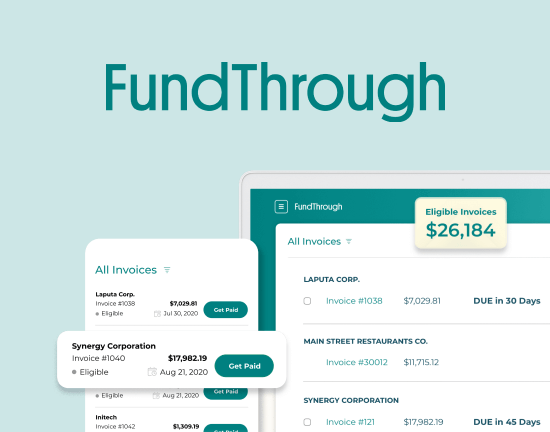

Bluevine has partnered with FundThrough for invoice factoring

Free up your cash flow and apply for invoice funding on FundThrough’s website.

Apply now

You’re a small-business owner in need of working capital. You’ve done your research and understand the different types of bank and alternative financing available to you. And you’ve decided to give invoice factoring a try. It’s fast, short-term and cheaper than alternatives like cash flow loans. So you start searching for good invoice factoring rates.

You start feeling good as you get some low offers – like 1.5% per month. So you pick a provider and get to the paperwork. Then it happens: you get that uncomfortable feeling you get when you’re trying to buy a car. Fees come up, some flat fees and others are percentages. Then you’re told that you need to get a minimum amount of financing, even if you don’t need the cash.

You eventually walk away with the financing you need, but you’re wondering: How much is it really going to cost my small business?

Why invoice factoring rates can be confusing

You’ve probably dealt with the persistent car salesman who tries to win you over by touting a low monthly payment. Similarly, many traditional factors will try to get you to sign up by focusing on a low official invoice factoring rate. But then you find yourself dealing with other figures that you don’t remember coming up in your first conversation.

Sadly, with traditional invoice factoring, confusion is sometimes part of the game.

Below are real, full terms from one traditional factor’s contract that one of our clients left to come to Bluevine. Take a look and answer one key question: under this structure, how much would you pay to factor $100,000 of 30-day invoices each month?

| Credit Facility Limit | $250,000 |

| Type of Financing | Accounts Receivable Financing: $250,000 |

| Advance Rate: | 80% |

| Fee Structure | Discount Fee: 1.15% every 30 days Interest Fee: Prime + 2% |

| Collateral/ Security Monitoring and Operational Fees | UCC Search Fee: $100/month Lockbox Fee: $100/month Wire/ ACH Fee: $35/$10 per payment |

| Minimum Sales Commitment | $50,000 per month – 120 days grace period |

| Term | 12 months |

| Recourse Period | 90 days |

| Due Diligence fee | $500 one-time |

| Closing Fee | 1% of Credit Facility Limit or Waived if Proposal is signed and returned by EOD [date removed] |

Did your eyes glaze over? That happened to this client, too. What they thought was a great invoice factoring rate – only 1.15% every 30 days! – became more and more expensive until they couldn’t actually tell what they were paying the factoring company. That’s when they decided that they needed to find a new factoring partner.

Nickel and diming

Not only are the fees numerous and confusing, but most also are thinly disguised ways for this traditional factor to make up for having such a low teaser rate.

Let’s take another look at some of these fees. Here’s what you should know about each:

- $500 due diligence fee: The primary costs for the traditional factor are background checks and UCC lien searches, and they are already charging you separately for UCC lien searches.

- $100/month UCC lien search fee: This traditional factor is charging its client $1200 per year (an exorbitant amount) for something it may never do again after day 1. That is pure profit for the traditional factor.

- $10/transfer ACH fee: Banks provide ACH services for under a dollar per transaction. Even Intuit charges QuickBooks users only 50 cents for ACH payments. (And with Bluevine, they are free.) This traditional factor is profiting on every single transaction.

- 1% closing fee (waived if signed by a specific date): It’s hard to find a more blatant pressure tactic than charging 1% of the entire credit line if you don’t hurry up and sign. This closing fee doesn’t even pretend to cover an actual business expense.

To be sure, many of these eyebrow-raising fees are common in other loans from merchants, too.

A business partner or an adversary?

Cash flow is the lifeblood of your business, so don’t underestimate the value of having a financing partner who knows your name and cares about your business.

Not all traditional factors take this contract-and-fees approach. Careful questioning can help you find factors — traditional or otherwise — who will put the same emphasis on transparency and relationship that you do.

As a test, do you view your traditional factoring company as a car salesman against whom you negotiate warily, or is your factor a true business partner with whom you have a relationship and who grows with you? Your blood pressure shouldn’t spike when you think about your factor.

How invoice factoring can help your small business

To help you make invoice factoring work for your small business, Bluevine prepared a guide on how to pick an invoice factoring company.

Invoice factoring can be a smart financing option even though, as we explain in this blog post, traditional factoring agreements often involve confusing terms and hidden fees. Bluevine was launched because we thought we could do a better job. Most small businesses grow based on trust, transparency, and reputation – but then must put up with the teaser rates, ridiculous hidden fees, and locked-in contracts of many traditional factors. We think small business owners deserve to have a finance partner – not an adversary – to help grow their business.

We set out to solve this by giving you one simple rate that is always posted in your dashboard so you know what you are paying. Our only other fee is optional: $15 wire fee if you want same-day funds via wire transfer. Otherwise we give you free next-day ACH transfers.

The key question now: do you trust your current factor to be just as transparent, or are they playing the confusion game?

You can get more information in our blog on Invoice Factoring Basics. It only a few minutes to sign up for a Bluevine invoice factoring account.