The global Coronavirus pandemic has significantly impacted small businesses. The crisis has stretched short-term operations, shifted long-term outlooks, and made much of the future uncertain.

Quick changes in government policies have led many to pivot their business strategies, such as adding e-commerce portals or transitioning their services to curbside pickup or delivery to keep business running during shelter-in-place. Many small businesses are under financial stress and have to reevaluate their business tools, paths, and objectives.

As a business owner, how do you know which path to take to stay financially solvent?

You’ll need to ask yourself and your financial advisor tough questions to set your business up for sustainability and success. Here are some conversations to have as you plan for the next 6 to 12 months.

1. Is my business allocating resources for tools and services effectively?

Businesses utilize many different resources to operate daily—everything from simple utilities like broadband and telephone to more substantial tools including ecommerce APIs and cloud-based security systems. It may be time to ask whether you’re using the right suite of tools and paying fair prices for them.

For instance, many software tools come with different features in a tiered pricing structure. If your business’s nature has changed, you may not be taking advantage of all of the features for which you’re paying. Are you working from home for the time being? You shouldn’t be paying for the ability to do a volume of transactions when your sales are down or paying for high-speed internet for your physical store location.

Additionally, tools that were working well for your business under normal circumstances may no longer fit how you’re operating. There might be better, more cost-effective alternatives to resources and features you need today.

Going through your operational costs with your financial professional can help better calibrate your spending and enable you to only pay for what you need.

2. What kind of resources are available to support my cash flow?

Many businesses are experiencing cash flow issues due to the pandemic, for reasons including lower sales, reduced consumer discretionary spending, or changing consumer habits and tastes. It’s uncomfortable to talk about these issues, but cash flow is the number one indicator of an organization’s financial health.

There are several ways to bolster cash flow. For example, you may be eligible for certain grant programs, tax credits, and short-term small business loans—this is especially true with new government programs that have emerged in the wake of the pandemic. However, many of these programs have rules and regulations that are moving targets, so it’s critical to have conversations with your financial professional to have the most up-to-date information.

Another way to put your business in a better cash position is through invoice financing, a small business loan that lets you get paid on outstanding invoices sooner. It’s easier to qualify for this loan than others, and it frees up cash tied for expenses like operations, general overhead, and payroll.

3. Do I have the right business bank for my current needs?

Small businesses rarely change banks, taking a “set-it-and-forget-it” approach to their business banking partner. Because COVID-19 has changed how many do business, it’s important to ask if your bank meets your current needs. Is your bank working both for and with you?

Your financial advisor can find you a better banking partner that offers a straightforward account setup, more realistic or no fees, and features that are a better fit for how you’re doing business now, such as mobile banking. They can also lead you to interest-bearing checking and savings accounts, which make your money work as hard as it can, especially when your finances are tight.

Plus, if you ever need a small business loan, a strong banking relationship will help make getting one less of a hassle.

4. Should I seek out investors to help with capital?

Many small businesses are hesitant to bring investors into their folds because they don’t want to give up ownership of an operation they’ve worked so hard on. However, if you’re having difficulty making ends meet, outside investment can be a smart consideration.

There’s a caveat: investors aren’t as active as they usually are and are more selective with how they invest. But if you can catch their attention, equity investors may be able to give you the capital needed to grow your business. Your financial professional can point you in the right direction for where to identify partners.

5. What immediate moves can benefit my business financially?

There are some fast-action steps you can take to set your business up for short-term sustainability and long-term success.

First and foremost, you’ll want to open up a detailed conversation with your advisor about the state of your finances. They’ll give you a true picture of your assets and liabilities and help set realistic goals for both best- and worst-case scenarios. They also may help you make crucial, immediate decisions, such as whether you should adjust your margins, limit your inventory, update your business model, and more.

There are other simpler steps you can take that don’t require a significant time investment. For instance, if you’re a brick-and-mortar business, you can try your hand at renegotiating your commercial lease to help alleviate some financial stress. You can also look into renegotiating contracts for utilities. Your financial professional may have some tips for how to have these conversations, and can give you a good idea of how much you can afford to pay, and how much of a discount to ask for.

All in all, opening up conversations around your finances—especially amid an uncertain economic environment—is the best immediate move you can make. Questions like the above can be tough to ask, and there may be even harder decisions on the other end. However, they’re vital to have to best position your business to succeed.

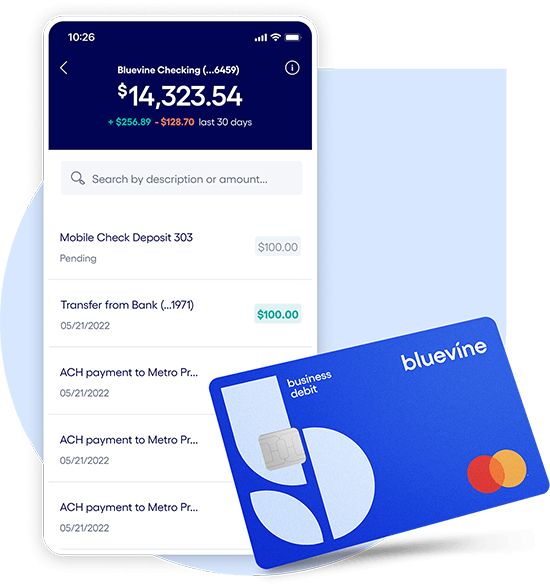

We want you to be among the first to benefit from Bluevine Business Checking, which offers no hidden fees, 1.5% interest for eligible customersBVSUP-00005, and support built for your business.

Sign up for checking built for your business today.

Small business checking, built for your needs

Unlimited transactions, live support, high interest rates, and no monthly fees. Open a Bluevine business checking account online today.

Learn more