For retail businesses, the holiday season can be one of the busiest times of the year; for other industries, like the service industry, it’s not uncommon to see a lull in business from Thanksgiving to New Years. If the holidays are slower for your business, it can be a tough time to navigate. But even if the fourth quarter isn’t your strongest, that doesn’t mean that you can’t still use the November and December months wisely.

Here are a few ways you can navigate a slower holiday season and use this time strategically so that you can be ready to start strong when things pick back up come the new year.

Consider alternate revenue streams.

While some businesses can easily survive a slow holiday season, it can be more difficult for others to recover when revenue takes a strong seasonal hit. If you’re in a position where a serious slowdown over the holidays could be detrimental to your business, it’s worth thinking about how to pivot or diversify to add new revenue streams. For example, a restaurant that’s seeing lower in-person dining over November and December could focus on building out a catering arm to drive more sales over the holiday season.

Be prepared with extra cash on hand.

Anytime you know that particular seasons are slower for your business, it’s a good idea to have some backup cash available to cover fixed expenses and operating costs during those times. Establishing a line of credit ahead of the holidays could be a good way to have some extra cash flow available at the end of the year, which not only helps you cover routine expenses but also helps you feel secure should any unexpected costs arise.

With lines up to $250,000 and rates as low as 4.8%, Bluevine’s Business Line of Credit gives your business the flexibility of revolving credit and allows you to draw only what you need when you need it. Discover financing that grows with your business and helps your business grow.

Lean into your content marketing efforts.

Spending the holiday months investing more heavily in content could be a good way to keep your customers entertained and informed, and can help you acquire some new leads ahead of ramping business back up in the new year. Market research has shown that content consumption tends to increase during the holiday season, meaning that shifting your focus to lead nurturing and generation through creative campaigns could be a good way to keep your business on customers’ radars, even if you’re not necessarily earning their business right away. Think of it as a time to lay the foundation for a stronger customer relationship down the road.

Focus on overdue organizational or brand tasks.

Running a business can be hectic work, and it’s easy to let a lot of mundane administrative, organizational, and general planning tasks (e.g., organizing business finances, implementing website updates) take a backseat to more non-negotiable responsibilities (e.g., paying invoices, placing inventory orders). Luckily, when things quiet down, it frees up some of your time to focus on the important—though not time-sensitive—things that you may have been putting off. Use this time to sit down and map out your annual projections for the upcoming year, or take a few weeks at the end of December to revamp your website. Tasks like this, which may get sidelined during busier times, could be the focus of your slower months and are a good way to help your business start off strong in the new year.

Dive into competitive analysis.

In the same vein as spending your slow season on overdue organizational tasks, you can also use the downtime for bigger, high-impact projects, like market research and long-term planning. Spend some of your time at the end of the year looking at industry trends and reflecting on how your business can better deliver in key market areas where gaps may exist. For example, if you run a consulting agency that’s not acquiring a lot of new clients during the final weeks of December, this could be the time to look at what competitors in your industry are offering to clients, or figuring out how they package their services to best suit client needs. By getting to know the market landscape and competition better, you can start thinking about new services to offer clients, ways that your business stands out, and how to better market the unique value of your existing services. All of these considerations will help you step up in areas where it matters most to remain competitive and effective come January and beyond.

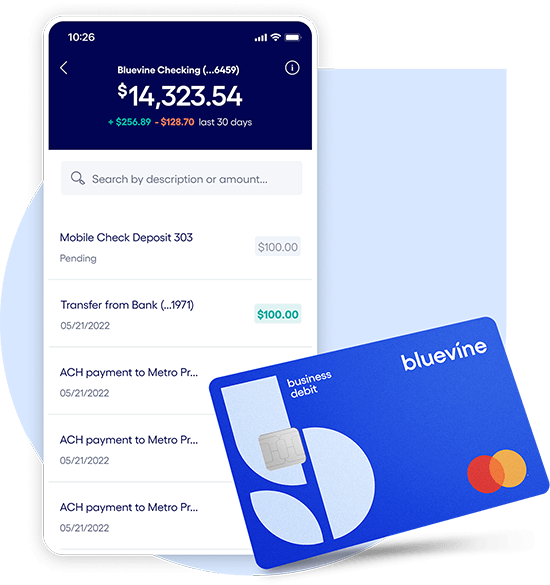

Small business checking, built for your needs

Unlimited transactions, live support, high-interest rates, and no monthly fees. Open a Bluevine Business Checking account online today.

Learn more