How to maintain your credit line.

Use this guide to learn how to maintain your eligibility for draws and increases, and keep access to your business line of credit.

Table of contents

Maintain good financial standing

Connect your external bank account

Repay your credit line on-time

Talk to us before you apply for a loan elsewhere

What to do if your account is put on hold

Maintain good financial standing

Your financial standing includes a range of factors. To maintain good standing, make sure to regularly review the following:

- Your FICO score allows us to confirm and reconfirm your eligibility for a business line of credit. We require a minimum score of 625 to open an account, but higher scores may help you unlock credit line increases.

- Your most up-to-date statements will give an overview of your revenue and expenses. You can automate this task with a bank connection or manually upload statements to your Bluevine dashboard.

- Significant business changes, such as changes in ownership or location, can affect your financial standing. Please notify your account manager with any important updates.

- Negative credit impacts, such as bankruptcy or unpaid debts, will also affect your financial standing. We may see these on your statements, or you can notify your account manager.

How to build a strong FICO score

It’s natural for your FICO score to fluctuate over time. To increase or maintain a strong score, make on-time payments and keep your outstanding balance low compared to your total credit limit. Maintain good financial standing over time to build credit history, which also bolsters your FICO score.

Learn how to make the most of a line of credit in your industry.

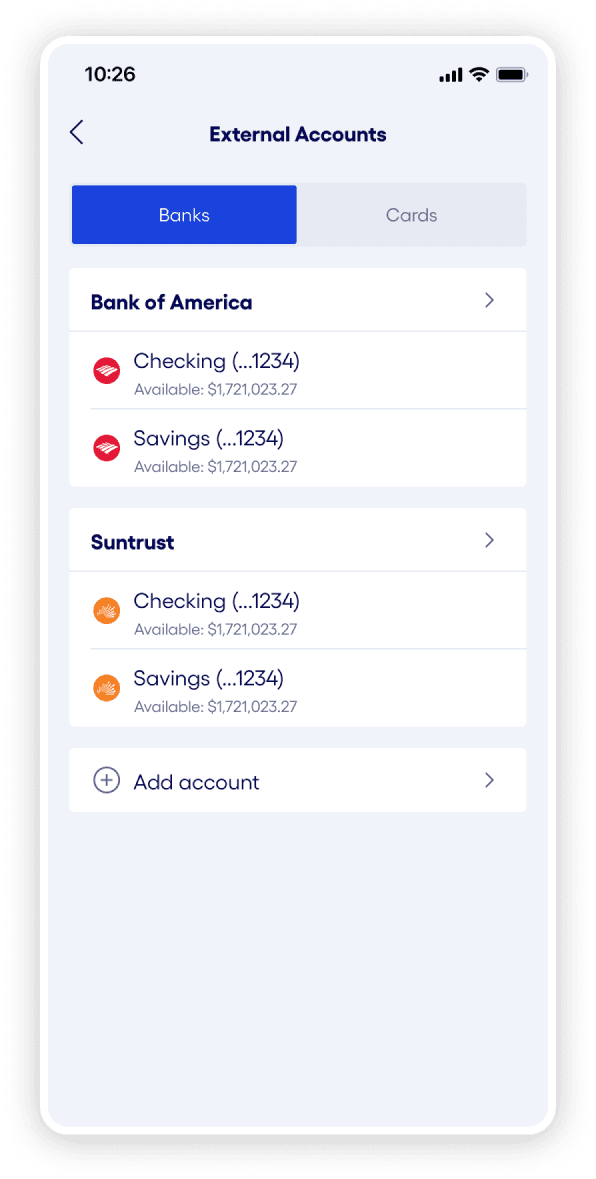

Connect your external bank account

We use bank connections both to make faster decisions about your line of credit application and to review your account for ongoing eligibility and increases. Without a bank connection, you’ll need to manually upload monthly statements for us to review.

What happens if my external bank account gets disconnected?

If your external bank account gets disconnected, we’ll notify you via email and on your Bluevine dashboard. There are multiple reasons your account might get disconnected, but none of them affect the pending debits and credits on your account.

For more information, see our bank connection guide.

Repay your credit line on-time

If you miss a repayment, your line of credit will be put on hold until you make a catch-up payment. Before you draw funds, we’ll let you know what your repayment amount will be so you can plan your budget and make sure you can repay your line. Review your account regularly to make sure you’re on top of your repayments.

For what to do if you miss a repayment, see this support article.

Talk to us before you apply for a loan elsewhere

Taking out more than one loan at a time is called loan stacking, and it can be a risky, unsustainable method for accumulating funds. Acquiring additional debt can affect your ability to make repayments and might lead to your Bluevine Line of Credit being put on hold.

Before applying for another loan elsewhere, contact us to discuss your options. For example, if you need to increase your credit line, you can ask for a review to see if you qualify. Together, we can work out the best path forward for your business.

What to do if your account is put on hold

There are a number of reasons your credit line might be put on hold. For next steps, please contact our support team.

Explore helpful guides.

Learn how to make the most of your Bluevine account with these in-depth product guides and resources.

Ready to apply?

Submit your application in just a few minutes.BVSUP-00006