There are plenty of highs and lows that come with running a business, and navigating complicated accounting functions like general bookkeeping, taxes, and budgets can be especially challenging. It’s no wonder, then, that 71% of small business owners outsource at least one accounting function. But the benefits of hiring an accountant or working with a bookkeeping expert go far beyond overcoming common financial challenges or freeing up your time as a business owner. It can also be a key ingredient to increasing revenue and growing your business over time.

What are some of the bigger financial challenges for small businesses?

When running a small business, there are so many different aspects that you have to stay on top of as an owner. It’s easy to find yourself feeling overwhelmed, especially when it comes to the financial end of the business, which can require more specialized expertise and foresight.

Here are some financial mishaps that small business owners often find themselves caught up in when they try to manage the books solo:

- Unforeseen expenses

- Improper budgeting

- Lack of funding or capital

- Overdue invoices

- Too much debt

- Poor or inconsistent reporting

- Limited or irregular cash flow

- Poor tax compliance

- Late or missed bill payments

- Mixed personal and business finances

This is where an accountant can be a lifesaver. By helping small businesses navigate complicated financial questions, an accountant can not only protect you from problematic missteps and detrimental oversights, but they can also help free you up to focus on other aspects of running your business.

What are some of the advantages of hiring an accountant?

Accountants are your go-to expert when small business owners need strategic financial advice about not only running your business but especially about growing your business. They are trained experienced professionals who help businesses succeed by giving sound and trusted advice.

Whether it’s an in-house accountant or a consultant to whom you outsource your business’s bookkeeping, accountants can help be a huge asset to you as a small business owner by helping you avoid costly mistakes—and maybe even save you some money here and there.

Here are some of the ways accountants support your business so that you can spend more time and money on efforts to scale.

Choosing a business structure.

The sooner you involve an accountant in your business, the better off you will be. Their advice can be very beneficial right from the start—even as early as when you’re forming your business. Choosing the right legal entity for your business can have certain tax implications, and making the right decision will ensure that you’re paying the right amount when the time comes to settle up with the IRS. An accountant can advise you on whether you’re better off setting up your business as a sole proprietorship, partnership, LLC, or C corporation.

Budgeting.

Budgeting helps keep your business on track by empowering you to plan for the future, which includes growing and scaling your business. With budgets, expenses are constantly being analyzed and if you need to move in another direction quickly, you can. Not only can accountants help you come up with a budget, but they can use budgets to forecast and manage cash flow so that you’re never (or at the very least rarely) caught off guard when it comes to your business finances.

Managing cash flow.

Managing cash flow is essential to growth. At any given time, it’s important to know how much cash you have readily available on hand, as well as how much money is expected to move in and out of your business in the coming weeks or months. Accountants can help set you up for success in this regard by working on forecasts that give you visibility into how your business finances are tracking and ensure that you always have enough funds on hand as you’re scaling up. Forecasting can also be a good way to gauge if financing your business growth is a good option for your business given the overall health of your finances and the strength of your long-term business plan.

Bookkeeping.

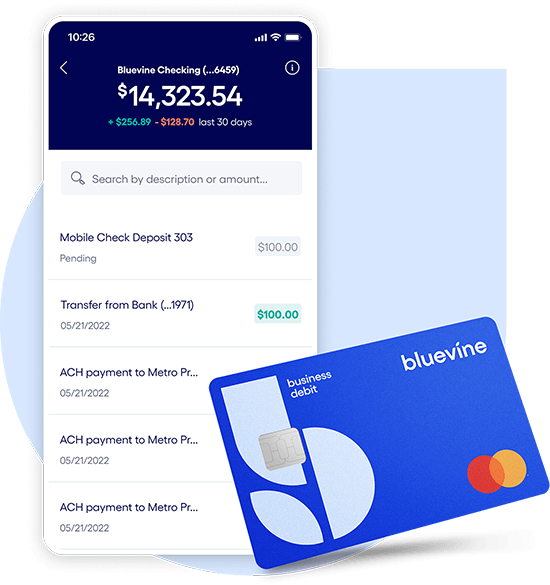

Accountants can act as a third party to access banking transactions. They can view and download bank statements, review your transaction history, create reports, keep up with payments received, and pay bills, especially with the right banking partner—such as Bluevine—that offers the ability to add multiple users with varying permissions directly to your checking dashboard. This can in turn save you a lot of time as a business owner—time that you can then put back into your business.

Managing payroll.

Payroll can be a complicated process with multiple employees having different withholdings, but accountants are well-versed enough in these complexities to manage your payroll processes without a hitch. This helps you rest assured knowing that no surprises will creep up on you down the road.

Taking care of tax planning.

Taxes are complex and tax laws change every year. Accountants can help with tax strategies that will save you money on your taxes, such as deferring or advancing income and finding the best approach to retirement accounts. Both of these strategies have the potential of lowering your tax liabilities. Not to mention, small mistakes on your taxes can result in hefty fines, so having an accountant on board to make sure you’re filing everything correctly can be a major cost-saver in addition to a timesaver.

Growth and marketing.

Accountants can determine how your company ranks within the industry and use this as a competitive advantage for growth. They can also identify sources for funding and potential investors that may support your plans for scaling in the future.

Accountants have the expertise to secure the financial health of your business by acting as business and financial consultants. Not only do they save you a lot of time and costly mistakes, but they free up valuable time so you can focus on your customers and growing your business. One of the best business investments you can make is partnering up with an accountant for smarter financial tracking, better planning, and increased success and profitability in the long run.

Small business checking, built for your needs

Unlimited transactions, live support, high interest rates, and no monthly fees. Open a Bluevine business checking account online today.

Learn more