Control and convenience to keep your business moving

You want to be in the driver’s seat of your business finances, with tools that give you the right amount of oversight, account security, and flexibility.

At Bluevine, we’re always bringing you more ways to run and grow your business—constantly building and evolving financial tools that help you save time, money, and headaches. With the latest updates to our comprehensive business banking platform, we’re giving you:

- More control over how and when you make payments, and

- More convenient tools to get paid

Product release highlights

- Control: Manage expenses with confidence knowing you can stop or block outgoing check payments, approve specific ACH transactions, and further customize alerts.

- Convenience: Streamline your invoicing with easy attachments, automatic reminders, recurring invoices, SMS delivery, and a convenient new dashboard.

- Flexibility: Issue physical and virtual debit cards for sub-accounts so you can better control spend and reduce fraud.

More ways to stay in control

From new debit card options to smarter fraud prevention tools, your business has even more at its disposal to stay ahead of potential risks while keeping operations running smoothly. Whether you’re getting more of a handle on team spend or safeguarding your payments, we’re putting more power than ever in your hands.

Debit cards for sub-accounts

You asked, and we delivered. Now, you can enjoy more control, flexibility, and peace of mind over team spending by issuing debit cards for your sub-accounts. These additional debit cards can be physical or virtual, and you can set custom spend limits for each card.

With debit cards for individual sub-accounts, you can easily manage spend, budget for specific projects, and help reduce the risk of fraud. And with sub-account automatic transfer rules, you can make sure a debit card for a specific sub-account only has access to the money it needs.

Learn more about how to master your cash flow with sub-accounts, debit cards, and automatic transfer rules in our helpful guide—or watch our on-demand webinar.

Did you know?

You can have up to 50 active debit cards between your main Bluevine Business Checking account and sub-accounts at any given time, including one physical card per account.

Added security for written checks

Send payments via written check more confidently from your Bluevine dashboard, knowing you can block all outgoing check payments from your main account or a sub-account, or stop specific checks from being cashed or deposited.

By combining these new written check controls with the security tools you already have in your Bluevine arsenal—including ACH debit blocks and ACH preauthorization—you can help protect your account.

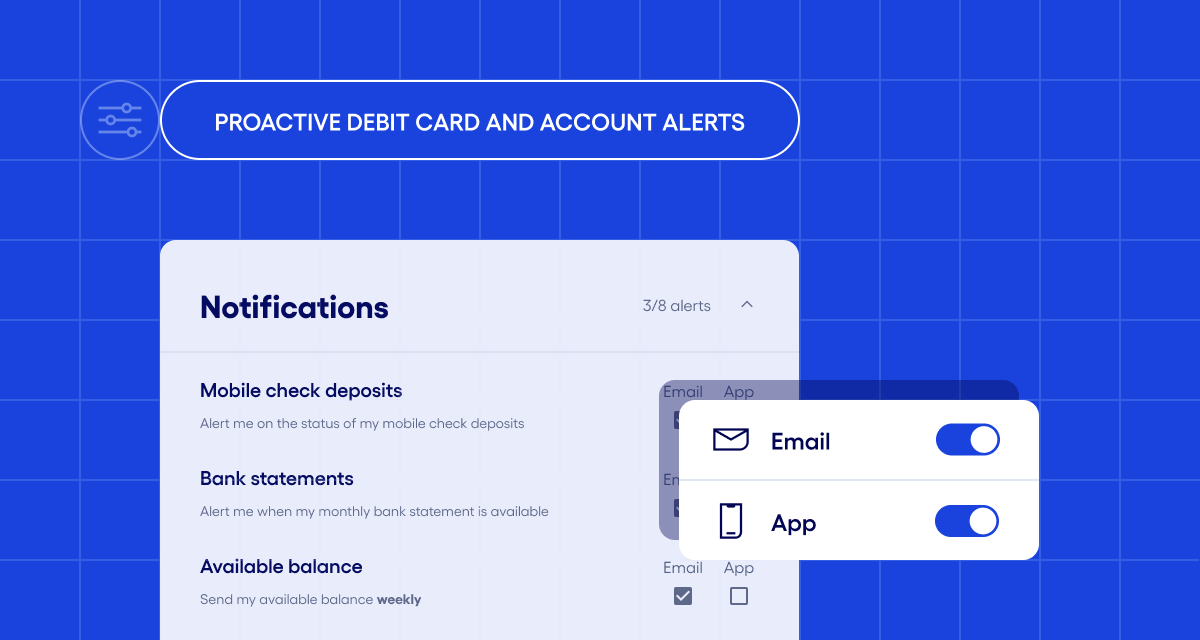

Proactive debit card and account alerts

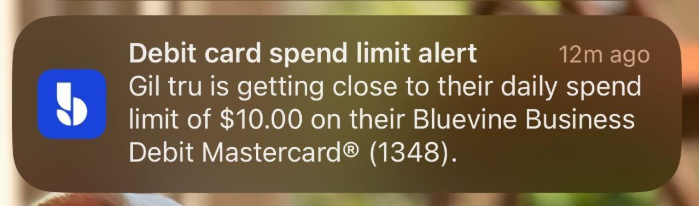

Notifications just got better, too. Now, to help prevent surprises and fraud, you’ll receive more proactive account alerts for when:

- You or your team are nearing debit card spend limits

- Someone makes a large purchase (above your set threshold)

- Your main account or sub-account balance is low (below your set threshold)

- Someone issues a new virtual debit card for your main account or sub-account

Here’s an example of a push notification you might receive if an employee is approaching the daily debit card spend limit you set for them:

Enhanced ACH fraud controls (up next)

Checking account customers will have even more control over outgoing ACH transactions. With our current control features, you can block or allow outgoing transactions from certain accounts or vendors, and soon, Premier customers will be able to monitor and review individual transactions before they leave your account. ACH positive pay gives you the power to set a dollar amount that triggers review, or simply choose to review all transactions from unblocked vendors.

Interested in upgrading? Learn more about what you get with our Premier business checking plan.BVSUP-00117

Getting paid just got even easier

Our invoicing and payment links tools have already made it simpler than ever for you to get paid right into your Bluevine Business Checking account. This month, we’ve made additional updates that will help streamline the payment process for both you and your customers.

Automatic payment reminders

Save time on follow-ups and get paid faster with automated reminders to customers. You can send one reminder the day before a payment is due with our Standard plan, or you can send up to four reminders per invoice on a custom schedule with Plus or Premier.

Easy attachments

You can now add contracts, estimates, purchase orders, and more directly to your invoices, eliminating extra back and forth that could delay payments.

SMS delivery

Sending invoices just got easier. In addition to email, link, and PDF, you can now send invoices by text message (SMS)—from web or mobile—in just a few clicks.

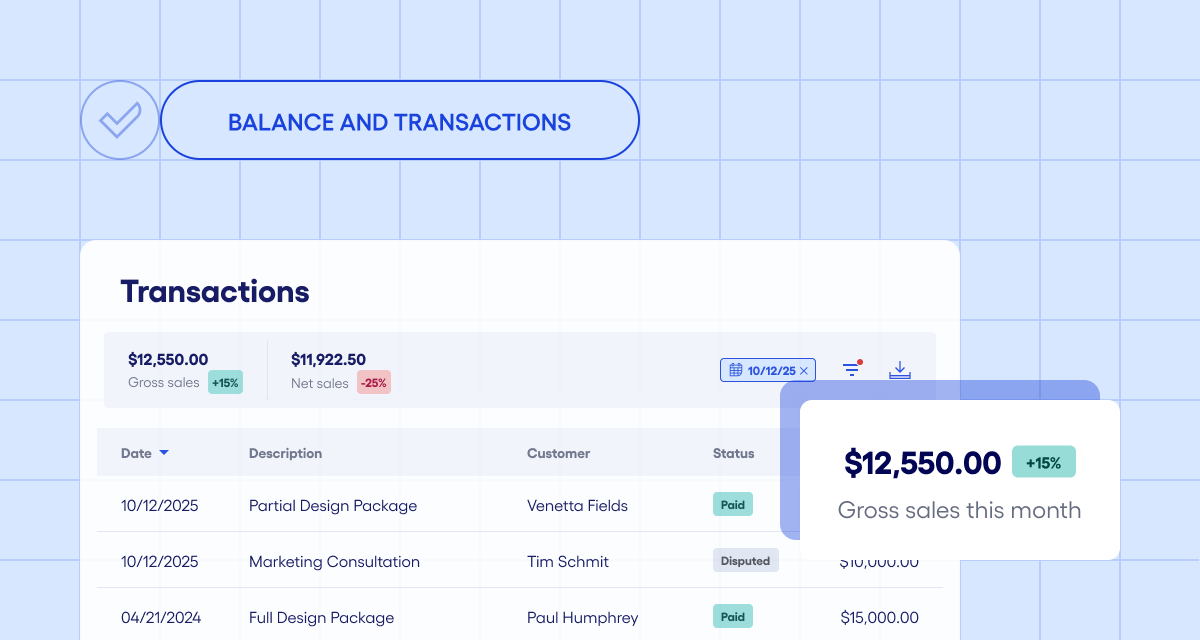

Balance and transaction dashboards

Stay on top of your cash flow: Track Stripe payouts, monitor your available balances, and review all your transactions in one place.BVSUP-00180

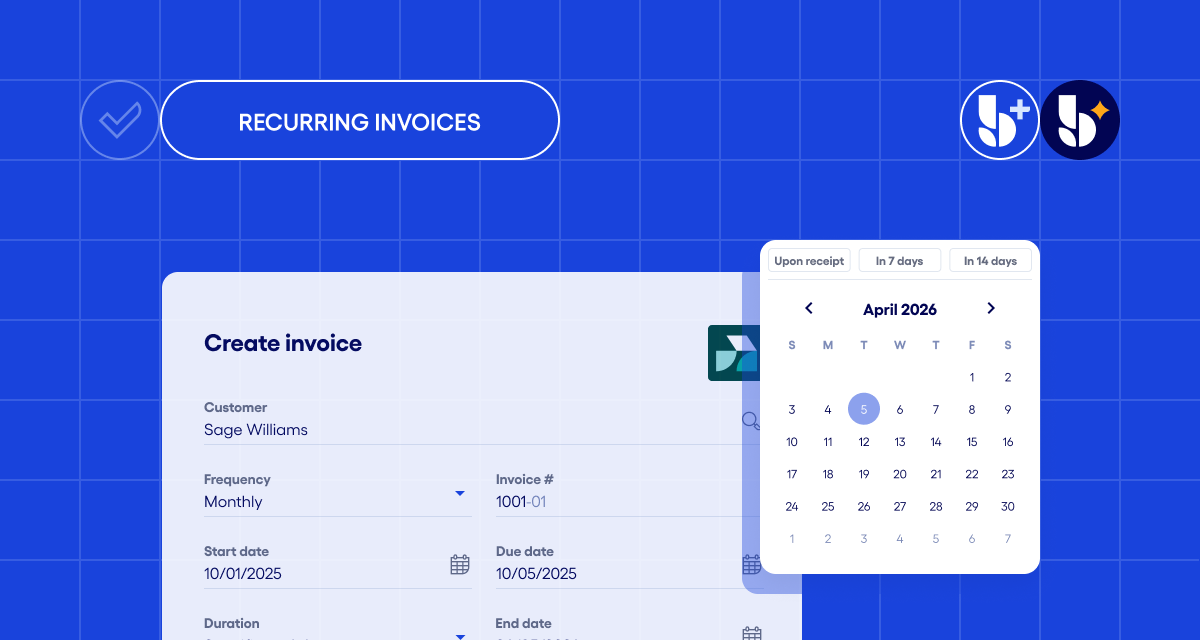

Recurring invoices

Plus and Premier plan customers can now save time and energy by setting up automated recurring invoices. Set a schedule that works for you and your customers, and simply wait for the payments to roll in.

See what else you can enjoy with our Plus business checking plan.BVSUP-00132

Custom invoice fields

Plus and Premier plan customers can capture all the unique info needed to run your business with custom invoice fields, such as PO number or service location. Whether you simply want to include information for organizational purposes, or they are required for compliance, your invoice is yours to control.

Closing thoughts

A large number of small business owners pursue their dreams out of unbridled passion, and many I’ve spoken to also cite their desire for freedom as a driving force. Well, we hear you, and we want to help give you the freedom to move faster while staying protected—the freedom to keep payments coming in with less hassle, to keep your team spending under control, and to keep your cash flow healthy and secure.

Explore why Bluevine is the largest small business banking platform in the U.S.BVSUP-00186

FAQs

How does ACH positive pay work?

With our Standard business checking plan, you can easily block unauthorized ACH transactions from your account—either by blocking all ACH debits for a given account or by blocking debits from specific payees. With ACH preauthorization, available in our Plus and Premier plans, you can also proactively allow specific payees to debit from your blocked account or sub-accounts.

Premier customers will get even better tools for protecting against unauthorized ACH debits. With ACH positive pay, you can monitor individual ACH debits before they post. Set a dollar amount that triggers review, or simply choose to review all non-approved vendors. You can also automatically decline (or approve) them, if no manual action is taken.

What’s the difference between a virtual debit card and a physical debit card?

A virtual debit card is essentially a digital version of your physical debit card that you can use immediately—no need to wait for a physical card to arrive in the mail. With its own unique card number, you can use your virtual card alongside your physical debit card whenever you want.

Vendors charge your virtual card just like your physical card. However, they won’t see your primary physical card information, which adds an extra layer of fraud protection. Plus, with a virtual card, you remove the risk of losing your physical card.

Another way to use your virtual debit card is to add it to your mobile or digital wallet, so you can make in-person purchases at tap-to-pay terminals.

How do I waive the monthly fee for the Bluevine Plus and Premier plans?

You can waive the monthly fee for Plus and Premier by meeting balance and spending requirements.

To waive our Plus plan’s $30 monthly fee: Maintain an average daily balance of at least $20,000 across your Bluevine Business Checking account and sub-accounts each billing period, AND spend at least $2,000 with your Bluevine Business Debit Mastercard® each billing period.

To waive our Premier plan’s $95 monthly fee: Maintain an average daily balance of at least $100,000 across your Bluevine Business Checking account and sub-accounts each billing period, AND spend at least $5,000 with your Bluevine Business Debit Mastercard® each billing period.