Incorporating your business comes with a lot of benefits—one being the ability to open a business checking account. As an LLC (or a limited liability corporation), you are establishing your business as a separate entity from you, the individual, so it makes sense to separate your finances, too. In this post, we’re going to show you how to do that.

Everything you need to know about opening a bank account for an LLC

If you’ve wondered how to open a bank account for an LLC, you’re not alone. Common questions include:

- Is a business checking account required for an LLC?

- What should you look for in a business checking account?

- What is the best business bank account for an LLC?

- What documents are required to open a business checking account?

- Does it matter if I’m a single-member or multi-member LLC?

In the following sections, you’ll get answers to these and other questions, so you’ll be able to open the right business checking account for your LLC.

Wait, do I need a business bank account for LLC?

If you form an LLC or other corporation for your business, you’ll want to keep your business and personal finances separate. Some banks actually require you to open a business checking account if you apply as a legal business entity. This is true for both single- and multiple-member LLCs.

Chances are, one of the key reasons you formed an LLC in the first place was to limit liability and protect your personal assets. Opening a dedicated business bank account can help bolster that. Not to mention, you’ll reap these additional benefits:

- More easily track business expenses

- Simplify taxes and potential audits

- Establish credibility with vendors (no more paying them with personal checks!)

- Accept credit card payments.

How to find the best business bank accounts for LLC

When you search online, you’ll no doubt find plenty of banks offering business accounts for LLCs, like Bank of America, Wells Fargo, and more. What you might not realize is that many of these accounts cater to larger companies and Fortune 500s, rather than small businesses specifically.

All this to say, not all business bank accounts are created equal. The best LLC bank account for you will depend on your unique needs.

Generally speaking, business bank accounts fall into three categories:

- Traditional banks

- Credit unions (not-for-profit, community-owned financial institutions that offer business banking and lending services at lower fees and higher APY than banks)

- Online-only banks (which, like Bluevine Business Checking, are able to offer features most closely aligned to small business owners’ needs).

Here’s how they compare:

| Feature | Banks | Credit Unions | Online-Only Banks |

| Monthly Service Fees | Up to $30/month | Some charge up to $20, but many do not charge a fee at all | N/A |

| Other Fees Charged | Cash deposit fees, transaction fees, overdraft/non-sufficient funds (NSF) fees, ATM fees | Bounced check and overdraft fees. Some require you to pay a one-time membership fee as low as $5 to open an account | N/A |

| Transaction Limits | 100-200 free transactions per month | N/A | N/A |

| Minimum Balance Requirements | As high as $3,000/day | N/A | None, though some require a minimum balance as low as $10 to open an account |

| Interest | 0% | 0.05% – 0.45% | As high as 1.00% |

| Payments | ACH, wire, check (with fees) | ACH, wire, check (some credit unions charge fees) | Free ACH, wire, check |

| Mobile app | Yes | Yes | Yes |

| Dedicated support | Poorly rated | Yes | Yes |

| Credit cards or other available financing | Yes | Yes | At some, like Bluevine |

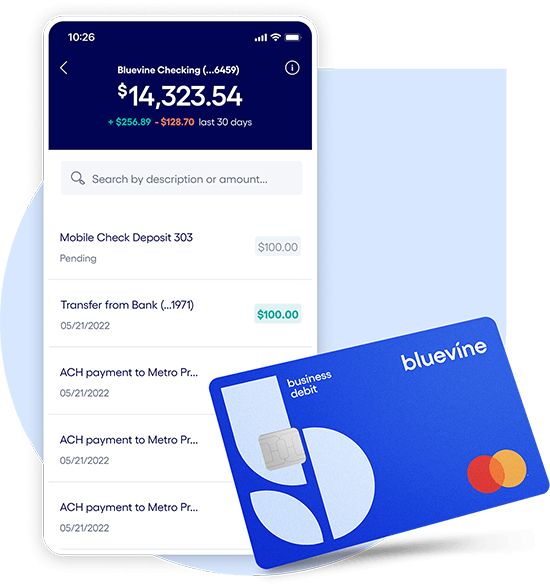

Bluevine offers an online-only banking solution called Bluevine Business Checking, which we built specifically for small businesses. With no fees, minimum requirements, or transaction limits, plus 1.5% interest for eligible customersBVSUP-00005, it provides the kind of flexibility you want and need from a financial partner.

What documents do I need to open an LLC business account?

Each financial institution has its own documentation requirements. In general, here’s what you can expect to provide to open an LLC business account:

- Proof of LLC. This includes articles of incorporation, certificates of formation, and date of formation.

- Federal taxpayer ID. Your Employee Identification Number or EIN. Note that some banks will allow you to open a single-member LLC with a social security number, but we recommend using an EIN instead for record-keeping and liability-limiting purposes.

- Valid owner ID. This can be a driver’s license or social security number. If there is more than one owner, all owners will likely need to present to open the account, but it depends on the financial institution.

- Physical business address. No P.O. boxes or mailboxes. Be prepared to show proof of address, such as a utility bill.

- Operating agreement. If you want to authorize certain members to use the account and/or sign on behalf of the LLC, you’ll need to bring an operating agreement.

How do I open a business account for my LLC?

If you’re planning to open an account in person at a bank or credit union, you’ll need some or all of the documentation listed above. To ensure you’re not turned away, we recommend calling your financial institution of choice to confirm what’s required before you actually go.

Or, you can streamline the set up and paperwork process by opening an account online at an online-only bank like Bluevine.

To open a Bluevine Business Checking account, you must be a small business owner, at least 18 years old, and a U.S. citizen or resident with a verifiable U.S. address. In some cases, you may need to provide your EIN confirmation letter from the IRS, but generally speaking, it’s very easy to open an account—and should take only one minute of your time.

We have a dedicated support team standing by to answer any questions you may have, both before you set up an account and once you’re up and running.

Ready to learn more or open an account? Visit Bluevine Business Checking today.

Small business checking, built for your needs

Unlimited transactions, live support, high interest rates, and no monthly fees. Open a Bluevine Business Checking account online today.

Learn more