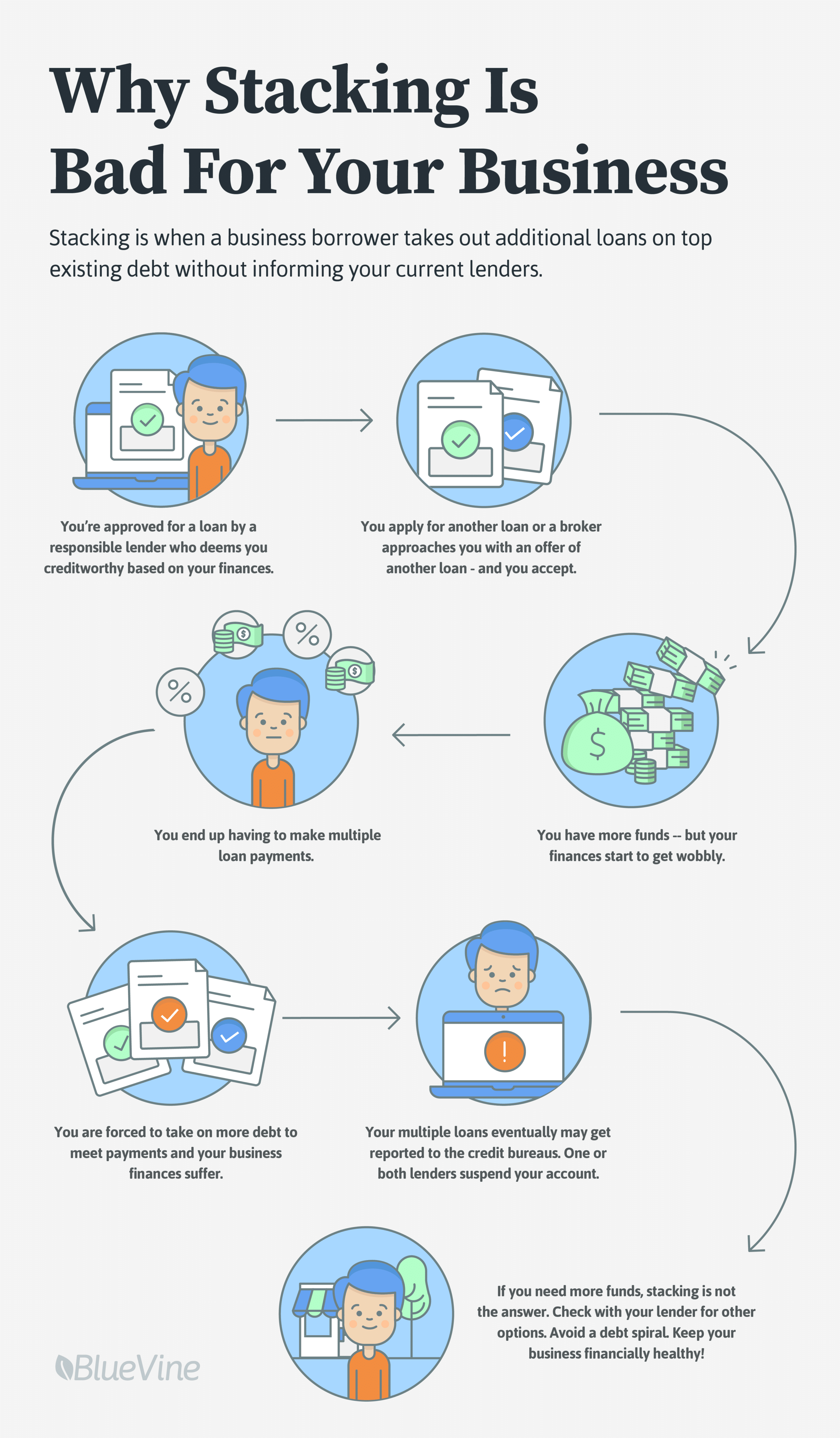

You just got a small business loan. But you need more funds for your business, so without informing your original lender, you apply and get approved for more financing with a different lender.

That’s called loan stacking, or taking on extra debt on top of existing loans in order to have more funds for your business without telling your primary lender.

Stacking is frowned upon by reputable lenders who will offer you financing based on all the information about your current debt obligations.

The underwriting process is meant to protect you and make sure that you’re capable of taking on the debt burden. This is not to say that the lenders themselves are not trying to protect their own interests, of course, since they want to make sure you can repay the loan.

Responsible lenders and their underwriting teams devote a lot of time to make sure the loans they issue don’t put them at risk while at the same time optimizing the client’s needs.

Unethical Lenders and the Debt Trap

But there are other lenders out there for whom a client’s needs are the least of their worries.

Stacking makes you extremely vulnerable to unscrupulous lenders who specifically target businesses that have already borrowed unsecured loans from reputable lenders. Their business model works by capitalizing on the due diligence of the first lender’s underwriting work, which in turn affects the entire online lending industry. These lenders have neither regard for your financial well-being nor care about growing a strong business relationship with you.

Additionally, these unethical lenders will try to bait you with financing that may seem attractive and manageable initially, but could actually lead you to a debt trap.

Why It Affects Your Business

Normally, these additional loans will have higher interest rates to compensate investors for taking on more risk. Unless you are completely sure that your business cash flow is stable and exceeding expectations every month, you will be spending every extra dollar paying off your additional debt which could have gone to your business.

That’s how stacking pushes you into a vicious cycle. You’ll first start needing more financing to pay for the mounting debt. Suddenly, you’re unable to grow your business because all of your extraneous funds goes back to paying off multiple lenders. In severe cases, your business will stall and be forced to scale back dramatically. In the worst scenario, you’ll end up selling the company to make ends meet.

What If You Need More Financing?

We understand your frustrations when it comes to seeking additional financing. However, stacking is not the final answer. If your business needs more funds, we advise you to work with your primary lender to explore additional financing options for your business. If you’re already working with multiple lenders, all hope is not lost—you can still reach out to your primary lender and find ways to consolidate your loans. Remember: a good and responsible lender will always consider the financial health of your small business, so it never hurts to seek their help, especially when it comes to stacking.

Check out our ultimate guide to small business loans.