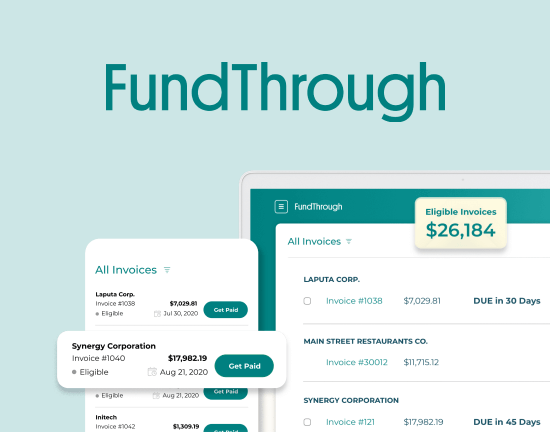

Bluevine has partnered with FundThrough for invoice factoring

Free up your cash flow and apply for invoice funding on FundThrough’s website.

Apply nowYou’re a business owner with a stable business growing at a moderate pace.

Suddenly, there’s an opportunity that could propel it to the next level. Maybe it’s a huge order from a retail giant or a lucrative contract with a major manufacturer.

You jump at the chance, but then you face a dilemma: It usually takes 60 days and sometimes longer for this new customer to pay its vendors, sometimes longer. You now have this huge unpaid invoice. Meanwhile, you require funds for other business needs. You need to pay your employees and procure supplies for other smaller jobs.

It’s a tough bind.

‘How am I going to survive in the next 60 days?’ business owners in this situation usually ask. ‘How am I going to keep the doors open?’

Invoice factoring is one answer. Factoring, which has been around for 4,000 years, lets you access capital trapped in your unpaid invoices.

Today, online factoring based on high-level data science and technology makes it even easier for business owners to turn unpaid invoices into working capital. For many business owners, invoice financing is a way to plug short-term cash flow gaps due to unexpected needs or even emergencies.

But factoring can also be a long-term game-changer for small businesses. It can actually help you grow your business.

Here’s how:

1. Invoice factoring helps you manage cash flow dips

Your ability to grow your business sometimes depends on your ability to manage your day-to-day finances.

Cash flow is usually the biggest problem faced by small and medium-sized businesses, especially those just starting out. Many of them struggle with cash flow dips when they have to wait 30, 60, 90 days for a client to pay them.

Invoice financing, as invoice factoring is also known, offers a way to manage those dips. It gives you a way to access funds for ongoing and pressing needs, such as payroll and inventory, and even for more strategic moves.

You don’t have to wait to get paid. You have convenient access to funds that you’ve already earned. You’d be able to steady out those dips to create a balanced cash flow. Your expenses will always be covered. And you’d even be in a position to grow your business.

2. Invoice factoring lets you pounce on opportunities

In many cases, factoring isn’t just for plugging short-term gaps. Invoice financing could help you pounce on opportunities, including those that could grow your business dramatically.

Let’s say your company is bringing in $50,000 a month. Then you come across a potential new customer, a big company that could help your small business grow faster.

But taking on the job would require using three months of your income. Plus, your potential new customer is a big corporation that can dictate not-so-favorable terms. This could include making you wait 60 days before paying for your services or products. This new customer could tell you: ‘Either you accept our terms or we will find someone else who will.’

With invoice factoring, this wouldn’t be a problem.

You could take on the big job without worrying about not having enough funds for payroll and other needs and for other small jobs. So you’re able to maintain your current customer base, but still be in a position to find and serve bigger customers that could help your business grow.

3. Invoice factoring helps you invest for growth

Having the financing tool for addressing short-term needs makes it easier for you to focus on long-term, strategic goals.

This is true for businesses in different types of industries, including staffing, consulting, janitorial services, manufacturing, energy, and digital media.

One point needs to be stressed here, however. You must work with an invoice financing company that offers flexible and transparent terms.

Traditional invoice factoring companies typically use confusing fee structures and set stringent terms. Many traditional factoring companies also require businesses to submit a set amount of invoices.

The good news is you have other options now. New online invoice financing platforms let you decide which invoices to submit for funding. They also offer more flexible and transparent terms.

Technology has transformed invoice factoring into a faster, more transparent and more convenient way of accessing capital for your everyday funding needs.

More from the Bluevine Business Blog:

Invoice Factoring Basics: How To Pick a Factoring Company

Business Line of Credit: A Smart Financing for Entrepreneurs