The way we manage money is changing, with new financial tools and opportunities emerging every day. Navigating this landscape requires a solid grasp of personal finance, but financial literacy statistics suggest many people are falling behind.

Financial literacy is the fundamental understanding and skill set needed to make good financial decisions. It involves everything from managing your daily budget and credit card debt to making savvy choices about saving, investing, and retirement planning.

This article will provide a clear look at the current state of financial literacy among various groups, including young people and small business owners, and explore what this knowledge gap means for financial security.

What you need to know

- Many small business owners are confident in their financial knowledge, but this confidence often doesn’t match reality.

- A significant portion of adults in the U.S. and Europe struggle with financial concepts like risk and inflation.

- Financial education is becoming more accessible for young people, with a growing number of states requiring a personal finance course for high school graduation.

U.S. financial literacy statistics

You might think you have a good handle on your money, but a look at recent data shows that many Americans don’t. A widespread lack of financial knowledge exists across the country, with significant gaps between different states and demographics.

These trends matter because a lack of financial literacy is directly tied to lower financial well-being and can cost the nation millions. To understand where these challenges lie, let’s dive into the latest statistics on financial literacy:

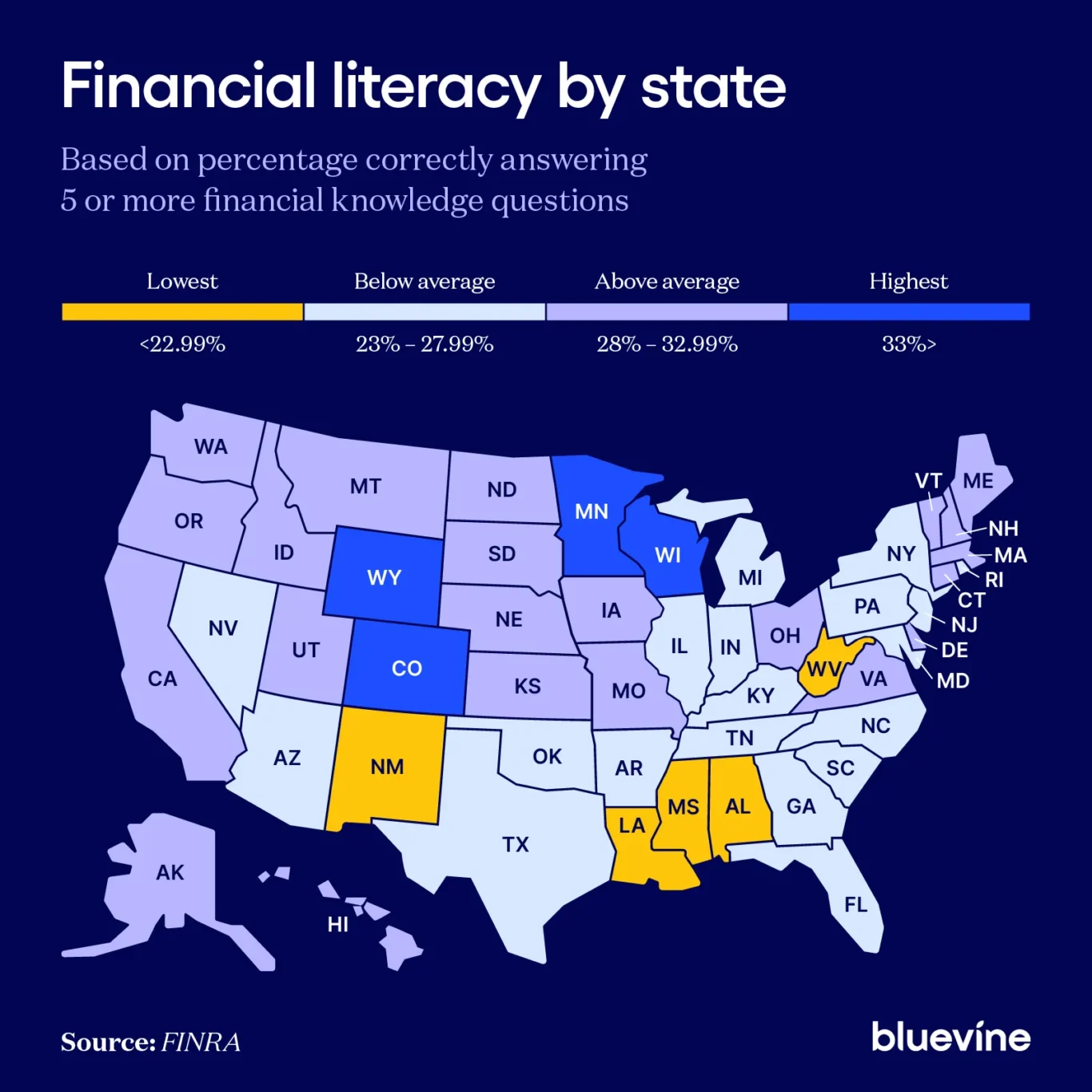

- Only 27% of 25,500 U.S. adults surveyed correctly answered 5 of 7 financial knowledge questions in 2024. (FINRA)

- Minnesota has the highest financial literacy score (34.8%), followed by Wisconsin (34.46%) and the District of Columbia (34.41%). (FINRA)

- The three states with the lowest financial literacy rate are Louisiana (18.1%), Mississippi (19.2%), and Alabama (20.2%). (FINRA)

- 58% of respondents correctly answered the inflation question— “Imagine that the interest rate on your savings account was 1% per year and inflation was 2% per year. After 1 year, how much would you be able to buy with the money in this account?”—when tested on financial literacy, an increase of 5% since 2021. (FINRA)

- When quizzed on financial literacy, a significant gap exists between men and women, with men correctly answering 53% of the questions and women answering 43%. (TIAA Institute)

- There’s a consistent link between higher financial literacy and better financial well-being across all demographics, including men and women, different racial and ethnic groups, and every generation. (TIAA Institute)

- While Asian Americans and White Americans have similar financial literacy levels (55% and 53%, respectively), there is a notable divide from Black Americans and Hispanic Americans (34% and 38%), whose comparable scores may be influenced by structural barriers that have historically limited their financial opportunities. (TIAA Institute)

- Financial illiteracy among adults is a major financial drain on the U.S., costing the country nearly half a billion dollars every year. (NFEC)

EU financial literacy statistics

Financial literacy isn’t just a concern for the U.S.—a look at recent data shows that Europeans are facing similar challenges. Despite a majority of citizens having a medium level of financial literacy, significant gaps in knowledge remain, particularly for key concepts like compound interest.

This lack of understanding is especially pronounced among women, young people, and those with lower incomes.

These findings, which mirror some of the same struggles seen in the U.S., highlight the widespread need for better financial education across the globe:

- On average, only half of individuals in the EU are financially knowledgeable, meaning they answered at least three of the five basic financial knowledge questions correctly. (Bruegal)

- According to another survey, 18% of EU citizens have a high level of financial literacy, 64% have a medium level, and 18% have a low level. (Eurobarometer)

- There is a 15-percentage-point gap in understanding inflation between the poorest (57%) and richest households (72%). (Bruegal)

- Similarly, there is a 14-percentage-point gap in understanding inflation between the youngest respondents (18-24; 58%) and the oldest (55+; 72%). (Bruegal)

- 65% of respondents understood the concept of inflation, and 45% understood how compound interest works. (Eurobarometer)

- Only roughly 1 in 3 Europeans trust the investment advice they receive from banks, insurers, or financial advisors. (Eurobarometer)

Financial risk comprehension statistics

When it comes to financial risk, most people feel confident in their ability to manage it—but the data tells a different story. The Personal Finance Index (P-Fin Index), an annual study of financial illiteracy among U.S. adults, consistently shows that comprehending risk is the single lowest area of financial knowledge.

This finding holds true across generations and is particularly concerning given that every financial decision involves some level of risk. The following statistics reveal just how unprepared many people are to navigate an uncertain economic world, and why this matters for their financial stability and retirement:

- Comprehending risk is consistently where functional financial knowledge is lowest among U.S. adults. (P-Fin)

- Americans’ understanding of risk has declined, falling four percentage points since 2017 to just 35% in 2025. (P-Fin)

- While financial literacy is lowest among Gen Z (when excluding Gen Alpha), the generational knowledge gap closes when it comes to comprehending risk, with even older adults scoring low on risk-related questions (31% vs. 31%, respectively). (P-Fin)

Percentage of P-Fin Index questions answered correctly

| Gen Z | Millennials | Gen X | Baby boomers | Silent generation | |

|---|---|---|---|---|---|

| Borrowing | 47% | 55% | 61% | 67% | 63% |

| Saving | 46% | 53% | 57% | 62% | 61% |

| Consuming | 43% | 50% | 53% | 55% | 50% |

| Earning | 38% | 45% | 53% | 54% | 54% |

| Go-to info sources | 39% | 45% | 51% | 54% | 52% |

| Investing | 34% | 43% | 49% | 53% | 54% |

| Insuring | 26% | 37% | 45% | 55% | 57% |

| Comprehending risk | 32% | 36% | 37% | 38% | 39% |

- Only 29% of women are risk literate, compared to 36% of men. Women are also more likely to answer “do not know” to a risk question than men, with 53% of women responding this way at least once compared to 39% of men. (Retirement Income Institute)

- 43% of those with a bachelor’s degree or higher are risk literate, compared to just 22% of those with less than a high school diploma. Similarly, 39.6% of those with an income of $100K or more are risk literate, compared to only 20.8% of those with an income below $25K. (Retirement Income Institute)

- 2024 revealed a 7% decline in U.S. adults’ ability to make ends meet and save for emergencies, reversing a 12-year trend of steady improvements. (FINRA)

- The proportion of people who always pay their credit cards in full each month decreased from 59% in 2021 to 53% in 2024, ending a period of steady increases. (FINRA)

- 80% of college graduates have a retirement account compared to only 37% of those with no college degree. (FINRA)

Financial literacy and young people

When it comes to financial literacy, young people are facing a unique set of challenges and opportunities.

On one hand, many teens and young adults lack confidence in their financial knowledge and feel unprepared to handle real-world financial decisions. Yet, there’s also a growing demand for financial education, with an increasing number of schools and states making personal finance a graduation requirement.

These financial literacy facts paint a picture of this new generation’s financial landscape, revealing their struggles, motivations, and what’s being done to help them prepare for the future:

- Financial literacy is lowest among Gen Z (38%), followed by Millennials (46%) in 2025. (TIAA Institute)

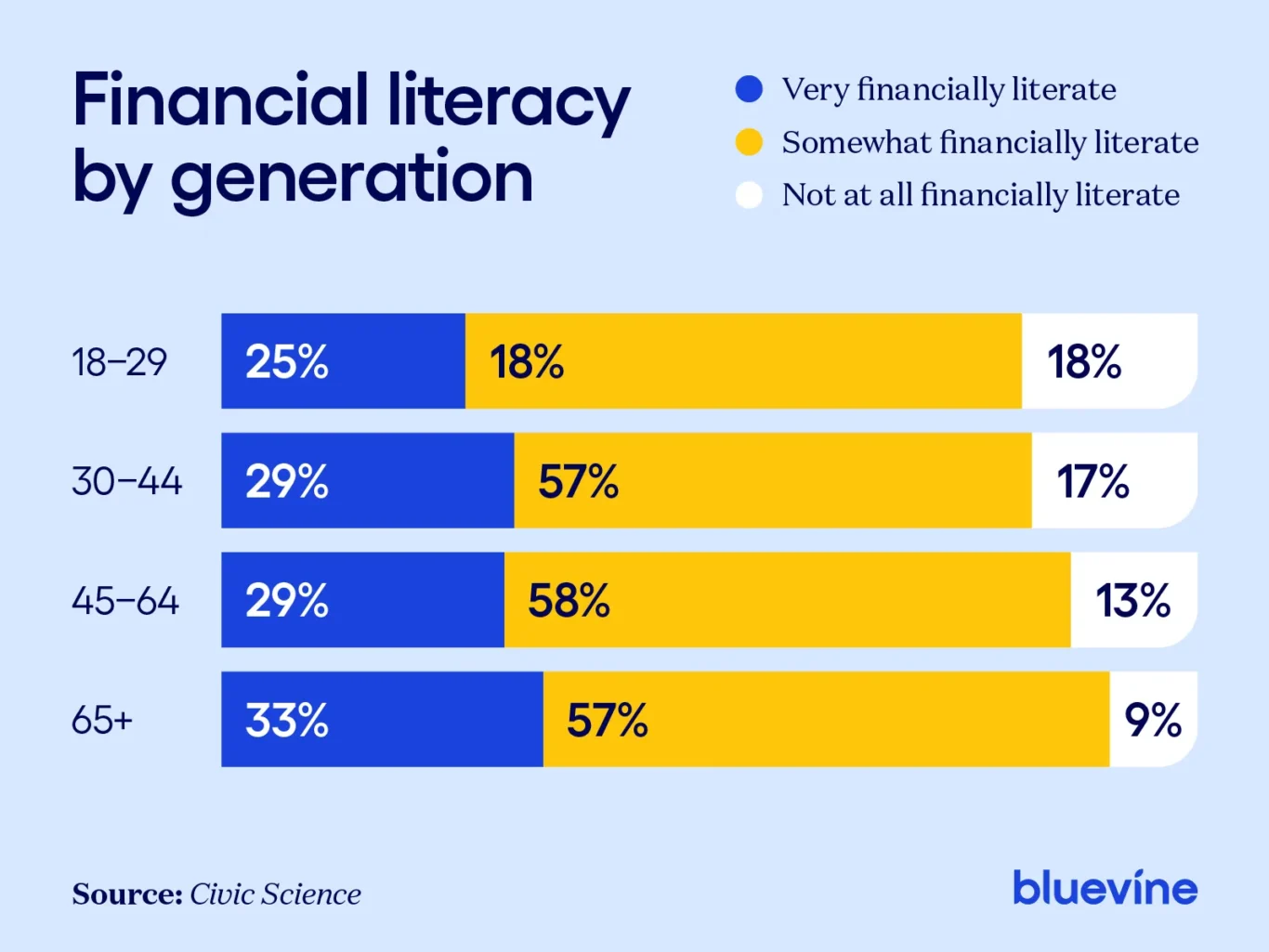

- In April 2025, only 25% of 18-to-29-year-olds felt “strongly confident” in their financial knowledge, a notable decline from 36% just two years earlier. (Civic Science)

- The percentage of Gen Z who say they are “not at all” financially literate has increased from 12% to 18% since 2023. (Civic Science)

- Gen Z is less likely than the general population to report managing their money “well” (50% vs. 57%–62% for the general population). (Civic Science)

- Nearly half of all Gen Zers—46% of those aged 13 to 28—rely on their parents or family for financial help and advice. (Better Money Habits

- Unlike previous generations, Generation Alpha is getting a head start on financial literacy, with many children beginning to engage with money by the age of seven. (Mastercard)

- 69% of kids age 6–14 have already started a side hustle or plan to, motivated by earning extra money, saving for the future, and developing skills. (Acorns)

- Of those Gen Alphas making money, 43% use tech and 26% use social media for activities like selling crafts, creating content, and running small online businesses. (Britopian)

- While 68% of teens say they would take a financial literacy class if it were offered, only 31% have access to one at their school. (Junior Achievement)

- Since 2022, 12 more states now require high school students to take a personal finance course to graduate, bringing the total to 35. (CEE)

- This means an additional 21% of U.S. high school students are now required to take a personal finance course for graduation, making it accessible to 10 million more students. (CEE)

Small business financial literacy statistics

It’s a common belief that running a business requires a high degree of financial know-how, but the reality is often quite different. Recent data shows that many small business owners start their ventures with limited financial literacy, and this knowledge gap can significantly impact their success.

From struggling with small business taxes to lacking emergency savings, the statistics highlight the challenges of learning on the job.

This list breaks down the key findings on the state of financial literacy among small business owners and why it matters for their bottom line:

- Only 16% of new small business owners have a business degree or similar qualifications—most learn as they go. (QuickBooks)

- Small business owners were nearly twice as likely to report that their income varied from month to month. Specifically, 41% reported income varying “somewhat” compared to 21% of non-owners, and 16% reported it varying “a lot” compared to 6% of non-owners. (CFPB)

- Nearly half of small business owners (42%) admit they had limited or no financial literacy before starting their businesses. (QuickBooks)

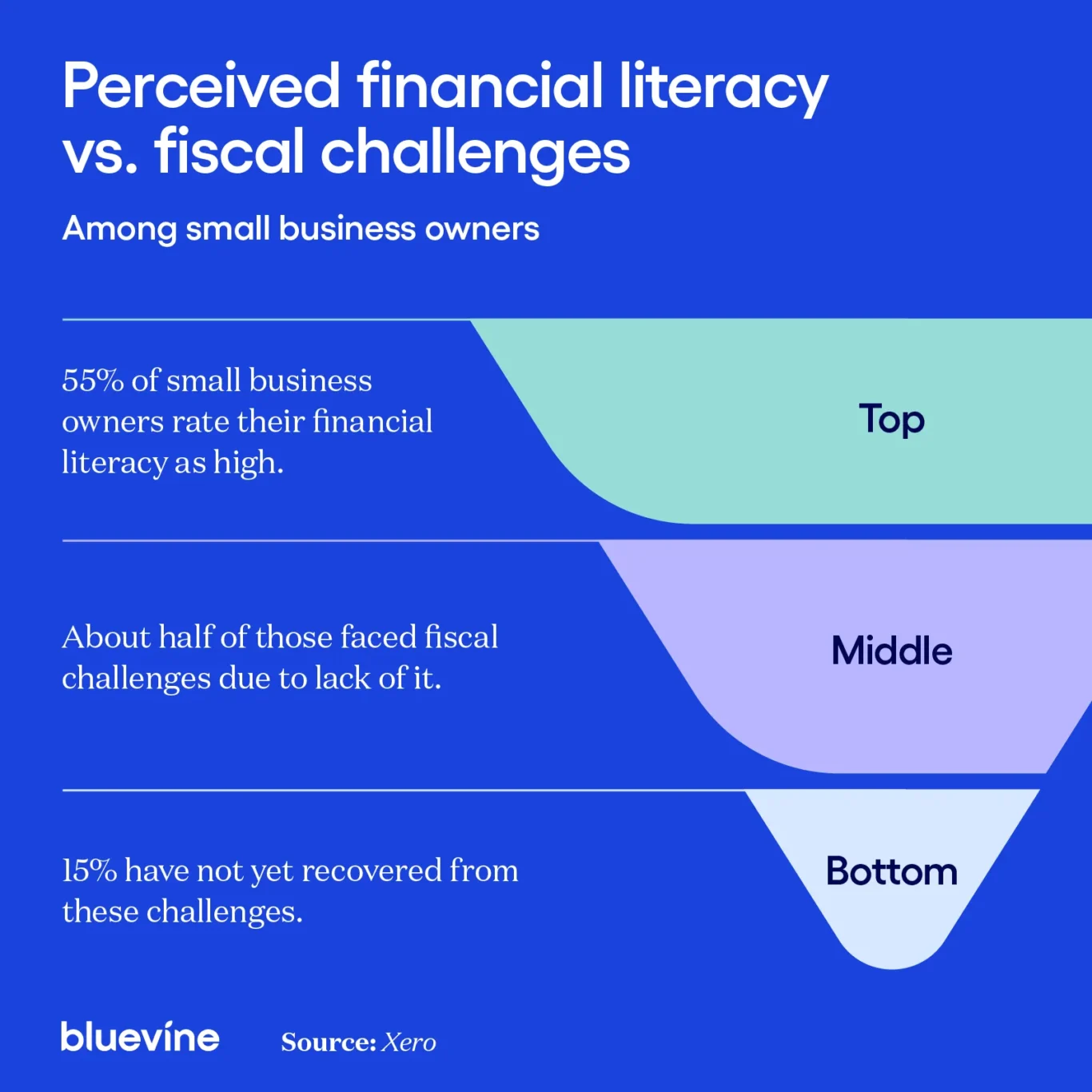

- 55% of small business owners rate their own financial literacy as “high,” yet half of them have faced fiscal challenges due to a lack of it. 15% have not yet recovered from these challenges. (Xero)

- While small business owners and non-owners applied for credit at similar rates, small business owners were more likely to be turned down or not receive as much credit as they requested. (CFPB)

- Low financial literacy costs small business owners an average of $118,121 in lost profit. (QuickBooks)

- A significant portion of small business owners (39%) manage their finances on their own, while only 16% use an accountant or advisor. (Xero)

- 18% of small business owners report optimizing tax strategies as their top financial literacy challenge, followed by implementing and sticking to business budgets (16%), interpreting financial metrics (16%), and implementing cash flow management (16%). (Xero)

How financial literacy trends impact small businesses

The challenges faced by young people and the general population directly affect the small business landscape.

With a new wave of entrepreneurs starting ventures without a strong financial background, the need for accessible financial tools and education is more apparent than ever. These broader trends—from a lack of confidence in managing money to a poor understanding of risk—translate into real-world struggles for new business owners who are often figuring things out as they go.

Ultimately, a financially literate public is key to building a more resilient small business economy.

Turn financial insights into action with business checking

From managing daily expenses to managing business cash flow, financial knowledge directly impacts your well-being. Whether you’re a young person just starting out, a small business owner navigating a new venture, or an adult managing a household, understanding your finances is the first step toward a more secure and prosperous future.The Bluevine Business Checking account is designed to simplify your financial life. We offer an all-in-one platform that helps you manage your money with clarity, so you can focus on confidently growing your business. With Bluevine, you don’t have to be a financial expert, you just need a partner who can help you make smart financial decisions every step of the way.

Start making smarter financial decisions for your business today.