There are so many advantages to owning a small business, like being your own boss, having creative freedom, and sometimes making your own schedule. As you work hard for these rewards, you might have to deal with some form of financial stress in your business—from cash flow hiccups to the impact of an unexpected event like the COVID-19 pandemic.

Fortunately, with the right financial decisions, you can manage through the stress, protect your business’s financial health, and set your business on a path for long-term growth. In this post, we’re going to show you how.

1. Create a budget

A logical first step to overcoming financial stress—or even preventing financial stress in the first place—is to create a budget.

Budgeting allows you to get a clear picture of your business’s overall financial health, from your cash flow to your profits. Not only that, you’ll be able to see where to cut back on spending and, in turn, increase your margins.

To create a budget, you’ll want to organize your finances into four key categories and track them each month. For example:

- Income. This includes how much money you’re making each month from sales and any other income sources you might have.

- Fixed costs. These are your business expenses that stay the same each month, such as rent, payroll, subscription services, and certain utilities like internet and data charges.

- Variable expenses. These are expenses that fluctuate each month depending on business performance and other needs, such as gas, electricity, shipping costs, sales commissions, office supplies, etc.

- Projections. Account for any future investments, one-time costs, or increased income projections that are in the pipeline. This can include seasonal marketing campaigns, the purchase of a new piece of equipment, etc.

There are a number of ways to track these financials on a monthly basis. You could comb through your bank and credit card statements, track data in a spreadsheet, use small business accounting software like Wave, Quickbooks or FreshBooks, or work with an accountant.

Once your budget is set, make sure to monitor it every month so you can stay on track, identify areas where you can cut spending, and look for opportunities to maximize your margins.

2. Get an emergency fund

It’s common in personal finance to hear about emergency or “rainy day” funds, where individuals set aside a certain amount of money (such as six months of income) for things like unexpected expenses, or job loss security.

This same strategy is equally important for small businesses. When you have a safety net of cash, your business will be more resilient in times of change—such as economic downturns or seasonality, or, as we’ve been experiencing this year, a global pandemic that’s affecting everything from supply chains to customer traffic.

To find money for your small business’s emergency fund, follow these simple steps:

- Budget for savings. As you’re putting together your business’s budget, think about adding “Savings” to your fixed costs, then put aside a specific amount of money each month.

- Improve cash flow management. Evaluate your cash flow to see how you can keep more cash coming in than going out. Then, as your cash flow continues to improve, you can set aside a portion of the increased in-flows for savings.

- Consider a line of credit. If it’s going to be difficult to build an emergency fund on your own, financing might be a suitable next step. For example, you could open a revolving line of credit from a lender like Bluevine. With our line of credit, you’d draw funds as you need them and pay only for what you use. It’s free to open and there are no monthly maintenance charges.

In addition to a line of credit, you could use invoice factoring to help improve cash flow. For example, an invoice factoring solution allows you to get paid on your invoices now. When you don’t have to wait for a customer payment, you have more cash on hand to save and/or invest in your business where it’s needed most.

3. Ask for help

As a small business owner, you’ve likely experienced your share of support from friends, family, customers, maybe even your vendors. This support can include everything from actual purchases to social media follows to referrals. And it can also mean supporting your business financially if you’re experiencing financial duress.

All this to say, it’s okay to ask for help if and when you need it. Here are some creative and comfortable ways to do that:

- Work with an expert. Sometimes, you might need expert guidance from a financial advisor or accountant to help get your business finances in order.

- Host a business fundraiser. Engage your community (friends, family, customers, social media followers, etc.) with a fun way to raise money for your small business. For example, give donors a free product or discount in exchange for their support. If you’re honest about your situation and financial needs, they’ll likely be more than willing to help. You could use a crowdfunding platform like Kickstarter, Indiegogo, or GoFundMe.

- Negotiate payment terms with vendors. If you have long-standing relationships and good credit with your vendors and suppliers, they may be willing to give you a discount or extended payment terms while you’re getting back on track. There’s no harm in asking.

Asking for help can be a humbling experience for anybody, but remember that you have a supportive community that wants to see your business thrive.

4. Plan for your future

As you think about where your business will be 5, 10, even 20 years from now, what do you see? Will you launch new products or service offerings? Will you expand to new locations? Will you hire more employees? Whatever the case may be, you’re going to want to plan for it.

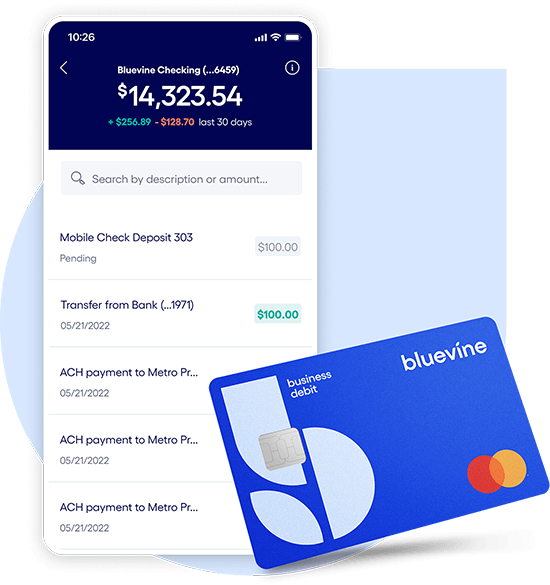

Part of planning for it means optimizing the financial strategy for your business. We’ve already outlined a number of ways to do this—such as by budgeting, improving cash flow, and getting financing—but you can also prepare with the right business checking account.

When you find the right small business bank, you’ll feel like you have a banking partner—not just a financial institution that allows you to make deposits and withdrawals. At the end of the day, you want a checking account that’s going to produce high yields without fees or balance requirements. That way, you’ll have more money in your pocket and more flexibility in planning for your business’s future.

At Bluevine, we created Business Checking to help you better manage your finances so you can create a thriving and sustainable business. There are no monthly or hidden fees, no transaction limits or minimum deposit requirements, and 1.3% interest for eligible customers.BVSUP-00005 With a Bluevine Business Checking account, you’ll get flexibility, transparency, and partnership.

Small business checking, built for your needs

Unlimited transactions, live support, high interest rates, and no monthly fees. Open a Bluevine Business Checking account online today.

Learn more