As a small business owner, you might be wondering how to find the best small business checking account for your needs. To help you, we put together the following post with everything you need to know about small business checking.

Small business checking, built for your needs

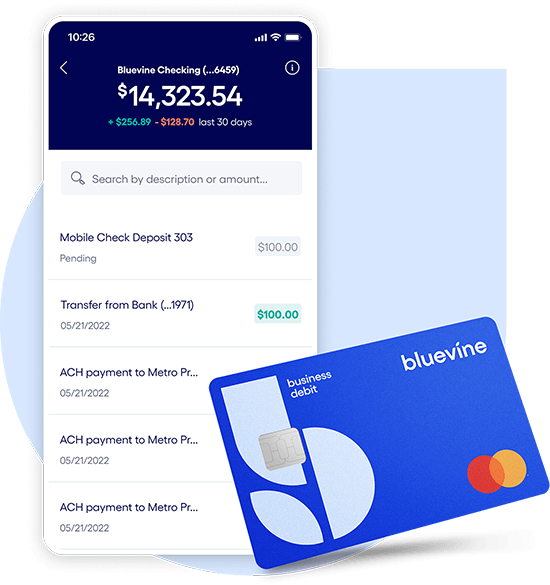

Unlimited transactions, live support, high interest rates, and no monthly fees. Open a Bluevine business checking account online today.

Learn moreWhat should you look for in a business checking account?

Here at Bluevine, we’ve heard from thousands of small business owners—from sole proprietors to startups to fast-growing SMBs and everyone in between—about what’s most important for their business checking needs. Through customer interviews and surveys, we discovered what business owners like you want, need, and expect from a checking account. From there, we built our Bluevine Business Checking solution from the ground up.

Here’s a summary of what we learned about your needs and preferences:

- No fees. 58% of small businesses rank “no fees” as the top benefit of a business checking account.

- Interest. Small businesses also prioritize annual percentage yield (APY), so they can make money from their existing balances.

- Customer service. Business owners want a bank that will provide dedicated support and guidance as well as simple communication options, like texting, email, chat, and phone (with an actual human, not a robot answering service).

- Trust and transparency. Business owners want a trustworthy bank that functions more like a financial partner. Part of this trust is earned when a bank is transparent about how the account works, what fees there might be, etc.

- Scalability. A business’s needs evolve as it grows, so it’s important to find a checking account that grows with your business.

- Financing options. 87% of business owners surveyed want to use the same provider for their banking and credit needs.

Ultimately, you want to find a solution that’s built specifically for small businesses. After all, business banking is different from personal banking, and as such, it should check some different boxes.

Did you know?

If you’re finding it hard to navigate the process of finding the right business bank account for you, you can read reviews from banking experts and other business owners. Comparative roundups on sites like NerdWallet and individual reviews on sites like Money Under 30 can be super helpful in guiding you through the unique pros and cons of each checking account based on your unique needs as a small business owner.

Factors to consider when looking for the best small business checking account

Small business checking accounts and personal checking accounts cater to different needs. In a nutshell, business checking accounts provide more liability protection and less complicated tax filings for a business owner—but that’s not all.

As a business owner, you face your own set of needs and challenges, which is why the best small business checking account is one built expressly for you.

Some features you can expect (and which you can compare) include:

- Minimum deposits/balance. Some business checking accounts require you to have a minimum balance or deposit amount—otherwise you’ll be charged a fee.

- Transaction limits. Some banks limit how many times you can deposit, withdraw, or transfer money. Others offer unlimited transactions.

- Fees. Traditionally, business checking accounts come with fees—like an account opening fee, monthly service fee, and NSF fees. Some of these fees can be waived if you meet certain requirements, or you can avoid them altogether by finding a true no-fee business checking account.

- Interest. Plenty of accounts allow you to earn interest on your balance, so it’s about finding the account that gives you the best rate. (For reference, the national average APY is 0.1%.)

- Integrations. Consider what kind of apps and services you want your account to connect to for things like accounting, fund transfers, or bill/vender payments.

- Easy/online account opening. Some business banking solutions let you open an account online, while others require paperwork and/or an in-person visit to a local bank branch.

How do you compare small business checking accounts?

As we just listed, there are a variety of features to expect from a business checking account—but not all business checking accounts are created equal. As you do your research, select a few banking providers and see how they stack up to the following criteria:

Feature | Bluevine Business Banking | Most Traditional Banks |

| Interest | ✓ 1.3% APYBVSUP-00005 | 0.1% APY* |

| Monthly maintenance fees | ✓ No monthly fees (unconditional) | $15, waived only upon meeting certain conditions* |

| Balance requirements | ✓ No minimum balance | $1,500+ minimum balance* to avoid monthly fee |

| Deposit requirements | ✓ No minimum deposit | $25–$100 minimum deposit required* |

| Transaction requirements | ✓ Unlimited transactions | Only the first 200 transactions are free* |

| Checks | ✓ 2 free checkbooks | $15–$35 per set* |

| Wire transfers | ✓ Free incoming wires | $15 per incoming wire* |

| Non-sufficient funds (NSF) fees | ✓ Zero NSF fee | $35 NSF fee* |

| ACH payments | ✓ Free ACH payments | $0–$30 fee* |

| Credit card fees | ✓ Transparent fee (2.9%) for bill pay with credit card | Layered, complex fees + per-transaction fee* |

At the end of the day, it’s important for your checking account to check off all the boxes that are most important to you as a small business owner. That starts with doing your research, weighing your options, and determining which account is best positioned to grow with you and your business.

A closer look at Bluevine’s Business Checking account

At Bluevine, we built our Business Checking product specifically with small businesses in mind. We know that you want more from a business checking account; that you want features and support that will streamline your banking, increase credit access as needed, and give you the flexibility to run your business on your terms.

That’s why we built our checking account accordingly, with no minimum requirements, no hidden fees, high interest, and more.

Here’s a breakdown of how Bluevine Business Checking account works:

Requirements. Or, should we say, lack thereof. No minimum deposit or balance is required, plus you get unlimited transactions.

No fees. No monthly service fees, ATM fees, or NSF fees.

High APY. 1.3% interest for eligible customersBVSUP-00005.

Easy payments. Easily pay vendors or bills via ACH, wire, or check (and, if needed, schedule one-time or recurring payments).

Simple account transfers. Make transfers to and from your other accounts.

60-second account setup. Easy online account setup.

Mobile app. Check your balance and make deposits and/or transfers directly from the Bluevine mobile app.

Credit access. Bluevine offers a Business Line of Credit for small businesses seeking lending solutions.

Small business checking, built for your needs

Unlimited transactions, live support, high interest rates, and no monthly fees. Open a Bluevine business checking account online today.

Learn more