Since the pandemic, small businesses have been tackling a growing number of challenges outside their control. Prices keep climbing, consumer appetites keep changing, and the labor market is evolving rapidly, thanks in part to artificial intelligence.

To understand how small business owners are feeling during a difficult time for small businesses across the country, we conducted a survey of over 1,000 company owners, founders, CEOs, and other executives with polling partner Centiment. (Previous iterations of the survey, published in early 2024, mid-2024, and 2025, were conducted with Propeller Insights and Bredin.) Read on to learn more about where the small business economy stands today, how it’s changed over the past year, and where it’s headed in 2026.

Key takeaways

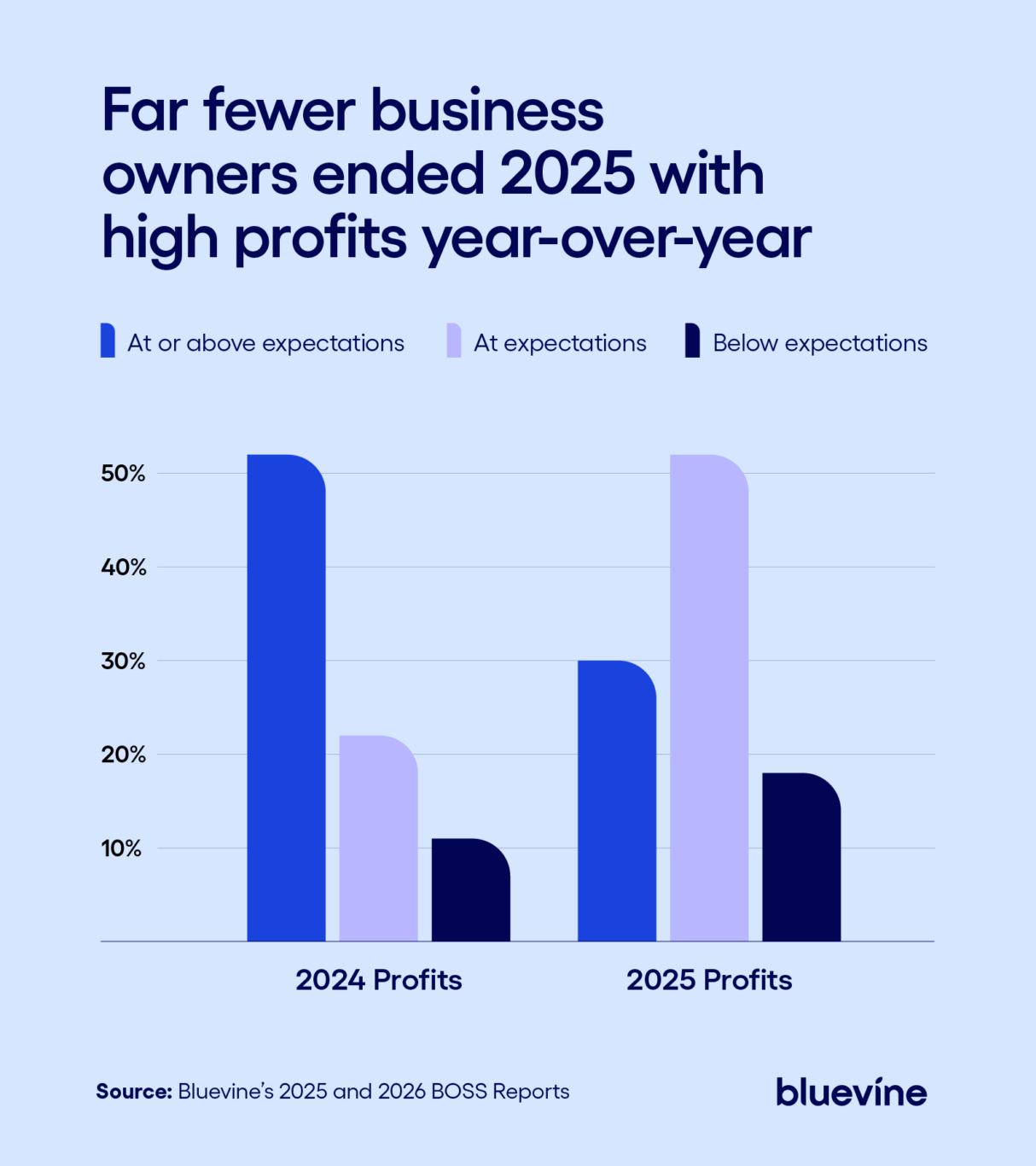

- Only 30% of SBOs say their profitability was above expectations in 2025, down nearly 50% from 2024.

- Several years of high inflation may have impacted profits: 80% of SBOs say inflation is challenging for their business, functionally unchanged from 81% in our 2025 report.

- Business owners are doing more with the tools at their disposal. In 2026, 42% of SBOs plan to increase efficiency/productivity, 37% will launch new products/services, and 32% plan to improve financial operations.

- Inflation remains a challenge, and many business owners didn’t meet their goals in 2025, but 78% of SBOs are optimistic about their profitability forecast for 2026.

The percentage of SBOs who surpassed their profit goals dropped nearly 50% YOY

Whether you’re a new business owner or a vet, you’ve probably noticed higher prices on everything from your groceries to your rent.

More than one-third (34%) of SBOs say the rising cost of supplies has impacted their business in the last year. A similar percentage (31%) said ongoing inflation has specifically impacted them.

Now, years of rising prices have cut into small business profits. According to our survey data, only 30% of business owners say they finished the year with profitability above expectations, down from 57% at the end of 2024:

Amid persistent inflation, business owners are saying they plan to do more with what they already have, instead of growing their operations. Around 1 in 3 (34%) SBOs reduced expenses in 2025 to adapt to changes in the economy. Similarly, 28% raised prices to offset higher costs.

Inflation isn’t only impacting business owners now. In the 2025 BOSS Report, the majority of SBOs said their business was impacted by inflation, and more than half (55%) of those business owners raised prices to help counter inflationary pressure. In that report, we also found that more than half of SBOs expected to spend more year-over-year on most major expenses.

The good news is inflation isn’t as high as it was a few years ago. Federal data shows that the nationwide inflation rate hasn’t budged much since December 2024. That means prices are still increasing, but they’re not rising much faster than they did a year ago.

Business owners are sacrificing their own finances, personal lives to stay afloat

Even in boom years, there’s no denying that owning a small business takes a toll on owners physically, emotionally, and financially. Now, many small business owners may be starting 2026 on empty.

To keep their business running, more than three-fourths (77%) of SBOs sacrificed something last year, like personal health and wellness, time with family or friends, or financial stability.

For most business owners, the struggle is worth it for a better future. But today, 49% of SBOs question whether entrepreneurship or running their own business is worth it at least monthly. Some (18%) question it daily.

Even in boom years, running a small business requires a complex juggling act of trying to grow your business, wrestling with taxes, and balancing your budget. Factors outside your control, like inflation, make that juggling act even harder.

Putting yourself first can be difficult when you’re worried about your business. But when you take care of both your health and your work, you’ll have the satisfaction of knowing you’re creating a sustainable business for the years to come.

Don’t be afraid to lean on your resources, including your community, financial partners, and friends and family. Bluevine Business Checking accounts offer high APYBVSUP-00147 and no monthly fees,BVSUP-00122 helping thousands of business owners through good times and bad.

SBOs plan to make small changes with their current operation, not major moves

Regardless of whether they struggled in 2025 or breezed through the year, most SBOs plan to make changes this year:

- 42% plan to increase efficiency and productivity, such as implementing new software and automating workflows.

- 37% plan to launch new products and services, such as diversifying their product line or adding a new service offering.

- 32% plan to improve financial operations, such as reallocating their budget, pursuing higher yields, or investing.

Striving for more efficiency and launching new products are largely tried-and-true methods to reduce costs and increase margins. It’s part of the larger trend of SBOs saying they want to do more with what they have, not make dramatic changes.

Relatively few SBOs plan to expand in 2026 by increasing hiring, and even fewer plan to consolidate their operations or downsize staff.

Business owners remain optimistic, despite high prices

Business owners have more stressors today than they did just a few years ago, but they’re not going down without a fight. Around three-quarters (78%) of SBOs are optimistic about their profitability forecasts for 2026, nearly unchanged from last year’s number of 77%.

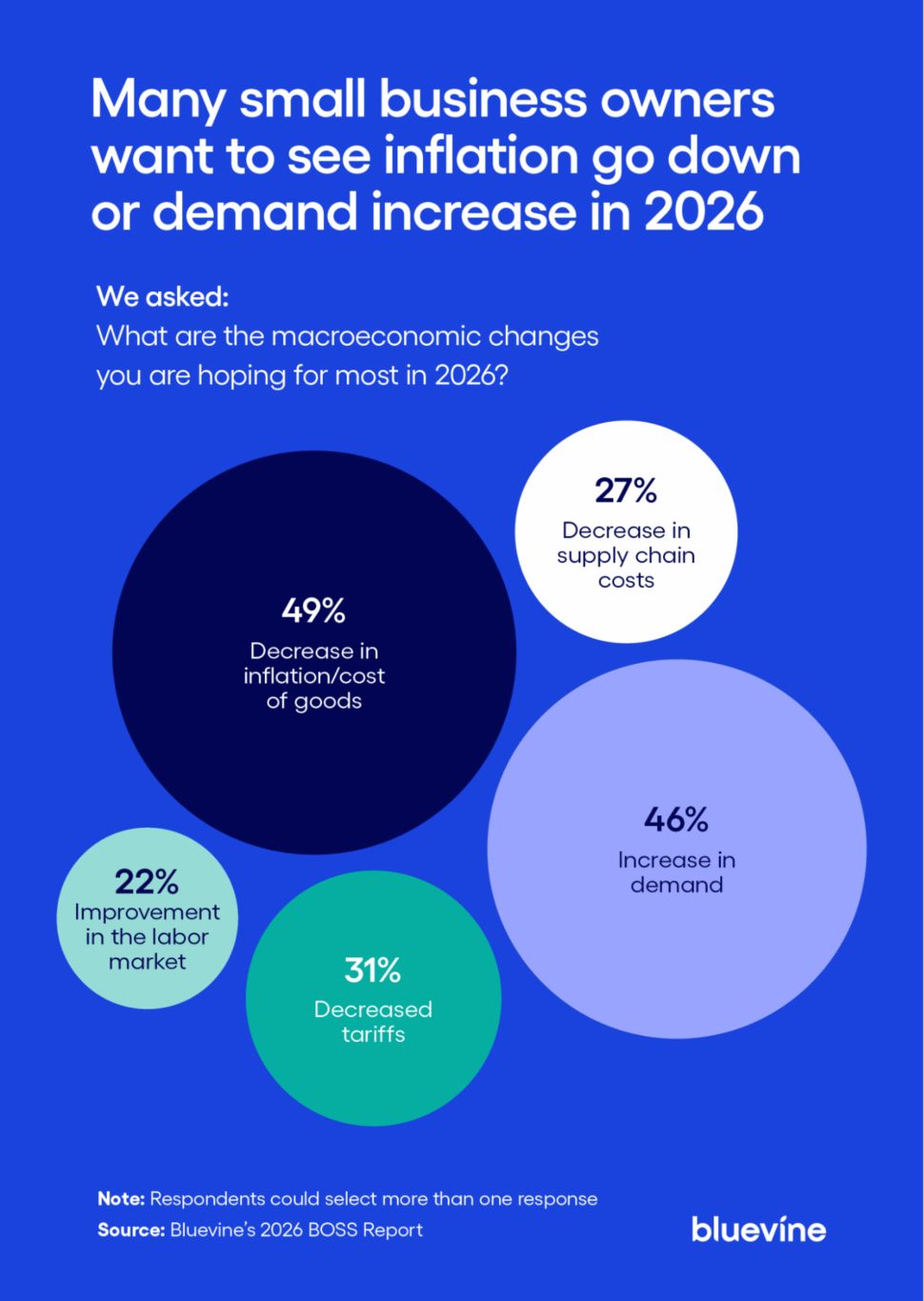

With inflation still making a major impact on operations, business owners are commonly hoping that either inflation and the cost of goods fall (49%) or that demand increases (46%):

Whether it’s massive economic shifts or a local supply hiccup, SBOs will undoubtedly have to tackle challenges in 2026. But they told us they’re ready to handle those challenges, and may even come out of the year stronger than ever.

Interest in accessing capital is up 66% after years of tight margins

With profitability short of business owners’ expectations, ongoing economic pressures may be leading far more business owners to look for funding to keep them afloat.

Nearly 2 in 3 (63%) SBOs say they plan to seek more capital by early 2026—a 66% increase from the 38% of respondents who signaled interest in accessing capital the year before. (Another 14% said they were unsure last year.) In a sign of business owners’ cash crunch, 1 in 4 (26%) SBOs say they plan to use the new funds to strengthen their cash reserves or emergency funds. Twenty-five percent say they plan to build inventory or purchase in bulk to reduce costs.

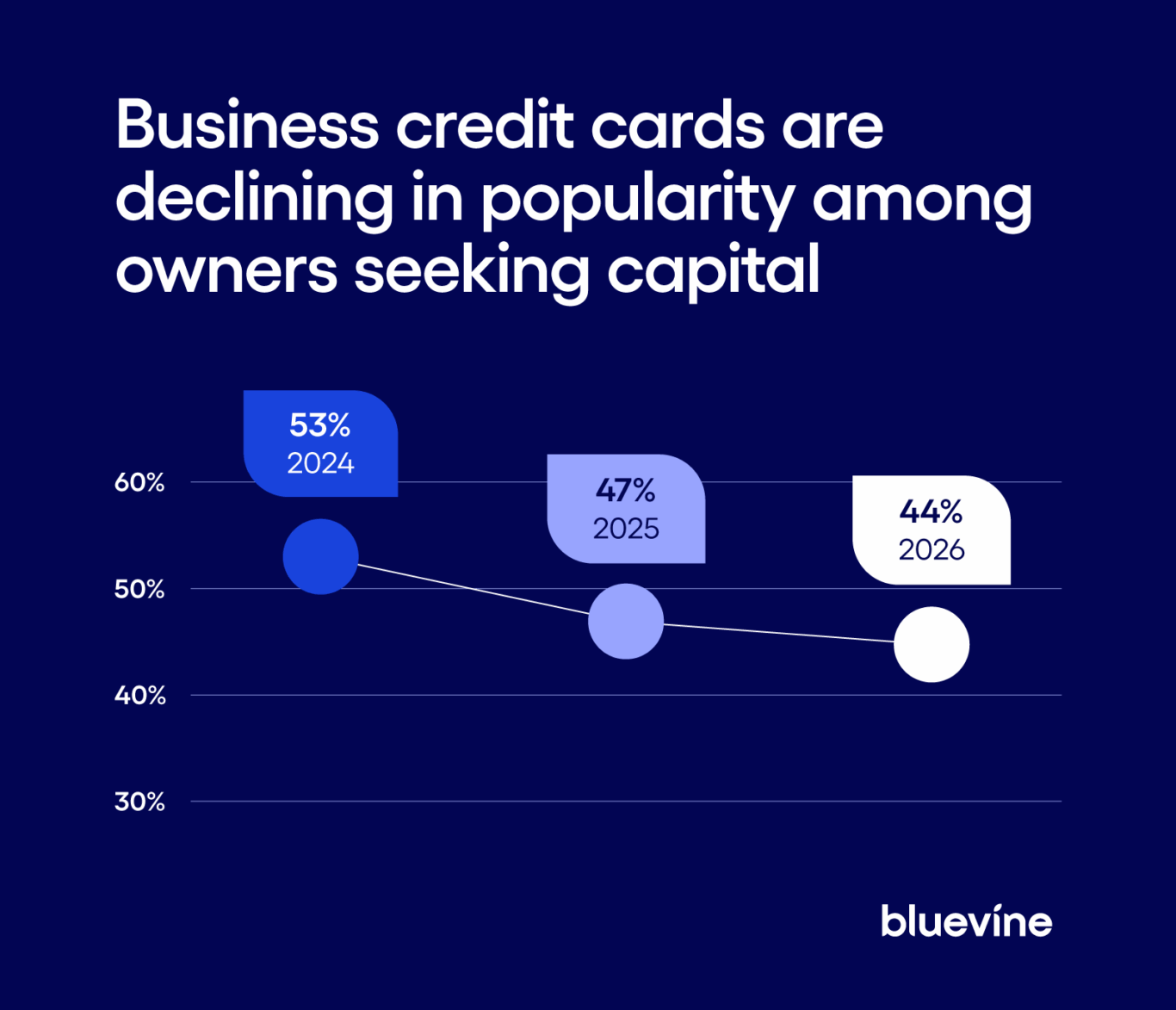

High interest rates are affecting SBOs, too. Historically, credit cards have been a popular way for SBOs to get new capital for their business. More than 2 in 5 (44%) SBOs seeking capital specifically plan to take out a new business credit card in late 2025 or early 2026.

That’s a steady decline from 2024 and 2025, when 53% and 47% of SBOs seeking capital said they were taking out a new business credit card, respectively.

Despite their need for funding, a declining interest in business credit cards makes sense in the broader context of the reality of small business ownership. As mentioned in previous Bluevine surveys, nearly 4 in 10 business owners think interest rates remain too high, and credit cards typically carry a higher interest rate among other forms of business capital.

Earlier this year, President Donald Trump called for a 10% cap on credit card interest rates starting in late January. However, he didn’t pass official legislation mandating the change, and, as of this writing, no major credit card company has announced they would slash rates, according to USA Today. Average credit card rates are still well over 20%.

Between AI advancements, persistent economic pressures, and other challenges outside their control, business owners will have a lot to consider this year. But our research suggests that SBOs aren’t letting the challenges keep them from making their business thrive. With a bit of innovation and outside help, they’re seeking financial security for themselves and their families.

Want to read our Business Owner Success Survey results from previous years?

Methodology

2026 Survey: Centiment Audience conducted this survey of 1,067 company owners, founders, partners, CEOs, presidents, or managing directors of U.S. businesses with annual revenue between $50,000 and $5,000,000 for Bluevine between November 4th and November 10th, 2025. Data is unweighted, and the margin of error is approximately +/-3% for the overall sample with a 95% confidence level.

2025 Survey: Bredin, an independent market research firm, conducted a 15-minute online survey of 1,200 respondents across the U.S. between November 14–27, 2024. Respondents are company owners, founders, partners, CEOs, or presidents of businesses with annual revenue between $100,000 and $5,000,000. Survey respondents include a broad cross-section of industries, business and respondent ages, and geographical locations.

2024 Survey: Propeller Insights, an independent market research firm, conducted a survey of 1,197 respondents across the U.S. between December 11th, 2023 and January 25th, 2024. At the time of data collection, all respondents were required to be (a) business owners, (b) with up to 50 full-time and/or part-time employees, and (c) have companies with an annual revenue between $100,000 and $5,000,000. Respondents represented a broad cross-section of demographics, including age, gender, industry, and geographical location across the U.S. Based on the population being surveyed, the results have a margin of error of +/- 3% with a 95 % level of confidence.