If you’re ready to open a business bank account online, you might be wondering how and/or where to do it. Do a quick search and you’ll find a number of options for online small business bank accounts. It’s great to have choices, but which one is right for you?

Here at Bluevine, we think that opening a business bank account online should be easy—we’re here to guide you along the way.

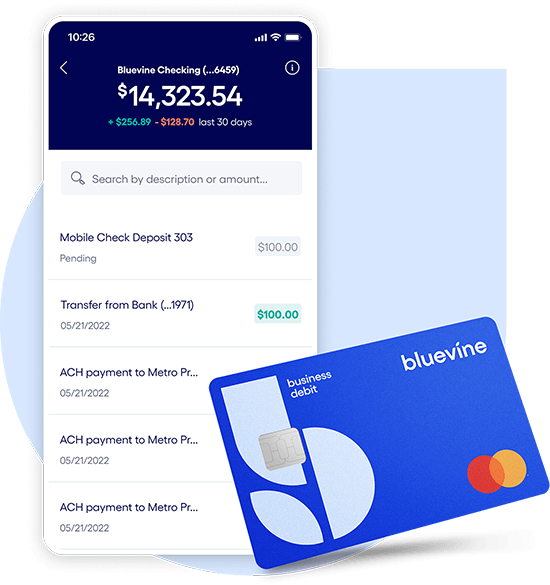

Small business checking, built for your needs

Unlimited transactions, live support, high interest rates, and no monthly fees. Open a Bluevine business checking account online today.

Learn moreCan I open a business checking account online?

First things first: can you open a business bank account online? The short answer is yes.

To help you get started, we put together the following guide, which covers:

- Why it’s hard to open a business bank account online

- How to set up a business bank account online (and what you’ll need)

- How long it takes to open a business bank account

- The differences between an online-only bank and opening a bank account online

- What to look for in an online business bank account

Is opening an account online difficult?

In a nutshell, banks are working with old, latent systems that aren’t set up to support things like streamlined application processes and automated compliance checks. Everything is manual because their legacy systems simply aren’t up to date. Not to mention, they were built for in-person interactions at a bank branch. (This is also why it’s traditionally very difficult for small businesses to get financing from banks.)

On the other hand, opening a personal bank account is easier because financial institutions only have to validate one entity: the individual. The process gets more complicated when there’s a business to verify, which is why many business owners opt to use personal checking for business (even though business checking accounts are the better, safer option for businesses). You’d think this trend would speed progress on online business banking, but it’s actually set it further behind at some financial institutions.

Here’s the good news, though: online-only business banks are becoming increasingly popular—and their processes are simple.

What’s the process of setting up the account?

You might be asking yourself, “Can I set up a business bank account online?”

Traditionally, opening a business bank account would require you to go to a local bank branch, fill out an application in person, and provide a lot of paperwork to prove your business’s legitimacy—in addition to your ties to the business, and those of anyone else you want to have signing power on the account. Fortunately, there are easier options that don’t require you to go to a branch or even talk to someone.

The process varies depending on the financial institution and its individual policies as well as your business entity type (LLC, sole proprietor, etc.). At a minimum, you’ll need to provide the following information:

- Proof of identification. This can be verified either through supplementary documents like your driver’s license and/or social security number.

- Business business information. This will include information about your business like address, EIN, and articles of incorporation.

If you go through a large legacy financial institution, you might also need to provide business licenses, DBA paperwork, partnership agreements, and/or other documentation related to your business entity type. You would likely have to bring everything to a local branch to open in person, as well.

With online business bank accounts—like Bluevine Business Checking—the process of opening a new account is designed with speed and convenience in mind. As a time-strapped business owner, all you have to do is a little preparation before quickly setting up an account online.

How long does it take to open a business checking account online?

Opening a business checking account online is much faster than going through a branch. Not only do you save time by not physically going anywhere, but you also have a more streamlined application process with little to no paperwork.

Exactly how long it takes depends on the financial institution. At Bluevine, it takes most customers just one minute to open a business checking account. It might take a few days to start transacting, but you won’t have to spend any more than 60 seconds going through the process of getting your account set up.

To open a Bluevine Business Checking account, you must be a small business owner, at least 18 years old, and have a verifiable U.S. address.

What’s the difference between opening an account online and banking with an online-only service?

Did you know that opening a business checking account online is not the same as using an online-only banking provider?

For starters, online-only banks for small businesses do not have a system of branches to maintain (or pay for). Some, like Bluevine, have a system of ATMs, but the overhead costs are much lower than physical bank branches. This is why most of them offer higher APY and no (or low) fees. They are also built with speed and convenience in mind, so their processes are simpler, typically requiring little to no paperwork. With online-only banks, you can be up and running with a new business checking account in a matter of minutes.

What should you look for in an online checking account?

Not all online business checking accounts are created equal. At the end of the day, you want to find an option that’s designed with your unique needs in mind so that you not only get your business banking in order but you also reap the most benefits. With that, here are some factors to consider in an online checking account:

- Fees. Are there monthly service fees, ATM fees, non-sufficient funds fees? What about hidden fees? Most traditional banks charge fees, while many online-only banks don’t.

- Restrictions and/or requirements. Look out for any limits on the number of transactions you can make in a given time period, as well as balance requirements.

- Convenience. Can you easily pay vendors and bills, manage ACH or wire payments, or access banking on your mobile device?

- Interest. The national average APY is 0.1%. This represents just a $10 return on $10,000 balance. At Bluevine, that number goes up to $120 with an interest rate of 1.3% for eligible customersBVSUP-00005.

- Support. You’re bound to have questions along the way, so what kind of support do you get? Is there a dedicated person for your account or an answering service?

At Bluevine, we understand small businesses and we are dedicated to helping you get the best possible financial support. In fact, we created our Business Checking account to meet your specific checking needs. There are no hidden or monthly fees, no minimum balance requirements, unlimited transactions, easy bill pay, 1.3% interest on balances up to $100,000 for eligible customersBVSUP-00005, and live support to help you along the way.

Small business checking, built for your needs

Unlimited transactions, live support, high interest rates, and no monthly fees. Open a Bluevine business checking account online today.

Learn more