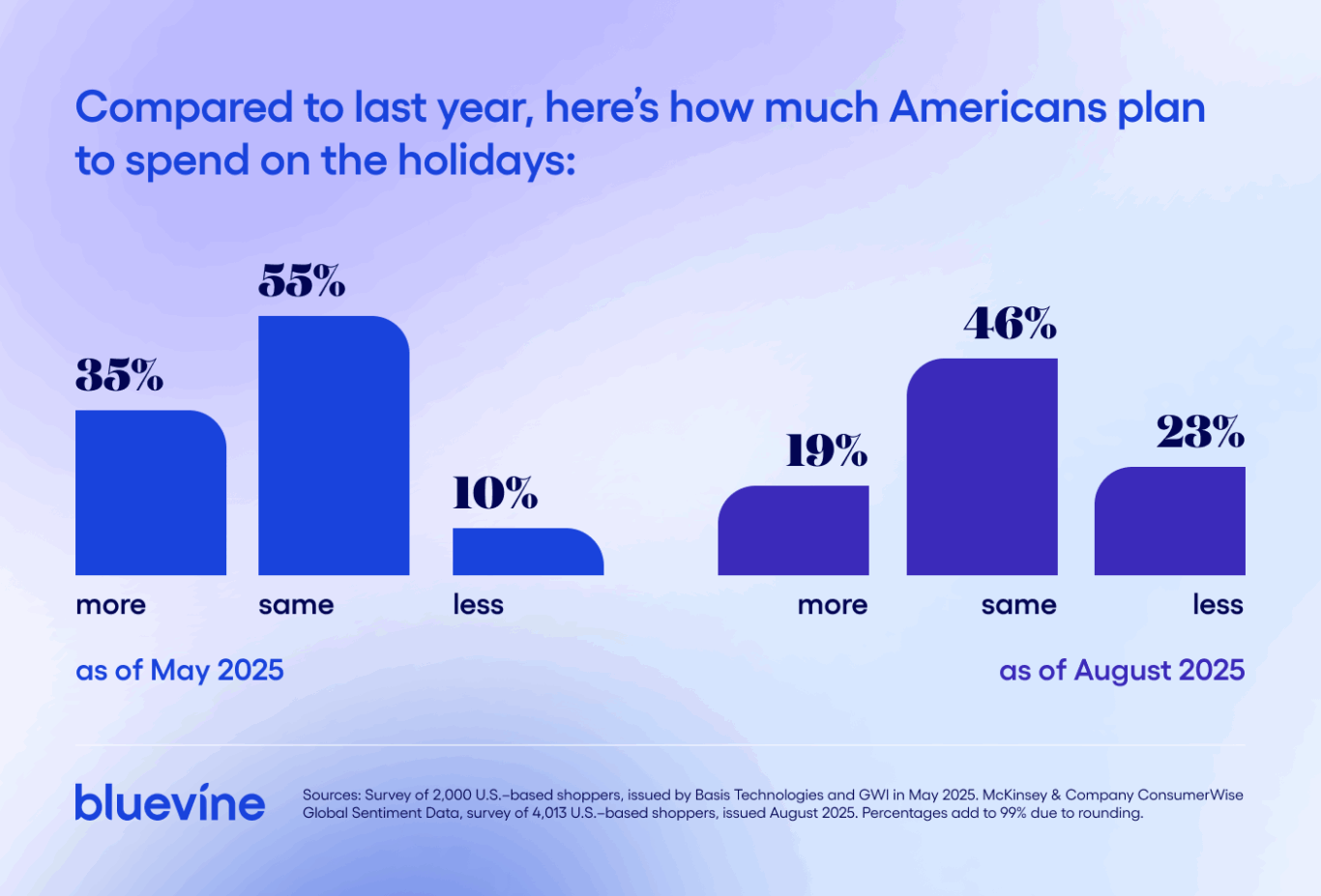

2024 was a rebound year for small businesses. Not only did performance exceed expectations across the board, 79% of our Business Owner Success Survey respondents entered 2025 confident that their businesses would beat expectations again.1 Their customers, on the other hand, have felt far more cautious about their economic future, but they also aren’t planning to spend less this holiday season—in fact, the average American household will spend 5.7% more on holiday expenses in 2025 than 2024.2

Yes, while shoppers from all income brackets reported they’d be cutting back on non-essential spending, 65% of households plan to match or increase last year’s holiday budget.3 This percentage climbs with household income, as 84% of households earning $75,000 or more plan to do the same.4

What’s going on? While survey respondents may be honestly reporting overall cutbacks, most still plan to celebrate holiday traditions like gathering and gift-giving, and will be more generous spending on gifts than on themselves.5,6 This means that, while overall holiday spending is projected to grow in 2025 (relative to last year),2 your customers will be spending more selectively, and seeking out sales, deals, and value more intentionally than ever before.

To help you navigate the long and delicate holiday season ahead, we compiled insights from 12 different customer analytics reports to help you understand your customers’ mindsets, take advantage of peak sales periods, and execute a holiday marketing strategy that will steer your business confidently into 2026.

Key insights and actions

Insights

- Americans plan to spend as much as they did on last year’s holidays, but more intentionally.

- Tariff anxiety will drive some early spending as shoppers rush to beat price increases.

- Customers will increasingly ask AI for gift recommendations this year and beyond.

Actions

- Capture high-value customers before Cyber Week, which will dominate seasonal sales.

- Provide options to last-minute and post-Christmas shoppers to establish loyal customers.

- Optimize your business website for recommendation by AI language models.

2 trends shaping customer spending in 2025

Inflation anxiety wanes, tariff uncertainty takes its place

Although inflation has continued to cool in 2025, ambiguity around tariffs is raising concern about the availability and price sensitivity of gifts. The latter is this year’s most common anxiety among shoppers, with 51% of shoppers “very concerned” about the effect of tariffs on prices, and 42% still “very concerned” about inflation.4

While tariff concerns eased slightly over the summer,3 77% of shoppers still believe their holiday spending will be at least “a little” affected by tariffs.2 31% of these potential customers will adapt by shopping early to beat price hikes, while 53% will wait for seasonal discounts.2

This suggests a longer holiday season than ever before, one in which sales may feel more or less continuous throughout the fourth quarter. Such price cuts were highly effective during last year’s holiday season—Adobe reported that, in 2024, shoppers’ economic anxiety and increased response to discounts accounted for an extra $2.25 billion in online spending during sales.7

Businesses and customers alike are becoming more comfortable with AI

According to our research, 61.3% of small business owners hold a favorable view of AI tools.8 For reasons that include potential job losses, frustrating customer support programs, privacy concerns, and a general loss of humanity, customers are much more skeptical of businesses using AI. However, their trust greatly increases when asked about specific business use cases,9 so if you implement generative AI into your holiday marketing, be transparent about how you’re using it, and only use it to support your employees’ existing creativity and expertise.

If you’re considering using AI this holiday season, keep in mind that trust and sentiment toward AI range significantly across demographics—those 50 and older trust it less than younger generations, and men trust it up to 30% more than women (depending on how it’s used). Women are also 26.8% more likely to object to the use of AI-generated human models in ads.9

Of the people who regularly use large language models like ChatGPT, 68% trust the information they receive, and about half of US-based users believe they’ll use an LLM to research gift ideas this year.2,4,9 This increase in trust, combined with search engines’ addition of AI-generated result summaries, may cause a significant decline in traffic to your business website—if it hasn’t already—making your direct marketing channels all the more important.

Holiday spend trends from 2024 and 2025

Here’s what last year’s data and this year’s projections show us about when and where customers like to shop for the holidays:

Summer, fall, and November: Capture early shoppers

In 2024, inflation anxiety was a major motivator for early deal shopping. For the 66% of shoppers bracing for tariffs to raise gift prices, 2025 should be no different—15.2% of all holiday spending is planned for before November.5 64% of shoppers plan to start holiday shopping before Halloween,4 while 35% of shoppers reported they’d already started before August.10

A lot of that early spending will be soaked up by Amazon’s Prime Big Deal Days on October 7–8, but your small business can capitalize on these early shoppers with fall season or Halloween deals. Such sales are the number one driver of early spending—66% of shoppers start early to capitalize on discounts, while 30% start early to avoid sell-outs or supply issues.4

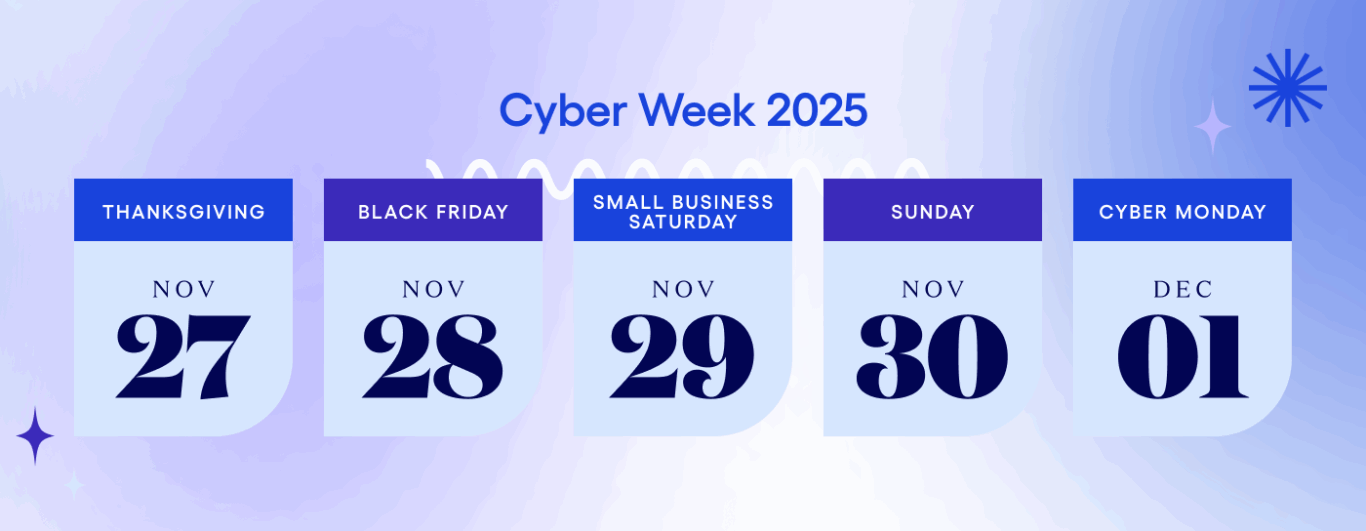

Cyber Week arrives late again this year, leaving a long November to capture early shoppers. 24.7% of all holiday spending is planned for Nov 1–27,5 with 27% of shoppers planning to start in November but before Cyber Week.4

Did you know?

Holiday shoppers spent $18.2 billion dollars on Buy Now, Pay Later (BNPL) purchases in 2024, more than any previous year. Cyber Monday 2024 set the standing daily record for BNPL spending: $991.2 million.

Source: Adobe for Business

Cyber Week: Peak sales

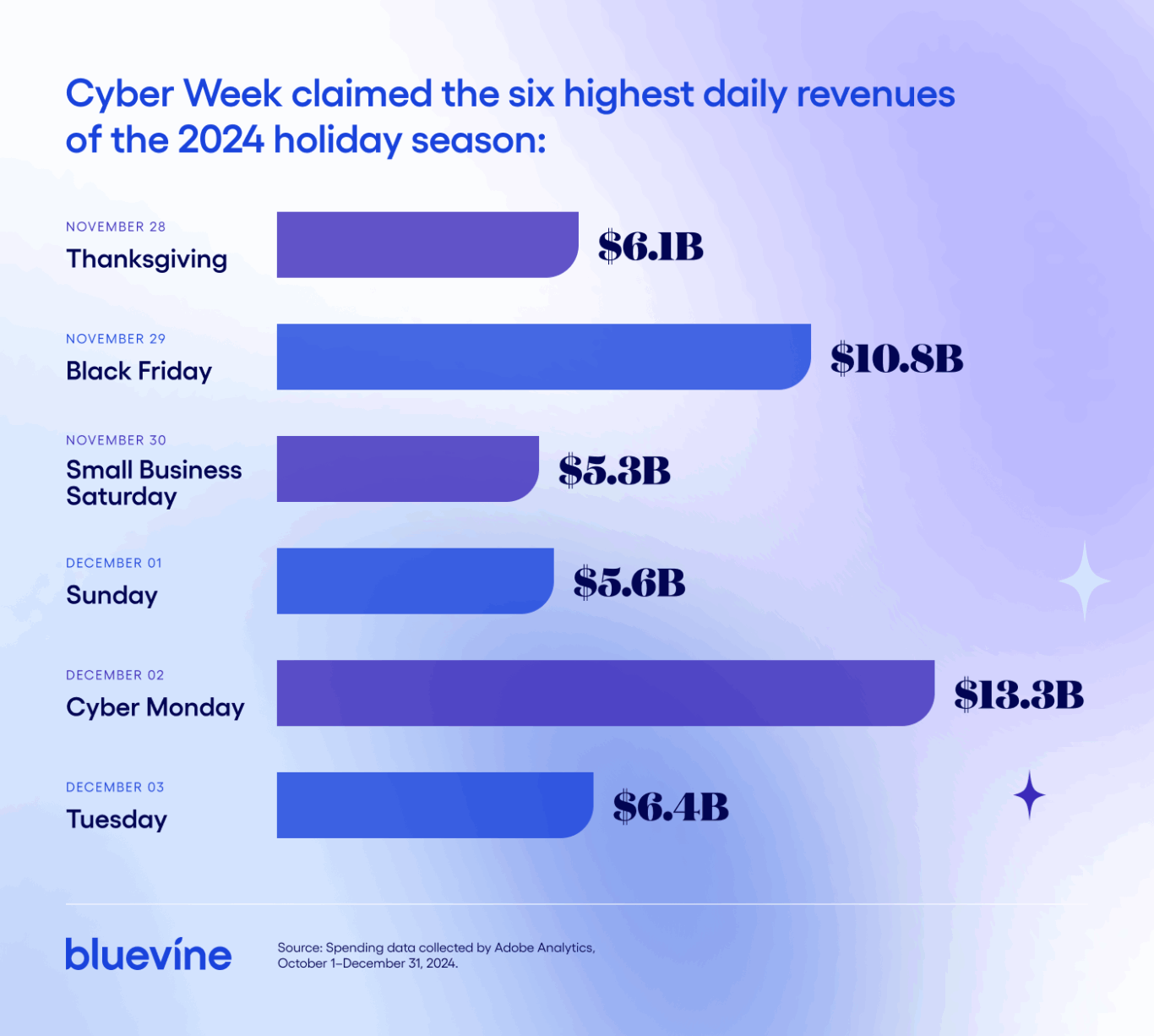

Americans may start shopping earlier this year, but 59% will wait for Black Friday or Cyber Monday to make major purchases,4 and 38.4% of all spending is planned for Cyber Week alone.5 This is exactly what happened last year, when daily revenue remained steady until the weekend before Thanksgiving. The five days of Cyber Week and the day after Cyber Monday were the six biggest spending days of the entire 2024 season.7

In 2024, mobile ordering hit its highest share of online revenue, at 54.5% of online orders in November and December. However, the conversion rate for desktop orders was almost double than mobile on Black Friday 2024, and 50% higher on Cyber Monday.7 Customers may be spending less time shopping on mobile than when browsing on desktop, or may be more accustomed to filtering out advertisements on mobile.

If your business targets younger shoppers, then consider ramping up your direct social media marketing, as 35% of Gen Z and 26% of millennials plan to buy gifts directly through social media this year. The most popular social channels for gift buying are Instagram (52%), Facebook (51%), TikTok (47%), and YouTube (40%).11

Overall, here were the most popular options for Black Friday and Cyber Monday purchases in 2024:

December and Christmas: Welcome all last-minute shoppers

This year, 19% of holiday spending is planned for December 2–25, a smaller share than Nov 1–27.5 In 2024, daily revenue steadily fell through December until spiking on the 20th through 23rd.7 Expect the same price hikes from last-minute shoppers to begin on the last Friday before Christmas: December 19, 2025.

As Christmas draws near, having flexible shipping options will become increasingly important. Last year, standard shipping was the most-used option throughout the holiday season. Expedited shipping was least-used, but its share of orders increased nearly fivefold from December 1st to its peak on December 19. Curbside pickup increased sharply in the 10 days before Christmas, peaking on December 23rd at 37.8% of all orders.7

Christmas and after: Returns, redemptions, and renewal

Mobile hit its peak share of online sales on Christmas Day, accounting for 65% of internet purchases.7 This may relate to one of the conspicuous trends in this year’s holiday reports: the ascendancy of the gift card. Gift cards have a number of benefits for the modern shopper: They circumvent the need for gift ideation while preserving gift-giving as a tradition, and can be an affordable way to cut back on whole purchases. In fact, gift cards are the most popular planned purchase this year—34% plan to spend more of their holiday budget on gift cards than any other category (including the second-place answer, groceries).3 52% of Americans plan to give at least one gift card to their friends.5

The holiday season by no means ends on Christmas—in fact, the following week is fertile ground for businesses to reach a particular type of customer: gift-givers who, now that their holiday travels and traditions are over, are ready to redeem gift cards or gift money on something for themselves:

- The New Year symbolizes a fresh start for many. Customers might make end-of-year purchases to get ahead on resolutions, evolve their identity, or leave a disfavorable year behind them.6

- Despite subsiding inflation, net consumer sentiment is down 35% since November 2024.3 As people continuously cut back on personal expenses, a dose of “retail therapy” after the holidays becomes all the more alluring.5

6 steps to maximize holiday sales in 2025 and beyond

As a small business owner, your size makes you uniquely suited to navigate this year’s longer and more conscious holiday season—you’re more flexible than big businesses, and your messaging can disseminate faster and feel more genuine. Based on the data above, here are six strategies you can implement this year and beyond to entice customers at each step of the season, build a lasting community around your brand, and tap into marketing white spaces.

1. Start sales early, but pace your holiday messaging

When holiday shoppers were asked about their biggest frustration last year, “high prices” was the most common response,11 and “rising prices” remain this year’s biggest concern.3 Most of this year’s shoppers are preparing to spend as much or slightly more than last year, but expecting to afford less, meaning gifts will be bought more intentionally and over a longer holiday shopping season than in years past.12

Some of these shoppers will try to outpace price hikes by shopping early, and your best chance of reaching customers throughout the season is with sales, preferably storewide. That being said, your early sales don’t need to be holiday or Christmas–themed. Customers in recent years have complained on social media of “Christmas Creep,” the alienating experience of seeing Christmas items or messaging before Halloween.6 Instead of pushing Christmas messaging too early, motion toward early shoppers using Fall, Halloween, Veteran’s Day–themed sales until Cyber Week and Small Business Saturday. Keeping in line with this year’s plans to shop early, 88% of shoppers would prefer to receive their holiday offers before the major holidays, but 36% want to receive fewer marketing messages overall.4 When reaching out to customers, more messages won’t always cut through the noise—create a wide audience funnel by pursuing many channels, but focus specific attention on low traffic and higher-cost channels like SMS or local advertising to differentiate your brand.6

Did you know?

From Summer 2024 to Summer 2025, internet searches for “discount” and “coupon code” rose 11%.

Source: PwC/University of Michigan

2. Cultivate a community, especially for high-value customers

52% of Americans this year plan to buy from local brands,11 and 22% plan to spend most of their holiday budget at small and locally-owned businesses.10 You can convert these prospective buyers—especially local ones—into high lifetime value customers by positioning your brand image to align with their values and reward them for doing business with you. For example, alert your VIP customers via SMS, email, or social media to an exclusive sales event or product preview ahead of Black Friday or Small Business Saturday.6 Supplement your digital strategy by hosting a holiday–themed in-person event or partnership catered to your local customer base.

In addition, a growing segment of the American public now considers brand values a deciding factor of where to shop:11

- 55% are more likely to buy from a brand that demonstrates care for their employees

- 42% believe brands should clearly state their values

- 41% would stop doing business with a brand that doesn’t align with their values

- 40% seek out sustainable brands and products

- 10% didn’t buy a product they liked last year because they don’t support the brand.

While online shopping will continue to dominate this season, 54% of Americans intend to shop both online and in-store this year,3 so if you have a brick-and-mortar storefront, take advantage of its strengths. Nearly half (48%) of in-person shoppers visit stores to interact with the products, so provide them with interactive displays and trials. Sales (38%) were the second most common lure, so advertise holiday sales clearly on your storefront and website, and consider store-exclusive deals.5

3. Pitch your business as a solution to gift idea fatigue

One of the most common holiday shopping frustrations last year was “difficulty coming up with gift ideas” (19%)11, and 36% say they struggle to find unique gifts for people they’ve known a long time.12 The internet age has made it easy to choose what to buy—guides, specialty subreddits, and comparative reviews form a consensus of which products are best. This has made certain personal purchases easier, but the ubiquity of these gift guides has created new difficulties, like choice overload, not knowing which sources to trust, and trouble finding unique products.12

Small and local businesses tend to be left out of these guides, which leaves you with the opportunity to solve your customers’ gift idea fatigue. In fact, 52% of holiday shoppers in 2024 said they prefer retailers who’ll help them choose a unique gift,11 so don’t be afraid to ask questions and suggest products to your customers. In addition, if you followed our advice from last year’s guide and created brand ambassadors through great products, responsive customer support, and a resonant brand voice, your customers will share their positive impressions among friends and on social media.

4. Tap into travelers and other seasonal behavioral segments

Your customers may shop differently during the holiday season compared to the rest of the year. Try organizing your target segments into demographics based on behavior and motivations instead of demographics—you may find new marketing opportunities. Start with some of the categories below:

- Holiday preppers – Some shoppers base part of their identity on being well-prepared for the holidays.6 This group will turn out for your pre-Cyber Week sales, along with customers who come early to beat tariff price hikes. They may prefer a calmer shopping experience compared to the holiday rush.

- Curators – As it’s become harder to find unique gifts, some customers are willing to go the extra mile. These shoppers are looking for quality gifts that their recipients won’t know about. Pitch your uniqueness and craftsmanship to these customers.

- Optimizers – These customers will spend time looking for the best product in a category, going beyond the online mass-audience gift guides to try products for themselves. Interactive product demos in-store or at an in-person event can help you reach these customers.

- Procrastinators – The opposite of your holiday preppers, these customers will do the bulk of their holiday shopping December 19–23. They’re more likely to use expedited shipping and in-store pickup for online orders, and may come to your store to avoid shipping delays, so make sure you have enough inventory on hand.

- Holiday travelers—44% of Americans expect to travel during the holidays this year, but this likelihood scales with youth: Gen Z and Millennial respondents are about 29% more likely than Gen X and more than twice as likely as Baby Boomers to travel.5 If your community sees a lot of seasonal travelers, reserve some of your messaging and events for them.

5. Close out December with flexible shipping and customer support options

In the week before Christmas, the availability of expedited shipping and in-store pickup becomes extremely important for your late shoppers. Providing different carrier options to make customers feel more comfortable making late purchases.

The week after Christmas, you’ll receive a wave of customers ready to redeem gift cards, purchase complements to a gift they received, process a return, or receive product support. You can massively lower your support load by offering automated or self-directed return options via your website, and you can encourage customers to return by recommending the perfect products to gift card redeemers.

You’ll also want to prepare a range of customer support options, as each channel has its pros and cons. Phone calls remain the preferred option, so make it fast and easy for customers to reach a human support professional. Preference for other channels varies across generations. Baby Boomers prefer speaking with an in-person representative (60%), while younger generations are more likely to email or live chat with a human representative.5

6. Start implementing an AI content strategy

AI won’t replace search engines this year, but it’ll be a major supplement for shoppers in 2025 and beyond: 49% of U.S. shoppers are likely to use a large language model (LLM) like ChatGPT to research gift ideas this year (a six-point increase from 2024), with men significantly more likely than women to do so. 32% of Americans under 40 use AI at least half the time they do an internet search, and 40% of users consider AI-generated responses more trustworthy than search engine results.9

While the algorithms behind ChatGPT, Claude, Gemini, and Grok remain opaque, it seems that optimizing your website for search engines also improves its chances of being cited by large language models and search engine AI overviews. To prepare your business, implement relevant keywords into the following elements of your business site, especially on any holiday campaign landing pages:

- Meta titles and descriptions

- Descriptive headings

- Short overviews and summaries of site sections

- Bulleted product and sale highlights

- FAQs

In addition, keep your Google Business Profile Merchant Center updated with any new products and promotions. Last, AI language models train on social media sources (especially Reddit) over almost any other source—by following all the tips provided in this guide, your happy customers will advocate for your brand online, boosting your chances of being represented in AI-generated responses.

To read more about the research cited above, check out our sources:

- “The 2025 Edition BOSS Report” – For the latest iteration of Bluevine’s (that’s us!) Business Owner Success Survey™ (BOSS), we partnered with market research firm Bredin to survey 1,200 small business owners from across the United States. Questions related to business performance and planning, and the impact of future market trends and public policy. The survey was issued November 14–27, 2024.

- “Holiday Shopping Report: Insights Summer 2025” – From July 25–31, 2025, management consulting firm Simon-Kucher surveyed 1,513 U.S.–based shoppers as part of their annual holiday shopping report series. This report, which you can access via email, combines insights from this survey with the previous six years of shopping trends.

- “An update on US consumer sentiment: Settling in for a tepid holiday season” – Management consulting firm McKinsey & Company report the findings of their most recent McKinsey ConsumerWise Global Sentiment Data research. The data was collected from 4,013 U.S. shoppers in August 2025.

- “Optimove Insights: 2025 Consumer Holiday Retail Shopping Survey” – Optimove Insights, the research arm of relationship marketing SaaS provider, Optimove, provided this report on the results of a 2025 survey of 345 U.S. citizens with household incomes of $75,000+ on their holiday shopping intentions, conducted in July 2025.

- “Holiday Outlook 2025 – A seasonal remix: Value, meaning and generational shifts” – The U.S. branch of professional services firm PwC administered their annual Holiday Outlook survey from June 26 to July 9, 2025. Respondents were 1,000 United States residents, and the consumer sentiment metrics cited by PWC were measured independently by the University of Michigan.

- “Holiday Shopping Unwrapped: Marketing Strategies for the Moments That Matter” – Email marketing platform, Intuit Mailchimp partnered with consumer insights agency Canvas8 to conduct expert interviews and issue a survey to 9,356 adults across Europe, Australia, and North America (1,142 in the U.S.), asking about their shopping habits with a focus on the holiday season. The survey was issued February 14–20, 2025.

- “2024 Holiday Shopping Trends” – Using their own Adobe Analytics platform, Adobe for Business collected U.S. spending data from October 1 to December 31, 2024 and compiled the results into this holiday spending report.

- “9 small business trends: Most feel AI is here to help” – This summer, Bluevine (that’s us!) published the results of our AI survey of 763 U.S. small business owners via market research firm Centiment Audience. The survey was administered June 2–4, 2025.

- “2025 Consumer Adoption of AI Report” – Consumer research company Attest compiled and published this report from two surveys of 5,000 shoppers across the U.S., U.K., Canada, and Australia. Responses were gathered via Attest’s own platform in January 2025.

- “The State of Holiday Shopping Today Amid Tariff-Driven Uncertainty” – Customer analytics firm CivicScience reported the results of several surveys on the holiday spending plans of American shoppers. The surveys were conducted in August 2025 with sample sizes ranging from “535+” to “780+”.

- “2025 Holiday Shopping & Advertising Trends Report” – This report provides insights from a survey of 2,000 U.S.–based shoppers, and was issued by advertising software and services company Basis Technologies and market research firm GWI. Research was completed in May 2025.

- “Holiday 2025: The year of intention” – Conversations with Reddit, a subsection of the Reddit for Business blog published a report on the findings of a Reddit custom survey of 500 respondents’ holiday purchases and social media use. Respondents were aged 16–60 and divided into Redditor vs Non Redditor segments. Responses were collected February 2–25, 2025.