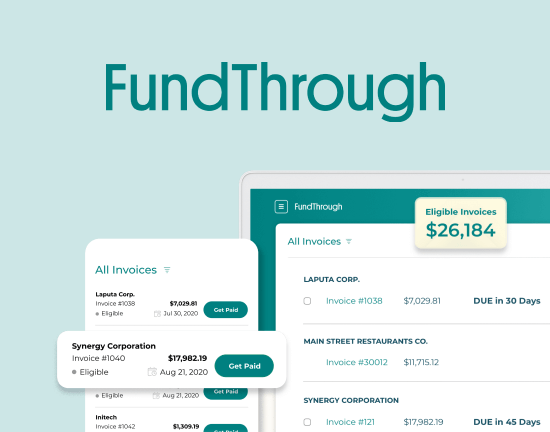

Bluevine has partnered with FundThrough for invoice factoring

Free up your cash flow and apply for invoice funding on FundThrough’s website.

Apply now

Every once in a while, you’ll run into a customer that doesn’t want to pay his or her invoice. Try as you might to get them to comply with the terms and condition of their billing agreement with you, they just won’t budge. They dodge emails and phone calls and despite facing a late charge, they still won’t pay.

What do you do to remedy the situation? Lose sanity as well as manpower trying to collect a debt? What if you’ve exhausted all the means available to you? Do you threaten your customer with a lawsuit?

Make a Lawsuit a Last Resort

A lawsuit should always be a last resort. You should always try a few other things before you threaten legal action. This will allow you to maintain your professionalism and hopefully get your customer to take care of the invoice once and for all.

Tips That Can Help You Collect Old Debt

The following tips will help you deal with accounts that have gone arrears in a professional yet effective manner. If you find more and more clients are taking their time to settle their debts with you, try the following:

- Make sure all correspondence with the customer politely explains your processes and policies for dealing with late payments. When you enter a written agreement to take payments from a client, make sure that there is a place in that contract stating that you charge extra for late payments. Hunting down customers who haven’t paid on time takes a big toll on a business. You’ll be spending valuable time which equates to even more money trying to settle a pre-existing debt.

- Contact the client and see what is causing the late payment. Explain politely that you are in agreement that all debt will be paid by a certain date. Ask if they need to change the method of payment in order to take care of their invoice. Many people are forgetful and simply need an additional reminder to settle up.

- If you still haven’t received payment, contact the person who handles invoices. Let them know that you are waiting for payment and you haven’t received it yet. Write a formal letter if you have to. Spell out all charges including late fees and interest. Give them a definitive date when these charges will start accumulating on the account.

- Know that some customers just won’t pay. Refuse to provide services going forward and send a letter stating you will take legal action on a specific date. Note that the customer will be responsible for all the time and money that you spent trying to get them to pay. Be prepared to follow through with your threat. Although court proceedings are daunting, they do provide you with additional support in collecting unpaid debts. Only take this course of action if nothing else seems to work.

Get Customers to Pay on Time By Offering an Incentive

Getting customers to pay on time isn’t easy but it is possible. Take time to set some incentives that reward early payments. This is one of the quickest ways to get the customer to settle their debts before the invoice due date. It’s one less hassle you have to deal with as a small business owner. We all know the saying, “Time is money.”

Whatever you do, do NOT put your customer on blast. Do not try to shame them by placing sensitive information about them on social media accounts. Other customers will see how you handle your affairs and be leery about doing business with you in the future. Always remain professional. For every customer that doesn’t pay, you’ll have one that pays on time or ahead of time.

This post was a contribution from JM Freuler, a Co-Founder of Funding Gates, a one-stop-shop for small businesses to better manage their receivables. Prior to launching Funding Gates, Jean-Marc worked in Private Equity and Investment Banking, and received a B.Sc. in Aeronautical Engineering from MIT.