Getting started with your Bluevine business debit card.

Easily activate your virtual or physical Bluevine

Business Debit Mastercard® and issue additional

debit cards with spend limits to your employees.

How to get started with your

Bluevine Business Debit Card.

Use your virtual card right away

Set up your virtual card from your dashboard to start

spending instantly and securely—no need to wait for your

physical card to arrive in the mail.Activate your physical card easily

Activate your physical card with just a few clicks in your

dashboard or over the phone, and keep your virtual card

activated even after your physical card arrives.Issue additional cards to your team

Give virtual and physical cards for each of your main or

sub-accounts to trusted employees so they can securely

make business purchases without sharing card numbers.Set spend limits to stay on budget

Create daily and monthly user-specific spending limits and

control ATM access for each physical or virtual card.

3 quick ways to activate your

physical business debit card.

Choose the activation method that works best for you from three convenient options.

From the app

Head to Profile in your Bluevine

mobile app and click Debit Card.From your dashboard

Sign in, navigate to your Settings,

and click Debit Card.Over the phone

Call (888) 216-9619 and follow the

prompts to activate your card.

How issuing debit cards to your team can benefit your business.

If you’re the administrator, you can issue both virtual and physical debit cards to team members with the

authorized user, employee, contributor, or accountant role on your Bluevine account. This gives your

business added flexibility in how you spend and allows your employees to make business purchases without

the need to share card details. Plus, with virtual cards, you can start spending right away.

Your team’s debit card spend counts toward your Bluevine Business Checking monthly APY activity requirementBVSUP-00005—or monthly fee waiver requirement for Plus and Premier customers.BVSUP-00153

Earn up to 4% cash back on business purchases at Mastercard Easy Savings merchants.BVSUP-00067

Issue virtual and physical cards with custom spend limits for each of your main or sub-accounts so you can budget for projects, control team spend, and reduce fraud risk.

See all debit card transactions and which users initiated them at a glance from your dashboard.

Issue, lock/unlock, or close additional cards at any time.

Understanding roles and permissions when

issuing debit cards.

Each role has different permissions to give you the flexibility you need to share account access while keeping

financial information secure.

Authorized users and company admins

Standard authorized users can lock or unlock their own cards and view their own transactions. However, authorized users with company admin permissions can issue, lock, and close debit cards without needing administrator approval. They can also edit spend limits, set/reset PINs, report employee cards as lost or stolen, and see all transactions made on your Bluevine account. Administrators can edit these permissions at any time.BVSUP-00076

Employees and contributors

Account permissions for the employee and contributor roles are more limited. Employees and contributors will only be able to manage and view their own card details and transaction information in the Bluevine dashboard.

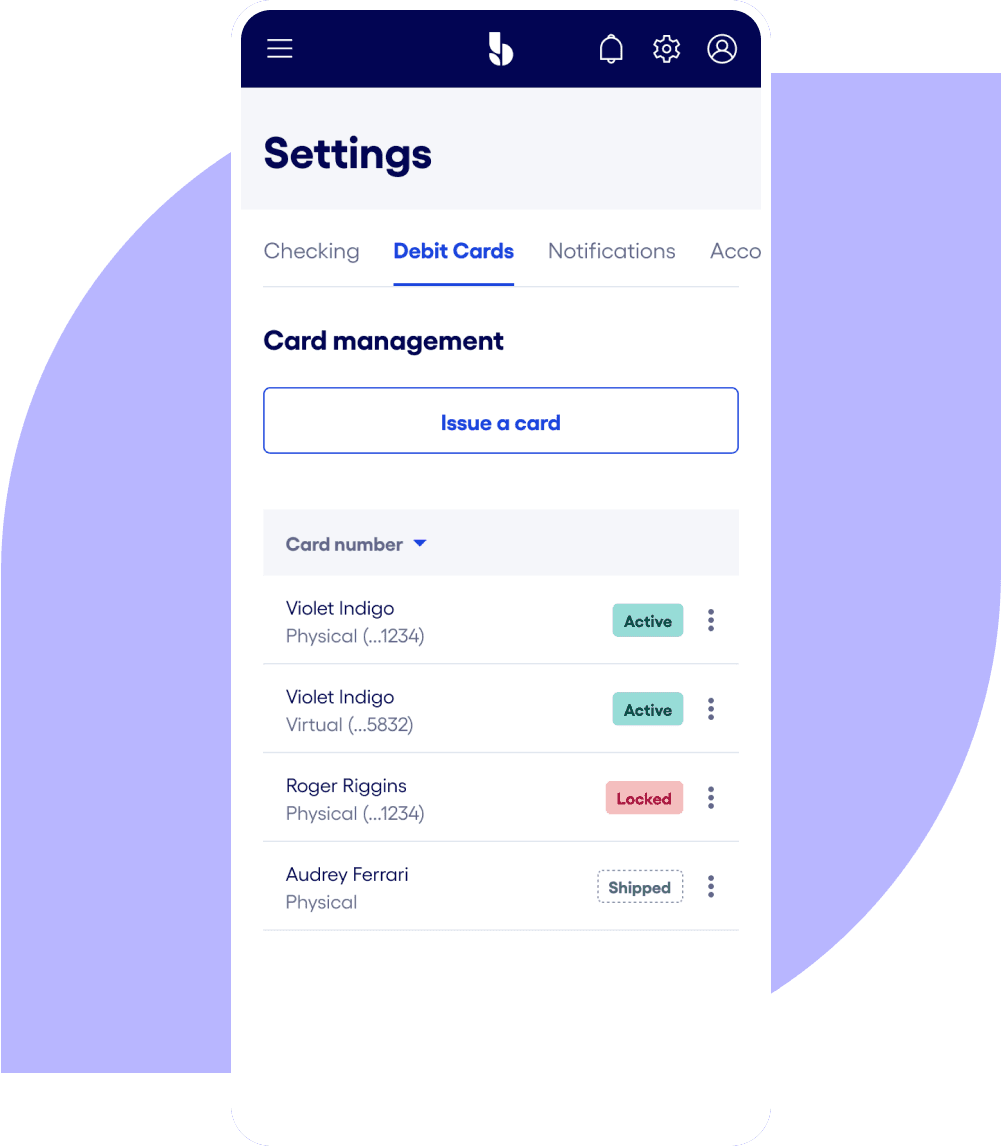

How to issue and manage team debit cards

How to issue employee debit cards

- Navigate to the ‘Debit Card’ tab in ‘Settings”

- Select ‘Issue a Card’

- Choose to issue a physical or virtual card

- Select the account you want to issue the card from and choose a user

- Set individual spend limits and decide who needs ATM access

- Click ‘Issue Card’

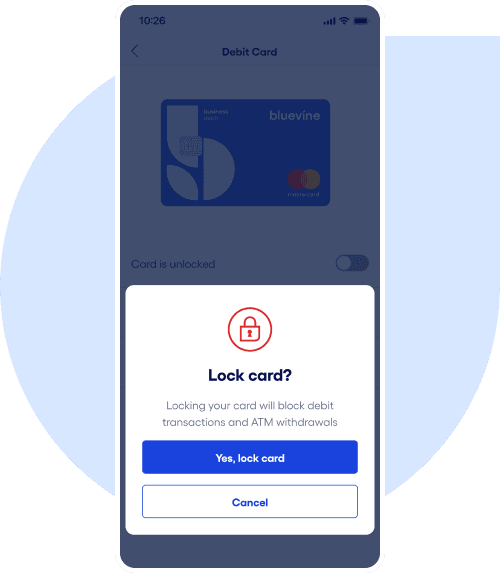

How to lock and unlock debit cards

Instantly lock a card from your dashboard or by phone if it’s lost or stolen. Once a card is locked, it won’t be able

to make additional purchases, but pending purchases may still be processed.

From your dashboard:

- Navigate to Settings on your Bluevine dashboard and click on the Debit Card tab

- Click the three dots next to the card you want to manage, then click Lock card or Unlock card

If the administrator locks a card, only the administrator can unlock it.

By calling (888) 216-9619:

An automated program will walk you through the steps to lock your card. You can also call this number 24/7 to:

- Activate or cancel your card

- Update your ATM PIN

- Check your balance

- Report a card as stolen

Checking on the go.

Save time with more convenient options to deposit or withdraw cash and make purchases.

Withdraw cash at 37,000+ no-fee

ATMs nationwide.BVSUP-00004

Find MoneyPass® ATMsDeposit cash at 91,500+ locations, including participating grocery stores, gas stations, and ATMs.BVSUP-00039

Find Allpoint+ ATMs and Green Dot® retail locations

Make fast, easy contactless payments by adding your Bluevine Business Debit Mastercard® to your

Apple, Google, or Samsung mobile wallet.BVSUP-00060

Learn more about checking on the go

FAQs

Yes, your Bluevine Business Checking account comes with a convenient and secure Bluevine Business Debit Mastercard®, which rewards you for everyday business purchases. Learn more about your debit card's benefits.

For no additional fee, you can also issue additional physical and virtual debit cards for each of your main or sub-accounts to your trusted team members, so you can make business purchases without sharing card details over text or email. A total of 50 physical and virtual debit cards can be issued. Closed and deactivated cards do not count toward the 50 card limit.

If you choose to issue a virtual debit card, you will immediately be able to start spending online as well as in person when you add it to your mobile wallet. This will allow you to make purchases at tap-to-pay terminals with your phone.

Your physical Bluevine Business Debit Mastercard® can take 7–10 business days to arrive at the address you selected when completing your application. Sometimes, it can take longer due to holidays or shipping delays. You can also get expedited shipping for a $30 fee by calling customer support.

Withdraw cash fee-free at over 37,000 ATMs in the MoneyPass® network. Bluevine charges a $2.50 fee for ATM transactions outside of the the MoneyPass® network. Additional third-party ATM fees may vary by ATM operator. Find ATMs near you.

To find where you can deposit cash into your Bluevine Business Checking account, search your address or zip code in this map of participating Green Dot retail stores or this map of participating Allpoint+ ATM locations.BVSUP-00039

Note: To ensure you're locating a cash deposit ATM, select the filter option next to the Search button and check the box for "Allpoint+ Cash Deposit ATMs."

You can easily order a new card from your Bluevine dashboard. Go to “Profile and Settings,” then “Debit Card,” where you’ll see a link to report your card as lost or stolen. From there, you can order a replacement card if needed.

You’ll be asked to set a four-digit PIN when you activate your card. You can change this PIN at any time, from your app or Bluevine dashboard. Simply sign in, head to “Profile and Settings,” and then “Debit Card” to set or change your PIN.

If you haven’t received your card within the expected timeframe, sign in to your account and make sure the address you had it shipped to is correct. If the address is incorrect, you can correct it, mark the current card as lost or stolen, and order a new card to the correct address.

If your address is correct and you haven’t received your card, you can still mark it as lost or stolen and order a replacement.

Explore helpful guides.

Learn how to make the most of your Bluevine account with these in-depth product guides and resources.

Ready to apply for

Business Checking?

Submit your application in just a few minutes.BVSUP-00006