The COVID-19 pandemic is just one part of the public health crisis from the last year and a half—the vast majority of Americans struggled with mental health too, as we coped with the economic downturn and social isolation. With anxiety, depression and mental illness already higher among entrepreneurs than other workers, the financial toll on small business owners exacerbated the problem. In honor of Mental Health Awareness Month, we’re highlighting one entrepreneur’s journey through the shutdown in his community and how he coped with the difficult time.

Entrepreneur Spotlight: Aaron Robertson of HandledNow

Aaron Robertson is the owner of HandledNow, a staffing agency focused on logistics, trucking and warehouse labor. Coming from a background in logistics, he and his cousin both caught the entrepreneurial bug and founded their company in 2015, which has eight employees and has grown to managing 80-120 staffers at various clients every week.

Finances become a bigger business burden

When the pandemic hit in March, Aaron found himself in a similar situation to many small business owners — in an industry fundamentally reliant on in-person work, his company was forced to pause operations. Major clients like car manufacturers shut down their own operations, and Aaron said he struggled to cope. He is in the business of keeping people employed, and finding long-term jobs for people in his community. The shutdown’s impact on his business, he said, was rough all the way into May 2020.

But finance has long been a main stressor in running his business: Aaron deals with most of the finances himself, recently bringing on an accounting assistant. “What we exist for is to put people to work, so we need to pay them,” he said. “When finances are in order, it’s like a huge weight lifted off your shoulders. I can sleep easier.”

Now that it’s safer to return to work, HandledNow has grown significantly. “It was then scramble mode to afford all of the growth that we had…once we opened back up, we extended our credit line.” Bluevine’s line of credit, Aaron said, and its flexibility to extend it when needed, helped his company with the cash flow issues that come with paying staffers by the week.

Positivity travels downstream, so uplift your employees

Aaron operates his business on an ethos of positivity and valuing his team. Despite the worries and uncertainties during the initial shutdowns, Aaron worked to boost morale among his clients and employees.

I tried to maintain a positive attitude and spread that [positivity] as much as possible. “We had a plan, and knew that if we were able to open back up it would work out. And it did.

Aaron said keeping his cool and working to instill calm throughout his company was a major challenge, though. “It’s one of those things that you look back and realize what you did well and what you didn’t. Being patient and not worrying is much easier said than done.”

Self-care is for everyone—especially entrepreneurs

Because of the long working hours many entrepreneurs endure, Aaron said taking time for himself was critical to cope with some of the stressors with his business. “I get up early, have an hour of prayerful, quiet time to reflect, get ready, and prepare my mind for the day.” Aaron also tries to get plenty of exercise and unglue himself from his phone to help de-stress.

“Getting off of your phone, as a business owner especially, is tough,” Aaron said, but it’s one of the most important parts of his self-care routine. He keeps his phone out of reach during dinnertime and breaks throughout the day to take a few moments to himself.

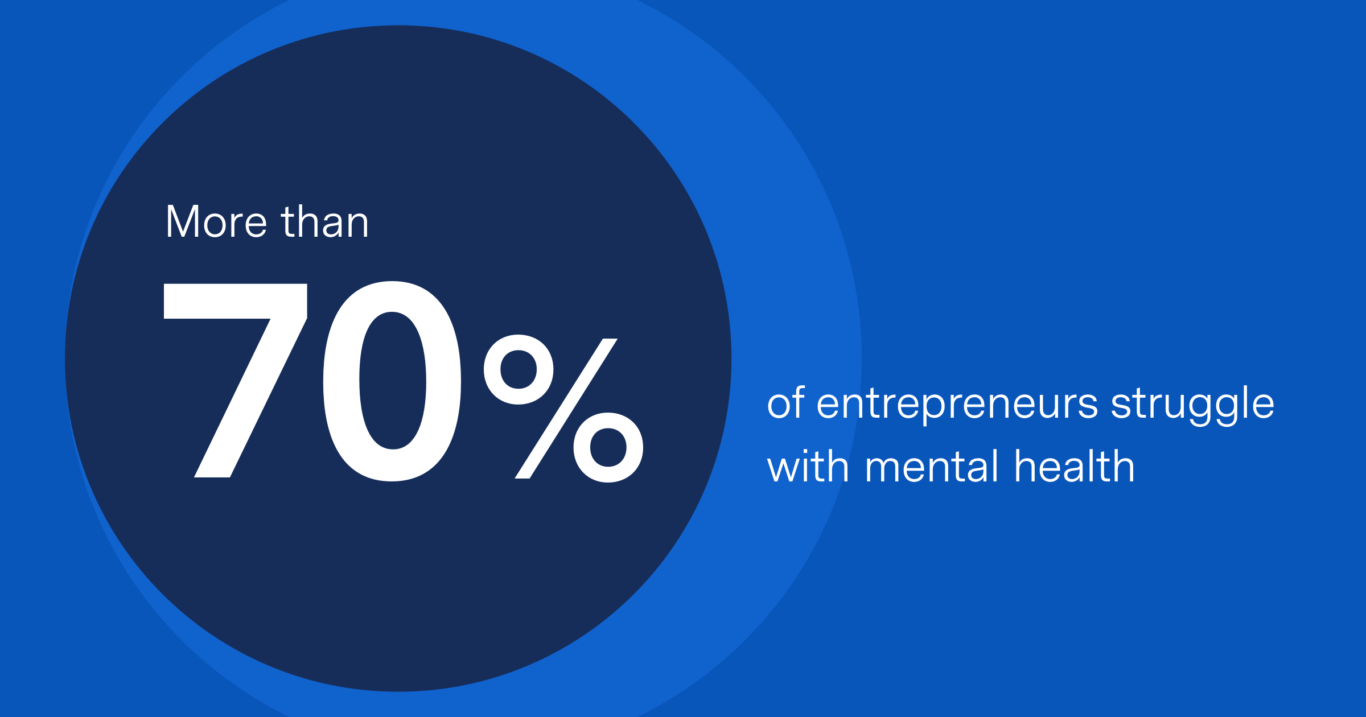

Starting a small business is a challenging pursuit — more than 70% of entrepreneurs struggle with mental health, which can also impact businesses and livelihoods. The last year was hard for small business owners, and we hope everyone can take some time to care for themselves and their mental health.

Bluevine was founded on the principle that finances shouldn’t be a hindrance to small business success. As champions for entrepreneurial endeavors of all sizes, Bluevine aims to lessen the hurdles and time spent for business owners to understand their own financial situation with easier-to-digest information, data and educational tools, as well as capital where needed.

Mental health goes beyond your business or finances. If you need support, visit resources like the National Alliance on Mental Health. You can call the helpline at 800-950-NAMI or text NAMI to 741741) or utilize the national or local resources in your community.