Did you know?

Small business factoring involves selling your unpaid customer invoices to a third-party to get cash up front instead of waiting for your customers to make payments. This method helps small businesses get upfront funds to improve cash flow but comes with higher interest fees that you pay to the factoring company.

For this reason, many small businesses consider term loans or lines of credit as better alternatives.

Small businesses are powering growth across industries, but even healthy companies sometimes face gaps between sending an invoice and getting paid. According to our latest small business trends report, inflation remains the top concern for 71% of small business owners, which can make those gaps feel even tighter.

One financing option that owners often consider in these situations is invoice factoring—selling unpaid invoices to a third party in exchange for immediate cash, or small business factoring.

While this can be useful in certain scenarios, it is not the only way to bridge cash flow delays. Alternatives like business loans and lines of credit can provide more flexibility and better long-term value, depending on your needs.

In this post, we will break down how small business factoring works, when it makes sense, and which alternative financing options might be a smarter fit for you.

What you need to know

- Small business invoice factoring lets you convert unpaid invoices into quick cash, helping improve cash flow without taking on traditional debt.

- While factoring offers fast access to funds and flexible qualification, it comes with fees and can reduce your control over customer relationships.

- Alternatives like business loans and lines of credit may provide more flexibility and long-term value depending on your needs.

What is invoice factoring?

Invoice factoring, also known as small business factoring when catering to small businesses specifically, is when you sell your unpaid invoices to a company that gives you cash upfront.

The company usually provides 70% to 90% of the invoice value, so you are not stuck waiting for your customers to pay. Once your customer settles the invoice, you get the rest after the invoice factoring company deducts its fee.

Factoring companies do this because their profit comes from the fee they charge for taking on the risk and handling collections. It is basically selling your invoice at a small discount to get cash faster and keep your business moving.

Bluevine Tip

While factoring can get you cash fast, business loans and lines of credit often give you more flexibility and lower fees in the long run. Plus, with loans or a line of credit, you keep full control over your customer relationships. No need to hand over your invoices to a third party.

How do invoice factoring services work?

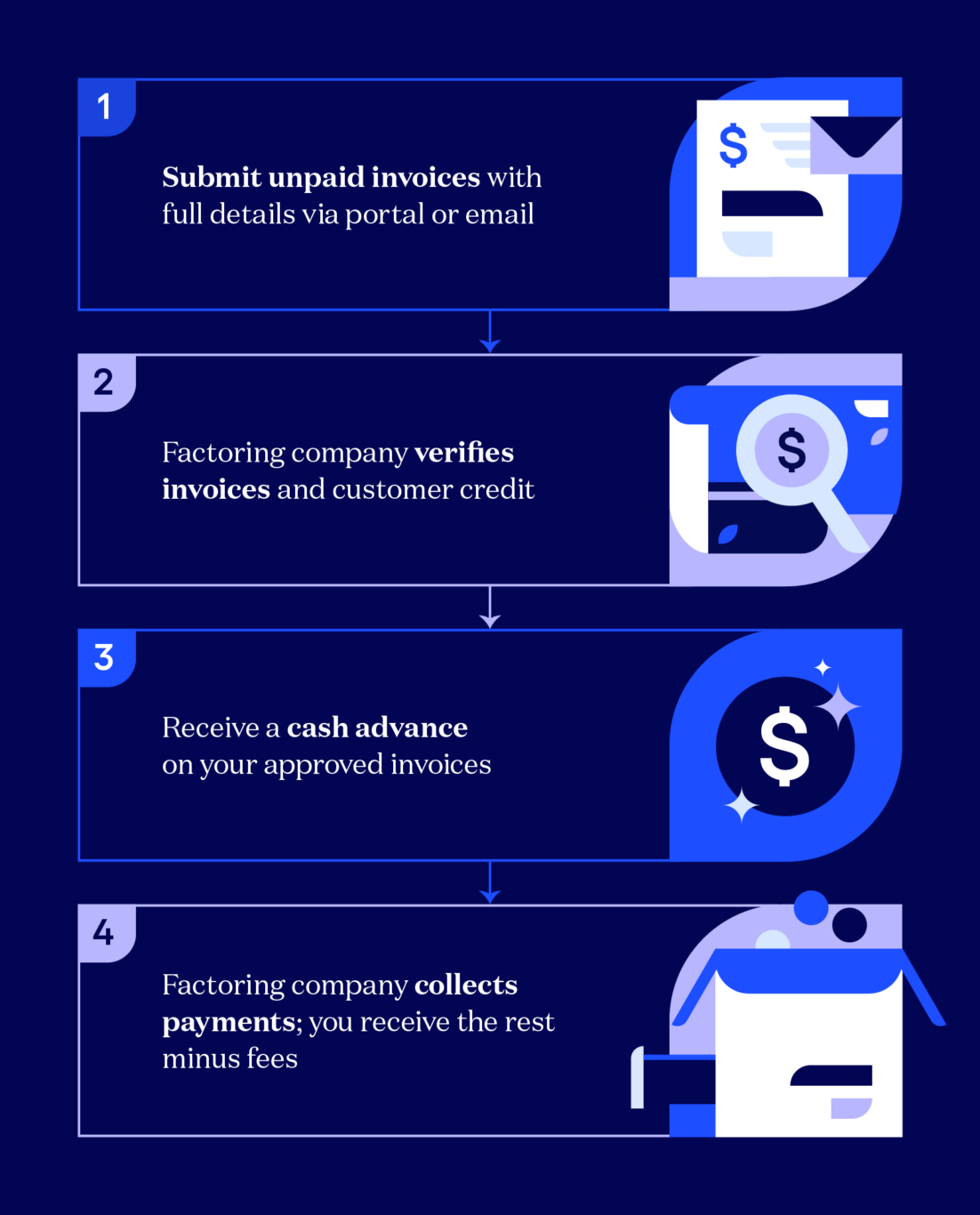

Invoice factoring usually starts when you submit your unpaid invoices to a factoring company for approval. Once they verify the invoices and your customers’ creditworthiness, they will advance you a large portion of the invoice value.

From there, the factoring company takes over collection efforts and waits for your customers to pay. When the customer fully pays the invoice, you receive the remaining balance minus the factoring fees. This process helps businesses get cash quickly without waiting for standard payment terms.

Below are detailed steps of how the factoring process works.

Step 1: Submit unpaid invoices

Start by gathering the unpaid invoices you want to factor. Next, head to the factoring company’s online portal (or email them if they allow) and upload or attach copies of those invoices. Make sure that each invoice includes the customer’s full name, contact details, invoice number, the total amount due, and payment terms like net 30 or net 60.

If you haven’t already organized your invoices, now is a good time to double-check for missing information or errors. Keep in mind that incomplete invoices can slow down approval.

The factoring company will review these details to verify your customers’ creditworthiness before advancing funds. The better your invoice quality, the faster you will get your cash.

Step 2: Factoring service reviews invoices

After you send over your invoices, the factoring company makes sure everything is legitimate and accurate. They double-check the customer info, make sure the amounts and dates line up, and look into how reliable your customers are in paying up.

This step helps the factoring service decide if they are comfortable fronting you the cash. The cleaner and more accurate your invoices, the quicker they can review them and get you your money.

Step 3: Receive an advance

If the company approves your invoices, they typically deposit the advance of the invoice amount directly into your business bank account. Depending on the company, this can happen within 24 to 48 hours after approval, so you get cash quickly to cover expenses or invest in growth.

You can expect a clear breakdown of the advance amount and any fees deducted in your factoring account dashboard or statement. It should clarify exactly what you are getting up front versus how much the company is holding in reserve until your customer pays.

Step 4: Factoring service collects payment

After advancing you the cash, the factoring company takes over collecting payment directly from your customers. They send payment reminders, follow up on overdue invoices, and handle any questions or disputes about the invoice.

This means you do not have to spend time chasing down payments, freeing you up to focus on running your business. Once your customer pays in full, the factoring company releases the remaining balance to you, minus their fees.

Types of invoice factoring

Invoice factoring is not one-size-fits-all. There are different types designed to fit various business needs. Understanding these can help you decide which approach might work best for your cash flow and customer retention.

Resource factoring

Resource factoring is when the factoring company manages the entire invoice process from submitting invoices to collecting payments on your behalf. They handle all the paperwork and customer communications, making it hands-off for you.

- Pros: It saves you time and effort since the factoring company handles collections and admin work. It is great if you want to offload those tasks and focus on running your business.

- Cons: Because they manage the process fully and will be the ones contacting your clients, it can sometimes impact your customer relationships. Also, fees tend to be higher due to the extra service.

Non-recourse factoring

With non-recourse factoring, the factoring company takes on the risk of your customer not paying the invoice. This means if your customer defaults or goes bankrupt, you will not have to pay back the money you received upfront. The factoring company absorbs the loss, giving you added financial protection.

- Pros: It reduces your financial risk and protects your cash flow if customers fail to pay. You get peace of mind knowing you will not owe money back for unpaid invoices.

- Cons: Because the factoring company takes on more risk, fees tend to be higher compared to other factoring types. Also, not all invoices or customers qualify for non-recourse factoring.

Spot factoring

Spot factoring allows you to sell individual invoices whenever you need extra cash, without signing a long-term agreement. This type of factoring works best for businesses with irregular or seasonal cash flow, like contractors or event planners, who do not always need financing but want the option when cash is tight.

- Pros: You only factor invoices when necessary, avoiding ongoing fees and commitments. This flexibility lets you control costs and use factoring as a safety net rather than a constant financing tool.

- Cons: Because you pay per invoice, spot factoring can have higher fees than a continuous factoring contract. Plus, submitting invoices one at a time means more administrative work for you.

Contract factoring

Contract factoring involves signing an agreement to factor a set percentage or all of your invoices over a fixed period, often 6 to 12 months. This setup is ideal for businesses with steady, predictable sales, like manufacturers or wholesalers, that want consistent cash flow support.

- Pros: It guarantees regular funding and often comes with lower fees due to the long-term commitment. Plus, it streamlines cash flow management since you know what to expect.

- Cons: You are locked into factoring a fixed volume of invoices, which can be costly if your cash flow needs fluctuate. Also, terminating the contract early may involve penalties or fees.

Advance factoring

Advance factoring involves the factoring company paying you a large portion—typically 70% to 90%—of your invoice value up front, while holding the remaining balance until your customer settles the payment.

This method suits businesses with steady invoicing cycles and predictable customer payments, like manufacturers or distributors, who need consistent cash flow to manage operations.

- Pros: You get quick access to most of your invoice amount, helping maintain smooth cash flow without waiting for customer payments.

- Cons: The factoring company holds the remaining balance until the invoice is paid, which can delay receiving the full payment amount.

What are the benefits of invoice factoring?

Invoice factoring for small businesses can be a smart way to keep your cash flowing smoothly when waiting for customer payments is not an option. Here are some of the key advantages that make factoring appealing to many small businesses:

- Improved cash flow: Factoring turns unpaid invoices into cash quickly, which helps you cover day-to-day expenses without delays.

- Fast access to funds: Once approved, you can get an advance on your invoices, often within 24 to 48 hours, so you are not waiting weeks for payments.

- Flexible qualification criteria: Factoring approval focuses on your customers’ creditworthiness rather than just your business’s financial history, making it accessible for many businesses.

- No collateral required: Since the invoices themselves serve as collateral, you do not have to put up other assets like property or equipment.

- Scalable funding: As your sales grow, factoring can scale with you by advancing funds against a higher volume of invoices.

- Predictable cash flow: With factoring, you can better forecast your cash flow since you know when and how much cash will be coming in from your invoices.

What are the downsides of invoice factoring?

While invoice factoring can be a helpful tool, it has drawbacks. Here are some of the main challenges to consider before deciding if factoring is right for your business:

- High fees: Factoring companies charge fees for their service, which can add up and reduce your overall profit on each invoice.

- Less control over customer relationships: Since the factoring company handles collections, you may lose direct contact with your customers, which can impact your relationship.

- Dependence on factoring service: If your cash flow problems persist, your business may become overly reliant on the steady financing that factoring provides.

- Potential impact on credit: Some factoring agreements might affect your business credit score, especially if customers do not pay and you are responsible for the balance.

- Customer perception: Customers might feel uneasy knowing a third party manages payments, which can raise questions about your business’s financial health.

- Contract terms and flexibility: Long-term contracts may include minimum volumes or fees for early termination, reducing your flexibility.

- Not suitable for all invoices: Factoring companies often reject invoices from customers with poor credit or disputed bills, limiting what you can factor.

Is small business factoring right for you?

Factoring can be a quick cash solution, but it is not for every business. Before jumping in, weigh these key factors to see if it fits your financial situation and goals.

- Customer creditworthiness: Factoring companies often assess your customers’ credit, not just yours, so if your clients have weak credit, it could affect your approval or rates.

- Long-term financing needs: Factoring could be ideal for the short term, but relying on it long-term can be expensive and limit your options for other financing.

- Costs of factoring: Fees and discount rates can add up, so make sure the cost does not outweigh the benefit of faster cash flow.

- Impact on customer relationships: Since the factoring company handles your invoices, your customers may feel pressured or confused, which can strain your relationships.

Alternatives to invoice factoring

If factoring is not the right fit, you can explore ways to improve cash flow without handing over your invoices. These options can help you get paid faster or access funds on better terms.

- Take out a small business loan: Loans can provide upfront cash at lower interest rates than factoring fees, with fixed payment schedules that help you budget better.

- Use a business line of credit: This flexible option lets you draw funds as needed, pay interest only on what you use, and avoid ongoing fees tied to factoring.

- Send bills quickly: The faster you send invoices, the sooner you get paid. Do not wait until the last minute to speed up your billing process to keep cash flowing.

- Automate payment reminders: Set up automatic reminders so customers do not forget or delay payments, reducing late invoices without extra effort.

Give customers easy payment options: Offering multiple ways to pay, like credit cards, ACH transfers, or online portals, makes it easier for customers to settle their bills promptly.

Did you know?

You can get paid faster and skip factoring altogether by accepting card, digital wallet, and other payment methods directly through Bluevine. Send invoices with payment links and manage everything from one dashboard.

Discover the right financial option for your business’s needs

Small business factoring can be a powerful tool to improve cash flow, but it is not the only path to financial flexibility. Weigh your options carefully and consider alternatives that might better fit your long-term goals and customer relationships.

Whether you choose factoring, a small business loan, or a line of credit, finding the best fit can help you take control of your cash flow.

Small business factoring FAQs

What are the main differences between invoice factoring and traditional small business loans?

The main differences come down to how you get money, repay it, and qualify:

- How you get the money: Invoice factoring advances cash based on your unpaid invoices, which means you are essentially selling your receivables. Traditional loans give you a lump sum based on your credit and financials.

- Repayment: Loans require you to pay back the principal plus interest over time. Factoring does not involve repayment because the factoring company collects directly from your customers.

- Qualification: Factoring approval depends mostly on your customers’ creditworthiness. Loans focus more on your business credit history and financial health.

- Collateral: Loans often need collateral like equipment or property. Factoring uses your invoices as collateral, so no extra assets are required.

- Cost: Loans have fixed interest rates and payment terms, while factoring fees vary based on invoice size, customer risk, and timing.

How much does invoice factoring cost?

Invoice factoring fees usually range between 1% and 5% of the invoice value per month. The exact cost depends on factors like your industry, the size of the invoices, your customers’ creditworthiness, and how quickly they pay.

Some factoring companies also charge setup fees, monthly minimums, or additional service fees, so it is important to read the contract carefully before committing.

What industries benefit the most from invoice factoring?

Invoice factoring works best for industries where businesses often wait 30 to 90 days (or more) to get paid but need steady cash flow in the meantime.

Some of the top industries that benefit include:

- Manufacturing: Long production cycles and extended payment terms create cash flow gaps.

- Wholesale and distribution: Large orders with delayed payments make factoring helpful for covering operational costs.

- Staffing agencies: Payroll often comes before client payments, making fast cash crucial.

- Transportation and trucking: Fuel, maintenance, and payroll require steady cash while waiting for invoice payments.

- Construction and contracting: Project-based work with lengthy payment cycles benefits from quicker cash access.