Mercury is a popular banking platform for startups, but its niche model has limitations that may lead business owners to look for alternatives. Mercury does not accept cash deposits, its standard savings accounts earn zero interest, and its services do not extend to sole proprietorships. For these reasons, many businesses are seeking a Mercury alternative that better aligns with their needs and financial goals.

For businesses looking to avoid traditional banking fees that can cost hundreds of dollars each year, it is important to explore alternatives to Mercury. We will examine nine of the top Mercury competitors, including Bluevine, Relay, Brex, and Rho, to help you find a financial partner that aligns with your business’s unique needs and goals.

What you need to know

- Mercury may not be a fit for many businesses as it lacks cash deposits, interest on savings in its free accounts, and support for sole proprietorships.

- Unlike Mercury, Bluevine supports cash deposits and serves a broader range of businesses, including sole proprietorships.

- Bluevine Business Checking lets you earn APY, a feature not offered on Mercury’s standard accounts.

- Choosing the right alternative depends on your specific needs, such as prioritizing high-yield interest or solutions that also provide business lines of credit.

Why consider an alternative to Mercury?

Mercury can be a good platform for tech-focused startups and digitally native businesses, but its specialized focus has limitations. Businesses with physical retail presences or those operating as sole proprietorships can face challenges. Understanding its shortcomings is essential for determining if a different platform would better fit your business needs. A few Mercury drawbacks to consider include:

- Limited business structures: Its services are restricted to incorporated companies, meaning it does not support sole proprietorships or trusts, which excludes many freelancers and independent contractors.

- No cash deposits: The platform’s inability to accept physical cash makes it unsuitable for businesses with a retail component, such as coffee shops, boutiques, or service providers that handle cash transactions.

- Zero interest on core accounts: Mercury’s standard business savings account does not earn any interest, representing a missed opportunity for businesses to earn a return on their operating capital.

Mercury vs. competitors overview

| Banking platform | Best for | Pricing | Key features |

|---|---|---|---|

| Bluevine | Small businesses looking for an all-in-one digital banking platform | Standard plan is free; Plus and Premier plans available with higher yields and additional benefits, starting at $30/month | – High-yield business checking account with up to 3.0%% annual percentage yield (APY)BVSUP-00116 – Add up to 20 sub-accounts with automatic transfer rules – Integrated invoicing and bill pay – FDIC insurance up to $3 million through Coastal Community Bank, Member FDIC and partner banksBVSUP-00108 – Offers a line of credit and business credit card |

| Brex | Venture-backed startups and larger tech companies | Essentials plan is free; Premium is $12/user/month | – Extended FDIC insurance up to $6 million via partner banks – Integrated corporate cards and AI-powered expense management – Strong global capabilities for international operations |

| Rho | High-growth businesses that need integrated banking | Free platform with no subscription or per-user costs | – Dedicated specialist and 24/7 support for all customers – FDIC insurance on savings accounts – Fee-free domestic same-day ACH and wire transfers |

| Meow | Businesses looking to earn a high interest on their cash | Core business checking is free with no monthly fees | – Directly purchase and manage portfolios of U.S. Treasury Bills – High-yield business checking with competitive APY – Send and receive USDC stablecoins with zero fees |

| Relay | Businesses that need multiple checking accounts | Starter plan is free; paid plans available for advanced features, starting at $30/month | – Create up to 20 individual, fee-free checking accounts – Issue up to 50 virtual and physical debit cards with spending controls – Low-cost wire transfers |

| Ramp | Companies focused on spend management and expense control | Core platform is free; Ramp Plus is $15/user/month | – AI-powered software to eliminate manual expense reports – Corporate cards with 1.5% cashback and granular spending controls – Full procure-to-pay suite for managing vendors and bills |

| Airbase | Mid-market companies with complex procurement needs | Quote-based pricing | – Advanced AP automation with purchase order and 3-way matching – Deep integrations with enterprise ERP systems like NetSuite – Guided procurement with multi-stakeholder approval workflows |

| Spenmo | Businesses with operations in the Asia–Pacific | Free basic plan; premium plans available via quote | – Includes a free system for processing payroll – International transfers with a 0% foreign exchange markup – Specializes in the financial ecosystems of Southeast Asia |

| Novo | Freelancers, solopreneurs, and small business owners | Free business checking with no monthly fees | – “Reserves” feature for setting aside funds for taxes or other goals – Refunds up to $7 per month in third-party ATM fees – Unlimited, built-in invoicing directly from the app |

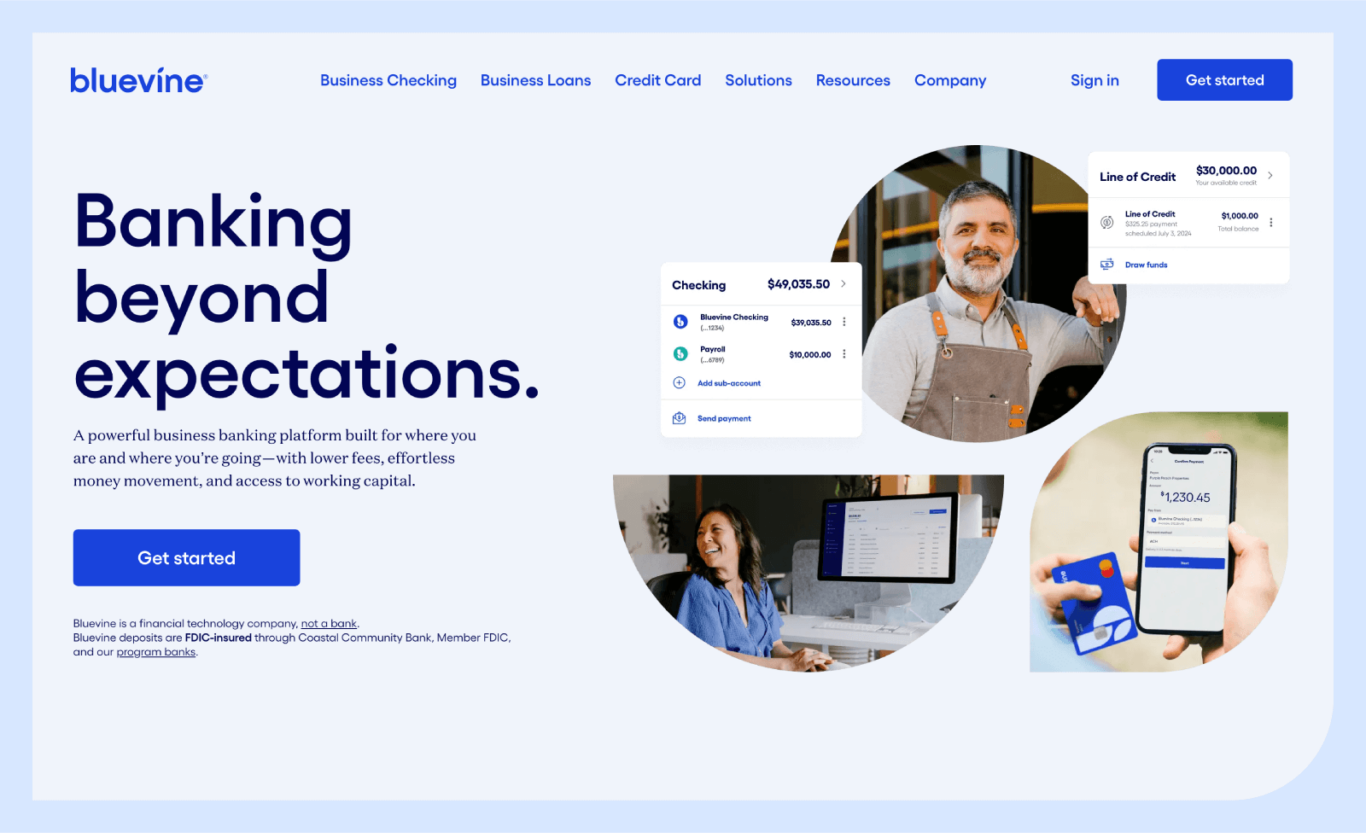

1. Bluevine

Best for: Small businesses looking for an all-in-one digital banking platform

Mercury vs. Bluevine: Bluevine shines against Mercury with its high-APY business checking account, while Mercury’s standard accounts earn no interest.

Bluevine is an all-in-one banking platform that provides a complete financial solution for small businesses, including sole proprietorships. It combines a high-APY business checking accountBVSUP-00166 with lending products and integrated payment solutions like bill pay, invoicing, and payment links powered by Stripe.BVSUP-00180 Bluevine’s straightforward application process allows business owners to sign up for an account in just a few minutes. This combination of services provides a solid financial foundation from a single, widely accessible platform.

Additionally, businesses can access financing through a line of credit. These features complement Bluevine’s high-yield business checking account, which allows line of credit customers to access their approved draws instantly in their Bluevine Business Checking account.BVSUP-00127 Customers can create up to 20 sub-accounts for budgeting purposes, plus make cash deposits at over 90,000 locations through the Allpoint+ and Green Dot networks.BVSUP-00039

Users on Trustpilot love Bluevine’s friendly and helpful customer service, along with the speed and efficiency of lending approval times.

Key features:

- High-yield business checking account with up to 3.0%% APYBVSUP-00116

- Up to 20 sub-accounts with automatic transfer rules

- Built-in invoicing and accounts payable tools

- Multiple checking plans, all with FDIC insurance up to $3 million through Coastal Community Bank, Member FDIC and partner banksBVSUP-00108

- Access to apply for a Bluevine Line of CreditBVSUP-00020

Pricing:

- Standard plan: Free

- Plus plan: $30/month, or $0/month if you meet fee waiver requirementsBVSUP-00132

- Premier plan: $95/month, or $0/month if you meet fee waiver requirementsBVSUP-00117

| See why 750K+ small businesses trust Bluevine. |

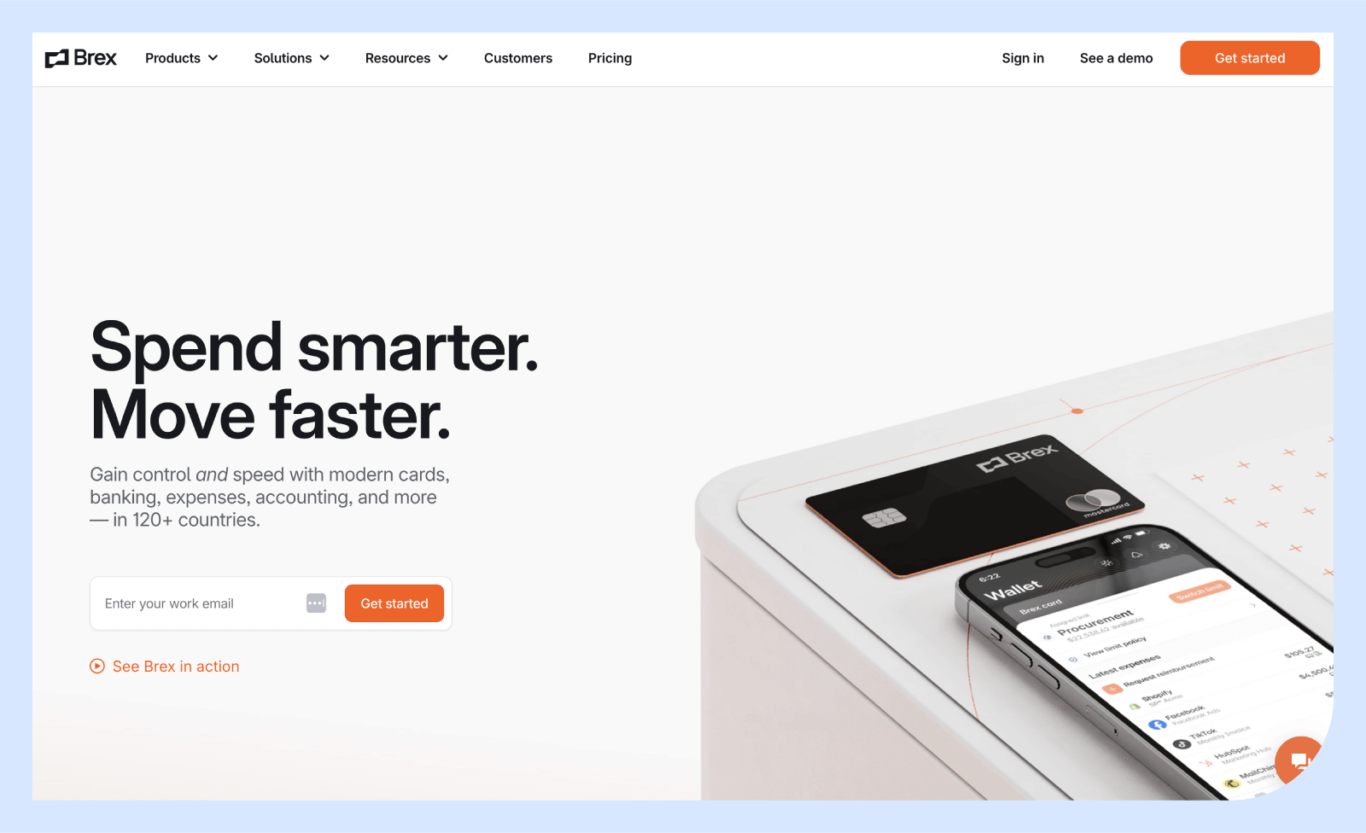

2. Brex

Best for: Venture-backed startups and larger tech companies

Mercury vs. Brex: Brex’s AI-powered management system automates receipt matching and eliminates expense reports, a more advanced solution than what’s currently available with Mercury.

Brex is a financial stack for venture-backed startups and scaling companies. It’s a fully integrated platform that combines a business account, corporate cards, and AI-powered expense management. The platform is engineered to automate financial operations. It eliminates traditional expense reports by automatically matching receipts and enforcing spending policies.

Brex is also built with strong global capabilities, supporting local currency card issuance in over 50 countries and employee reimbursements in over 60 countries. For cash management and security, Brex offers a sophisticated high-yield Treasury account. All in all, Brex is a powerful financial operating system for companies looking to scale their operations internationally.

Users on Trustpilot find Brex’s interface easy to navigate, but complain about customer support and terminated accounts.

Key features:

- Extended FDIC insurance up to $6 million via partner banks

- Integrated corporate cards and AI-powered expense management

- Strong global capabilities for international operations

Pricing:

- Essentials plan: Free

- Premium plan: $12/user/month

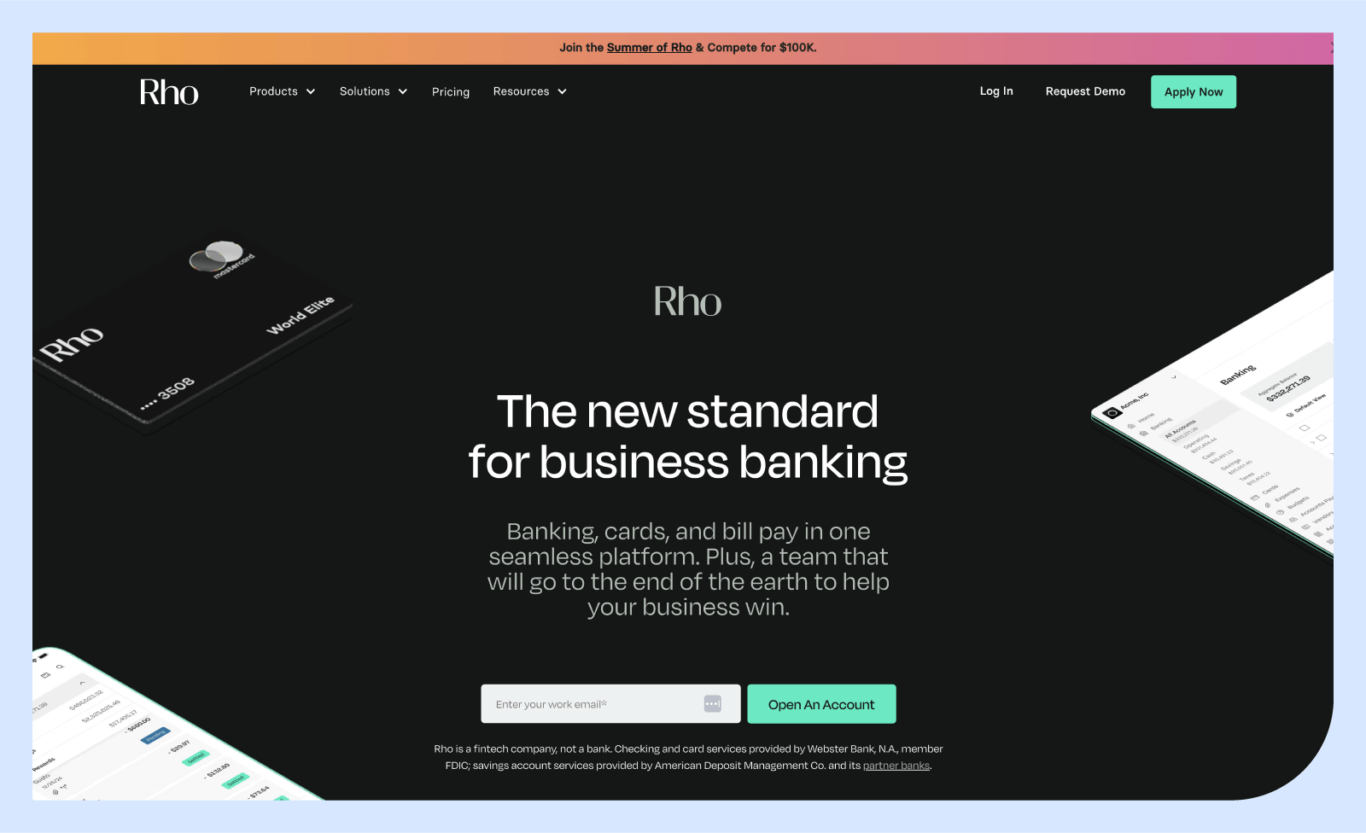

3. Rho

Best for: High-growth businesses that need integrated banking

Mercury vs. Rho: Rho’s advantage is its customer support model, where every customer is assigned a dedicated specialist with 24/7 access, while Mercury primarily relies on email support.

Rho was made for high-growth businesses that value attentive customer service with access to around-the-clock support. The platform’s suite of tools includes business checking, corporate cards, and automated accounts payable. All services have no monthly subscription or user fees.

Rho offers corporate Mastercards that earn up to 1.25% cashback with no annual fees and provide fee-free domestic payments, including same-day ACH and wire transfers. Its combination of dedicated support and robust security makes Rho a compelling choice for businesses seeking a financial partner.

Users on Trustpilot like Rho’s friendly service, but some complain of communication issues and shifting rates.

Key features:

- Dedicated specialist and 24/7 support for all customers

- FDIC insurance on savings accounts

- Fee-free domestic same-day ACH and wire transfers

Pricing:

- Free platform with no subscription or per-user costs

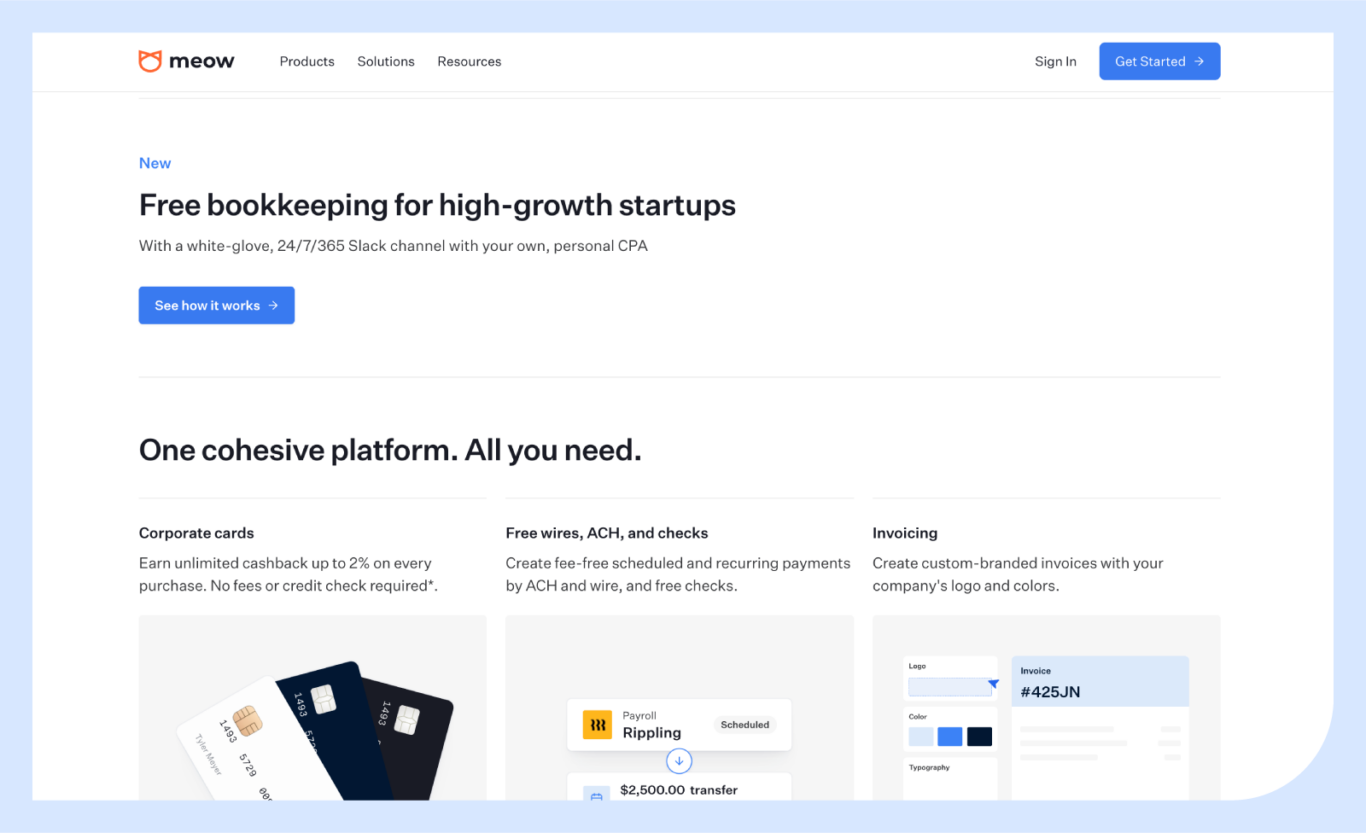

4. Meow

Best for: Businesses looking to earn high interest on their cash

Mercury vs. Meow: Meow goes beyond Mercury’s treasury offerings by giving businesses access to purchase and manage portfolios of U.S. Treasury Bills, a more direct investment vehicle than money market funds.

Meow is designed for startups and investment firms. It offers a business checking account with a competitive APY on all balances. Beyond savings, Meow gives businesses direct access to purchase, ladder, and manage portfolios of investment-grade securities, including U.S. Treasury Bills.

The platform allows businesses to send and receive USDC stablecoins directly from their cash balance with zero fees. This feature simplifies cross-border payments and treasury operations for crypto-curious companies. Specialized offerings are part of a financial suite that includes corporate cards with up to 2% cashback, fee-free domestic and international wire transfers, and integrated invoicing tools.

Meow currently lacks a presence on TrustPilot and has no user reviews available for consideration.

Key features:

- Directly purchase and manage portfolios of U.S. Treasury Bills

- High-yield business checking with a competitive APY

- Send and receive USDC stablecoins with zero fees

Pricing:

- Core business checking is free with no monthly fees

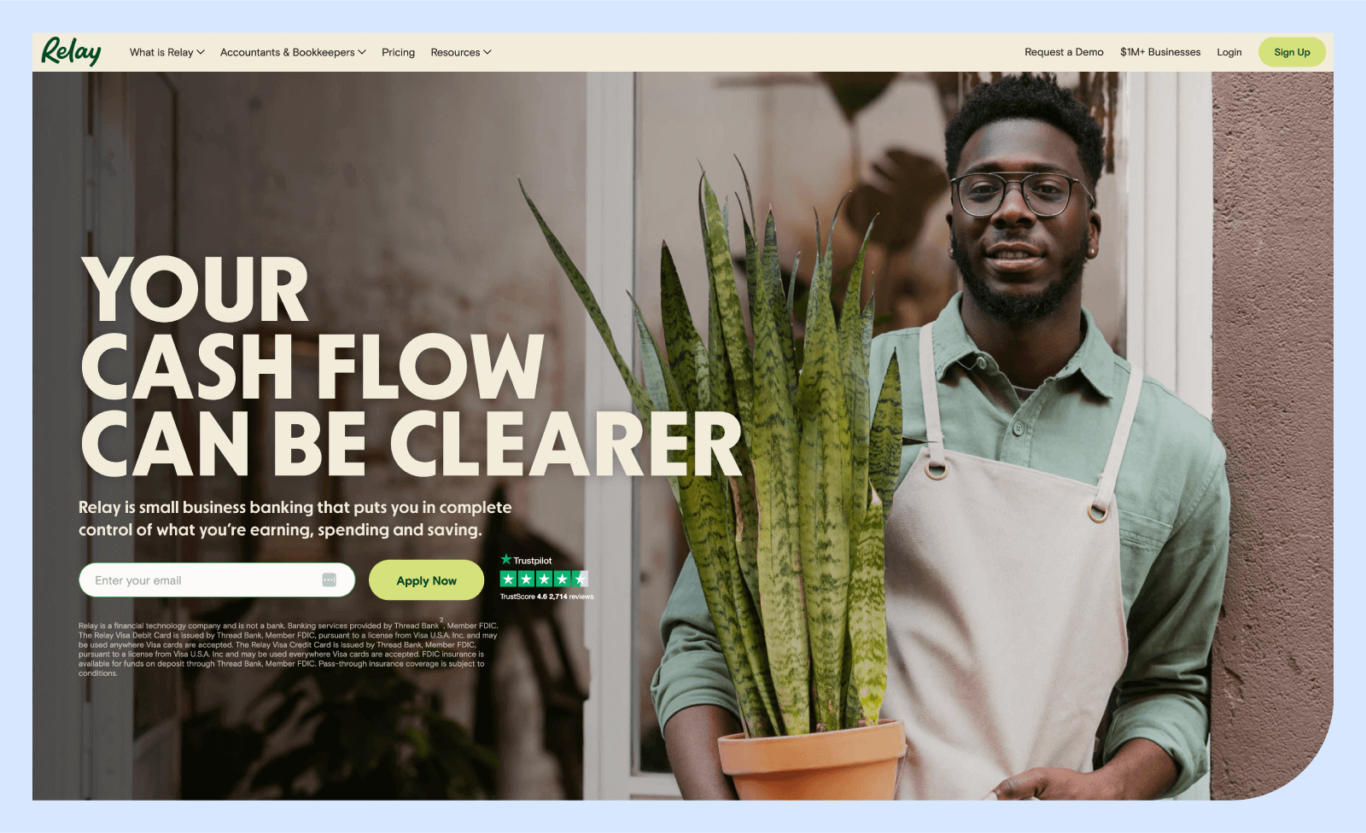

5. Relay

Best for: Businesses that need multiple checking accounts

Mercury vs. Relay: Relay one-ups Mercury by supporting cash deposits through the Allpoint ATM network, an important ability for retail businesses that Mercury doesn’t offer.

Relay is designed for small and medium-sized businesses, featuring granular cash flow management. Businesses can open multiple fee-free checking accounts with the free Starter plan, allowing for up to 20 accounts. Relay is primarily marketed toward companies that adhere to specific budgeting methodologies, such as Profit First, where business owners can allocate funds for taxes, payroll, and operating expenses.

Relay is built for team collaboration, allowing businesses to issue up to 50 physical and virtual Visa debit cards with customizable spending limits and permissions. The solution also offers management flexibility, supporting cash deposits through the Allpoint ATM network. Its business savings account offers a competitive, tiered APY. However, this APY does not extend to its business checking account.

Users on Trustpilot appreciate Relay’s straightforward setup process, but some have complained of frozen accounts and a lack of communication.

Key features:

- Create up to 20 individual fee-free checking accounts

- Issue up to 50 virtual and physical debit cards with spending controls

- Low-cost wire transfers ($5 domestic, $10 international)

Pricing:

- Starter plan: Free

- Paid plans available for advanced features, starting at $30/month

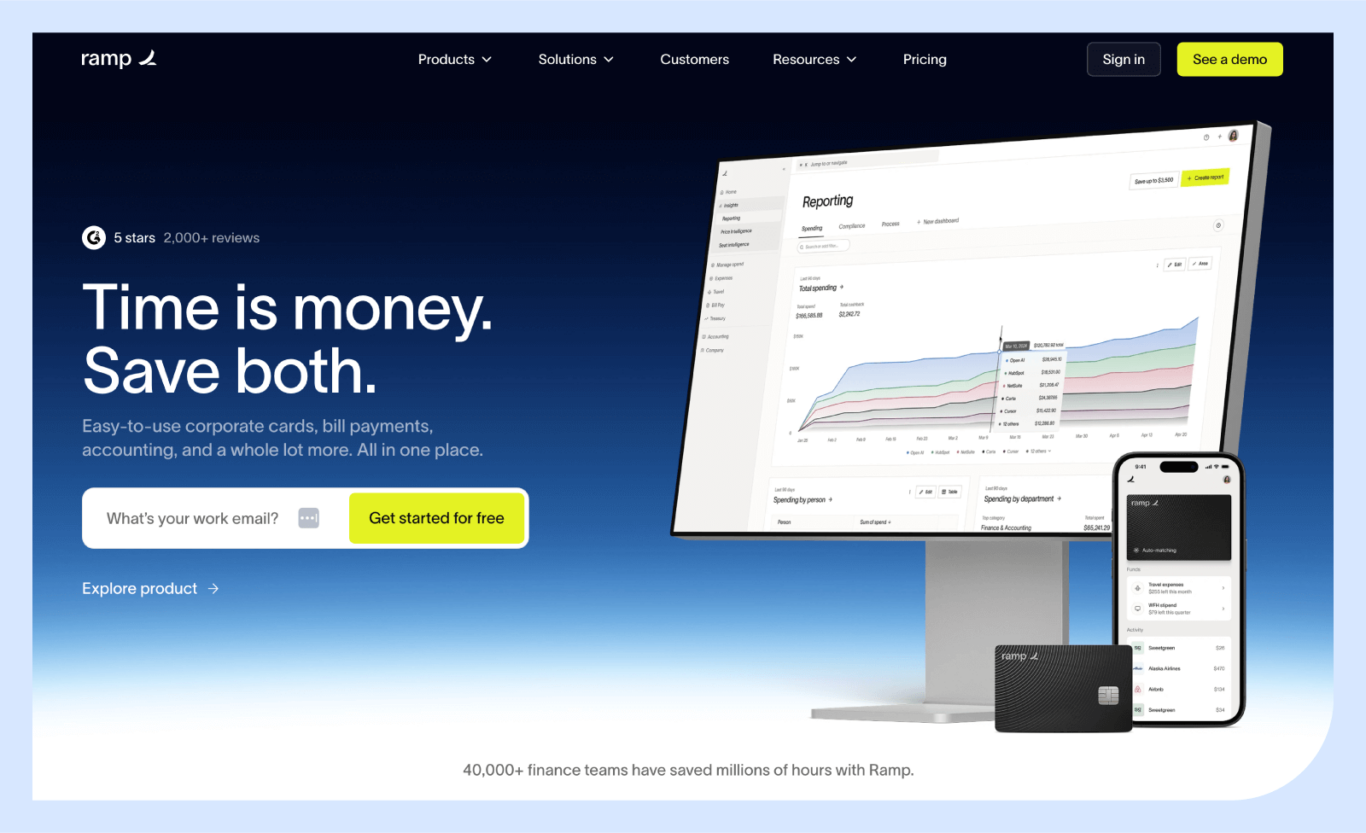

6. Ramp

Best for: Companies focused on spend management and expense control

Mercury vs. Ramp: Ramp shines as a spend management platform, designed with a core mission to help companies save money, rather than just being a banking platform (like Mercury).

Ramp is built to help companies save time and money through intelligent automation and cost controls. It uses an AI-powered expense management system to help automate and streamline expense reports. The platform automatically collects, matches, and categorizes receipts while enforcing spending policies. Ramp also offers corporate cards with a flat 1.5% cashback, providing customizable spending controls.

Beyond automation, Ramp offers a full procure-to-pay suite for managing vendor invoices, purchase orders, and multi-level approval workflows. The platform includes corporate cards, expense management, and standard bill pay, making it a solid solution for businesses looking to implement spending controls and automate tasks.

Users on Trustpilot like Ramp’s time-saving features, but some vocal users criticize the company for poor customer service.

Key features:

- AI-powered software to eliminate manual expense reports

- Corporate cards with 1.5% cashback and granular spending controls

- Full procure-to-pay suite for managing vendors and bills

Pricing:

- Core Ramp platform: Free

- Ramp Plus: $15/user/month

7. Airbase

Best for: Mid-market companies with complex procurement needs

Mercury vs. Airbase: While Airbase provides an enterprise-grade solution for large companies, Mercury is designed for early-stage startups.

Airbase isn’t a banking platform like Mercury; rather, it is a procure-to-pay spend platform. However, businesses may consider the platform for its expense management, corporate cards, and procurement offerings. Airbase includes accounts payable automation designed to handle multiple scenarios, such as support for purchase orders, two-way and three-way matching, and multi-subsidiary accounting.

Airbase’s enterprise-grade features are part of a single system that combines AP automation, expense management, and corporate cards. It is known for its integrations with ERP systems, such as NetSuite and Sage Intacct. It is a logical solution for businesses that have outgrown simpler tools and require sophisticated controls.

Users on G2 enjoy Airbase’s straightforward expense management system, but dislike poor receipt management and report upload issues.

Key features:

- Advanced AP automation with purchase order and three-way matching

- Deep integrations with enterprise ERP systems like NetSuite

- Guided procurement with multi-stakeholder approval workflows

Pricing:

- Quote-based pricing

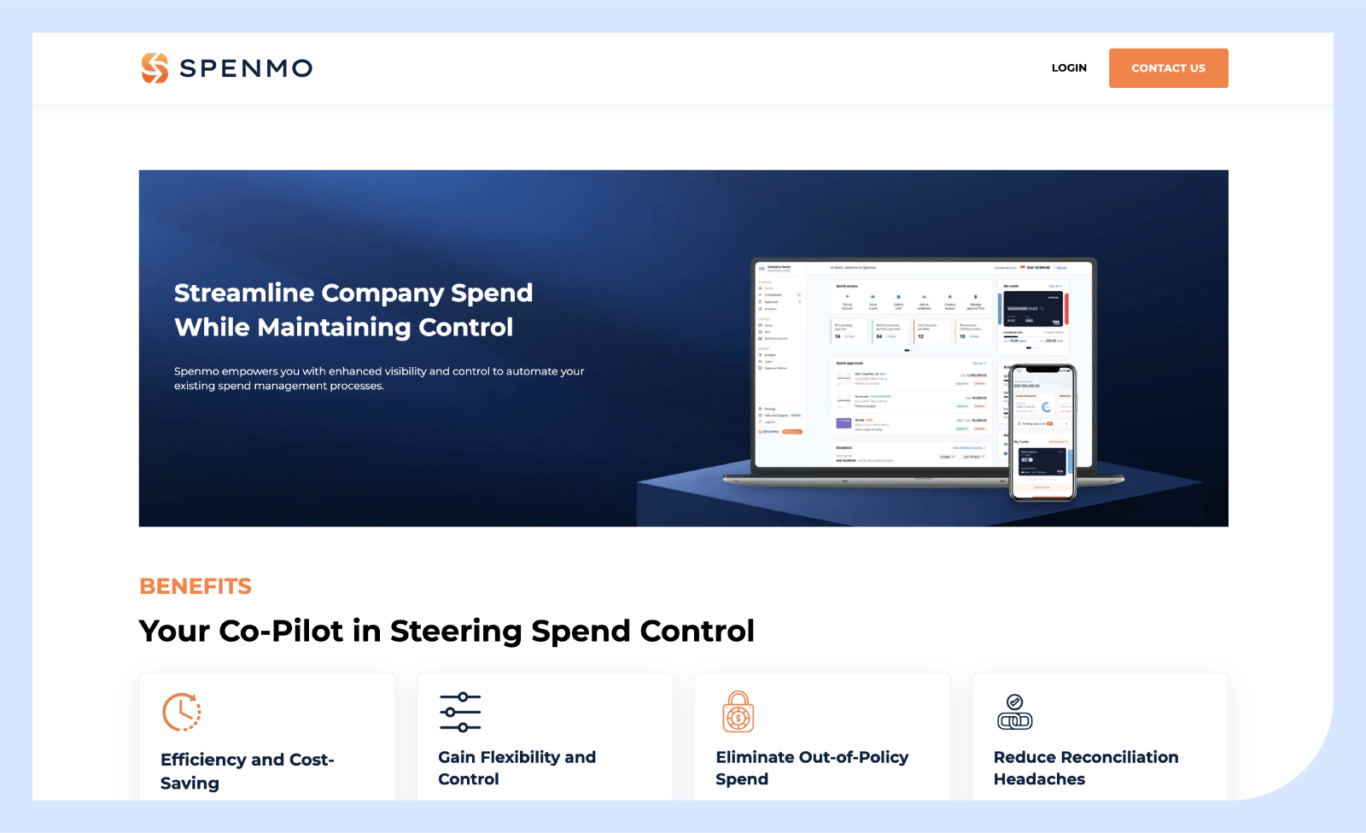

8. Spenmo

Best for: Businesses with operations in the Asia–Pacific

Mercury vs. Spenmo: For businesses operating in Asia, Spenmo’s key advantage over Mercury is its international transfers, which feature a 0% foreign exchange markup, while Mercury charges a 1% fee.

Spenmo is an end-to-end payables and spend management platform focused on Asia–Pacific businesses. It was built to navigate Southeast Asia’s financial, regulatory, and payment ecosystems and has a strong presence in Singapore and Indonesia. It provides a suite of spend management tools, including corporate debit cards, automated bill payments, and multi-level approval workflows.

The Spenmo platform offers international transfers with a 0% foreign exchange rate. It also includes a free integrated system for processing domestic and international payroll. Localized features and competitive rates make it a strong choice for businesses with substantial operations in Southeast Asia.

Users on G2 like Spenmo’s user interface and customer support, but complain about limited reporting capabilities and the multi-wallet system.

Key features:

- Free system for processing payroll

- International transfers with a 0% foreign exchange markup

- Specializes in the financial ecosystems of Southeast Asia

Pricing:

- Free basic plan

- Premium plans available via quote

9. Novo

Best for: Freelancers, solopreneurs

Mercury vs. Novo: Novo stands above Mercury for freelancers and solopreneurs by offering unlimited built-in invoicing, while Mercury’s invoicing tools are part of its paid subscription tiers.

Novo is a mobile-first banking platform aimed at freelancers, independent contractors, and solopreneurs. It enables business owners to create, send, and manage professional invoices from the app, with options to accept payment via ACH or through Stripe and Square accounts. Novo offers a free business checking account with no monthly fees or minimum balance requirements.

It also has a feature called Reserves, which allows users to create up to 20 digital envelopes for setting aside funds for taxes, profit, or other specific goals. Its integrations with e-commerce and payment platforms, such as Stripe, Shopify, and PayPal, make it a convenient choice for online sellers. The solution also provides flexible ATM access, refunding up to $7 per month in fees charged by third-party ATM owners.

Users on Trustpilot like Novo’s user interface, but have noted frustration with user support, terminated accounts, and poor fraud assistance.

Key features:

- Reserves feature for setting aside funds for taxes or other goals

- Refunds up to $7 per month in third-party ATM fees

- Unlimited built-in invoicing directly from the app

Pricing:

- Free business checking with no monthly fees

Fully integrated business checking, invoicing, and bill pay.

How to find the best banking platform for your startup

Choosing the best banking platform requires thoroughly reviewing how it aligns with your business’s operational model, cash in your business checking account, and overall growth strategy.

- Accessibility and convenience: Evaluate daily usability, from the quality of the mobile app to the availability of cash deposits and withdrawals, and responsive phone support.

- Financial needs: Match the platform’s tools to your cash flow, considering your need for fee-free wire transfers, integrated invoicing, or corporate cards with spend management.

- Interest rates and loan options: Compare the annual percentage yield on checking accounts to ensure your cash generates returns. Review the types of financing available, including lines of credit and venture debt.

- Pricing and fees: Look beyond the monthly maintenance fee and analyze the entire cost structure, including per-transaction fees for wires and foreign exchange.

- Reputation and stability: Evaluate the stability of banking platforms and look for enhanced security features, such as extended FDIC insurance, to safeguard deposits beyond the standard limit. For example, Bluevine offers FDIC insurance up to $3 million.BVSUP-00108

Business growth begins and scales with a trusted banking partner

The ideal financial partner is one that aligns with your operational needs, whether that is earning a high yield on your cash balances, depositing physical money, or supporting your business structure. For many small businesses looking for a flexible banking solution, Bluevine is a top choice.

A Bluevine Business Checking account directly addresses the common gaps in the market by offering a high APY on checking balances,BVSUP-00166 letting your working capital generate revenue for you. Unlike many digital-only platforms, it supports cash deposits and serves a broad range of businesses, including sole proprietorships.

Sign up for a Bluevine Business Checking account and see what it can do for your business.