Proper accounting is critical to running a successful small business—and finding the right accounting partner to get the job done can be a huge help. Accountants keep your books up-to-date, manage your tax-related work, and assist you with keeping tabs on every aspect of your company’s financial activity. But the support doesn’t have to stop there. Given the opportunity, accountants can do much more for your business. Here, we’ll dive into seven ways that your accountant can be great for business growth, from boosting your profitability to providing your business an edge over the competition.

Getting your cash flow projections right

Successful entrepreneurs and business owners know the importance of maintaining adequate cash reserves. You should have enough money to meet your financial commitments at any point in time. If you run out of cash and can’t pay your employees or your suppliers, it could harm your reputation. In fact, if you run out of money, the survival of your business could be at stake.

According to a recent report from CB Insights, the top reason that startups fail is a lack of funds.BVSUP-00059 So, how does accounting help a business with its cash management? Good small business accounting software and an efficient accountant will help you watch your cash flow closely. Where is the money coming into your business? Where is it going out? What are your commitments in the next three, six, and twelve months? Entrepreneurs often make mistakes monitoring their cash flow, but an accountant can be an invaluable aid in helping you keep track of your cash inflow and outflow.

Managing tax compliance and saving on taxes

Tax laws are complicated, and it can be a real headache to ensure your company complies with the applicable rules and regulations. That’s where the role of the accountant comes in. A good accountant will support you with income tax filing, sales tax, and employee taxes, and will take all the steps necessary to safeguard your company’s interests.

Accountants can also help you save on taxes. There are several perfectly legal ways to reduce your tax outgo. For example, you could deduct travel expenses or claim a home office deduction if you work from home.

Did you know?

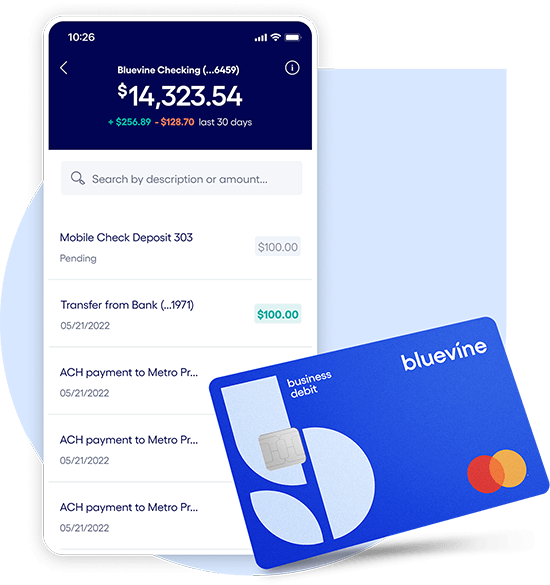

As part of our efforts to streamline the relationship between business owners and their accountants, we’ve designed a dedicated banking experience for accountants and bookkeepers. With features like bulk statement downloads, bill management, and easy client invites, this easy-to-use dashboard makes it easier than ever for accountants to provide best-in-class service to clients.

Helping raise money for your business

If you’ve ever applied for a loan for your small business or a business line of credit, you know that lenders usually ask for several financial and legal documents as part of the credit approval process. You may need to provide the bank or financial institution with:

- Personal and business income tax returns

- Company financial statements

- Financial projections and a cash flow statement

This paperwork, along with other potential loan documentation requirements, can be cumbersome and time-consuming to gather for submission to the lender. An efficient and capable small business accountant could play a key role in helping to get your application materials in tip-top shape prior to submitting a loan or financing application.

Getting your budget in order

One of the key small business accounting functions is preparing a budget for your company. A budget translates your business plans into hard numbers. Think of it as a roadmap that will take your company to its destination.

Your company’s accountant will prepare several different budgets, such as a cash budget, a sales budget, and an expense budget. The key to getting the best out of the budgeting exercise is to sit down with your accountant and understand the figures that go into it. Every month, you should carry out a review in which you compare the actual and budgeted numbers. This exercise can help identify if and when your business is operating off-track and allow you to take corrective action, thus putting you on track to achieve smarter business growth with your accountant’s help.

Monitoring your company’s key performance indicators (KPIs)

Not only does accounting play a role in keeping your business running smoothly from day to day, but it can also be an important part of smart growth. Accounting records can provide the data to keep track of your company’s key performance indicators, or KPIs. These important metrics help you track business performance over time and allow you to set reasonable growth goals that constantly push your business forward. For example, KPIs can provide insight into:

- How your business stands compared to competitors

- How healthy your customer acquisition costs are

- Trends related to your average order value

There are many KPIs that it’s necessary to track, and analytics can play a big role in driving business growth and helping you make more informed decisions about your business future. Your small business accountant can support business growth by helping you identify and track the most important KPIs to inform that process. This could give you the information to run your business more efficiently and profitably.

Help you maintain financial discipline

Many company owners don’t bother to keep their business and personal expenses separate. They use the same bank account when they are, say, buying office supplies and when they need cash for making a personal purchase. This practice can do immense harm to your business. Here are two ways in which it can create problems:

- You’ll need to separate your business expenses to claim them as tax deductions when tax season comes around. And if you’ve failed to keep your business and personal expenses separate, it could take your accountant many hours to complete this task.

- The second issue is more serious. Say you’ve borrowed money from a bank and failed to pay it back, and the lender brings a lawsuit against your company. If you’ve co-mingled your funds, it could mean that your personal assets are at risk as well.

Separating your personal and business finances can make a big difference as far as protecting yourself and your business goes—and your accountant can guide you on the best way to do that.

Serving as a trusted advisor

According to data from OnPay, 86% of small businesses view accountants as trusted advisors.BVSUP-00059 They are experts in bookkeeping, and they know your clients well. In fact, the same survey found that 53% of small business owners think that their accountants know the company’s clients “very well”.

That said, your accountant can be an invaluable resource when it comes to answering questions about business decisions and general financial questions. Their role could go far beyond the usual bookkeeping and tax work. Some entrepreneurs may want to involve their accountants in their strategy meetings, or may lean on their accountants for other tasks, like helping with collecting unpaid invoices. If you apply your mind, you’re sure to find many ways your accountant can support your business growth and play a bigger role in your future.

Small business checking, built for your needs

Unlimited transactions, live support, high interest rates, and no monthly fees. Open a Bluevine Business Checking account online today.

Learn more