Since you started your small business, you’ve likely wondered what kind of bank account you need to manage your business’s finances. It’s true that banking needs for small businesses are different than personal banking needs or even those of bigger enterprises. Which begs the question: Which business bank is right for you?

At Bluevine, we spend a lot of time speaking with and working to understand the unique banking needs of small business owners like you—so we put together the following roadmap to help you find the right bank account for your business.

What are the top banking needs for small business?

The top small business banking needs fall into a few different categories. In general, they include:

- Basic small business banking services. This includes a small business checking account, online and mobile banking, transparent fees, and more.

- Small business lending and financing. Such as lines of credit, invoice factoring, equipment leasing, and SBA loans.

- Cash management options. Like wire and ACH transfers.

In the next few sections, we’re going to break these down further to help you identify your own business’s needs so you can decide which small business bank account is right for you.

Wait, do I need a small business bank account?

Whether or not you need a small business bank account depends on your business entity.

If you’re a sole proprietor, you technically could use a personal checking account for your business, but you’ll benefit from liability protection, easier tax filings, and more if you open a business checking account instead.

If you’re a legal business entity, your bank might require you to open a business checking account for LLCs.

What to look for in a small business bank account

All things considered, it’s in your best interest to open a small business bank account.

Note that we’re recommending a small business bank account. As you may have seen from your research or experience, most traditional banks tend to be a better fit for larger businesses with ample cash reserves and human capital. These enterprises can waive banking fees without even trying—and some might not even notice the dent that banking fees can make on their bottom line.

On the other hand, banks for small business owners are designed to meet the unique needs of small businesses. There are standard benefits, like liability protection and more streamlined tax preparation. Then, there’s added banking flexibility, like no minimum balance requirements, transaction limits, or monthly fees, as well as high APY.

Ultimately, the best business checking account for small business is one that meets all of the following basic, financing, and cash management needs:

Banking needs for small business #1: Basic services

At a minimum, you’ll need basic small business banking services so you can make deposits and withdrawals, easily pay vendors or accept customer payments, and manage your business’s finances on the go. With that, here are five basic needs to consider:

- Small business checking account. You’ll need an account solely dedicated to your business income and expenses. That way, your business and personal finances remain separate—and your tax prep is more streamlined as a result.

- Online banking. As a busy business owner, you might not have time to go to your local branch for every deposit or money transfer. Instead, you’ll want to easily manage your account online.

- Mobile app. Mobile banking apps allow you to easily deposit checks, make transactions, check account balances, and more—all from your smartphone or mobile device. This is especially helpful for small business owners who are constantly on-the-go.

- Transparent fees. Most major banks charge fees for their business banking services. These fees range from monthly maintenance charges to other hidden fees for things like transaction limits, overdrafts, or checks. To avoid these business banking fees, you have two options: get a clear understanding of exactly what your bank charges and when/why, or look for a bank with no monthly or hidden fees, like Bluevine Business Checking.

- No requirements. Traditional banks often have minimum balance requirements and transaction limits that you must meet in order to avoid their fees. For some small businesses, these can be hard to meet.

Banking needs for small business #2: Lending and financing options

Small businesses need financing to grow—to invest in new inventory, launch marketing campaigns, or hire new employees. Finding a bank that offers the right financing options is key for your growth. Here are some common small business lending and financing options you might need:

- Lines of credit. Revolving lines of credit allow you to draw funds as you need them and pay only for what you use. Lines of credit are great for both growth investments and unexpected expenses.

- Invoice factoring. Turn your unpaid invoices into working capital by getting an advance on your outstanding invoices. Invoice factoring can help bridge gaps in cash flow while you’re waiting for payment from your customers but still have to cover expenses like rent and payroll.

- Equipment leasing. If you need new equipment, you can use equipment leasing to ultimately rent it from a vendor. This goes for simple office equipment like computers to heavy machinery and vehicles. It’s especially helpful if you need new equipment but don’t have enough capital to purchase it outright.

- SBA loans. An SBA loan is a small business loan that is partially guaranteed by the government. The funding itself comes from SBA-approved lenders (like traditional banks, credit unions, and other lenders). The SBA’s partial guarantee helps reduce risk for the lender, thereby increasing their chances of approving a small business loan in the first place.

- Bank loans. If you qualify for them, bank loans can help you make the right investments in your growth. Here’s a breakdown of small business bank loan pros and cons.

Banking needs for small business #3: Cash management options

For small business owners, having positive cash flow is key for growth. When there’s more than enough money coming in, you can cover expenses and invest in next-level opportunities. Which is why cash management is another important factor to consider with your small business bank. This includes things like wire, ACH, and account transfers—or, to put simply, how money flows into and out of your business checking account.

Wire and ACH transfers are very similar in that they involve the transfer of funds from one financial institution to another. Where they differ is in speed and processing. In other words, wire transfers are immediate, ACH can take 2-3 days to process. Wire transfers are processed by banks, while ACH payments are processed through a clearinghouse.

In either case, wire and ACH transfers allow you to move money around as well as make and receive payments—all of which are common use cases for small business owners like you.

All in all, what to look for in a small business bank account are features that align with how you do business, especially when it comes to banking, lending, and cash flow management. To say you’re busy is an understatement, so ideally you’d find a business checking account that works for you and with you—and that comes with a high APY (like Bluevine’s 1.00%).

How Bluevine works for small business

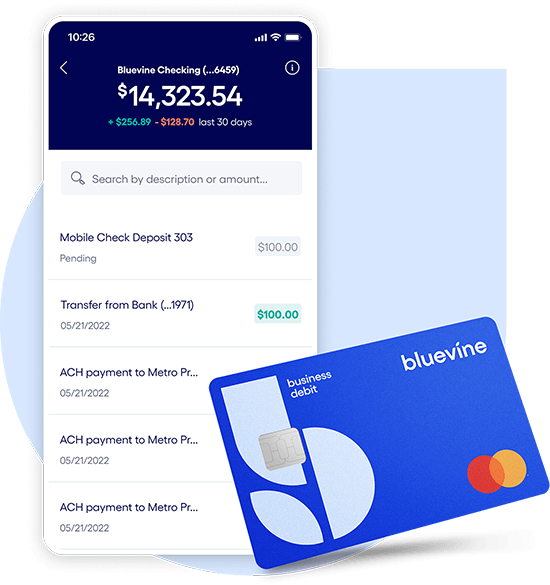

We spend a lot of time at Bluevine trying to understand the financial needs of small business owners so that we can build products designed for you. Our Business Checking account is one such product. As an online-only bank, we are able to offer you top-notch banking services with the transparency and flexibility you need from a financial partner.

Here’s what you’ll get with a Bluevine Business Checking account:

- No monthly or hidden fees.

- No minimum balance requirements or transaction limits.

- 1.3% interest for eligible customers (40x the national average)BVSUP-00005

- Free ACH and wire transfers.

- Flexible financing with the Bluevine Line of Credit and Invoice Factoring products.

- Online banking and mobile app.

And that’s not all. Check out the Bluevine Business Checking to learn more or open an account.

Small business checking, built for your needs

Unlimited transactions, live support, high interest rates, and no monthly fees. Open a Bluevine business checking account online today.

Learn more