There’s a lot of buzz about the proposed changes to the income tax brackets in 2023. While it’s still unclear exactly how these changes will play out, it’s essential to start thinking about how they could affect your business so that you can file your tax returns correctly and on time.

Filing tax returns on time is crucial because failing to do so could result in hefty fines and penalties, affecting your ability to do business and remain profitable. The proposed tax bracket changes could also increase your tax bill, which means it’s vital to start budgeting now.

In this article, we’ll cover how to make sure you’re filing taxes for yourself and your business correctly and the significant differences between the 2022 and 2023 income tax brackets. We’ll also discuss how these changes may affect your business and customers, when they’ll take effect, and how you can prepare for those changes as you plan for the future.

What does income tax apply to?

Income tax applies to all taxable income, including wages, salary, tips, dividends, interest earned on bank accounts and investments, rental income, capital gains from trading stocks or selling property, and certain government benefits such as Social Security payments and unemployment compensation. It also applies to any other type of income that you receive during the year.

It’s important to note that not all income is taxable. Certain types of income, such as gifts and inheritances, are generally not subject to tax. Additionally, some states let you exclude certain types of income from your 2023 federal tax brackets when filing taxes.

To make sure you’re filing your taxes correctly and within the right time frame, refer to federal, state, and local government websites for up-to-date information on personal and business tax forms, instructions, and tax return timetables. If you are still unsure if certain income qualifies for taxes, speak with your accountant to ensure you’re following all applicable tax laws and not paying more taxes than you need to.

How can I make sure I file my income tax returns correctly?

Filing taxes accurately and on time is essential to avoid penalties, late fees, and other serious complications. To ensure that you’re filing your income tax returns correctly, here are a few steps you should take:

- Familiarize yourself with the federal tax code and applicable state laws. This will help you understand which forms and documents you must submit and ensure you pay the correct amount of taxes due.

- Organize all relevant documents, such as the year’s W-2 forms, 1099s, and other income statements. This will help you quickly gather the information needed for your return.

- Double-check your calculations before filing your return. This will help you avoid mistakes and ensure that everything is accurate.

- Use reliable accounting software or hire a tax professional. Accounting software can make it easier to file your taxes. At the same time, a certified accountant can ensure that your tax return meets all required standards.

How does a marginal tax rate work?

When it comes to income taxes, many people don’t realize that they are incremental. This means that the more you make over a certain amount (‘margins’), the higher your tax rate. This is known as a marginal tax rate.

A marginal tax rate describes how much of an additional dollar of income will be taxed at each level. It’s important to understand that the marginal tax rate only applies to each additional dollar you earn above a certain amount, not all of your income.

For example, let’s say your income is $50,000 and the federal income tax code has three different brackets: 10%, 15%, and 25%. You would be taxed at

- 10% on the first $20,000 of your income,

- 15% on the next $30,000,

- and 25% on any amount above that.

This means you would be taxed at a marginal tax rate of 25% on each additional dollar you earn above $50,000.

Marginal tax rates can also vary from state to state. Each state has its own tax brackets and rates that are used to calculate your income tax liability. To illustrate how marginal tax rates work, let’s look at another example:

Assume you’re single and make $60,000 a year in California. Your marginal tax rate would be 9.3% on each additional dollar you earn over $53,000. If you make an extra $1,000 from a side hustle, you would have to pay 9.3% of that $1,000 in taxes ($93).

It’s important to understand how marginal tax rates and the 2023 federal tax income brackets work so you can make informed financial decisions. Knowing how much you’ll be taxed on each additional dollar of income can help you plan your budget and make sure you are setting aside enough money for tax obligations. Understanding marginal tax rates will also help you take advantage of any deductions or credits that may apply.

To sum up, marginal tax rates describe how much of your income over certain thresholds will be taxed, and rates can vary from state to state.

What are the income tax brackets for 2022?

The 2022 tax year has seven federal income tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. The amount of taxes you owe will depend on your filing status and taxable income. Keep in mind that the thresholds for each federal tax bracket are adjusted for inflation each year.

If you file a single return or head of household, the income tax brackets for 2022 are as follows:

- 10% on taxable incomes $10,275 or less

- 12% on taxable incomes from $10,275 to $41,775

- 22% on taxable incomes from $41,775 to $89,075

- 24% on taxable incomes from $89,075 to $170,050

- 32% on taxable incomes from $170,050 to $215,950

- 35% on taxable incomes from $215,950 to $539,900

- 37% on taxable income of more than $539,900

What are the income tax brackets for 2023?

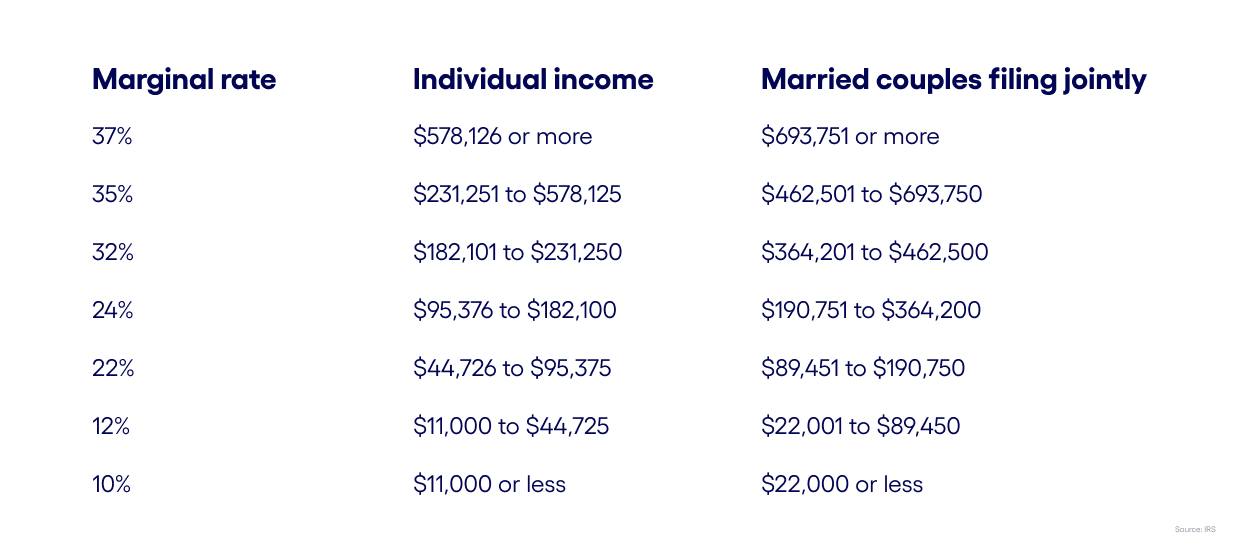

The 2023 tax year will have the same federal income tax brackets as the 2022 tax year: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. You can see below that the thresholds for the 2023 federal tax brackets have been adjusted for inflation. Visit the IRS website to stay up-to-date on the latest information.

2023 federal income tax brackets

If you file a single return or head of household, the 2023 income tax brackets are as follows:

How can income tax brackets impact my business?

Changes to income tax brackets can have a significant impact on small businesses. The rate and amount of taxes paid are subject to change based on new legislation and will be based on the 2023 income tax brackets. Small business owners will feel the impact of these changes, so knowing how income taxes affect your business can help you plan for future success.

Consumer spending

One way that income tax bracket changes can affect your business is through consumer spending. When tax rates are lowered, it often translates to an increase in disposable consumer income. If people have more money to spend on goods and services, it can lead to higher sales for small businesses. Conversely, when taxes are raised, people may be less likely to purchase discretionary items or services, which could lead to a drop in sales.

Investor interest

Another way that income tax brackets can impact your business is through investment and growth opportunities. Lower taxes generally encourage people to invest more money, which can lead to increased capital for small businesses.

This additional capital allows business owners to grow their operations, hire more employees, or take advantage of other expansion opportunities. On the other hand, higher taxes may cause investors to be more conservative with their money, limiting the amount of capital available for business growth.