COVID-19 has had an outsize financial impact on small and medium-sized businesses. This is true both in terms of revenue and sales and how businesses rely on their banks for support and resources. Cash-based operations face especially unique challenges as they’ve had to quickly adopt digital payment technologies. Additionally, companies that rely on in-person banking tools have found themselves in the lurch with most branches closed (or at least significantly curtailed due to safety measures).

For these reasons and more, it may be time to reevaluate your business-banking strategy. You’re hardly alone in thinking about making changes: one in five small businesses are dissatisfied with their current bank in the wake of difficulties getting Paycheck Protection Program loans. Entrepreneurs who conduct their banking with larger institutions may have missed out on PPP funding, as smaller banks (with assets less than $10 billion) wound up securing 60% of these loans during the first round of funding for the program.

Between the challenges small businesses face due to pandemic-related disruptions and the newly discovered shortcomings from their banks, now is the best time to consider new business banking options.

Here’s what you need to consider when shopping around for the right bank, especially in these unprecedented times.

Consider What Matters Most from Your Banking Relationship

There are several reasons why you might want to reassess your existing business banking and checking provider.

Even in normal times, a business may have simply outgrown the usefulness of their current account. Entry-level business checking accounts that offer a small number of features in exchange for a low- or no-fee account are great in the beginning when needs are few. But they don’t scale in ways that are best for growing businesses—or when circumstances change, and you find you need different features to keep your business up and running.

For instance, if you’re now sending and receiving more wire transfers than when you set up your account or making more digital transactions such as check deposits, you may find that each transfer after a certain threshold comes with a fee. This is a common scenario as fewer customers are relying on physical tender, and instead migrating to cashless payments. Once you’ve hit the threshold of free services, the fees begin piling up.

Customer service is another major component of your banking relationship. Getting the attention you deserve as a small business can be challenging especially when you may need support more than ever. Sometimes, even getting in touch with your bank is an ordeal: major business banking providers require you to call or email them with queries—something busy entrepreneurs can’t afford to do during business hours, or when needs are urgent.

If you’re not getting what you need from your bank, it might be time to switch, especially if your business is slower than usual (or on pause entirely) due to the current economic environment.

Evolve Your Financial Strategy for Business Banking

Establishing the best business banking relationship goes well beyond opening a checking or savings account. You’ll also want to think about your bank’s role in supporting your short-term sustainability and your long-term strategy as the economic environment stabilizes.

Many businesses are currently concerned about cash flow, regardless of whether they’re in an early growth phase or further in their operations. Looking toward a bank that provides business banking services, and has a strong track record of accessible lending, can help position businesses to supplement cash flow in times of distress.

Know Your Must-Have Banking Features

The post-COVID-19 landscape is likely to change several core components of how businesses operate. What was important to your business last year may now play second-fiddle to other concerns. It’s essential to know what your current must-have banking features are to set yourself up for success.

For many businesses, support for cashless payment will take center stage. This means that banks with intuitive and powerful digital tools will rise to the occasion better than others. Many larger national and regional banks have been caught flat-footed in providing modern digital technology, giving digital-first banks an advantage.

Customer service will have to cater to the needs of business owners more than before. The days of waiting in line at a local branch are over, which may strain the large support centers most larger banks depend on. Finding a bank that works with you through text, chat, email, or phone calls may climb the priority list for entrepreneurs who don’t have all day to wait for answers.

Ultimately, banks designed with innovation at the core of how they do business will better help businesses recover and flourish in the second half of 2020, especially Coronavirus effects become clearer.

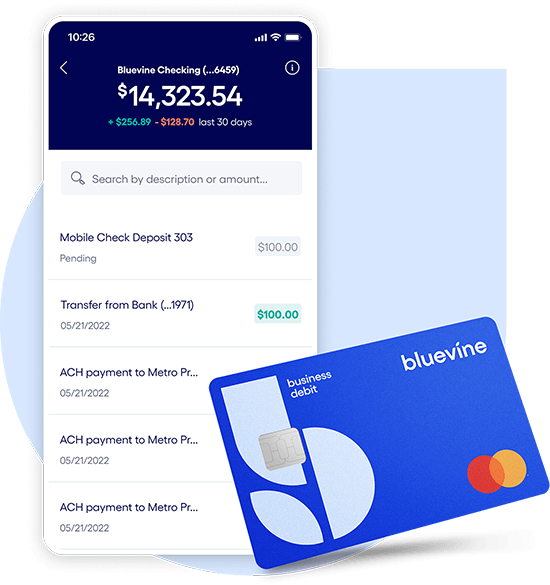

Business success begins with better banking. No hidden fees, services and support built for your business, and rewards like 1.3% interestBVSUP-00005 on checking for eligible customers. Get these benefits for your business now. Open a Bluevine Business Checking account today.

Sign up for checking built for your business today.

Small business checking, built for your needs

Unlimited transactions, live support, high interest rates, and no monthly fees. Open a Bluevine business checking account online today.

Learn more