A strong customer service strategy is key for any business. When you meet and exceed your customers’ expectations, they’ll be more inclined to stay loyal to your business, share their experience with other people, and pay more for your products or services.

As a small business owner, you have the unique opportunity to really personalize the customer experience—and you can do so without taking time away from other equally vital responsibilities of running your business. To help you get started, here are three ways to create a successful customer service model.

1. Choose the right tools

There is a reason that companies have dedicated customer service teams: it takes a lot of time and work to nurture customer relationships. Fortunately, there are tools to help you automate, track, and report on your customer service efforts without losing the personal touch that is so key for positive customer relationships. Here are five such tools:

Customer Relationship Management (CRM)

A CRM is your customer database where you store information such as their name, contact info, and purchase history. You can also add notes and other details that can help you personalize their experience. For example, if you own a toy store and a customer mentions their kids’ interests, you can record them in your CRM and then make tailored gift recommendations, unprompted, the next time they’re in your store. Many CRMs, like MailChimp, ActiveCampaign, and Salesforce, have built-in email features so you can also segment and track customer communication.

Email & Social Media Marketing

One way to stay top of mind and provide consistent value to your customers is through email and social media marketing. As we mentioned above, most CRMs have built-in email features. For social media, there are other tools like Plann, Hootsuite, and SproutSocial that let you schedule and automate posts. In some cases, you can also read, track, and respond to incoming messages and comments as you get them.

Support/Help Desk

Depending on your business, you might need to give customers the ability to submit support tickets. Tools like Freshdesk, Jira, and Zendesk allow you to set up a variety of customer support tools, prioritize tickets, and track resolutions. Having a place to organize customer questions, issues, or complaints will help you better manage and more quickly respond to them.

FAQs and Knowledge Bases

If customers typically ask a lot of the same questions, consider creating an interactive FAQ section on your website. Tools like Document 360, KBase, and Freshdesk allow visitors to filter through questions based on specific topics. That way, they don’t have to scroll through a long list of text to find what they need.

Because follow-up questions might come up, make sure your contact information is embedded into the FAQ. That way, if a customer wants to talk to you directly, they know how to easily reach you (and make sure someone is available to field in real-time any calls, emails, or chats that might come in).

Customer Service Reporting

Most of the tools mentioned above have analytics features that allow you to see, report on, and respond to certain customer service trends. For example, you’ll be able to get information on the most common customer complaints, how long it takes to respond to customer inquiries, and more. Then, you can use this information to create strategies to fix any issues and continue investing in what’s working.

2. Invest in training

To help build a successful customer service model for your small business, both you and your staff might need some training—from basic customer service skills to specific business rules. For example:

- Effective communication skills: Learn how to greet customers, respond to certain situations, and convey certain technical information about your business, product, or service.

- How to manage customer interactions: Be able to detect and manage certain customer interactions—from complaints to purchases—so you can ensure a smooth, positive experience for all customers.

- Tools: Take advantage of any trainings a company provides when you invest in their tools, so both you and your staff know how to use them properly. Part of this training should include any rules you set—for example, if you want to respond to all support tickets within two hours, design necessary protocols, train your team to follow them, then set up reporting so you track success.

- Your business: Make sure your employees understand your mission as well as your product(s) and/or service(s) inside and out.

- Your customers: Anyone who works for you and/or with your customers should have a firm grasp on who your ideal customer is and how your business serves them.

3. Listen to your customers

The age-old sentiment that “the customer is always right” certainly rings true today—especially in a world where your customers have more choices and control over their purchases than ever before. This is why it is so important to listen to your customers.

On one hand, you want to understand their needs, wants, and pain points so you can create products and/or services that deliver the most value to them. On the other, you want to tune in to the feedback they give you, so you know where to keep investing resources and where to make improvements. Listening to your customers will help ensure you’re doing the best you can to meet their needs in a way that inspires their business, loyalty, and referrals.

Speaking of listening to your customers, we heard from 800 U.S. small businesses about what you want and need in a small business bank. At the end of the day, you’re looking for transparency and flexibility. That means no hidden fees, transaction limits, or minimum balance requirements.

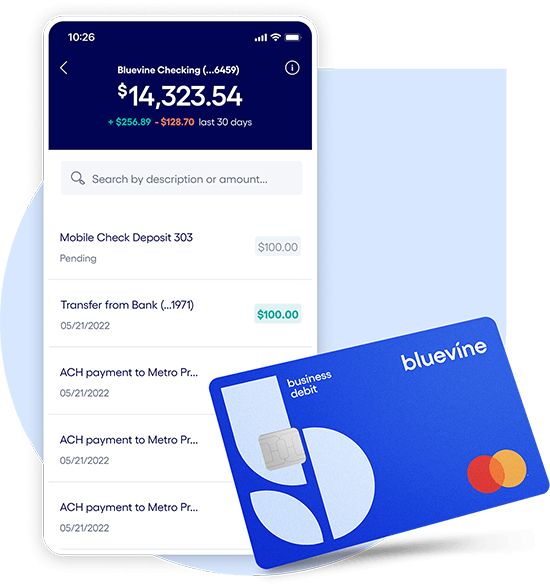

We took this feedback to create Bluevine Business Checking, the first checking account designed specifically for small businesses. There are no monthly maintenance fees, hidden fees, balance requirements, or transaction limits. Plus, you’ll earn 1.3% interest for eligible customers.BVSUP-00005

We understand that every dollar counts—especially now. Business Checking can help you make the most of every dollar you make.

Small business checking, built for your needs

Unlimited transactions, live support, high interest rates, and no monthly fees. Open a Bluevine Business Checking account online today.

Learn more