Small business owners and entrepreneurs are nothing if not self-reliant. They capitalize on this talent by working long hours, paying close attention to the competition, researching the latest improvements in their field, and leaving no detail unattended. Of course, this skill and drive to do it all can also be a burden, especially when it comes to some of the more complicated aspects of running a business. Case in point: small business accounting.

Managing cash flow, balancing the books, dealing with accounts receivable/payable—all of these accounting tasks tend to be some of the more daunting ones for small business owners. However, the most successful business owners know when it’s time to lean on others for help, and accounting and bookkeeping is one such area where partnering with an experienced professional can minimize stress and time spent trying to go it alone.

Here are four ways that outsourcing your accounting functions can benefit you and your growing business.

You can lean on a professional’s expertise and unique skills.

Very few home builders, independent opticians, and restaurant owners go into these businesses to crunch numbers. Unfortunately, bookkeeping and accounting are necessary evils when running a business—even if they’re not really your strong suit. As many business owners find out early on, accounting is more than just a matter of simple arithmetic. There are plenty of standardized rules that have evolved over time, and professionals are now expected to abide by them. If you’re not familiar with these guidelines or up to speed on any changes, it can be to your business’s detriment if you try to go it alone.

For large, publicly traded companies, there are accounting principles and practices in place to ensure that all financial reporting is as accurate and transparent as possible. These standards are collectively known as Generally Accepting Accounting Principles (GAAP). While small businesses may not necessarily be bound by GAAP, there are still reasons to follow its principles. For example, lenders often tend to look favorably on businesses that are GAAP-compliant. Having an accountant that’s savvy when it comes to these niche regulations and accounting guidelines can go a long way in ensuring the accuracy of your bookkeeping and putting your business in good standing when the time comes to seek financing or settle up with the IRS.

You can spend more time on business development.

Unfortunately, all that time spent trying to tackle accounting firsthand means that you have less time to focus on high-impact business tasks like mapping out a marketing plan to acquire more customers, or building a plan to scale the team. One alternative might be to retain a staff accountant on a full-time basis. The problem is that many small businesses aren’t at a size or level where they can invest in a permanent accountant on the team. For some businesses, the hurdle might be that there’s a more immediate need to scale the team for other necessary functions, such as design or product development.. Still, accounting and bookkeeping expertise is an asset which, as demonstrated, they can ill-afford to do without.

Nearly 60% of small business owners agree that accounting is one of the most draining tasks in running a business. This isn’t just because of the time it takes to manage the books, but the additional time it often takes to correct mistakes after the fact. For this reason, when it comes to managing your business’s bookkeeping processes—including notably complicated tasks like federal payroll taxes—working with an outside accountant helps you avoid wasting countless hours trying to make sense of your books instead of spending your time on tasks that contribute more directly to your business growth, including marketing, product development, and strategy.

You’ll get to learn from experienced and knowledgeable analysts.

An external accountant/bookkeeper can find things that an owner might miss—they can see both the forest and the trees when it comes to a business’s cash flow. For example, if you run a brick-and-mortar business, one question you might come across is where the ideal location to set up shop is. While you as the business owner might start by taking into account the cost of rent or maintenance, an accountant can help you understand the tax implications of planting your business roots in one location over another. An objective accounting consultant with whom you build a good relationship will essentially be a great source of reason and information to help inform some of your key decisions as a business owner and balance out your passion and vision with real-world considerations and numbers that you might not think to consider right off the bat.

You can enjoy some peace of mind.

Finally, working with an accounting consultant for your business can simply free up your mind of the anxiety and doubt that often plague business owners who wrestle with their own books. The Young Entrepreneur Council commissioned a report that determined three areas of attention to attain peace of mind when launching and growing a startup:

- Productivity – focus on outcomes when overseeing staff.

- Cybersecurity – make sure information infrastructure is hardened against penetration.

- Retention – discover what makes the best employees stay rather than bolt.

What does this have to do with accounting? Only superhuman business owners can attend to these things while also looking after things like payroll, cash flow, and government tax regulations. With external bookkeeping staff, however, it is more than possible, and so is a clear and unstressed mind—one that will be all the stronger to expand your business and garner greater profits.

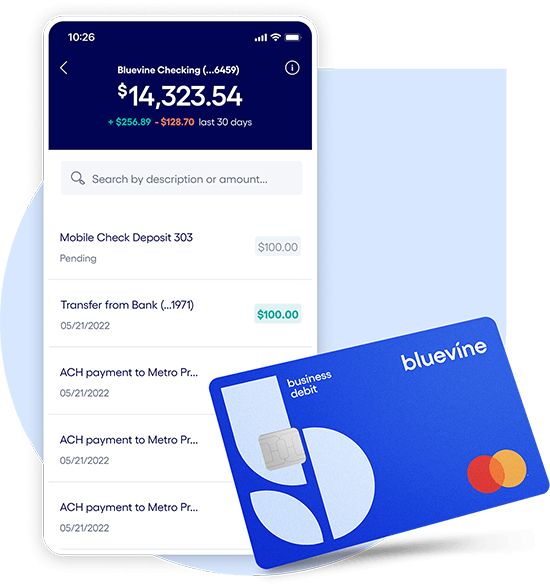

Small business checking, built for your needs

Unlimited transactions, live support, high interest rates, and no monthly fees. Open a Bluevine business checking account online today.

Learn more