2025 has delivered mixed economic signals—some optimism, plenty of caution—but among Americans, the itch to start a business has not gone away.

Thinking about launching something of your own this year? We surveyed 1,040 Americans who have expressed interest in business ownership to understand the real barriers and motivations behind that leap, from economic concerns to practical banking needs.

Here’s what stood out—and what could help more people move from concept to company.

Key takeaways

- 78.9% of respondents say now is a good time to start a business, yet even among the optimists, 47.9% still rank economic uncertainty in their top three concerns.

- 73.8% of those laid off in the past two years are very interested in starting a business, versus 42.7% of those not impacted by layoffs.

- Advanced degree holders show a 23-point edge in strong interest for starting a business (69.8%), compared to non-degree holders (46.8%).

- Potential business owners prefer fast payment processing/funds availability (56.2%) and easy access to credit/loans (54.5%) from their banking solution over no monthly fees (37.7%) and high-interest accounts (37.0%).

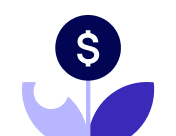

Economic uncertainty is the top worry—nearly half of respondents name it among their top 3

Nearly half of the would-be business founders we surveyed listed “economic uncertainty” in their top three concerns for starting a business (47.9%), ahead of fear of failure (40.0%) and unpredictable income (38.5%).

That anxiety tracks the headlines: Small-business uncertainty jumped sharply in July, even as overall optimism ticked up, and the latest jobs report showed hiring nearly stalling with unemployment edging higher. Meanwhile, inflation is running at 2.7% year over year—which is moderate by recent standards—but 83.2% of respondents say lending rate cuts would make them more likely to start, a sign that uncertainty is still very real.

Money is also a common concern. Over one-third of respondents worry about not having enough savings for startup costs (36.9%) and unpredictable income (38.5%). Federal Reserve small-business reports show that access to capital remains a consistent challenge. Founders benefit from clearer, faster access to credit and cash-flow tools that steady early revenue swings.

Skills and information gaps are the next layer:

- 26.7% hesitate to take the next steps due to a lack of business know-how

- 18.1% said they do not know enough about lending options

Pair that with practical life constraints, and the support brief writes itself:

- 25.0% worry about loss of benefits (health insurance/retirement)

- 23.8% cite time commitment

- 23.9% are concerned about technological uncertainty

Despite concerns, most Americans see now as a good time to start a business

Even though people are worried about the economy, most still see opportunity: In our survey, 78.9% said now is a good time to start a business (either broadly or in select industries).

There are a few reasons for this:

- Borrowing could get cheaper: Inflation has cooled (2.7% YoY for July), and the Fed just cut rates while adding two forecasted rate cuts by EOY—both signals that financing and operating costs may ease.

- Owner sentiment is inching up: The MetLife–U.S. Chamber Small Business Index rose to 65.2 in Q2 2025, with more owners reporting good business health and comfort with cash flow.

- The tool stack is getting smarter: Small business financing software like Bluevine are rolling out features like AP automation and integration capabilities, providing hours back each month for new founders.

- Access to capital has some tailwinds: Recent SBA moves (including higher caps for standard small 7(a) loans and Community Advantage lenders) broaden the runway for smaller, working-capital needs.

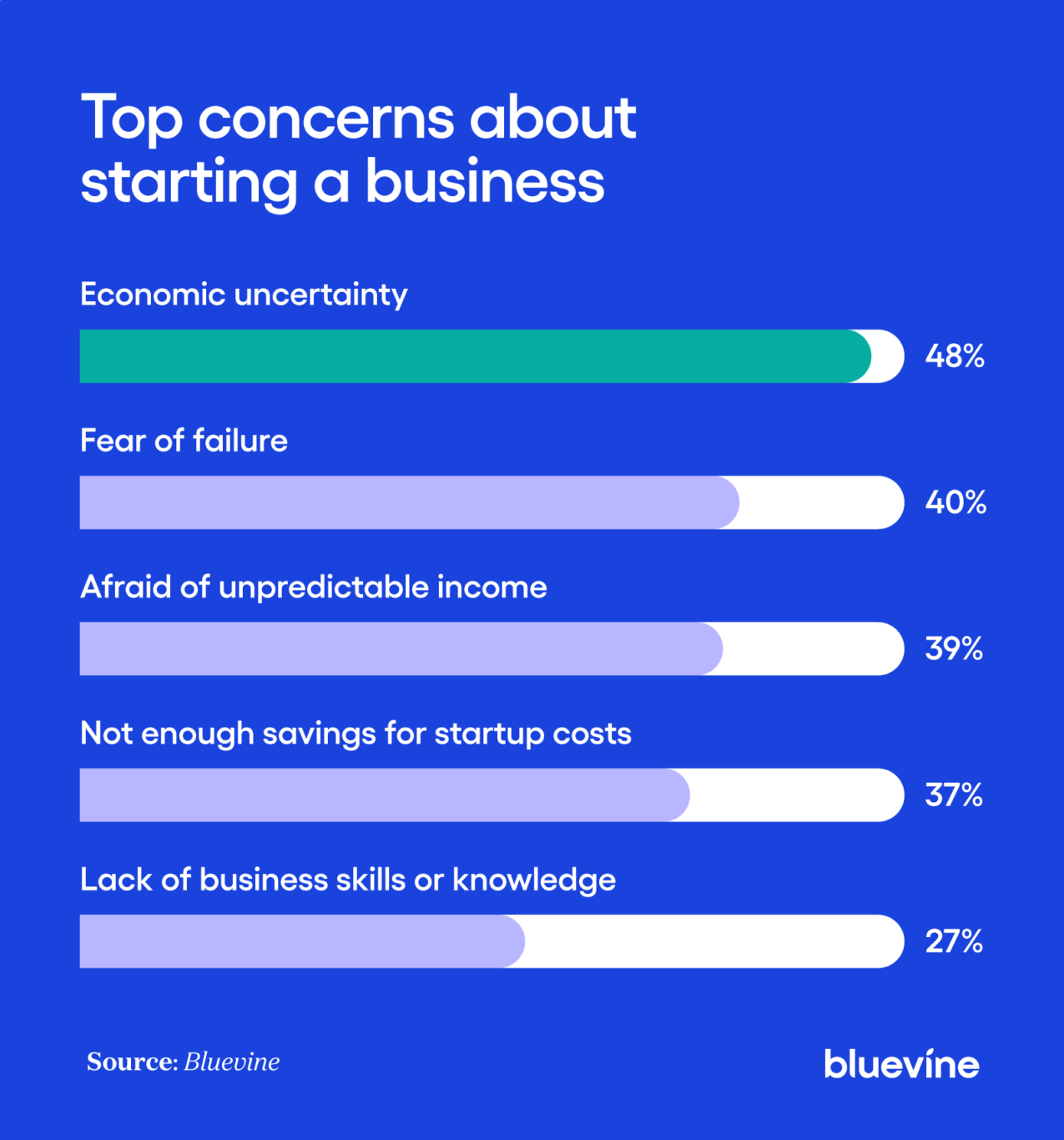

Layoffs correlate with a strong interest in starting a business

Layoffs are strongly linked to higher interest in starting a business. Among people laid off in the last 1–2 years, 64.9% say they are “very interested—actively making plans now” to start a business, compared with 42.7% of those not impacted by layoffs.

Recent layoff headlines and a still-active churn in parts of the economy help explain this—U.S. employers announced 85,979 job cuts in August 2025—up 39% from July and the highest August since 2020. Recent high-profile cuts at UPS, ConocoPhillips, Oracle, and Dexcom kept the topic top of mind.

At the same time, new business applications remain high, suggesting many people are acting on that interest. The U.S. Census Bureau’s Business Formation Statistics show 470,571 seasonally adjusted business applications in July 2025 (+2.6% m/m). Of those, 168,155 were high-propensity applications (more likely to become employer firms).

It’s clear that layoffs are a real catalyst for entrepreneurship, and follow-through is most likely when access to capital and early cash flow tools are within reach.

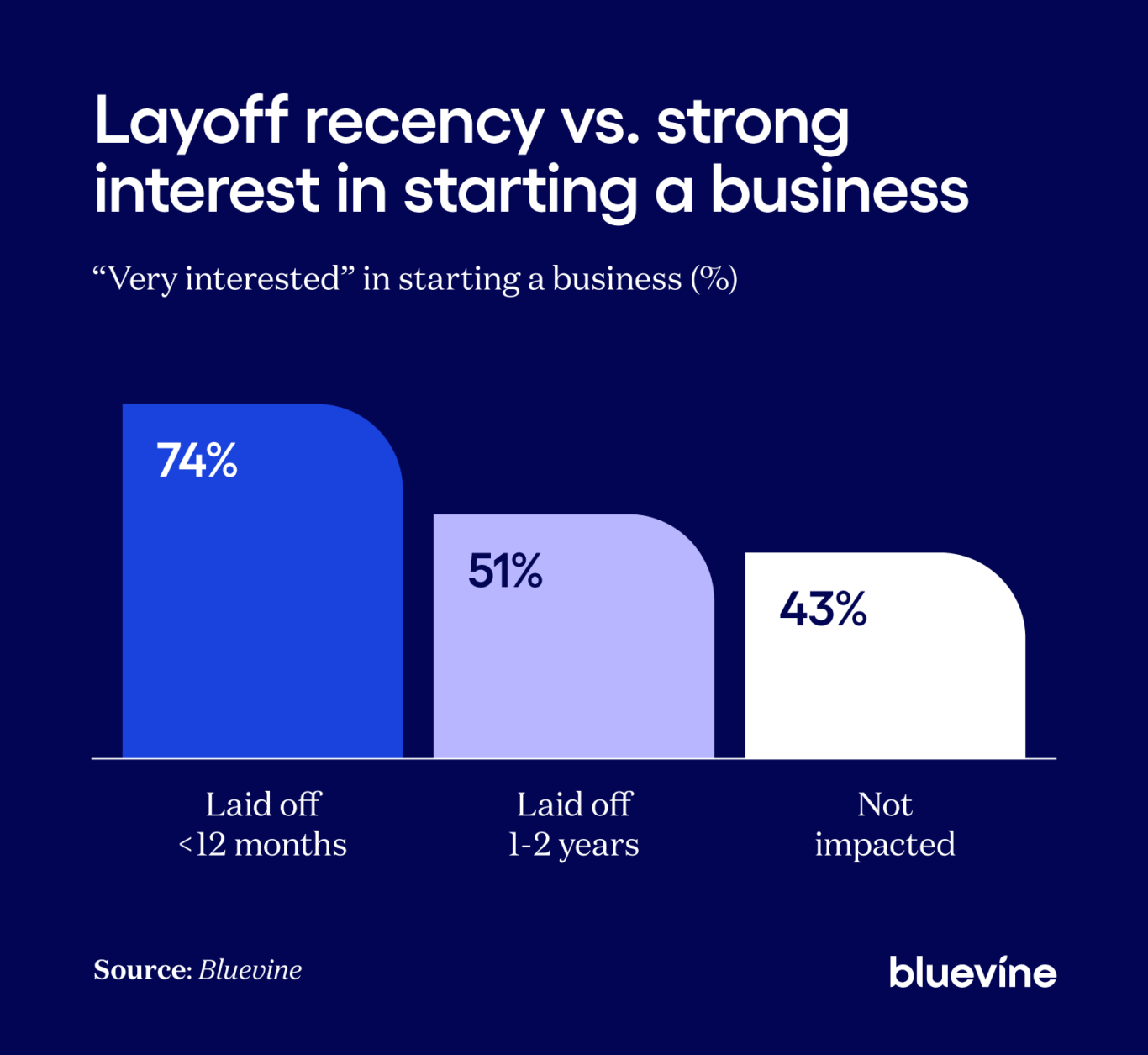

Advanced degree holders are over 33% more likely to start a business

While it should come as no surprise that individuals with higher education levels are more likely to chase entrepreneurial endeavors, our survey data uncovered that the gap may be much bigger than previously thought.

In our survey, 69.8% of Master’s/Doctoral holders say they are “very interested” in starting a business, compared with 46.8% of respondents without a degree—a 23-point gap.

So what explains the gap? The data points to a few common factors.

- National surveys show that financial capability is lower among adults without college experience, with behaviors like having a retirement account differing sharply by education level (about 80% among college grads vs. 37% with no college).

- That confidence shows up in entrepreneurship, too. Startup entry has been tied to perceived capabilities and lower fear of failure.

- Being assigned classmates with prior startup experience increases the odds of founding after graduation.

Taking a high-level look at the market, roughly one-half of U.S. entrepreneurs hold at least a bachelor’s degree.

The gap likely reflects three advantages common to advanced degrees—higher financial capability, structured exposure to entrepreneurial skills, and denser networks. You do not need a diploma to close it; practical training, mentorship, and simpler access to capital can deliver the same lift.

Men and younger adults are more likely to express strong interest & optimism

Education is not the only divider; who leans in also varies by gender and age.

In our data, men show higher intent than women (62.1% vs. 46.9% “very interested”), yet women in our sample are more likely to already be owners (2.5% of women vs. 0.1% of men).

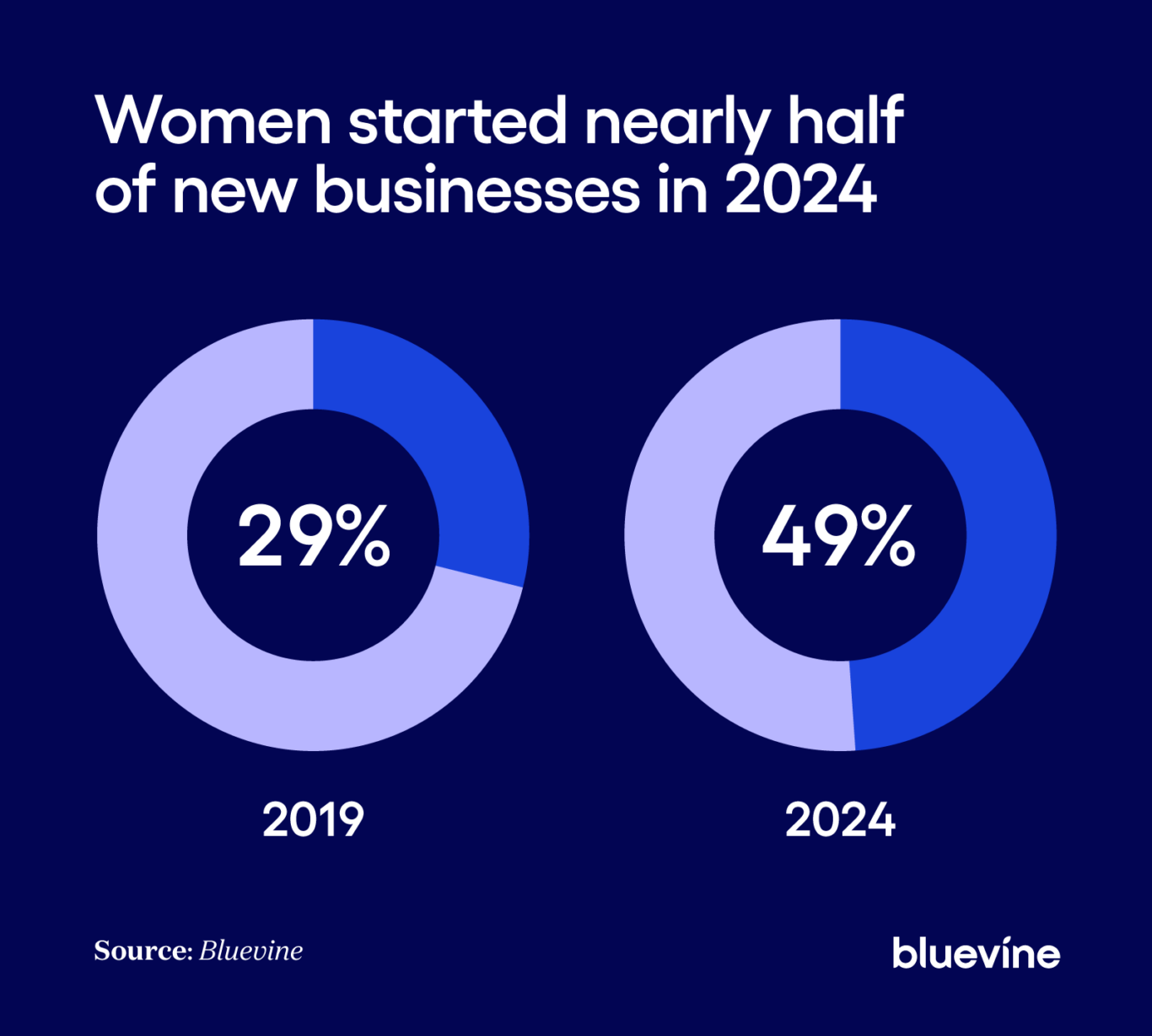

Historically, men start businesses at higher rates (in 2023, 0.44% of men vs. 0.26% of women became new entrepreneurs). Still, women have been closing the gap: The latest formation reports find women started about one-half of new U.S. businesses in 2024 (up from 29% in 2019).

By age, interest is strongest among 25–34 (58%) and 35–44 (56%) in our survey. That lines up with national indicators showing younger adults drive new firm creation: One U.S. report notes 18–24-year-olds are starting businesses at higher rates than older cohorts, echoing the “start younger” momentum we are seeing.

Over one-half of respondents would start a business with better funding options

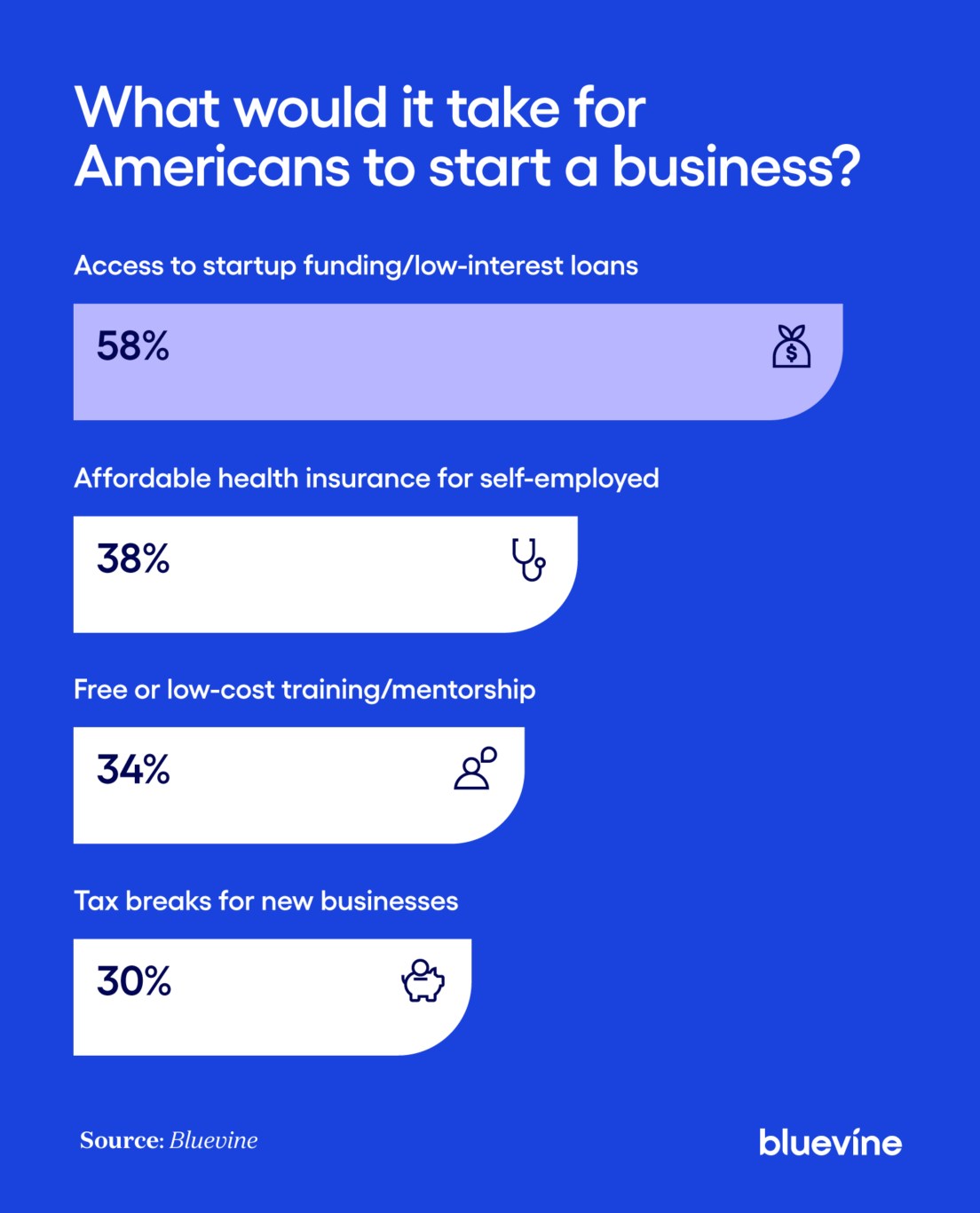

More than one-half of would-be founders say they would launch with better policy and product support—especially cheaper capital.

In our survey, 58.3% of respondents said access to startup funding or low-interest loans would make the biggest difference in starting a business.

That squares with the findings from the March 2025 Consumer and Community Context Fed report: Many employer firms apply for relatively small amounts (half seek $100k or less) and a sizable share turn to higher-cost online lenders, where high interest rates and strict terms are common pain points. That shows evidence that lower-rate, faster credit could move people from intent to open.

Cost of coverage is the next obstacle, as 37.9% of our respondents say affordable health insurance for the self-employed would make starting feasible.

It’s understandable: ACA marketplace premiums are climbing—insurers filed for a median 7% premium increase for 2025—and broader reports show the steepest health insurance cost jump in 15 years, with even larger hikes projected for 2026.

Speed to cash & access to credit dominate business banking wishlists

A crucial early decision in starting a business is choosing a banking platform you trust—one that helps you get up and running fast and gives you the tools to grow at your own pace. Founders don’t just want perks; they want cash to move quickly and credit to be simple when it’s time to invest.

In our survey, would-be founders rank fast payment processing and funds availability (56.2%) and easy access to credit lines/loans (54.5%) above all other business banking features.

Even 24/7 customer service (38.2%) outranks more traditional hooks, such as:

- No monthly fees (37.7%)

- High-interest checking/savings (37.0%)

- Accounting integration (29.7%)

Translation: When launching a business, quick cash and credit on tap matter more than perks.

Why this matters now

Real-world trends prove these priorities are rising for a reason:

- Instant‑money infrastructure is finally here—and scaling: FedNow, the Federal Reserve’s instant payment service for U.S. banks and credit unions, settled 2,130,889 payments in Q2 2025 and now counts 1,300+ participating institutions, roughly 95% of them community banks and credit unions. The Clearing House’s RTP network also logged a record $246B across 343M transactions in 2024. Together, the rails exist to turn incoming payments into real funds availability for small businesses.

- Credit access is strained and goodwill is fraying: The Fed’s 2025 report on employer firms shows lender satisfaction declined even as application rates stayed flat, pointing to a need for simpler, faster paths to working capital.

- Cash-flow friction is widespread. Federal Reserve research finds that around 4 in 5 small firms face payment-related challenges, underscoring why speed to cash ranks so high.

Access funds when you need them with flexible business credit

Starting a business is easier when money moves fast and credit is simple. Our survey shows that many concerns around starting a new business boil down to cash flow and confidence—how to cover early costs, smooth income, and make decisions without second-guessing.

Ready to act? Explore business line of credit solutions for flexible working capital you can draw when you need it.

Methodology

Centiment Audience conducted this survey of 1,040 Americans aged 25+ who have researched business ownership in the past five years for Bluevine between August 26 and August 28, 2025. Data is unweighted, and the margin of error is approximately +/-3% for the overall sample with a 95% confidence level.