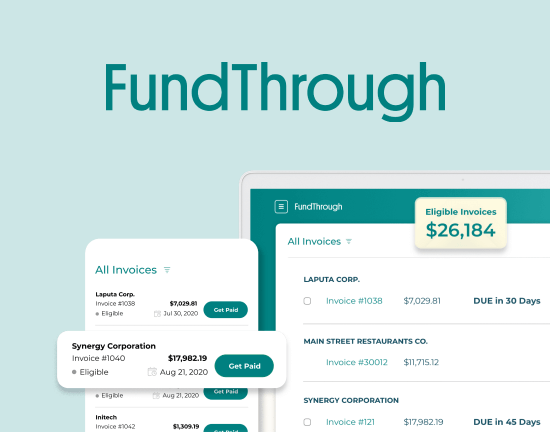

Bluevine has partnered with FundThrough for invoice factoring

Free up your cash flow and apply for invoice funding on FundThrough’s website.

Apply nowInvoice factoring allows you to access funds trapped in your unpaid invoices. It is one of the most convenient ways to finance your small business.

Here’s how it basically works: invoice factoring, which is also referred to as invoice financing, allows you to get advances on those unpaid invoices due in 30, 60, 90 days, or more. This gives you access to the funds you need to manage and grow your business.

This is good news if you have to cover a bi-weekly payroll but are on net 30 terms. Sometimes, you can even realize longer-term benefits. For example, you may come across an unexpected business opportunity. A current customer may be looking to order more products or launch a new project, or a new client is interested in doing business with your company. You’d need capital to take on such opportunities, which would be tough when you’re still waiting for payment on completed projects.

Take a small staffing company with big customers. It’s not uncommon for them to have clients that pay invoices on 30 to 60-day net terms. That typically makes it challenging for the small business to meet its financial obligations, especially payroll, and maintain its growth.

But what if the staffing company can get access to funds it already earned? Invoice factoring makes this possible.

Instead of waiting weeks for a client to pay an invoice, you can get an advance on those funds that you could use to cover your business expenses.

But before you rush off to find an invoice factoring company to work with, make sure you understand how invoice financing works.

This is a guide to the different types of invoice factoring companies and how to best shop around for the perfect factoring company.

We will go over some of the key concepts and terms, as well as the industries and channels in which factoring has proven to be an effective form of financing.

Notifying Your Customers

Factoring companies typically will require you to notify your customers about your invoice financing arrangement. You will have to ask your own customers to assign all future receivables to the factoring company.

By notifying your clients, the factor can be more certain that they will be paid according to the terms agreed. This lowers the factor’s risk. Companies tend to have different processes in order to accomplish this goal, some take the more ‘soft touch’ approach, vs others have more of a traditional approach.

Companies that offer a non-notification option are happy to work with you without notifying your clients of the arrangement between you and the company. However, they often will still require you to change your remittance information to a lockbox and bank account in your business name, which they control. These offers tend to be for a lesser overall value and a bit more expensive as it is not as secure.

Companies that offer non-notification factoring will sometimes also offer notification factoring. This will help you qualify for a higher credit line that in a pure non-notification arrangement.

Factoring Contracts

All things being equal, companies that require contracts will always advertise lower rates than companies that don’t require contracts. Just keep in mind that lower rates do not necessarily translate directly into lower costs; be sure to study and understand the factoring agreement closely.

What you gain in pricing, you lose in flexibility and control. If you only need to factor 50% of your receivables but are forced to factor 100% due to long-term contracts and monthly minimums, you are essentially doubling your cost. Beware of companies’ teaser rates if they use contracts: low rates are usually padded with additional fees that you don’t learn about until you are stuck with them. Oftentimes, these hidden fees can more than double your financing costs and leave you feeling nickeled and dimed.

Bottom line with a factoring contract is this: read the document carefully, especially the fine print. Have a clear sense of the fees you would need to pay as a client, including any penalties that may kick in if you decide to end the factoring arrangement.

Traditional Invoice Factoring vs. Spot Factoring

Here’s another significant difference between online and offline or traditional factoring companies: With many traditional factors, you will be asked to turn over the accounts receivable process to that company. This means they will be responsible for sending all invoices and collecting them. They will also usually require all invoices with all clients to flow through them. This can be useful in cases where you do not mind having all invoices advanced and paid early.

While this outsourcing appeals to some small businesses, others prefer to retain ownership over their customer relationships. You should determine whether you see this as a benefit or drawback for your own business.

If you’re not comfortable with a third party taking over your entire invoicing process, spot factoring, which is offered by most online factoring companies, is an excellent option.

Spot factoring allows you to ‘pick and choose’ not only the invoices you want to fund but also the clients. This gives you more flexibility to choose which invoices you would like to advance and when.

Recourse Factoring vs Non-recourse Factoring

Factoring firms that work under a recourse contract are able to pursue your clients if they do not pay an invoice that has been funded. If they do not pay, your business is responsible for the amount owed.

In contrast, the non-recourse contract will allow the factoring company to pursue your client if they do not pay and they will not pursue you for the funds owed. However, a non-recourse contract typically requires you to have a reserve account that you must maintain at a certain level of funds. If your client does not pay, they will use the funds to cover the difference and require you to replenish the reserve account. Some factoring companies may not require you to maintain a reserve fund, but would instead have you pay for credit insurance on those funds added.

Online Factoring vs. Offline Factoring

The vast majority of traditional invoice factoring companies are also offline. They are usually much more likely to require long-term contracts, monthly minimums, and more aggressive with hidden fees.

The fees usually include application fees, background check fees, field examination fees, attorney’s fees, UCC filing fees, invoice submission fees, ACH fees and Wire fees, transaction fees, and others.

Most traditional factoring companies use a heavily paper-based system. You will be typically be asked to overnight their original documents, including invoices, client contracts, and bills of lading.

On the other hand, online invoice factoring companies offer a convenient online dashboard where you can easily view and submit your invoices. Some even offer a mobile app. Both of these mean more speed, both in the application and in getting funding after you’re approved.

A few online factoring companies also have support staff and account managers to help guide you through the process of applying and using your account.

One benefit of offline receivables financing companies is that oftentimes they will take the time to come to see you in person. This is partially to build the relationship, but it also helps them with the underwriting and due diligence. They want to verify that you have a business and are trustworthy.

On the other hand, online factoring companies may be easier to find. Because they serve a national client base, most of them can be found on third-party review sites like TrustPilot, the Intuit Apps Center, and NerdWallet. This gives you visibility into other clients’ experiences with the company. In contrast, most traditional factors are regionally-focused and may not have a sufficiently large client base to have online reviews from reputable third-party sites. Here are links to a few third-party sites when you can read unbiased third-party reviews:

Fundera

Business News Daily

Merchant Maverick

NerdWallet

Common Invoice Factoring Industries

While factors serve a broad range of industries, some industries are especially heavy users of factoring, such as transportation, apparel, and staffing. Other industries require specialized forms of factoring, such as companies in the medical and construction industries, for instance).

Construction Factoring

Many construction firms are forced to look for specialized construction factoring companies because construction has unique challenges that general factoring companies will not deal with. Mechanics liens and “pay when paid” arrangements are especially difficult for non-specialized factors to work with.

Medical Factoring

Regulatory constraints make medical receivables difficult to factor and require specialized invoice financing companies. However, if you invoice medical companies (hospitals, insurers, etc.) this does not necessarily make it a “medical receivable”. To count as a medical receivable, the invoice needs to be pertaining to a medical product or procedure, for a specific patient and paid by an insurance company. If your company provides software services to an insurer or staffing services to a hospital, for example, a general factoring company should be able to serve you well.

Trucking Factoring

While plenty of trucking companies work with industry-agnostic factoring companies, others like working with specialized companies that offer additional benefits like fuel advances, fuel cards, freight broker credit checks, and even higher advance rates. Which makes sense for you will depend on how much value you place on these specific features vs. the reputation of and benefits offered by the general factoring companies.

This article was first published on Sept. 2, 2016, It was updated on March 6, 2018.

More from the Bluevine Business Blog

How To Get A Business Line of Credit and 5 Mistakes to Avoid