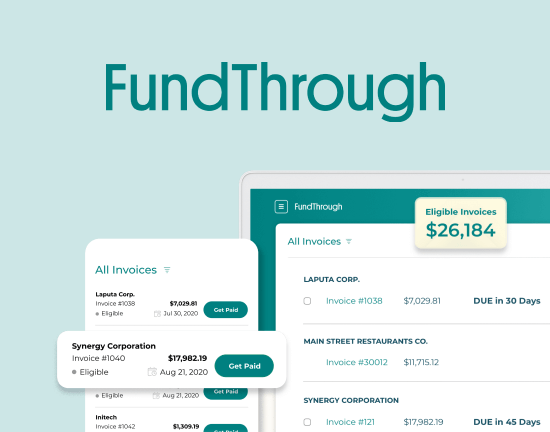

Bluevine has partnered with FundThrough for invoice factoring

Free up your cash flow and apply for invoice funding on FundThrough’s website.

Apply now

As a small business owner, you know that invoicing is an essential part of your daily operations.

Invoicing helps you get paid on time and manage your cash flow. Yet, sending and following up on invoices can be stressful, especially if you are dependent on these payments to keep your business chugging along.

So, what can you do to help streamline the often tedious invoicing process? Here are 5 ways to manage your invoices more effectively.

1. Clarify payment expectations with your clients

Regardless of whether you’re a solopreneur or run a small business with 20 employees, make sure someone at your company clearly explains your invoicing and billing policies to every new customer and client. This way you’ll establish clear guidelines right from the get-go.

To this end, it’s a good idea to discuss expectations – on both sides – before issuing the first invoice to a new customer. Some of the things you may want to address include:

Is there a key contact person you should send the invoice to, perhaps the director of accounting or an outside billing company?

Should the invoice be sent in a particular format, like an attached Word document or from an accounting system like Intuit’s Quickbooks?

Is there a specific date that your customer prefers to receive invoices, such as the first of each month?

Once you understand your client’s invoice parameters, you can ask how you’ll get paid, such as via PayPal, direct deposit, your accounting system, or even a mailed check. If you have your own terms, it’s also important that you discuss these with your client or customer. For example, you may require payment within 30 days, or charge a late fee or interest for invoices paid after two months.

2. Get paid faster by including details in your invoices

Even if you’ve discussed your payment requirements with your customers, it’s advisable to include as much detail as possible in your actual invoices. The reasoning behind this is compelling. You’ll likely get paid faster.

In fact, whereas 63% of invoices are paid on time and within 30 days, 16% don’t get paid at all, according to Due.com. To help ensure that your business is not included in this 16%, try including details in your invoice, such as: the actual project or purchase completed, invoice amount, due date, payment terms, applicable late fees, how you wish to receive payment, your contact information, and your company logo. According to Due.com, you’re eight times more likely to get paid on time if you include a due date on your invoice. And, believe it or not, 25 percent of all invoices are sent without a due date.

Likewise, by including your company logo, you are three times more likely to get paid than if your invoice does not include a branding image. While Due.com did not state the exact reasoning behind this, it’s our conclusion that a logo helps present your company in a more professional manner. Along these lines, when clients take your company more seriously, they may be more inclined to pay you faster.

3. Automate

Managing your invoices can be a tedious process. For this reason, going paperless may be the best solution to stay organized, save time and get paid faster.

There are several small business accounting platforms that allow you to send and track invoices, as well as accept payments and run profit and loss reports. I have used Quickbooks for the past eight years, yet several other small business accounting programs are gaining ground, such as Freshbooks and Wave. Even PayPal (which is not a full-scale accounting platform) offers a simple invoicing option that allows small businesses to send and accept online payments from customers.

Regardless of which platform you choose, automating your invoicing process will help you keep better track of your cash flow and billing.

4. Stay on top of unpaid invoices

So, what happens if you’ve followed the steps above and your invoice still hasn’t been paid by the due date?

In this case, you may have to send out reminders through your accounting platform, or even via a personal email or phone call. It’s never a pleasant task, and I’ve personally had to do this countless times. Here are my top suggestions:

Send a copy of your invoice through your accounting system with a personal note attached. You can start by thanking your client for his or her valued business. After that, include a friendly reminder that you haven’t yet received payment for the completed job or purchase.

Wait a few days. If you get no response, reach out to your direct contact via email or phone (or both). If you’re lucky, you’ll get an immediate email response or your customer will pick up the phone. But be prepared to leave a voicemail message.

If you don’t hear back from your direct contact by the following week, send a reminder note to the payroll manager. If there is no payroll manager, send another email to your direct contact. In my experience, this type of nudge pays off: you’ll often see a payment within a week.

5. Try factoring your invoices

If you find that chasing payments is affecting your daily operations and cash flow, you may want to consider invoice factoring.

Invoice factoring through Bluevine, for example, allows you to get paid via cash advances on your unpaid invoices. This way, instead of waiting 30, 60 or even 90 days to receive payment, you’ll get paid right away. In turn, your unpaid invoices become instant working capital for your business.

You can get started by simply applying online. Within 24 hours, you can get approved. At that point, you can begin getting paid on your invoices by syncing them with your accounting platform or uploading them directly to your Bluevine dashboard. Better yet, you decide which invoices you’d like funded.

Ready, set, go

As you can see, there are several ways to effectively manage your invoicing process. By following these 5 suggestions, you’ll be on your way to improving your invoicing system – with less stress. This will help you focus on what you do best: run your business!

More From The Bluevine Business Blog

How To Get A Business Line of Credit And 5 Mistakes To Avoid