Update: Paycheck Protection Program has ended

It was our honor to have supported more than 300,000 small businesses with COVID-19 relief loans to help them cover expenses, pay employees and get back on their feet.

For the best tips on running and scaling your growing business, check out the latest on our blog:

In March 2020, Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act to provide over $2 trillion in economic relief to American workers, families, and small businesses hit hard by the COVID-19 pandemic. At the time, $350 billion was set aside for Paycheck Protection Program (PPP) loans, but demand was so high that Congress increased the amount to $670 billion. When the program ended on August 8, there was nearly $134 billion in unclaimed PPP funds.

Curious if you’ll be able to apply for any of the remaining PPP funds?

Here is everything you need to know about what’s next for the small business paycheck protection program.

Latest updates for the small business paycheck protection program

Established by the CARES Act, the small business Paycheck Protection Program is a forgivable SBA loan for small businesses that lost significant revenue due to the COVID-19 pandemic.

Businesses can use their PPP funds as they wish, but loan can be fully forgiven if funds go towards eligible expenses. Here’s how PPP loan forgiveness works:

- Spend at least 60% of Paycheck Protection Program loan on payroll or payroll-related costs (like wages and benefits).

- Spend remaining 40% on mortgage interest, rent, and/or utilities that were in effect prior to February 15, 2020.

- Cover expenses for 24 weeks starting from the loan origination date, or until December 31, 2020 (whichever comes first).

Initially, small businesses had to apply for PPP loans by June 30, 2020, but the SBA extended the application deadline to August 8, 2020.

Even though the program is officially closed right now, there is still an ongoing need for relief—not to mention $134 billion in unused PPP funds. As a result, there is a lot of activity in Congress to restart the program and allow businesses to apply for a second loan (more on this below).

Is the paycheck protection program still available?

As we just mentioned, the deadlines — June 30, 2020 and August 8, 2020 — have passed, so lenders are not currently accepting Paycheck Protection Program loan applications.

When the program launched, businesses were expected to use their funds within 8 weeks in order to get loan forgiveness. Now, businesses have up to 24 weeks.

How much funding is left in the Paycheck Protection Program today?

Originally, Congress set aside $350 billion of CARES Act funding to the Paycheck Protection Program, allowing vulnerable businesses to continue paying employees and other expenses despite their sudden loss in revenue. Because these funds were depleted within two weeks, Congress allocated an additional $320 billion to the PPP.

When the program ended on August 8, 2020, nearly $134 billion in PPP funds remained unclaimed.

Where will leftover PPP money go?

The Paycheck Protection Program — and the rest of the CARES Act funding — originated from the U.S. Treasury. As such, the unused $134 billion in PPP loans will remain with the Treasury for now until another relief package is determined by Congress.

What will happen to the PPP funding that was returned?

Not all businesses that received PPP loans actually kept their funding. Some funds were fraudulently obtained while others were returned by business owners who worried they wouldn’t be able to meet the loan forgiveness criteria.

So are the PPP loans that were returned still available?

The returned funds did replenish the pool of available PPP funds, but because the program closed, businesses cannot apply at this time.

Is the small business Paycheck Protection Program being extended?

As we mentioned earlier, Congress is pushing to re-open applications (more on this in the next section).

Assuming there is another extension, you’ll have to meet the minimum requirements for applying, which include:

- Any small business that has been affected by COVID-19;

- Has been in operation since February 15, 2020 and;

- Has fewer than 500 employees, including sole proprietorship, independent contractors, eligible self-employed individuals, non-profit and veterans organizations, or Tribal concerns.

These requirements are subject to change based on the new stimulus bill.

What are the next steps for the CARES Paycheck Protection Program?

Members of Congress have introduced bills for new stimulus packages that would supplement the CARES Act and restart the Paycheck Protection Program. They include:

The HEROES Act: The Health & Economic Recovery Omnibus Emergency Solutions (HEROES) Act calls for a $3 trillion stimulus package, with $290 billion earmarked for the PPP. Other PPP-related proposals include:

- Extend application deadline to December 31, 2020

- Reduce eligibility restrictions so more small businesses can apply

- Provide more forgiveness exemptions, such as removal of the 60/40 rule

The HEALS Act: The Health, Economic Assistance, Liability Protection & Schools (HEALS) Act calls for $1 trillion in economic stimulus. The PPP component—known as “Continuing Small Business Recovery and Paycheck Protection Act—would reserve $190 billion for companies with 300 employees or less and at least a 50% reduction in gross revenue. Other highlights include:

- December 31, 2020 application deadline

- The ability to apply for a second loan

- $25 billion reserved for firms with fewer than 10 employees

The “Skinny” bill: The “Skinny” bill, was introduced earlier this month, but did not get the necessary votes to advance. In this bill, lawmakers introduced a $300 billion stimulus package that included a proposal to restart the PPP.

Two key dates are approaching for Congress: the fiscal year-end on September 30, and the election on November 3. Whether they’ll come to a bipartisan agreement before either date remains unknown. That said, it’s clear that Congress understands the need for a new stimulus package and continued support for small businesses, which we find promising. We’ll continue to monitor the situation and any updates from the SBA.

If I received a PPP loan, can I apply for another?

There is a limit of one Paycheck Protection Program loan per business EIN number.

However, some lawmakers are pushing to change this. The Prioritized Paycheck Protection Program (P4) is a bill that, if enacted, would allow businesses to apply for a second loan if they:

- Have fewer than 100 employees

- Used up (or are about to) your first PPP loan

- Have seen a 50% loss in revenue during the COVID-19 pandemic

- Need additional funding for payroll and eligible non-payroll costs

Don’t meet this criteria—or not able to wait for Congress to agree on a new stimulus package?

You have other financing options. Small business lenders like Bluevine offer financing solutions to help you boost cash flow and continue paying your workers and other expenses.

Bluevine offers invoice factoring as well as a business line of credit. The application is entirely online and you can get a decision and funding within 24 hours.

How to apply for the paycheck protection program if extended

Even though the PPP loan is an SBA-backed loan, you cannot apply for one through the SBA. Instead, you’ll have to find a PPP lender, like Bluevine.

Bluevine participated in the PPP this year, lending more than $4.5 billion to thousands of small businesses nationwide—and saving more than 470,000 jobs in the process. We are following the SBA’s guidance on loan forgiveness and are closely monitoring activity in Congress to see when/if the PPP reopens. We stand ready to participate and will leverage our streamlined lending processes to create a seamless application experience for you.

In the meantime, learn more about the PPP from Bluevine.

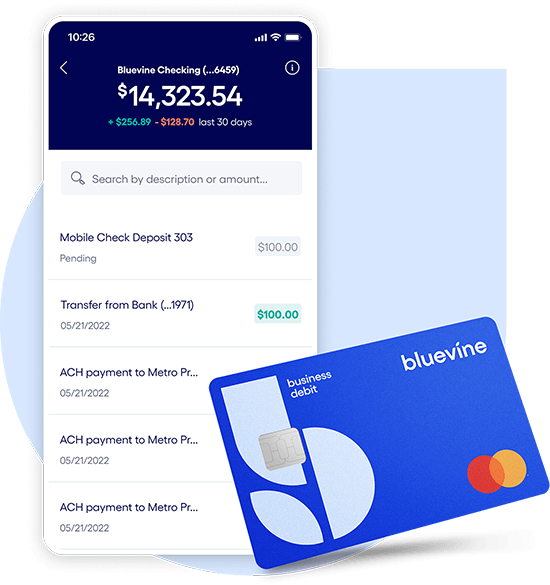

Small business checking, built for your needs

Unlimited transactions, live support, high interest rates, and no monthly fees. Open a Bluevine business checking account online today.

Learn more