Sustainable business growth can only be achieved through scaling, which in turn requires you to ensure that your company is in solid financial health. Gauging the condition of your business finances is simple enough when you know which small business financial KPIs, or key performance indicators, to keep an eye on.

All KPIs serve to support business goals, and the KPIs that you track might be general or specific to the business you’re in. For example, the number of pieces produced in a week is a common manufacturing KPI. Meanwhile, in the e-commerce sector, conversion rates are often measured as KPIs.

When it comes to understanding the financial health of your business, there are common small business financial KPIs that can be tracked regardless of industry sector for the purpose of helping you scale your business. If your business is at a stage where you’re ready to start scaling, read on for a list of key metrics to keep a close eye on as you strategize.

Sales Growth

With this financial KPI, you are effectively measuring the ability of your salesforce to increase revenue throughout specific periods. In business accounting, sales growth is typically measured in monthly, quarterly, and annual intervals. To calculate your sales growth, use the following formula:

Growth = (Sales from Current Period – Sales from Last Period) / Sales from Current Period x 100

You can start by measuring this KPI on a weekly interval to figure out if a particular growth strategy is feasible and sustainable. An example of evaluating sales growth for scaling is to set up a monitoring period right after a large marketing campaign has launched. If your business uses a digital sales dashboard, you may be able to get real-time measurements from this KPI.

Gross Profit Margin

This financial KPI is generally used to gauge the strength of your business and basically tells you how much profit you are making on each dollar of sales. The formula to calculate your Gross Profit Margin is:

Gross Profit Margin = ([Sales Revenue – COGS] / Sales Revenue) x 100

This is the percentage of a company’s revenue that is greater than its cost of goods sold. A company can have extraordinary sales growth without actually posting impressive numbers in terms of gross profit margin. When this happens, it is very likely that the cost of goods sold is not balanced. With regard to scaling, this financial KPI is useful in that it allows you to gauge financial health and how your business stacks against competitors.

It’s also a good way for you to identify opportunities to steadily increase gross profit margin over time, such as by reducing your cost of goods sold (COGS). You could also consider expanding your product offering to include options with a higher profit margin that essentially offset offerings with a lower margin. The idea is to identify if your profit margin numbers could be healthier and implement a strategy to steadily increase that margin month over month.

Net Profit Margin

This financial KPI tells you how much of each dollar earned becomes profit. Revenue may increase but it doesn’t necessarily mean your company is more profitable. The formula to find your Net Profit Margin is:

Net Income = Gross Income – Total Expenses

You can have situations in which your sales growth is on the rise while the net profit margin is flat, which means that you are spending the same — or even more — in proportion to your results. When your growth efforts involve labor-intensive strategies that require high expenses, this KPI can give you more insight into how effectively your business is performing, as well as give you an idea of whether or not this is an area for improvement. If you find that your net profit margin is lower than is optimal to achieve your growth objectives, it’s worth considering tactics to increase this number, such as by streamlining operations to reduce costs or testing price adjustments.

Gross Margin Return on Investment (GMROI)

If your company sells products, this is an important financial KPI to look at as it measures the profit potential of your inventory. You can also use this KPI to figure out your company’s ability to generate cash with the stock you have on hand. This is calculated by:

GMROI = Gross Margin / Average Inventory Cost

In general, you want GMROI to be as high as possible within your retail segment. Any number above one means that your company is selling inventory at a higher price than it was purchased for and any number below one means that your company is selling it at a loss.

Cash Conversion Cycle (CCC)

If your company sells products, cash conversion cycle (CCC) is a very important financial KPI to look at. The CCC essentially gives you an idea of how long it takes for money to move through your business by taking into account how much time it takes to sell inventory, collect receivables, and pay bills. The formula for calculating this metric is:

CCC = Days of Sales Outstanding + Days of Inventory Outstanding – Days of Payables Outstanding

If your business is consistently selling through inventory and having an influx of sales activity, your CCC will be low. If you have a high volume of inventory that it takes you a while to sell through, your CCC will be high. When you’re experiencing the latter, it might mean that it’s time to reevaluate your product offering, target customer, or marketing strategy. The goal is to get your CCC lower over time so that you can be in a more stable spot financially, which is essential to sustainably scaling.

Customer Retention Rate

Since we all know that it costs more to attract new customers than to keep your existing customers around, it pays to avoid the churn-and-burn effect. Customer retention is one of the most important aspects of business growth, particularly if you operate an e-commerce or tech business that depends on monthly renewals or subscriptions. Thanks to advances in information technology, it is now easier than ever to identify customers and figure out what kind of relationship they have with your business. The formula to calculate your customer retention rate is:

Customer Retention Rate = ([# customers at the start of the year – # of customers at the end of the year] / # of customers at the start of the year) x 100

Calculating your retention rate will tell you the percentage of customers who remain loyal month over month. This conversely helps you understand your churn rate — i.e., the percentage of customers who stop doing business with you, such as by canceling a subscription or failing to renew.

Of course, no business can experience a zero percent dropoff in customers over time. While some churn is natural, the key is to look at the average rates by industry and see where you fall. This will give you a sense of how your retention and churn rates compare to industry benchmarks, and will signal whether or not you need to improve your numbers. If so, you might consider implementing strategies like winback campaigns, special discounts for lost customers who choose to come back, or perks for those who stay with your business for an extended period.

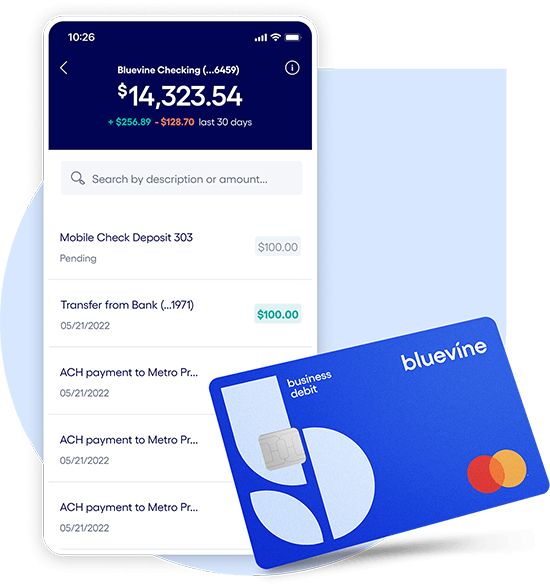

Small business checking, built for your needs

Unlimited transactions, live support, high interest rates, and no monthly fees. Open a Bluevine business checking account online today.

Learn more