As a small business owner, you’re likely familiar with monthly account fees. Most major banks charge businesses savings or checking account fees to maintain an account over time, and while those fees may not seem major upfront, they manage to add up over time. This can spell serious trouble for your cash flow—especially when it comes to hidden fees that you didn’t even see coming.

Luckily, there are options for business owners looking to reduce or totally eliminate checking account fees (including opening a Business Checking account with Bluevine). Here, we cover how to go about minimize checking account fees to maximize your business growth.

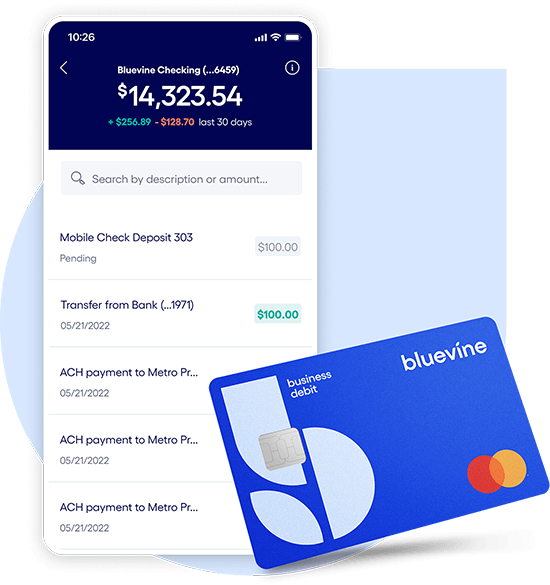

Small business checking, built for your needs

Unlimited transactions, live support, high interest rates, and no monthly fees. Open a Bluevine business checking account online today.

Learn moreWhat are account fees actually for?

First things first, why do banks charge fees to begin with?

Traditionally speaking, banks charge business checking account fees for a few reasons. For one thing, fees allow them to provide many of the services you use as their customer. Fees help to cover their own operating expenses. Third, fees help banks turn a profit.

The good news is, most banks and banking service providers waive their fees if you meet certain criteria. For example, you can save on bank fees if you:

- Maintain a minimum balance. Many banks will waive their monthly account maintenance fees if you have a certain daily or monthly balance.

- Follow transaction and deposit limits. Most banks allow their small business customers to make a certain number of transactions for free each month (usually around 200). Some may also have deposit-based fees, where you can deposit up to a certain amount before you’re charged.

- Make sure deposits clear. Many banks charge overdraft or non-sufficient funds (NSF) fees if you make a deposit that doesn’t clear, so it’s important to ensure that won’t be the case before writing big checks or transferring funds.

- Sign up for alerts. Another way to avoid overdraft or NSF fees is to set low balance alerts so you can make sure that you stay above the minimum balance requirements.

- Read the fine print. Even banks that claim to be fee-free still charge fees, which is why it’s so important to read the fine print and ask your bank about what fees they charge, as well as when and why. You might find that there are fees for replacing a debit card, adding overdraft protection, sending ACH or wire payments, etc.

Did you know?

At Bluevine, we designed our Business Checking account specifically for small businesses. It comes with no monthly or hidden fees, 1.3% interest for eligible customers, and no minimum balance requirements or transaction limitsBVSUP-00005. We’re able to offer this because, as an online-only banking service provider, we avoid costly infrastructure expenses that banks have to pay to maintain physical locations. This means we can afford to offer fewer fees and a higher level of flexibility for business owners.

What are some common account fees and charges to monitor for?

Depending on the bank or banking service that you turn to for your business needs, you could be charged nearly a dozen different fees. As you’ll see in the chart below, the fees themselves are fairly low, but if incurred enough times, they could add up to hundreds of dollars each year. That’s not nothing, and it can hit especially hard if you’re hit with those fees unexpectedly.

Here are common business checking/savings account fees you might be faced with, as well as how to eliminate or save on them when possible:

| Fee | What is it? | How high is the fee? | How can you avoid it? |

| Monthly account maintenance | A fee that is charged each month your account is open | Anywhere from $12–$30 each month | Meet daily minimum balance requirements (usually between $1,500–$3,000) or a minimum monthly balance (usually between $5,000–$15,000) |

| Overdraft or NSF fee | A fee that is charged if you bounce a check or have a negative balance | Usually between $27–$35 | You might be able to get it reversed if you talk to your bank. Otherwise, set up low balance alerts and always make sure that deposits clear. |

| Overdraft protection | A fee you pay to avoid NSF fees | Typically around $35 | Simply don’t opt-in to overdraft protection and you won’t be charged for it. |

| Returned deposit fee | A fee you’re charged if a check you deposit bounces | Usually between $20–$40 or a percentage of the check amount | You could tell the person who wrote the check when you’ll be depositing it, or potentially ask them to cover the returned deposit fee. |

| Checkbooks | Typically, your first box of checkbooks is free. After that, you’ll have to buy more from your bank. | Usually between $20–$40 per checkbook, plus shipping. | Opt for ACH payments or use one of these less expensive checkbook providers. |

| Cashier’s check | A check drawn from a bank’s own funds and signed by a cashier or bank teller that guarantees payment to the recipient. | Usually less than $10 per check | They are typically free if you have a premium-level business checking account. |

| Paper statements | Most statements are now provided online. If you opt for paper statements in the mail, you might be charged for them. | Usually $2–$3 per statement | Sign up for paperless statements. |

| ATM fees | Fees to use an ATM outside your bank’s network | Usually $2–$3.50 | Stick to using your bank’s ATMs, or get cashback at retail stores when using your debit card. |

| Lost card | If you need a replacement debit card (or want to get one for an employee), you’ll likely have to pay for it. | Anywhere from $5–$25 depending on your bank and how quickly you need the card. | The best way to avoid this is to keep track of your debit card at all times. |

| Wire transfer fees | A fee banks charge to send or receive payment via wire transfer | Usually $25–$30 for transfers within the U.S. and $45–$50 for transfers going outside the U.S. To receive a wire, you might be charged $15. | Nonbank providers typically charge fewer fees for wire transfers. |

| Inactivity fees | If you don’t use your account at all for 6 months or longer, your bank may charge a fee for each month of inactivity. | Usually between $5–$20 per month | Make consistent transactions. |

How can you avoid fees related to your account?

As you can see in the table above, there are ways to avoid nearly all of the different fees that banks charge business owners. These fee waivers are extremely helpful, but we’re willing to bet that you’d rather spend your time on growing your business and revenue and not trying to dodge account fees by tracking minimum daily balances and monthly transaction limits.

Fortunately, there are ways to avoid bank fees and their fee waivers. You just need to find a bank or banking provider that looks out for your business interests as much as you do. Your best course of action is to educate yourself on your bank’s fee structures and other banking alternatives that charge fewer (or no) fees than traditional banks. From there, you’ll be able to make an informed decision about your business’s banking needs.

Small business checking, built for your needs

Unlimited transactions, live support, high interest rates, and no monthly fees. Open a Bluevine business checking account online today.

Learn more