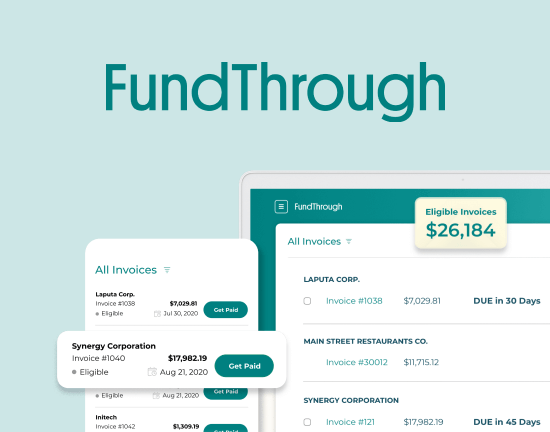

Bluevine has partnered with FundThrough for invoice factoring

Free up your cash flow and apply for invoice funding on FundThrough’s website.

Apply now

Invoice factoring companies provide working capital to small businesses – in particular B2B companies– based on the value of their outstanding invoices.

How does invoice factoring help small businesses?

Small businesses turn to alternative lenders, including invoice factoring for help with their cash flow. Small growing businesses in particular need working capital financing because in spite of recent economic recovery, banks are lagging behind in terms of funding offerings for small businesses, often stifling their growth.

Since small business owners need to reinvest to grow their business. Business can suffer when they don’t have ready access to working capital. Waiting for large lump sum payments from clients to fuel operations strains their cash flow. While some companies turn to bank loans, one variable making bank loans less desirable is the sheer amount of time that one needs to spend to aplly, as well as the subsequently wait for an approval or rejection. With timing in mind, traditional bank loans are becoming less relevant to many small business owners, as many would prefer to get faster loans and to have more control over their funding.

The Wall Street Journal’s official guide titled “How to Use Factoring for Cash Flow” notes the following: “Some companies use it to meet cash-flow needs as a stop-gap measure. Others prefer factoring to banks, which often require more paperwork, or other outside investors, who may want a piece of the business.” Read on and review these questions to determine whether or not invoice factoring is the best option for your business.

How does competition among alternative lenders help small businesses?

There’s a large market for alternative lenders like invoice factoring companies. According to researchers at the Harvard Business School, the alternative lenders’ portfolios are doubling each year. Meanwhile, traditional banks’ outstanding portfolios are declining by 3 percent each year. Keep in mind the context, which is that alternative lenders are starting from a small base and that the bank credit market is still seven times the size of the alternative lenders’ market. (Gordon Mills, McCarthy)

The competition to attract small business owners and keep their loyalty has driven a myriad of companies to make better products.This is great news for small businesses, especially in the invoice factoring industry, which remains little changed since the 1920s. Invoice factoring has been around for ages, but only recently has been available in a convenient online format. Small and medium businesses that have clients that don’t pay upon receipt have worked with invoice factoring companies for ages in order to maintain a steady cashflow. (For more, see this guide to invoice financing.) Now, they can look forward to working via the convenient, online format they’ve been used to in order facets of running their business.

Forbes notes that, “The growth is also driven by ways in which alternative lenders are innovating in small business lending, particularly in terms of simplicity and convenience of the application process and speed of delivery of capital. For example, all of the biggest players emerging in the alternative lending space offer online and mobile applications, many of which can be completed in under 30 minutes…Upon filling out an online application, owners can be approved in hours and have the money in their account in just days, whereas in the conventional banking model small business owners may not be approved for several weeks.”

Are you a good candidate for invoice factoring?

What is your credit score?

You may have taken on some debt as a small business owner or may have imperfect credit. Alternative lenders understand this. However, most reputable factors require a minimum personal credit score of at least 530 in order to become eligible for funding.

Do you own a Business to Business (B2B) company?

Invoice factoring companies work with B2B companies, whether they be SMBs, startups, sole proprietors or freelancers. The amount of funding a company can qualify with factoring depends on their outstanding invoices. For example: If your customer owes you $10,000, then the invoice financing company would advance you 80-90% of that amount within several business (often in less than 24 hours), allowing you immediate access to the cash.

Industries that qualify to work invoice factoring

My industries are a good match for invoice financing. These include IT Services, business and professional services, wholesale trade, distribution, manufacturing and staffing services. These types of businesses are perfectly suited invoice financing since they typically have reliable large business clients that require 30-90 days to pay their invoices.

Are your clients large companies with good credit?

The businesses best suited for factoring tend to have clients that with lengthy repayment terms on their contracts. Whether your business has good credit or bad credit, you can leverage your clients credit worthiness to qualify for invoice factoring.

What are the terms on your invoices?

Generally speaking, most invoice financing providers advance invoices with a face value of at least $500 or more for US-based customers. If you have many small invoices (below $500) due from the same customer, some providers allow you to batch those invoices to meet the minimum requirement. Most factoring companies required that the due date on your unpaid invoice be one week to 12 weeks away – or Net 7 to Net 90.

When does your business need the money?

For many growing companies, time may be the most important factor in choosing to work with factoring companies. While bank loans and federal grants may take months to process, factoring companies can process applications much faster. This makes it appealing for small businesses that need immediate working capital.

The fees may be relatively higher than a traditional loan, however, depending on the loan’s structure. If you can afford to wait longer and are fairly certain that your loan will be approved, then perhaps a bank is indeed the better option for your small business.

Even when eligible for bank loans, some companies decide that the wait to apply for and process a loan, can actually cost them in the long run.

Small business should take some time to understand the options available for their company and how to choose an invoice factoring provider, if that is the route they decide to go.