Bluevine for restaurants

Cooking up better banking and

loans for you.

Discover business checking, lending, and

payments solutions ready to serve the needs of

your restaurant.

Bluevine is a financial technology company, not a bank.

Bluevine deposits are FDIC-insured through Coastal Community Bank,

Member FDIC, and our program banks. The Bluevine Line of Credit is issued by Celtic Bank.

The secret sauce to your financial success.

Split your checking account

into sub-accounts for payroll,

ingredients, and more.Manage money in and out

seamlessly with built-in

invoicing and bill pay tools.Access a line of credit in as

fast as 24 hours to boost cash

flow, hire staff, and more.BVSUP-00166

Business checking with tools built for you.

Our digital banking platform has all the tools your restaurant business needs.

- Organize finances for tips, payroll, taxes, and more with up to 20 sub-accounts

- Easily deposit cash at 91,500+ locations nationwideBVSUP-00076

- Send and receive an unlimited number of transactions

- Earn up to 3.5% APY right in your checking accountBVSUP-00020

- Set custom spend limits for multiple virtual and physical debit cards, so your team can handle large purchasesBVSUP-00151

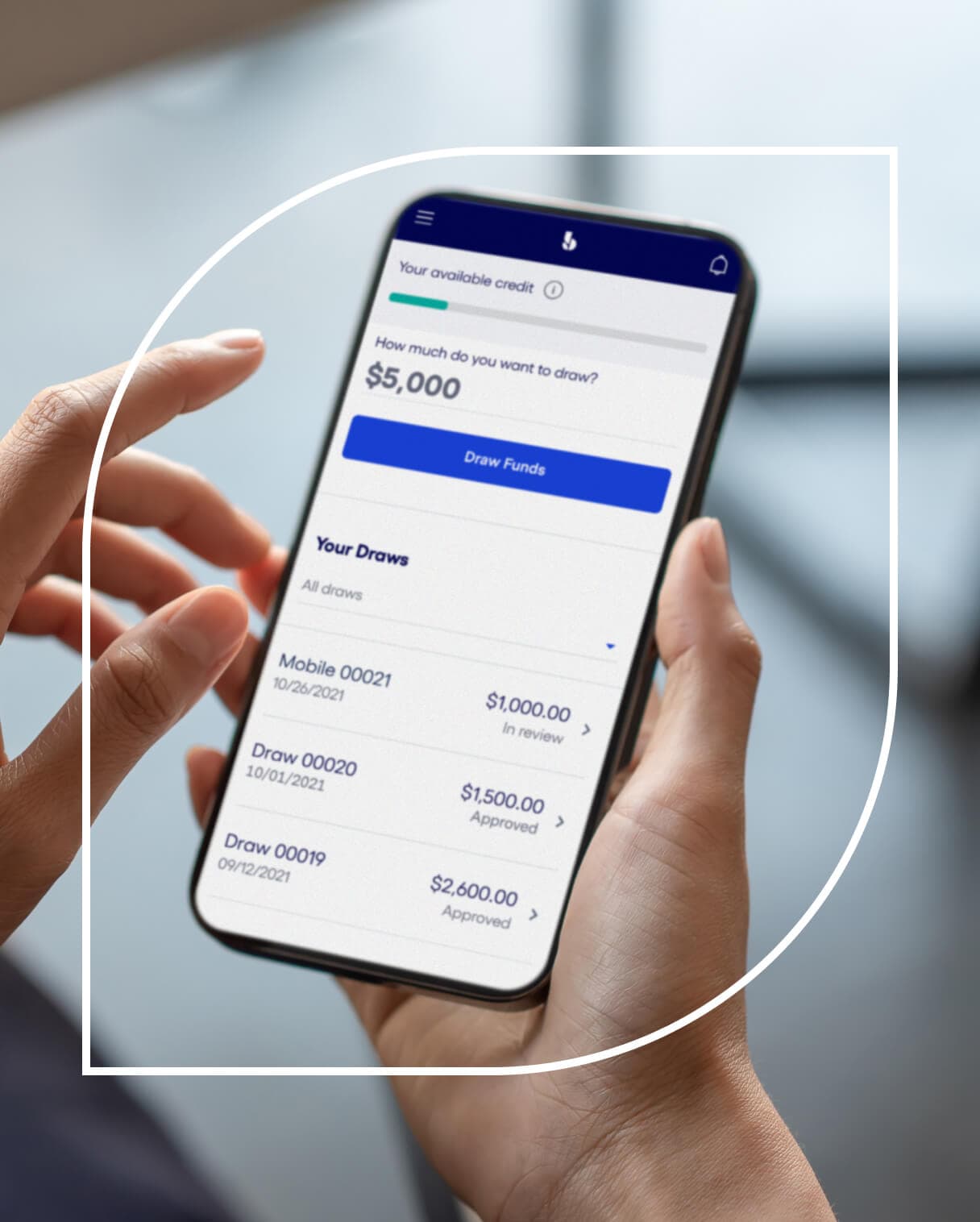

Financing fit for your appetite and needs.

Get the line of credit or term loan you need to cover seasonal staff and fluctuating inventory.

- Lines of credit up to $250,000BVSUP-00166 and term loans up to $500,000 through our lending partnersBVSUP-00127

- Predictable weekly or monthly repayment terms

- Apply in minutes and get a response in as little as 24 hours

- Access approved line of credit draws instantly when paired with a Bluevine Checking accountBVSUP-00127

Hear from businesses like yours.

“With how much time I save now, I don’t know if I could ever go back to a traditional, brick-and-mortar bank.”

Michael T.FoodDays

Bluevine customer since 2022

“It's nice to log in and see everything thoughtfully laid out in a way that makes sense for a business.”

John F.Aged & Infused

Bluevine customer since 2024

“With sub-accounts, it's nice to know this year's money is there for next year.”

Joshua P.Forever Farms

Bluevine customer since 2023

Related content for

restaurants.

FAQs for restaurant and hospitality

businesses.

Bluevine can be a great banking platform for restaurants and hospitality businesses of all sizes. In fact, Bluevine Business Checking offers multiple plans, each with the opportunity to earn high-yield interest and save on payment fees, along with the support and security you need to bank with confidence.

Eligible U.S.-based businesses are welcome to apply online for a business checking account or business line of credit. Minimum qualifications apply, as well as additional restrictions related to industry and operating location.

Use your Bluevine Business Debit Mastercard® at a participating Allpoint+ ATM and follow the ATM instructions to make your cash deposit.

You can also head to participating Green Dot retail locations and ask a cashier to add money to your Bluevine Business Debit Mastercard. Your transaction should appear in the Checking tab of your Bluevine dashboard.

A business line of credit gives you access to funding when you want it. Unlike traditional one-time loans, a Bluevine Line of Credit is “revolving credit,” meaning your available credit replenishes as you make repayments, so you can draw additional funds without having to fully re-apply.BVSUP-00005

Once approved for a credit line, you can request funds directly from your Bluevine dashboard. We’ll deposit funds in your account as soon as a few hours, pending review and approval. Depending on which repayment plan you qualified for, we’ll automatically debit your account for weekly or monthly repayments. As you pay off your balance, the amount of available credit automatically replenishes.

With funds in as fast as 24 hours, a Bluevine Line of Credit lets you take advantage of growth opportunities early.

You could use a line of credit to cover payroll, hire full-time or seasonal employees as you need them, stock up on extra inventory in uncertain economic times, cover expenses during a slow season, or replace old equipment. You could also renovate your premises, or lease a larger one. Check out our resources for restaurant businesses above to get more ideas.

Bluevine provides business owners with customized financing options that meet their specific needs. When you apply for a Bluevine Line of Credit, you’ll also be considered for funding from our network of lending partners.BVSUP-00131 Our partners offer a variety of funding options, including term loans.

Term loans and lines of credit are two different types of business loans:

- A term loan provides a lump sum upfront. You repay on a fixed schedule until you’ve repaid the full sum.

- A line of credit provides access to ongoing funds from which you can request one or more draws and borrow any amount up to your given limit. You repay only what you’ve borrowed on a fixed schedule.

Your repayment schedule and terms may vary and are determined by your lender.

As your business grows and operations become more complex, organizing all your finances through one account can become a headache. Instead, you can open up to 20 sub-accounts under your main Bluevine Business Checking account. Each sub-account has its own account number, making it easy to control which accounts your vendors, suppliers, or sub-contractors can bill.

You can send and receive payments into your sub-accounts, but you can’t order a debit card for or make cash deposits into them.

Eligible customers can earn up to 3.5% APY on main account and sub-account balances with one of our business checking plans.BVSUP-00020

Learn how sub-accounts can help organize your finances.

You (the account administrator) can invite your partners and team members to become additional users on your Bluevine account, which lets them manage bills and make payments. There are two different additional user roles—authorized user and contributor—with different permissions.

You can also invite your accountant to become an additional user. With the accountant role, they can access the transaction and tax information they need using their own sign-in credentials.

Learn more about the different roles you can assign additional users.