and sit under your main account, while Bluevine sub-accounts function just like your main account, with their own account numbers and debit cards.

Did you know?

With Bluevine Business Checking, you can issue up to 50 physical or virtual debit cards for your main account and sub-accounts.

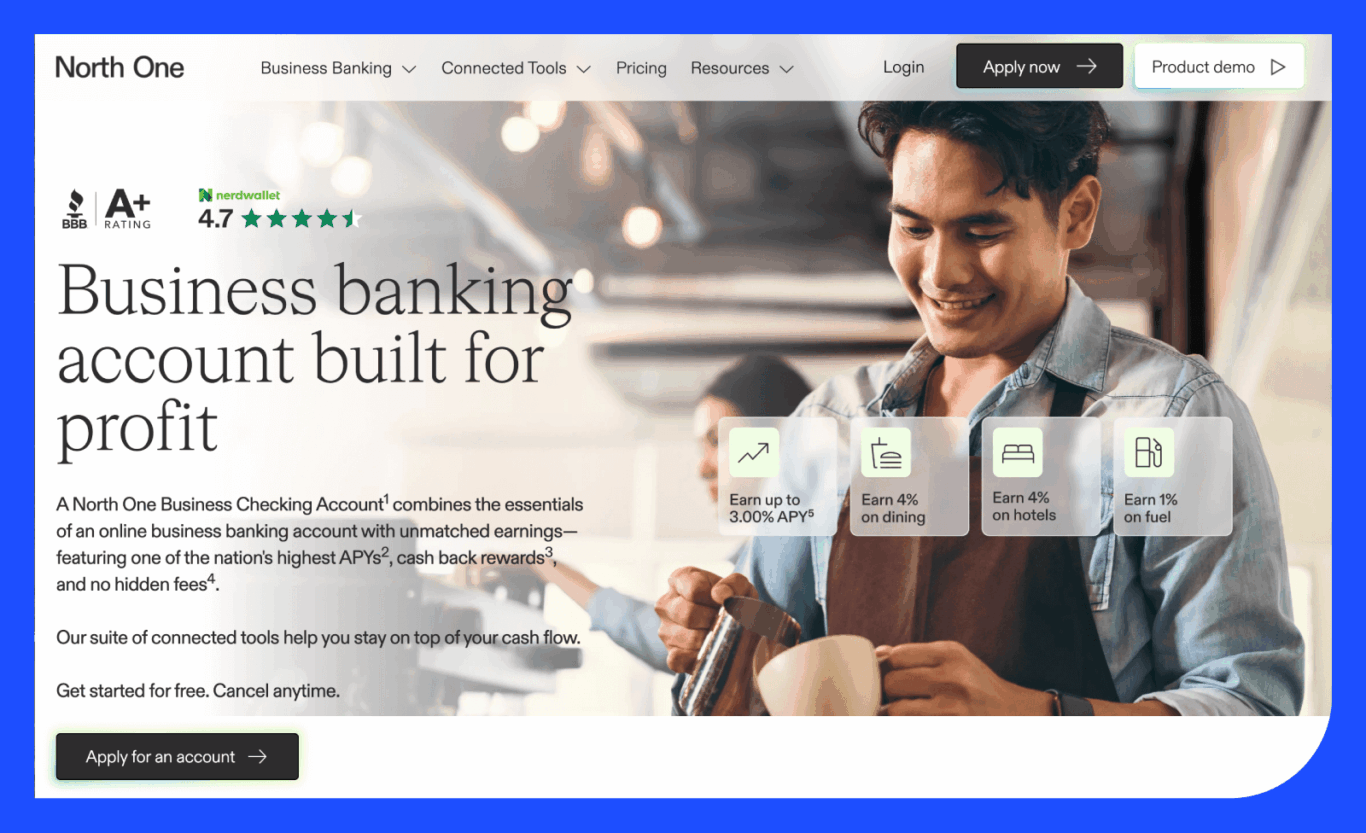

North One

North One vs. Bluevine:

- North One and Bluevine both offer multiple business checking account plans that earn interest, including a plan with no monthly fees.BVSUP-00122

- North One lets you budget with unlimited “Envelopes” that sit within your main checking account, while Bluevine lets you add up to 20 sub-accounts, each with a unique account number.

Pricing: Free plan available, upgrades require monthly fees

North One is a digital-first banking option built for startups, freelancers, and small businesses. It offers no monthly fees or balance requirements, expense tracking through unlimited “Envelopes,” and integrations with more than 50 popular external tools, like QuickBooks, Shopify, and Expensify.

Bluevine’s digital-first banking platform is also designed for startups and small businesses, with a no-monthly-fee Standard plan, as well as upgraded checking plans, sub-accounts, built-in invoicing and bill pay, and convenient software integrations.

What sets Bluevine apart is the way sub-accounts work: North One’s “Envelopes” do not come with their own account numbers, so they’re more for organization than function. Bluevine’s sub-accounts have unique account numbers, automated transfer rules, and even their own debit cards, so you can use them to organize your finances, send or receive payments, and control employee spending.

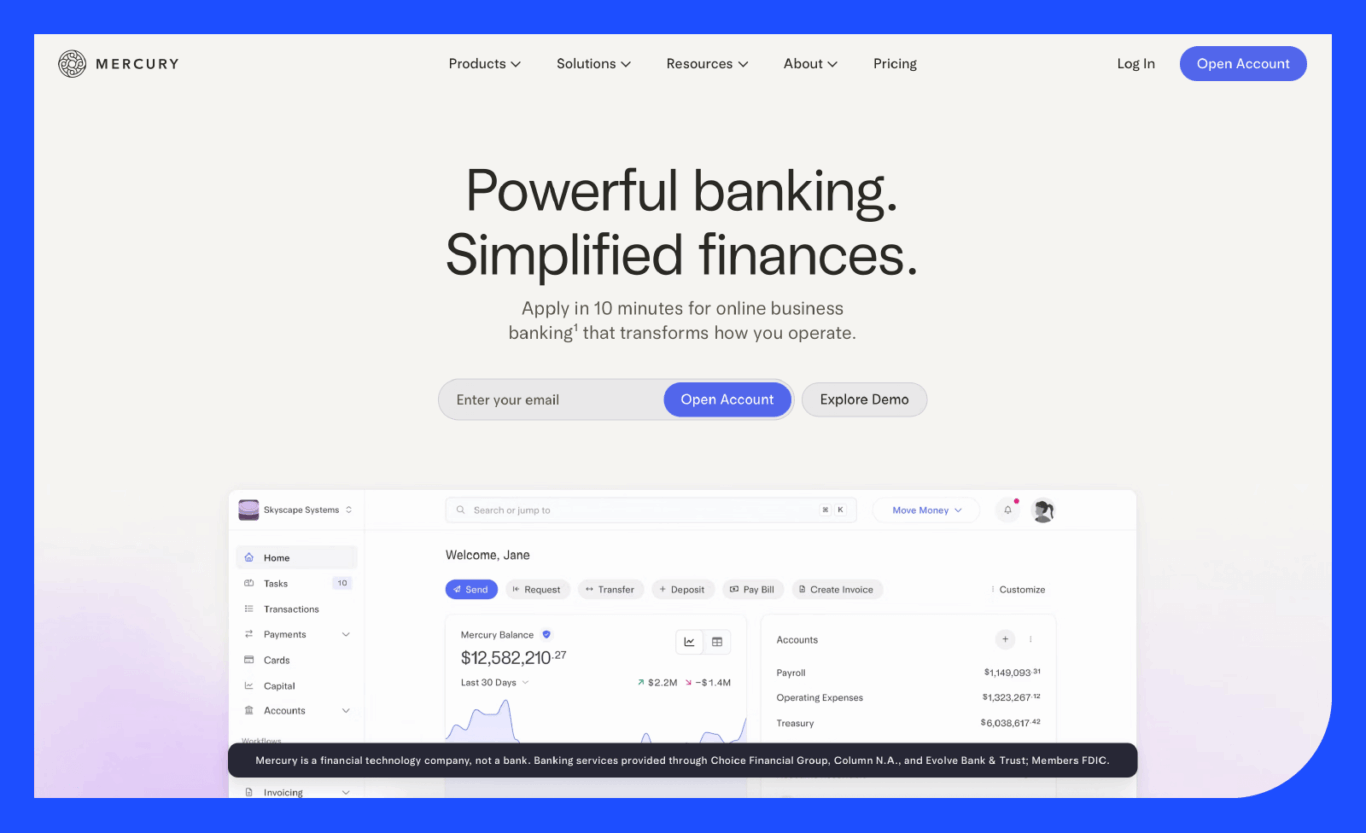

Mercury

Mercury vs. Bluevine:

- Mercury business checking does not offer interest, while Bluevine allows customers to earn APY on checking balances.BVSUP-00147

- Mercury’s Treasury account is available to customers with balances of $250,000 or higher. Bluevine Treasury is more accessible, with a $50,000 minimum balance for the Standard and Plus checking plans, and no minimum balance for Premier customers.BVSUP-00129

- Pricing for Mercury’s most premium checking plan can be as low as $299/month (if paid annually), whereas Bluevine Premier is available for a $95 monthly fee—which you can waive if you meet monthly balance and debit card spend goals.BVSUP-00117

Pricing: Free plan available, upgrades require monthly fees

Mercury provides digital banking for startups and small businesses, offering checking and savings accounts with no monthly fees or minimum balances, expanded FDIC insurance through partner banks, and support for domestic and international transfers, ACH payments, and integrations with accounting tools. Mercury does not offer checkbooks or interest on checking balances.

In addition to all the features mentioned above, Bluevine also provides multiple checking account plans with competitive APY, sub-accounts, automated transfer rules, checkbooks, and team debit cards with spend controls.

Mercury’s banking platform caters more to venture-backed tech startups and full financial teams, while Bluevine’s platform is designed to help all types of small businesses manage cash more efficiently—and is especially useful for small business owners who manage their own finances.

Lili

Lili vs. Bluevine:

- Lili focuses on expense tracking, tax tools, and a simple interface, whereas Bluevine offers online bill pay, checkbooks, higher APY, and broader accounting software integrations.

- Bluevine’s upgraded checking plans allow monthly fee waivers based on activity or balance,BVSUP-00153 while Lili’s paid plans can be more expensive and do not offer the same flexibility.

Pricing: Free plan available, upgrades require monthly fees

Lili is a financial platform designed for freelancers, independent contractors, and sole proprietors, with tools that simplify managing both business and personal finances. It includes free business checking, automated tax savings, expense tracking, invoicing, and cashback rewards on debit card purchases—all accessible through a user-friendly mobile app.

Bluevine is also a strong fit for sole proprietors and goes a step further by offering banking features that support long-term growth. In addition to checking and payment tools, Bluevine gives you the opportunity to earn interest on checking balances, as well as easy access to financing through business lines of credit and term loans via partners—so you can continue using the same account as you expand.

Traditional banks

The biggest difference between traditional banks and Bluevine is that big banks offer a range of products and services for both personal banking and business banking. Bluevine, however, focuses specifically on small business banking.

While traditional banks technically serve all types of businesses, many features and benefits seem to favor larger companies and corporations. Bluevine’s all-in-one financial platform is built to grow with small businesses, including features designed to help entrepreneurs save time and money—so they can focus on doing what they love.

With no brick-and-mortar locations to maintain, Bluevine is able to offer higher interest earnings on checking balances to give small businesses more for their money.BVSUP-00147 Also, as a digital-first platform, Bluevine provides a simple, sleek online banking experience that lets on-the-go owners manage their finances from anywhere.

Though some small businesses that deal heavily in cash may choose traditional banks over online banking platforms, Bluevine does support cash deposits at more than 37,000+

ATMs and cash withdrawals at over 91,500 locations nationwide through partnerships with MoneyPass®, Green Dot®, and Allpoint+ ATMs.BVSUP-00110

| Company | Monthly maintenance fees | How it compares to Bluevine |

|---|---|---|

| Bank of America | Yes (waivable if you maintain a minimum daily balance of $1,500) | Bank of America offers traditional banking with branch access, while Bluevine focuses on online banking with higher-yield checking and flexible lending options for SMBs, without ever requiring an in-person bank visit. |

| Wells Fargo | Yes (waivable with $500 minimum daily balance) | Wells Fargo offers traditional business checking and lending with branch access, while Bluevine provides an online-first banking experience with flexible lending and integrated payment tools for SMBs. |

| Chase | Yes (waivable by having electronic deposits that total $500 or more) | Chase provides traditional business checking and lending with extensive branch and ATM access, while Bluevine supports cash deposits and withdrawals through third-party partners.BVSUP-00110 |

Bank of America

Bank of America vs. Bluevine:

- Bank of America accounts often require maintaining thousands in average balances to avoid monthly fees, while Bluevine offers a free business checking planBVSUP-00122 with no minimum balance.

- Bank of America checking typically offers little to no interest, but Bluevine accounts can earn competitive interest on checking balances.BVSUP-00147

Pricing: Includes monthly maintenance fees (waivable if you maintain a minimum daily balance of $1,500)

Bank of America offers a wide variety of banking services across personal banking, corporate banking, and business banking. Their business checking options come with tiered monthly fees, a large branch and ATM network, fraud protection tools, and cash flow management services.

Bluevine delivers exceptional value with free business checking (plus upgraded plan options), no minimum balance requirements, and one of the highest checking APYs available.BVSUP-00116 In contrast, Bank of America business checking often comes with monthly fees and requires maintaining thousands in average balances to waive them, while typically offering little to no interest on checking balances.

Did you know?

Bluevine’s Standard business checking plan comes with no monthly fees, high-yield interest, and built-in invoicing and bill pay tools.

Wells Fargo

Wells Fargo vs. Bluevine:

- Wells Fargo and Bluevine both provide digital banking tools, fraud protection, and options for managing payments and vendors.

- Wells Fargo accounts have tiered monthly fees (waivable with minimum balances) and transaction limits, while Bluevine offers high-yield checking, unlimited transactions, and a plan with no monthly fees.BVSUP-00122

Pricing: Includes monthly maintenance fees (waivable with $500 minimum daily balance.)

Wells Fargo offers several business checking options—Initiate, Navigate, and Optimize—covering different stages of business growth. Accounts include branch and digital access, 24/7 fraud monitoring, Zero Liability debit card protection, and tools for payments and vendor management.

Bluevine simplifies business banking with a robust platform that scales with you as you grow, featuring three checking plans you can switch between at any time in your dashboard.

While most Wells Fargo accounts involve fees, balance requirements, and low interest, Bluevine gives businesses the opportunity to earn interest on checking balances with no minimums, plus a Standard plan with no monthly fees. On top of that, Bluevine layers in modern digital tools and built-in access to credit—features Wells Fargo doesn’t include with standard checking.

Chase

Chase vs. Bluevine:

- Chase offers physical branches and ATM access. Bluevine partners with multiple ATM networks for cash deposits and withdrawals, with no need for branch visits.

- Chase provides merchant services for in-store, online, and mobile payments, whereas Bluevine focuses on high-yield checking and integrated lending for streamlined cash flow.

- Bluevine has no monthly fees (for its Standard plan) or minimum balances and combines banking with lines of credit directly in the platform, while Chase accounts typically have fees that can be waived with minimum balance requirements.

Pricing: Includes monthly maintenance fees (waivable by having electronic deposits that total $500 or more)

Chase provides a broad range of business checking accounts—Business Complete Banking, Performance, and Platinum—for companies of all sizes. These accounts come with online and mobile banking, debit cards with security features and tools for invoicing, payments, and fraud protection.

Bluevine delivers a fully digital platform that consolidates everyday banking, team management tools, and streamlined cash flow oversight, helping businesses save time and manage operations in one place. Customers get physical and virtual debit cards for their checking accounts, and can issue up to 50 cards total for their main account and sub-accounts.

Bluevine also supports cash withdrawals and deposits through partnerships with MoneyPass®, Green Dot®, and Allpoint+ ATMs.BVSUP-00110

Business lending

| Company | How it compares to Bluevine |

|---|---|

| OnDeck | OnDeck is part of Bluevine’s lender network, through which small businesses can access a Bluevine Line of Credit, OnDeck loans, and more financing options with one simple application. |

| Fundbox | Fundbox is also part of Bluevine’s lender network, which lets small businesses apply for a Bluevine Line of Credit, Fundbox loans, and other options simultaneously. |

| Lendio | Lendio is a marketplace that connects businesses with multiple lenders, while Bluevine offers access to its own line of credit and a network of lenders. Lendio typically takes days for funding, whereas Bluevine can offer instant funding through its integrated checking account. |

| Idea Financial | Idea Financial focuses on providing quick, flexible business lines of credit and term loans. Bluevine also offers flexible lines of credit with instant access to funds through its integrated checking account, plus term loans through its lending partners. |

OnDeck

OnDeck provides a straightforward application process and fast access to funding, with decisions typically made quickly and funds available as soon as the next day. It offers flexible repayment schedules, with automatic weekly or monthly payments and no prepayment penalties, making it suitable for businesses that need working capital for inventory, expansion, or cash flow management.

Bluevine allows businesses to apply for a line of credit or a variety of loans through its network of trusted lending partners, including OnDeck, Fundbox, and Headway—all with a single, streamlined application.BVSUP-00126 This approach provides access to multiple financing options at once, plus small businesses can access their Bluevine Line of Credit funds instantly with a Bluevine Business Checking account.BVSUP-00127

Easily apply for financing through Bluevine and OnDeck with one simple application.

Fundbox

Fundbox is an online lending platform designed to help small businesses manage cash flow by providing lines of credit and invoice financing. Its application process is simple and fast, with funding often available within a day or two. Fundbox also offers flexible repayment terms and integrates with popular accounting tools.

Bluevine allows businesses to apply for a line of credit and a variety of loan options through its network of trusted partners, including Fundbox, OnDeck, and Headway. This means that with a single, headache-free application, small businesses can get access to multiple financing options at once.BVSUP-00126 Plus, Bluevine Line of Credit customers can access funds instantly when they pair their credit line with a Bluevine Business Checking account.BVSUP-00127

Both Bluevine and Fundbox have fast turnaround times and strong customer ratings.

Easily apply for financing through Bluevine and Fundbox with one simple application.

Lendio

Lendio is a marketplace that connects businesses with a network of over 75 lenders for a wide variety of loan types, including term loans, lines of credit, and SBA loans. Its matching tool helps businesses find options based on their needs, and can sometimes provide access to larger loan amounts.

Lendio is not a lender itself, so one potential downside of its marketplace structure is that it’s primarily focused on originating loans. This means post-funding customer support may be less robust than lending platforms that manage accounts directly.

Bluevine connects you with a trusted network of lenders and offers its own lines of credit through a single applicationBVSUP-00126—with a focus on speed, convenience, and competitive rates. Bluevine can be better suited for SMBs looking for fast, flexible funding from a single trusted source, especially businesses in search of an all-in-one financial platform.

Idea Financial

Idea Financial offers merchant cash advances, lines of credit, and term loans designed to help small businesses manage cash flow or growth. The applications are digital, and approvals can come within hours. Repayments are made week by week, and businesses get support from dedicated advisors.

Bluevine allows small businesses to apply for multiple line of credit and loan options simultaneously, including the Bluevine Line of Credit and term loans through its lending partnersBVSUP-00126—making the process simpler and eliminating the need to shop around. Bluevine also offers a fully integrated business checking account, which allows for instant access to approved credit line draws.BVSUP-00127

Other fintech competitors

| Provider | Pricing | How it compares to Bluevine |

|---|---|---|

| Brex | Free plan available, upgrades require monthly fees per user | Brex targets tech startups and larger companies looking for more control over spend management, while Bluevine offers a robust banking platform specifically for small and medium-sized businesses. |

| Ramp | Free plan available, upgrades require monthly fees per user | Ramp specializes in corporate cards and spend management for growing companies, whereas Bluevine provides a full-service banking platform with checking accounts, lending, and payment tools for small and medium-sized businesses. |

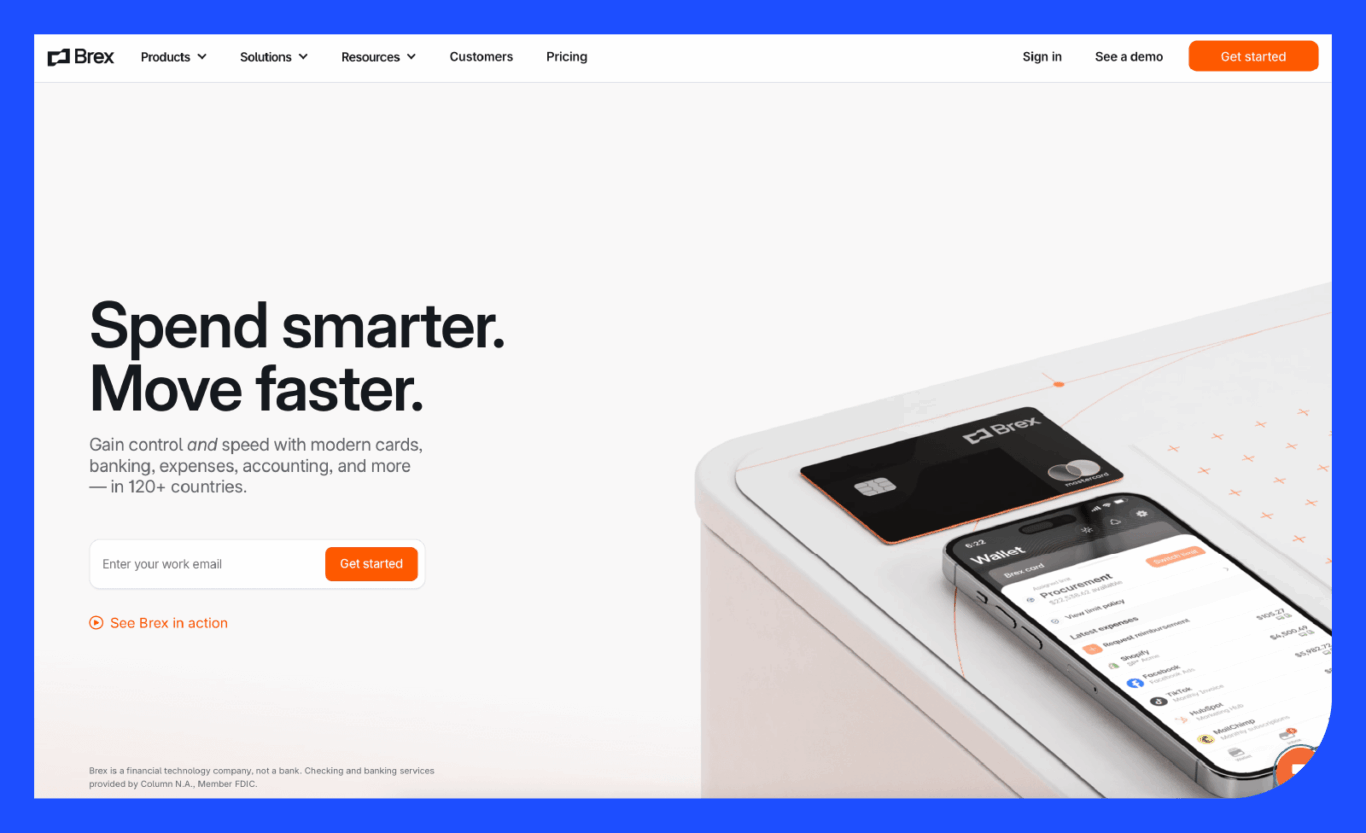

Brex

Brex vs. Bluevine:

- Brex’s forte is credit cards, spend management, and treasury solutions. Bluevine’s main focus is full-featured checking accounts, lines of credit, and term loans through partners.

- Brex features automated spend controls and high-yield treasury accounts, while Bluevine offers high APY on checking,BVSUP-00147 easy ways to pay and get paid, and smooth software integrations.

Pricing: Free plan available, upgrades require monthly fees per user

Brex’s primary offerings are corporate credit cards and expense management. It also offers business checking, treasury, and vault accounts with expanded FDIC coverage through partner banks. Plus, Brex supports multi-currency payments and integrates with accounting software like QuickBooks Online, NetSuite, and Xero.

By comparison, Bluevine’s main offering is its all-in-one business checking account that offers high APY,BVSUP-00147 expanded FDIC coverage through partner banks,BVSUP-00108 simple domestic and international payment options, built-in invoicing tools, and convenient integrations with QuickBooks Online, Xero, and more.BVSUP-00056

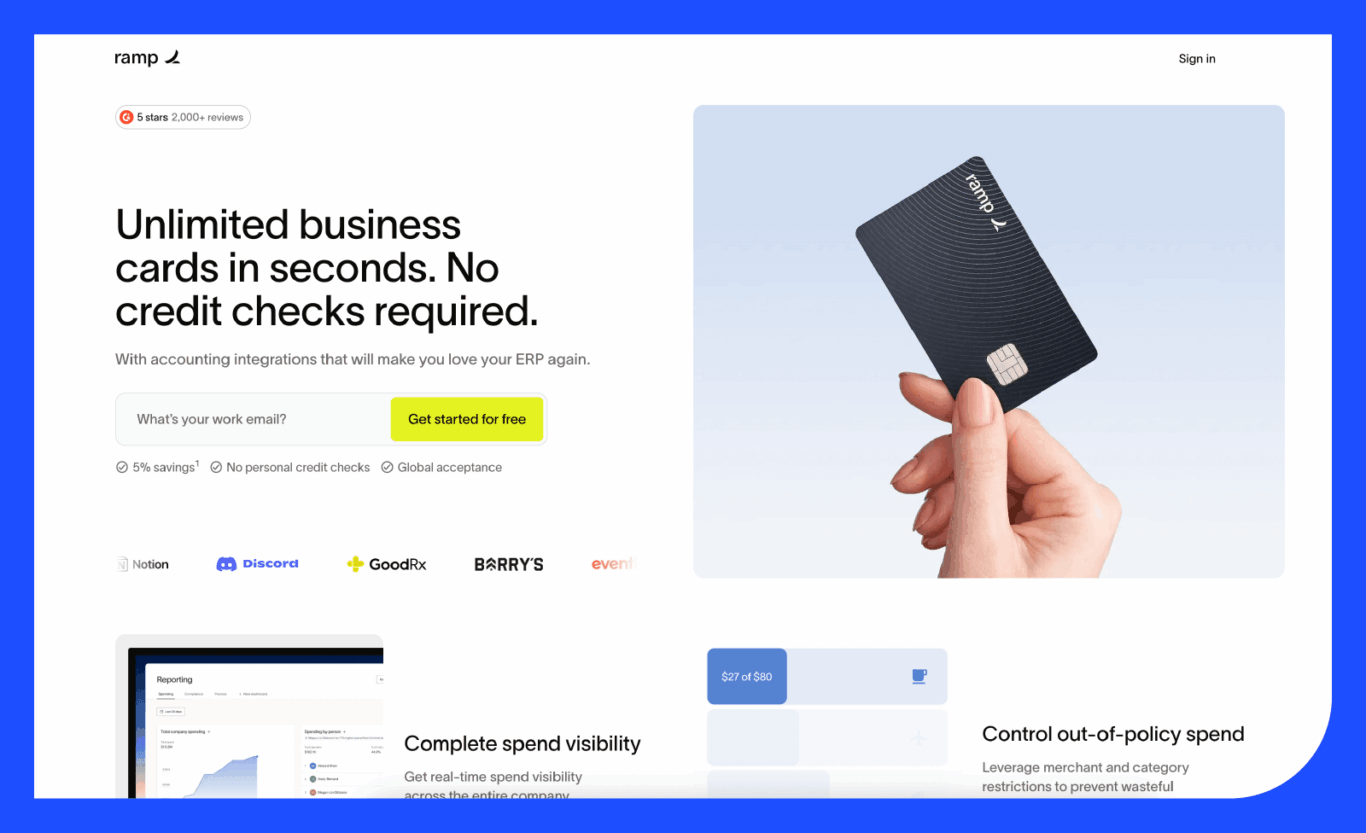

Ramp

Ramp vs. Bluevine:

- Ramp focuses on corporate cards, automated expense management, and multi-currency payments, while Bluevine offers a robust business checking account with invoicing tools, domestic and international payments, and spend controls built for small businesses.

Pricing: Free plan available, upgrades require monthly fees per user

Ramp is a financial operations platform that provides corporate cards with built-in spending controls, automated expense management, and vendor management tools designed to help businesses optimize their financial workflows. Ramp focuses on offering AI-driven insights, cashback rewards on spending, and customizable reports for smarter decision-making.

While Ramp focuses on corporate expense optimization, Bluevine simplifies small business banking with an easy-to-use checking dashboard that offers everything from invoicing and accounts payable tools to sub-accounts with their own debit cards. Bluevine’s platform scales with businesses as they grow, allowing you to streamline your finances at every stage and unlock new features as you need them.

Choosing the best banking partner for your startup or small business

The right banking choice depends on your specific needs—whether it’s day-to-day banking, access to credit, or tools to manage cash flow. Features, fees, and flexibility vary by provider, so it’s worth taking a closer look before committing. Below are some key aspects to consider when evaluating your options.

Did you know?

Our most active business checking customers save up to $500/year in fees.*

- Account features and transaction limits: Consider the types of accounts offered, transaction caps, and whether sub-accounts or multiple cards are available.

- Customer support and physical access: Look at how support is provided and whether the banking platform allows cash deposits or withdrawals—Bluevine, for example, supports cash deposits at partner network ATMs.BVSUP-00110

- Fees and APY on deposits: Compare monthly fees, transaction fees, overdraft charges, and interest rates to make the most of your money.

- Lending products and access to capital: Evaluate what credit lines, term loans, or invoice factoring options are available and how quickly you can access funds.

- Technology and software integrations: Make sure the banking platform you choose plays nicely with your preferred accounting software, payment tools, and more—or that the platform has its own accounting and payment features built in.

*Average annual savings for Bluevine’s top 1% of business checking customers (44+ monthly transactions) compared to the top six U.S. banks.

**As compared to publicly available data on the number of lifetime customer accounts held by other U.S. banking platforms dedicated to small business, as of January 2026.