Until recently, depositing a check meant you needed to trek to the bank and pass it to a teller, who ran it through a check scanner. Today, banking platforms accept digitized copies of checks, and you can use your phone camera to take a high-quality scan from anywhere that has internet access.

What you need to know

- Mobile deposits allow you to quickly and securely deposit checks from

anywhere with just your mobile device and a banking app. - Ensure that any photos of your checks are in focus and well-lit against a flat, dark background.

- A successful deposit doesn’t mean the check has cleared, so hold on to paper checks until they clear, then destroy or void them.

What is a mobile check deposit and what are the benefits?

A mobile deposit allows you to scan and cash a check using your phone camera and banking app instead of going to a bank branch. In fact, mobile check deposits have some major benefits compared to in-person check deposits.

Mobile deposits are easy and convenient

Mobile deposits eliminate the need to commute anywhere—simply deposit checks from anywhere you have internet access (up to your check deposit limit). In addition, mobile deposits are fast, and you’ll receive instant confirmation that it worked. This doesn’t mean your check has cleared, just that it was accepted for processing.

See how Timberdoodle saves countless hours with mobile check deposits from Bluevine.

Mobile deposits are secure

Whichever cybersecurity measures protect your banking accounts—encryption, biometrics, multi-factor authentication, etc.—will also protect your mobile deposits. In addition, check photos aren’t stored locally on your device. You can further protect your mobile deposit information with basic security measures like using virtual private networks (VPNs) and avoiding public Wi-Fi when banking, as well as obeying password safety best practices.

How a mobile check deposit works

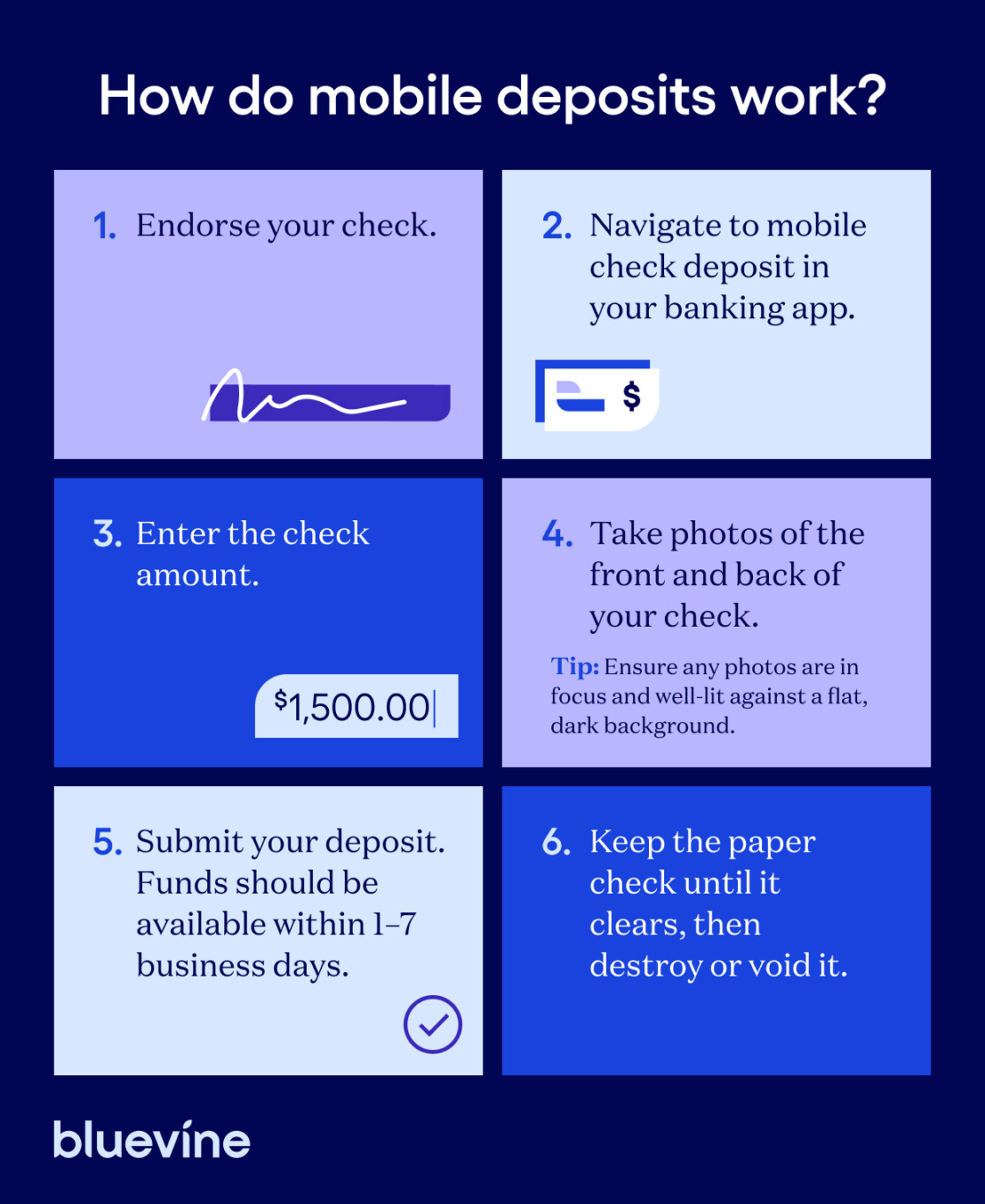

Most mobile check deposit processes tend to follow the same steps:

Bluevine Tip

Place the check on a flat, dark surface. Make sure your photos are well-lit and the checks are in focus. If your app still doesn’t accept the photos, contact your banking provider.

What to do with checks after a mobile deposit

A successful mobile deposit does not mean the check has cleared—it can still bounce, or the bank can put it on hold. Keep the paper check until the deposit clears, then destroy it or void it (your accountant/bookkeeper may want it for their records).

Save time on everyday banking with Bluevine Business Checking.