Chances are your business is more mobile than ever. As an entrepreneur, you’re always on the go, and your technology must move with you. No matter where you are or where you’re going, you need to have the full power to do business and manage your money.

Thinking mobile isn’t just about getting tasks done while you’re on the road, however. Integrating mobile technology is actually a big part of developing an ahead-of-the-curve business strategy to lead your company into the future. Developing that strategy means finding the right tools and making the right partnerships.This is true for both client-facing and internal business tools.

Many of us rely on apps, mobile sites, and other tools to help us take care of business essentials from anywhere. Yet, business owners often overlook the value of their banking partner as part of a comprehensive, mobile-friendly business strategy. Pairing with the right bank has many advantages—and finding one that’s mobile-first can help you move forward quickly and efficiently.

Understanding How New Technology Can Improve Your Business

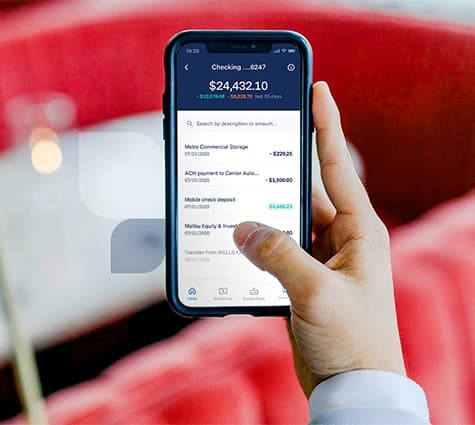

Especially as companies increasingly transition to ecommerce and other modes of contact-free service, a mobile banking solution that can support your business is essential. A banking partner with a mobile focus lets you take care of tasks on the spot versus turning to a computer or a branch.

Most personal banking providers have acknowledged the essential role of mobile-friendly banking. Standard features include depositing checks by photo, transferring funds with minimal steps, and having top-line information about account balances.

But too many banking providers are behind in offering up the same functionality to businesses. Some traditional financial institutions that serve many businesses—including banking stalwarts—don’t consider the importance of helping businesses keep up with technology.

Finding Features That Keep You Nimble, Productive, and Safe

The best mobile banking solutions blend three crucial components within their platform: agility, productivity, and safety. Apps and mobile sites need to offer a full suite of features, not a watered-down version of their desktop experience. Not every bank provides this—especially not the smaller, regional small business banks that don’t have advanced technological infrastructures.

When developing a mobile-first mindset for managing your business’s money, consider foundational features like mobile check deposits and account transfers, and always be on the lookout for features you may not be taking advantage of to help your business be productive on the road.

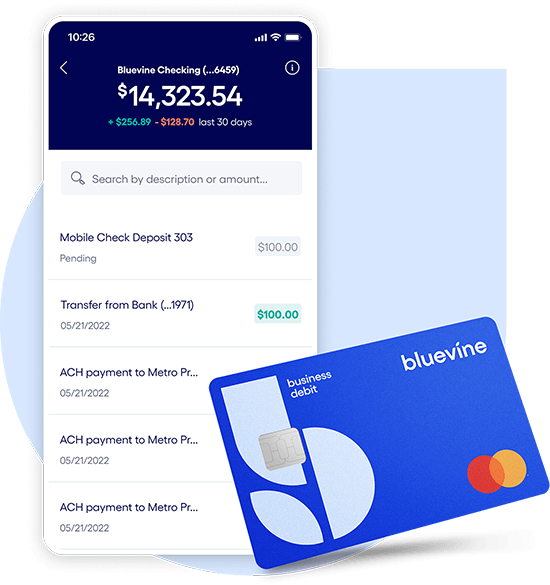

For example, Bluevine’s Business Checking enables you to pay vendors by ACH, wire, or check right from the app, and also gives you the option to schedule payments. Plus, if you run into any issues, there’s live customer support from dedicated professionals—something many institutions don’t offer.

Another consideration is security. The right mobile banking partner will both FDIC insure your deposits and offer features that further protect your money, like locking a debit card in seconds if it’s lost or stolen.

Building an On-the-Go Strategy for Your Future

Your business will only get more mobile, especially as small business technology advances to make data accessible everywhere. Going mobile may mean integrating an on-the-go POS, or more heavily relying on cloud infrastructure that enables you to access your information anywhere. A mobile banking solution is a big part of building a robust mobile business strategy.

When your bank offers an extensive mobile experience, your business can manage its money from anywhere and will no longer be tethered to a desk to take care of essential banking. This kind of productivity goes a long way for entrepreneurs who are pressed for spare moments. Ultimately, with the right mobile banking partner, you’ll better harness your time and money for years to come.

We want you to be among the first to benefit from Bluevine Business Checking, which offers no hidden fees, 1.3% interestBVSUP-00005 for eligible customers, and support built for your business. Get these features and more for your business now.

Sign up for checking built for your business today.

Small business checking, built for your needs

Unlimited transactions, live support, high interest rates, and no monthly fees. Open a Bluevine business checking account online today.

Learn more