What sets Bluevine apart?

Experience banking that goes far beyond what you get with other

financial platforms—with accessible, affordable, and easy-to-use

tools built specifically for small businesses.

Make the most of your hard-earned money.

Save on fees and earn high APY so you can put

more money back into your business.

Up to 3.0% APY on checking balancesBVSUP-00147

Earn even higher yields with a Treasury account§

No monthly fee for Standard plan

Free standard ACH and incoming wiresBVSUP-00137

No limit on number of transactions

Low fees for domestic wires and international paymentsBVSUP-00137

Multiple pricing plans to fit your needs

Free professional invoicing

Did you know…?

Sending payments internationally with traditional banks can come with hidden fees. Bluevine’s fees for global payments are simple and competitive, so you always know what you’re paying upfront.

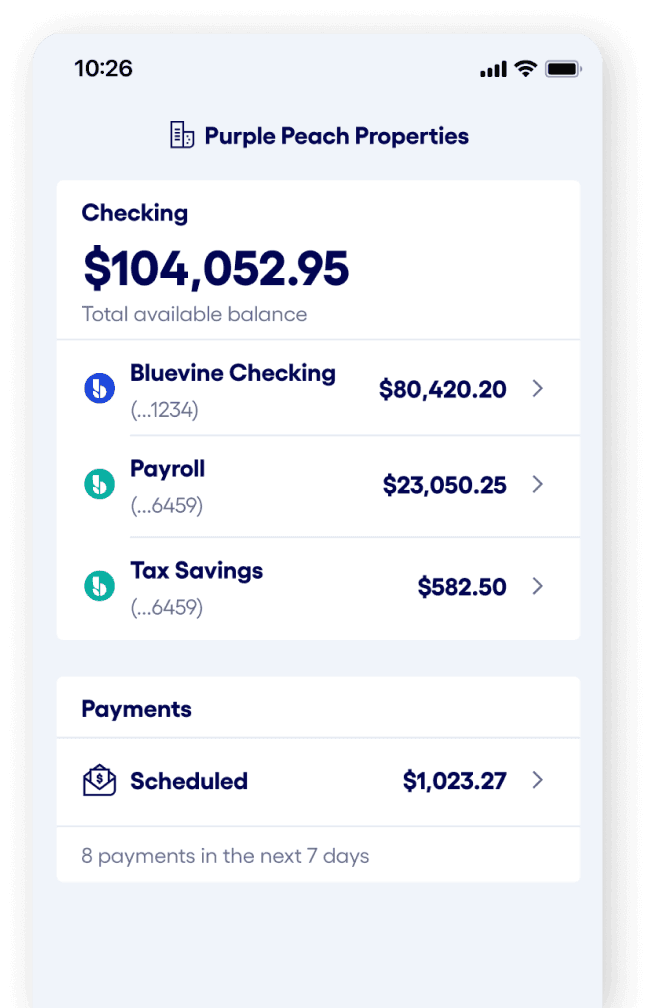

Automate and simplify financial operations.

With all the banking tools you need in one place, you’ll

have more time to focus on running your business.

All the payment options you need for one-time, scheduled, recurring, and bulk payments

One seamless dashboard for your checking account, bill payments, credit card, and line of credit

Sub-accounts with custom automatic transfer rules

Set up custom bill approval workflows so payments automatically get routed to the right team members

Software integrations like QuickBooks Online,BVSUP-00056 Xero, and more

Get paid directly to your Bluevine account with invoicing and payment links, easily managed from your Bluevine dashboard

Banking that scales with you as you grow.

Give employees their own debit and credit cards, plus let them

pay business bills to take work off your plate.

Multiple roles and permissions for additional users and your accountantBVSUP-00076

Physical and virtual debit and credit cards with spend controls for your team

Accounts payable automation with custom approval workflows

Live chat support for authorized users

Pro tip: Your virtual debit card can be a great expense management tool. Easily separate expenses by using multiple physical and virtual debit cards—plus set spending limits so you stay on budget.

Financing to boost your business.

Power your business with a line of credit or term loan

to drive growth and build momentum.

Business financing via the Bluevine Line of Credit and the Bluevine Business Cashback Mastercard®

Additional financing options via term loans and SBA loans through our lending partners

Instant access to line of credit funds through a Bluevine Business Checking accountBVSUP-00127

Opportunity to build business credit history with Experian and qualify for more financing as your business grows

#1 small business need for 2025: Access to capital

Small business owners identified access to capital as their #1 need for 2025. With Bluevine, you can apply for a line of credit without impacting your credit score.(Source: BOSS Report 2024)

Manage your money with peace of mind.

Know your money is safe, your information is private,

and we’re here to support you every step of the way.

FDIC insurance up to $3 millionBVSUP-00108

Live support from real people

ACH fraud protection tools

Two-factor authentication and data encryption to keep your account secure

Custom notifications and alerts

Did you know…?

With Bluevine Business Checking, you can easily block ACH debits from your main accounts and sub-accounts—or from specific payees—to prevent unwanted transactions.

Never go to the bank again.

All-in-one digital platform so you can do your banking on the go or wherever you do business.

Full-featured mobile banking tools and app

Easy mobile check deposits with higher monthly limits than the industry averageBVSUP-00088

Virtual debit and credit cards for contactless payments

Convenient cash deposits and withdrawals at 120,000+ locations nationwideBVSUP-00110

Accessible customer support via phone, chat, and email

Get more

from your

business

banking.

Choose from three different checking account plans, all with benefits built with your business in mind.

Explore business checkingApply for

working

capital.

We offer flexible funding to fit all your business needs. Cushion cash flow or reinvest in your business with a Bluevine Line of Credit or partner term loan.

Explore business loans