Bluevine for healthcare

The cure for your banking and funding needs.

Discover a secure checking, lending, and

payments solution equipped with everything your

medical practice or healthcare business needs.

Bluevine is a financial technology company, not a bank.

Bluevine deposits are FDIC-insured through Coastal Community Bank,

Member FDIC, and our program banks. The Bluevine Line of Credit is issued by Celtic Bank.

Improve your financial health

with our banking tools.

Set up business checking sub-accounts for supplies, payroll, CME courses, and more.

Simplify accounts payable and receivable with built-in bill pay and invoicing tools.

Access a line of credit to cover equipment, delayed reimbursements, and more.

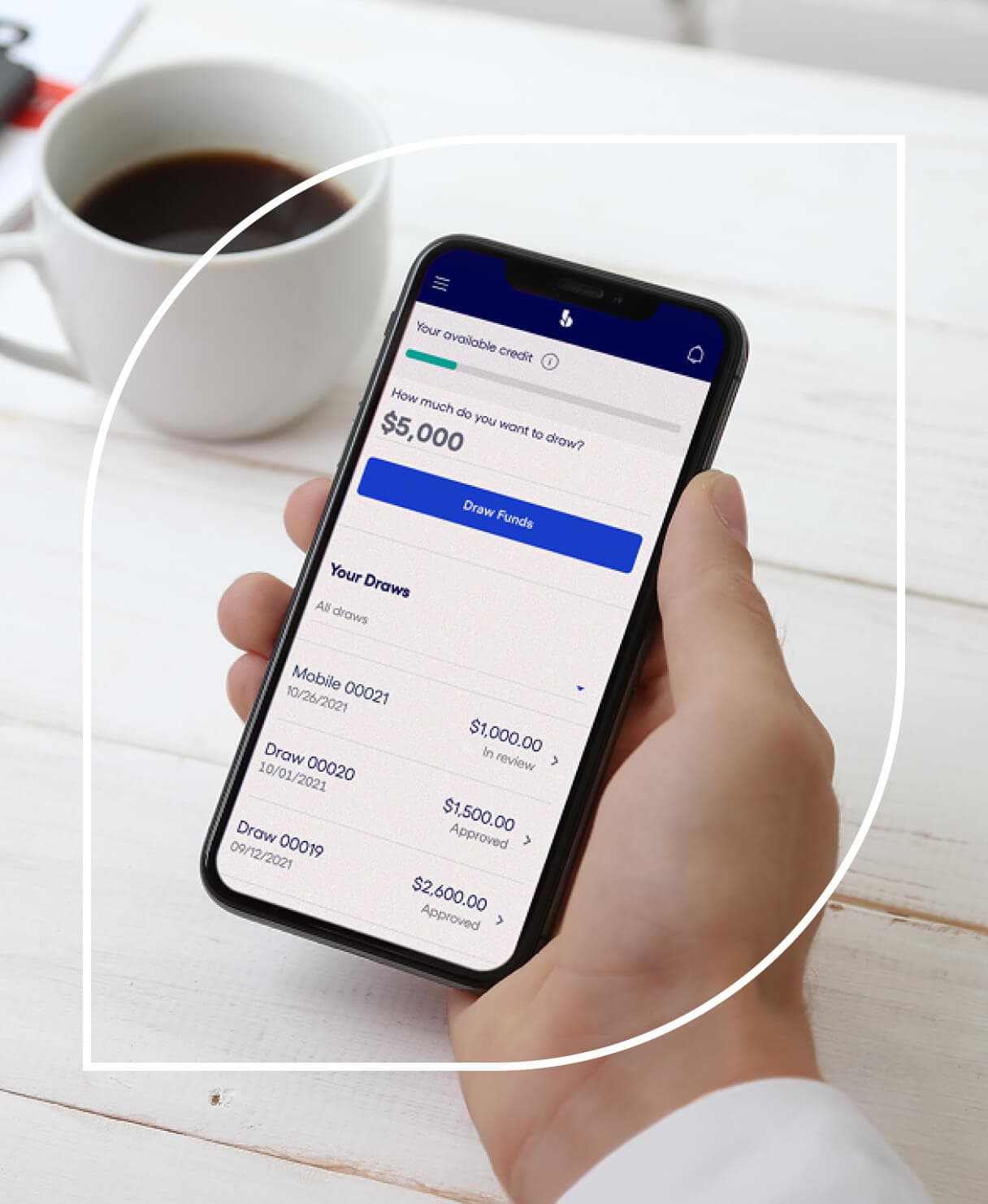

Healthcare banking has never looked better.

Our digital banking platform allows you to bank on the go—no more extra stops during your busy day.

- Separate funds for different parts of the business with up to 20 sub-accounts

- Automate your accounts payable with streamlined bill pay approval flows

- Manage, track, and accept patient payments with easy-to-use invoicing and payment links

- Earn up to 3.0% APYBVSUP-00166 right in your checking account

- Give your accountant or bookkeeper the access they needBVSUP-00076

Keep healthy cash flow with flexible financing.

Get the line of credit or term loan you need to open or expand your practice, cover new medical equipment, and more.

- Lines of credit up to $250,000BVSUP-00020 and term loans up to $500,000 through our lending partnersBVSUP-00151

- Predictable weekly or monthly repayment terms

- Access approved line of credit draws instantly when paired with a Bluevine Checking accountBVSUP-00127

Hear from businesses like yours.

“We've grown, Bluevine has grown, and I'm confident we'll continue to grow together.”

Michael T.FoodDays

Food Services Technology

"In 30 seconds, I was up and running. Bluevine has the best onboarding process for a bank account."

Edward M.SMS Tech Solutions

IT Services

"There are so many problems you need to deal with as a small business, but just knowing I can call or email a person and get a response is amazing."

Tamara M.Nexus Automation

eCommerce

Resources for

healthcare businesses.

FAQs for healthcare businesses.

Bluevine can be a great banking platform for medical practices and healthcare businesses of all sizes. In fact, Bluevine Business Checking offers multiple plans, each with the opportunity to earn high-yield interest and save on payment fees, along with the support and security you need to bank with confidence.

Eligible U.S.-based businesses are welcome to apply online for a business checking account or business line of credit. Minimum qualifications apply, as well as additional restrictions related to industry and operating location.

We currently offer three Bluevine Business Checking plans: Standard, Plus, and Premier. Our standard plan comes with 1.5% APY, no monthly fees, and FDIC insurance up to $3 million. With our Plus plan, you get all the great benefits of our standard plan, and 2.7% APY, 20% off most Standard payment fees, and more for a waivable $30/month fee. Finally, with our Premier plan, you’ll enjoy 3.7% APY on checking balances up to $3 million, 50% off most Standard payment fees, and access to priority customer support for a waivable $95/month fee.

A business line of credit gives you access to funding when you want it. Unlike traditional one-time loans, a Bluevine Line of Credit is “revolving credit,” meaning your available credit replenishes as you make repayments, so you can draw additional funds without having to fully re-apply.BVSUP-00020

Once approved for a credit line, you can request funds directly from your Bluevine dashboard. We’ll deposit funds in your account as soon as a few hours, pending review and approval. Depending on which repayment plan you qualified for, we’ll automatically debit your account for weekly or monthly repayments. As you pay off your balance, the amount of available credit automatically replenishes.

With funds in as fast as 24 hours, a Bluevine Line of Credit lets you take advantage of growth opportunities early.

You could use a line of credit to cover payroll between insurance payouts, stock up on extra materials in uncertain economic times, or buy new medical equipment and devices for your practice. You could also renovate your office or lease a larger one. Check out our resources for healthcare businesses above to get more ideas.

Bluevine provides business owners with customized financing options that meet their specific needs. When you apply for a Bluevine Line of Credit, you’ll also be considered for funding from our network of lending partners.BVSUP-00126 Our partners offer a variety of funding options, including term loans.

Term loans and lines of credit are two different types of business loans:

- A term loan provides a lump sum upfront. You repay on a fixed schedule until you’ve repaid the full sum.

- A line of credit provides access to ongoing funds from which you can request one or more draws and borrow any amount up to your given limit. You repay only what you’ve borrowed on a fixed schedule.

Your repayment schedule and terms may vary and are determined by your lender.

As your business grows and operations become more complex, organizing all your finances through one account can become a headache. Instead, you can open up to 20 sub-accounts under your main Bluevine Business Checking account. Each sub-account has its own account number, making it easy to control which accounts your vendors, suppliers, or sub-contractors can bill.

You can send and receive payments into your sub-accounts, but you can’t order a debit card for or make cash deposits into them.

Eligible customers can earn up to 3.0% APY on main account and sub-account balances with one of our business checking plans.BVSUP-00166

Learn how sub-accounts can help organize your finances.

You (the account administrator) can invite your partners and team members to become additional users on your Bluevine account, which lets them manage bills and make payments. There are two different additional user roles—authorized user and contributor—with different permissions.BVSUP-00076

You can also invite your accountant to become an additional user. With the accountant role, they can access the transaction and tax information they need using their own sign-in credentials.

Learn more about the different roles you can assign additional users.