A new vision for business accounting is entering the scene. Banking platforms designed specifically for client management are making it easier for accountants and bookkeepers to partner with their clients and improve their working relationships.

Learning about these new tools will position your firm as an innovative partner to small businesses looking for banking solutions that help them grow. So if one of your clients has invited you to be a user on their account or you’re doing independent research, we’re here to cover what you should know before diving in.

How can I streamline my day-to-day?

Most banks don’t focus on accountants and bookkeepers, often making their job harder. But new solutions are expanding their focus, treating accountants as the valued partners they are to their clients. By doing so, these banking solutions are improving the lives of small business owners—helping accountants, bookkeepers, and their clients manage their money more easily.

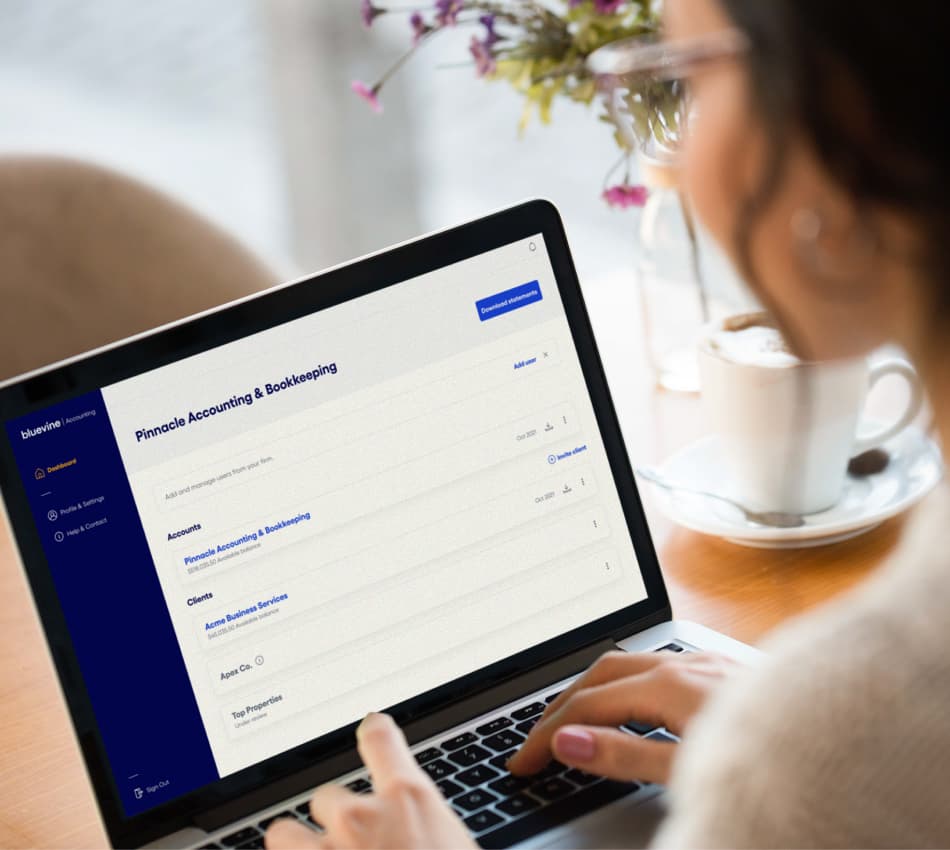

How are they doing this? Effective accounting features grant firms controlled access to clients’ bank accounts, reimagining how accountants and bookkeepers partner with their clients.

Controlled access gives you amazing visibility into client books, eliminating the need for tedious email chains, unnecessary back-and-forth, and manual book reconciliation. Some platforms even allow business owners to empower their accountants to send bills and schedule payments on their behalf via secure approval flows. Combine all that with other convenient features like QuickBooks Online syncing,BVSUP-00056 and you’ve got a powerful tool ready to make waves in the accounting industry.

How do I know if these tools are right for my firm?

The right platform for your firm will save you time and increase productivity. It can also make you an attractive partner for small business owners seeking bookkeepers who share their vision for a streamlined, innovative accounting process.

Assess your needs and figure out what your pain points are when working with your clients. Do you currently use their login credentials to access their account? Or maybe you experience a lot of back-and-forth whenever you need a client to send their statements. Whatever problem you’d like solved, keep it in mind when looking into accountant platforms.

Here are a few other things to look for:

Client compatibility

The right banking solution should serve your clients’ needs. Think about the sort of checking or lending solutions your clients want and then keep an eye out for an account that offers those things. Maybe high-yield interest tops their list, or your clients may value no or low fees for money movement services.

Did you know?

Some platforms offer referral or partnership programs. Look for bonuses that indicate a platform values accountants and the impact they have on their clients’ success.

Features

Several features come together to create a platform that supports your needs. Here are some of the most common and exciting features these solutions are using to streamline the accounting process.

App syncing

Integration with popular apps like QuickBooks OnlineBVSUP-00056 creates a seamless experience between a client’s account and the tools you already use. For many bookkeepers, app syncing is a must-have.

Bill approvals

For accountants with a hands-on style or who build a collaborative relationship with their clients, bill approvals are a major plus. These services allow account holders to give their bookkeepers the power to create and schedule bills for approval with custom workflows. Many accountants view themselves as a partner in their clients’ growth, and payment approval workflows help foster those relationships even more.

Your own login

Password sharing can be a risky and inconvenient way to gain access to your clients’ accounts. With a platform designed for accountants, firms are able to create logins for each firm member, so no one ever needs to sacrifice the security of their account.

Bulk statement downloads

Downloading bulk statements saves time on reconciliation and makes it easier to stay organized. During tax season, bulk statement downloads can be especially helpful. Some accounting tools even let you download check images when you get your clients’ statements.

Customer support

Customer support can make or break a platform for accountants and their clients. When looking into a platform, check to see if they offer extra support to their accountants, like account executives, education or product walkthroughs, and other resources.

Innovation

Above all else, accounting tools should be innovative in how they build and partner with accountants and bookkeepers. As your firm grows, you’ll want a solution that can grow with you. Look for companies that are excited about the future of small business accounting and want to see their platform continue to evolve into the future. These companies will be more likely to introduce impactful new features over time and listen to feedback from their users.

Banking designed for your clients, a dashboard built for you.