The evolution of online banking has created opportunities for businesses to be more mobile and provide better services to a broader customer base. It can also be an opportunity to increase business efficiency. With tools that let you deposit checks and pay bills on the go, you can save time on everyday tasks and focus more on growing your business.

What is online banking?

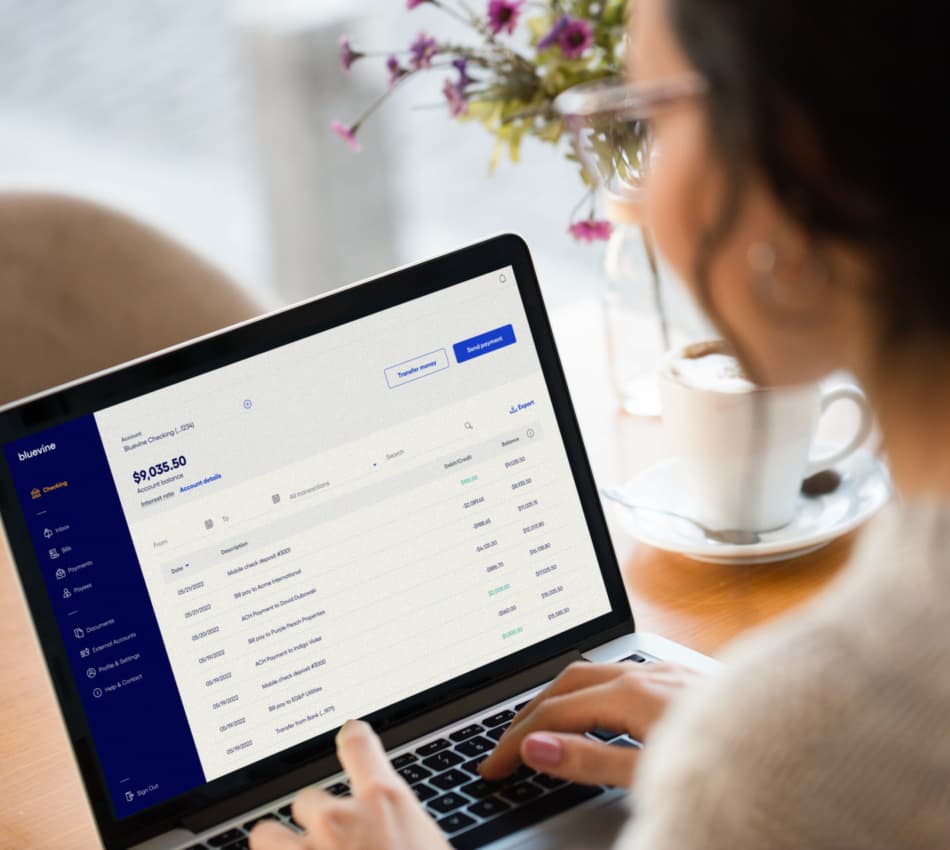

Online banking is a method of banking where transactions are done electronically, via desktop or mobile. These transactions include deposits, withdrawals, and online bill payments. Online banking has become so popular that most traditional brick-and-mortar banks and credit unions now offer some type of online banking services.

Despite sharing many of the same attributes, online banking is not the same as mobile banking, which is conducted strictly on mobile devices. Online banks provide services that can be accessed on a desktop computer, laptop, or phone. Functions that are not available on a mobile app may be accessible through an online banking website.

How do online banking solutions differ from traditional banks?

Aside from the convenience of being able to bank from anywhere, online-only banks also offer lower fees than traditional banks. They don’t have the expensive overhead costs of maintaining a physical location or staffing a lobby 40 hours a week. Most online banks offer customer service through email, phone, or chat.

Those lower costs could also translate into higher interest rates on savings accounts and investment products. High-yield interest is why many businesses choose online checking accounts––they’re able to capitalize and earn more on their operating balances.

Time management tips for online business checking

One of the best tips for time management that small business owners should consider is opening an online business checking account. Adopting it into 100% of your financial functions will increase business efficiency because it eliminates time-consuming tasks like physically going to the bank or manually filling out deposit slips and withdrawal requests. According to our recent small business survey, owners’ trips to the bank may total one full working day per month. That’s 12 working days a year.

In today’s digital world, the ability to do all your banking online while minimizing costs is a competitive advantage. Most traditional banks and credit unions fall short in this area. Online banks have the technology to offer these services, and small businesses can lose ground to their competitors if they’re not taking advantage of them.

How to save time paying your business bills online

Progressive business owners don’t mail checks to pay bills. The cost of postage is too high, not to mention the inconvenience of writing checks and keeping checkbook registers. Online banks offer online bill pay services that eliminate all of that. Plus, some bill pay services will print and mail check payments for you, for a small fee.

Bill payments can also be streamlined through automation and transaction data can feed to the business accounting software. Synchronizing online banking with accounting/bookkeeping software removes the possibility of human errors that happen when manually entering data. Automating bill payments prevents late payments and the fees that they incur. Add that to the convenience, time savings, lower fees, and higher interest rates on savings––your business could benefit from online banking.