Update: Paycheck Protection Program has ended

It was our honor to have supported more than 300,000 small businesses with COVID-19 relief loans to help them cover expenses, pay employees and get back on their feet.

For the best tips on running and scaling your growing business, check out the latest on our blog:

The Paycheck Protection Program (PPP) has been vital for U.S. small businesses that have lost revenue due to the COVID-19 pandemic. Perhaps even more vital is the PPP loan forgiveness program, which exempts eligible businesses from repaying their loan.

Under this program, businesses can get their PPP loans forgiven if they meet specific criteria. The amount forgiven depends on several factors, including how and when the applicant uses their PPP loan funds.

Our goal with this blog post to help you make sense of the latest (and evolving) PPP loan forgiveness requirements from the U.S. Small Business Administration (SBA), so you can determine your eligibility and whether or not to apply to receive PPP loan forgiveness.

How PPP loan forgiveness works

PPP loan forgiveness requirements differ depending on your business’s size and whether or not you have employees.

Businesses with employees might be eligible for PPP full loan forgiveness if they:

- Maintained headcount and wagesBVSUP-00024

- Used at least 60% of PPP funds on paying employees and staff and spent the rest on non-payroll, PPP-eligible expenses.

Self-employed borrowers without employees might be eligible for PPP full loan forgiveness if they used at least 60% of the loan to cover payroll (i.e., profit) and spent the rest on non-payroll, PPP-eligible expenses.

Timing for SBA loan forgiveness

So when does SBA PPP loan forgiveness officially begin? Here’s what you need to know right now about loan forgiveness application deadlines, when to apply, what happens if you don’t meet all forgiveness criteria, and more.

When should I apply for loan forgiveness?

The SBA is accepting forgiveness applications on a rolling basis. If you don’t apply for forgiveness, you’ll have to repay your PPP loan. Most borrowers prefer to apply for forgiveness before their repayments start.

PPP repayment starts ten months after your “covered period” ends. Your covered period is the time frame during which you must spend your PPP loan to qualify for forgiveness. Your covered period can range anywhere from the borrower’s choice of a minimum of 8 to a maximum of 24 weeks.

Most likely, you’ll need to indicate the covered period you selected when you apply for forgiveness. However, you can’t choose a covered period if it means that your loan repayments started on a day that has already passed.

See our post on important considerations when selecting your PPP covered period.

So, your covered period is the 8 to 24 weeks that follow the day of your PPP loan disbursement. From the end of that period, you’ll have 10 months until your payments start.

Here are a few examples:

| Date of PPP loan disbursement | Covered period | Last day of covered period | End of repayment deferment |

| May 1, 2020 | 8 weeks | Jun 26, 2020 | Apr 26, 2021 |

| June 1, 2020 | 12 weeks | Aug 24, 2020 | Jun 24, 2021 |

| July 1, 2020 | 24 weeks | Dec 16, 2020 | Oct 16, 2021 |

| February 1, 2021 | 8 weeks | Mar 29th, 2021 | Jan 29, 2022 |

| March 1, 2021 | 24 weeks | Aug 16, 2021 | Jun 16, 2022 |

If you want to figure out your own covered period and repayment dates, a days between dates calculator is a good place to start.

There are multiple PPP loan forgiveness applications available from the SBA, but as you can see from the above examples, you may not be required to apply quite yet.

If you received your loan from Celtic Bank through Bluevine, the applicable forgiveness form is digitized, so there is no need to download it from the SBA.

When will PPP loan repayments happen?

Repayment, if applicable, won’t begin for most borrowers that got their PPP loan from the first round until Fall 2021. The repayment period itself depends on when you received your loan. According to the SBA, loans issued before Jun 5, 2020, have a 2-year repayment term, while loans issued after Jun 5, 2020, have a 5-year repayment term.

However, depending on the disbursement date of your PPP loan, repayments may not begin until Fall 2021, giving businesses more time to recover lost revenue due to the COVID-19 pandemic—and allowing the SBA and PPP lenders to finalize repayment processes. We’ll continue to monitor PPP loan repayment guidelines and update this post accordingly.

Are any updates planned for the PPP loan forgiveness program?

Congress passed the Economic Aid Act in Dec 2020, and passed further legislation to simplify the PPP loan forgiveness process further for many borrowers, including those with loans of $150,000 or less. These borrowers only need to submit the 3508S form, a one-page application.

What if I don’t fulfill all the PPP loan forgiveness requirements?

The more requirements you meet, the higher your forgiveness amount will likely be, with partial forgiveness granted where applicable. Be sure to keep comprehensive records of your PPP-eligible expenses to qualify for the highest amount possible.

To learn more, check out our PPP Loan Forgiveness Guide or use a forgiveness calculator to estimate your loan forgiveness amount.

How to prepare for PPP loan forgiveness?

The best way to prepare for PPP loan forgiveness is to track your expenses. Specifically:

- Payroll (including salaries and wages, vacation and extended leave, health benefits)

- Mortgage interest

- Rent

- Utilities

- Note that your mortgage interest, rent, and utility expenses are only eligible for forgiveness if you were paying them before Feb 15, 2020

- Covered operations (software, cloud computing, etc.)

- Supply costs that were essential to your business

- Certain property damage

- Worker protections (PPE, plexiglass, ventilation, etc.)

Many accountants have advised that business owners open a new bank account specifically for PPP-related expenses. Doing this will save you time in the long run—after all, you won’t have to sort through all of your transactions to separate expenses.

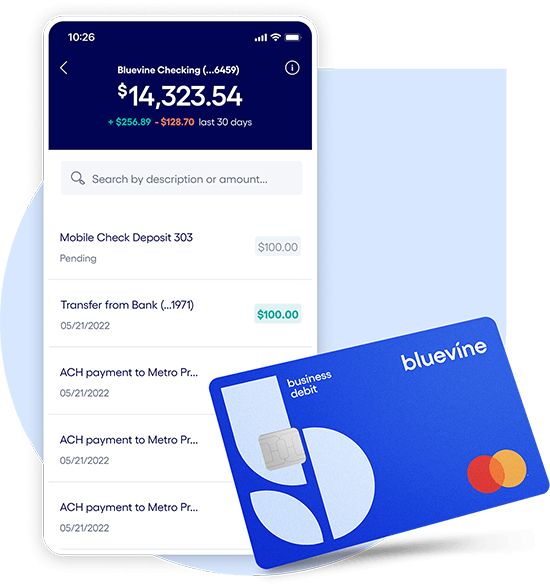

Interested in opening a new account? Check out Bluevine Business Checking, a high-yield online business account with no minimum deposit or balance requirements, no monthly service fees, 1.3% interestBVSUP-00005 on deposits up to $100,000, and more.

Is it too late to apply for PPP funding if I need alternative financing options?

PPP reopened in Jan 2021 and extends until Mar 31st, 2021. The latest government stimulus package committed $284.5B to PPP and allows for second PPP loans and simplified loan forgiveness.

Since our founding in 2013, we’ve dedicated ourselves to helping small businesses improve cash flow to grow their businesses. We’re proud to have lent more than $4.5 billion in PPP loans in 2020, helping more than 155,000 small businesses and saving more than 470,000 jobs nationwide—and we’re proud to participate in the current round of PPP.

Learn more about loan forgiveness and getting a PPP from Bluevine.

Small business checking, built for your needs

Unlimited transactions, live support, high interest rates, and no monthly fees. Open a Bluevine Business Checking account online today.

Learn more