Save time

and money

on business payments.

Easily send, track, and manage your payments with some of the lowest fees in the industry and all the payment options you need.

Open accountMore payment

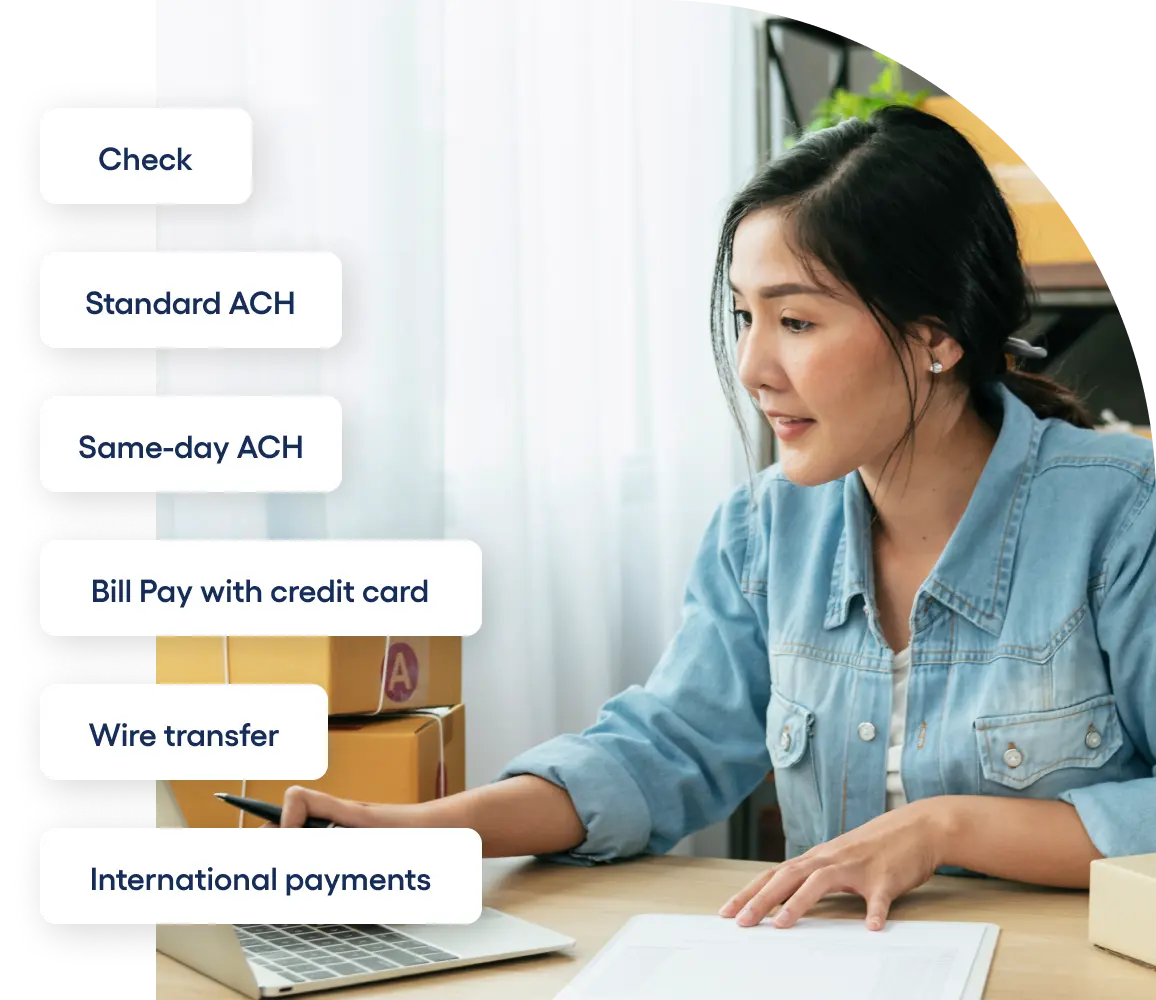

options, fewer

fees.

As your business needs evolve, you’ll have both free

and advanced payment options—all available in your Bluevine dashboard.

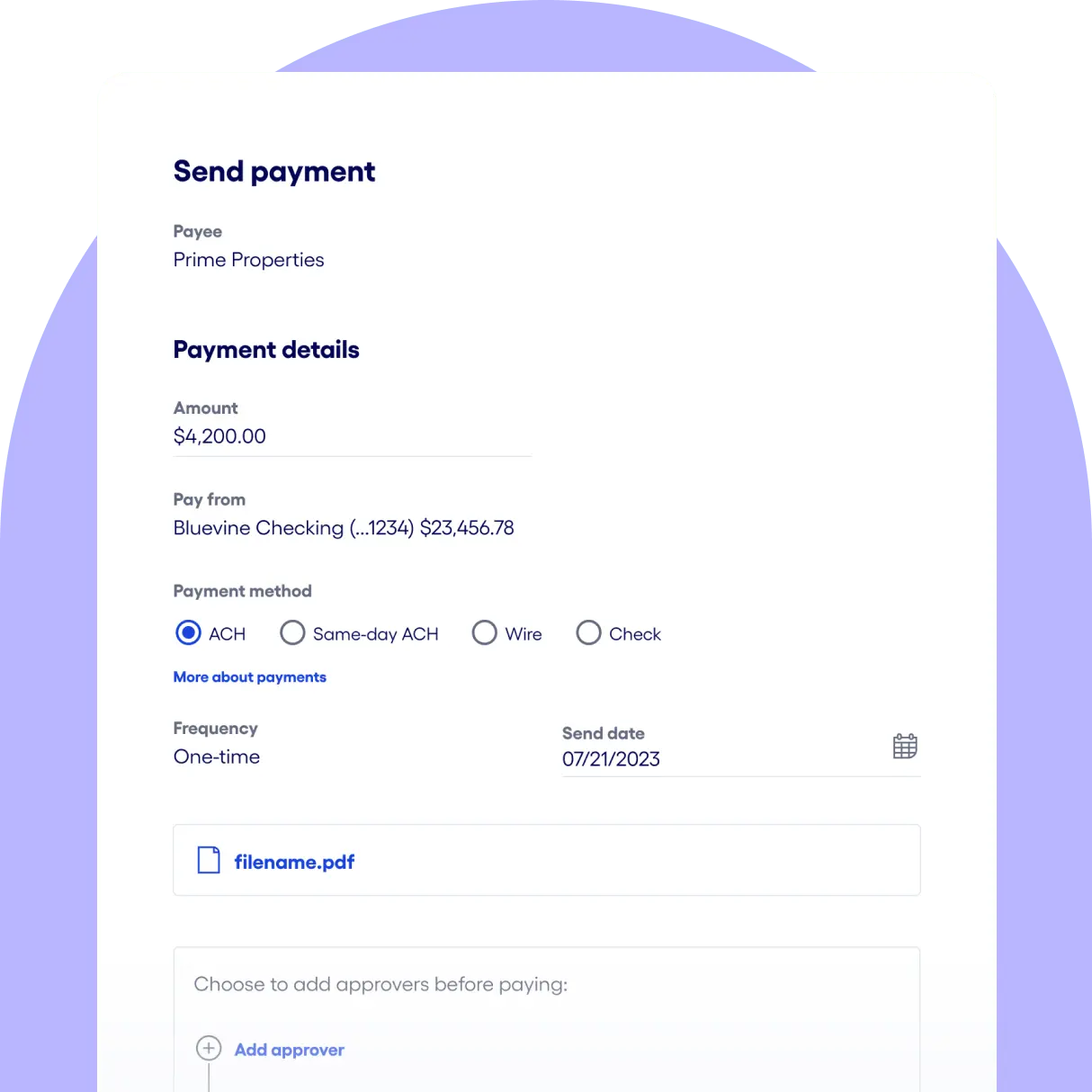

Sending payments is easier than ever.

Send money to vendors quickly and track payments from your dashboard.

Your payee also gets a notification as soon as you send a payment their way.

Check

We’ll print and mail checks to payees for you.BVSUP-00073 You can also get free checkbooks with any of our business checking plans.BVSUP-00042

Standard and same-day ACH

Use free standard ACH, or hold on to your cash longer and pay bills faster with same-day ACH payments.BVSUP-00072

Wire transfer

Send payments fast via wire transfer, for a fee that’s significantly lower than the industry average.BVSUP-00106

Get paid directly to your business checking account.

Accept payments in your main Bluevine Business Checking account or sub-accounts with easy, professional invoicing and secure payment links, powered by Stripe.BVSUP-00180

Explore invoicing and payment

links ›

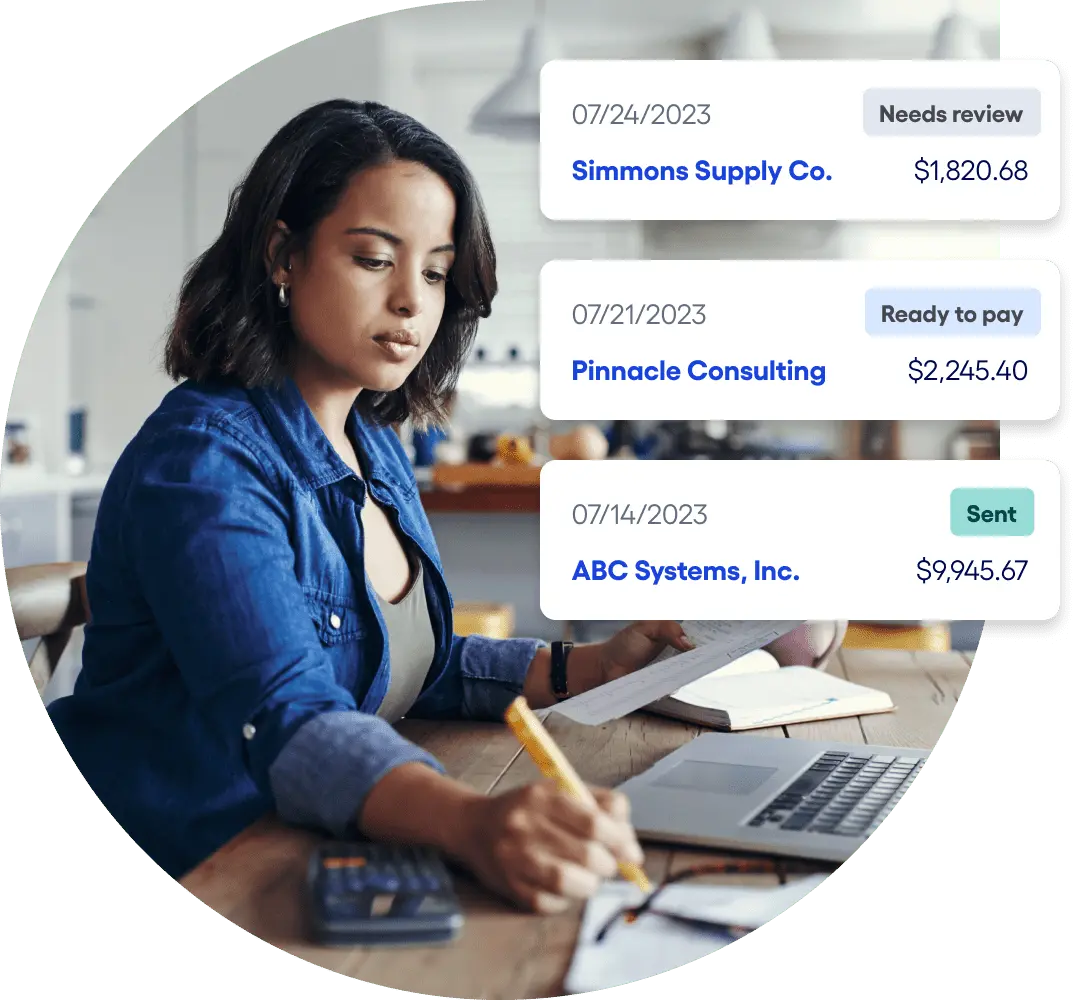

Stay on top of

payments.

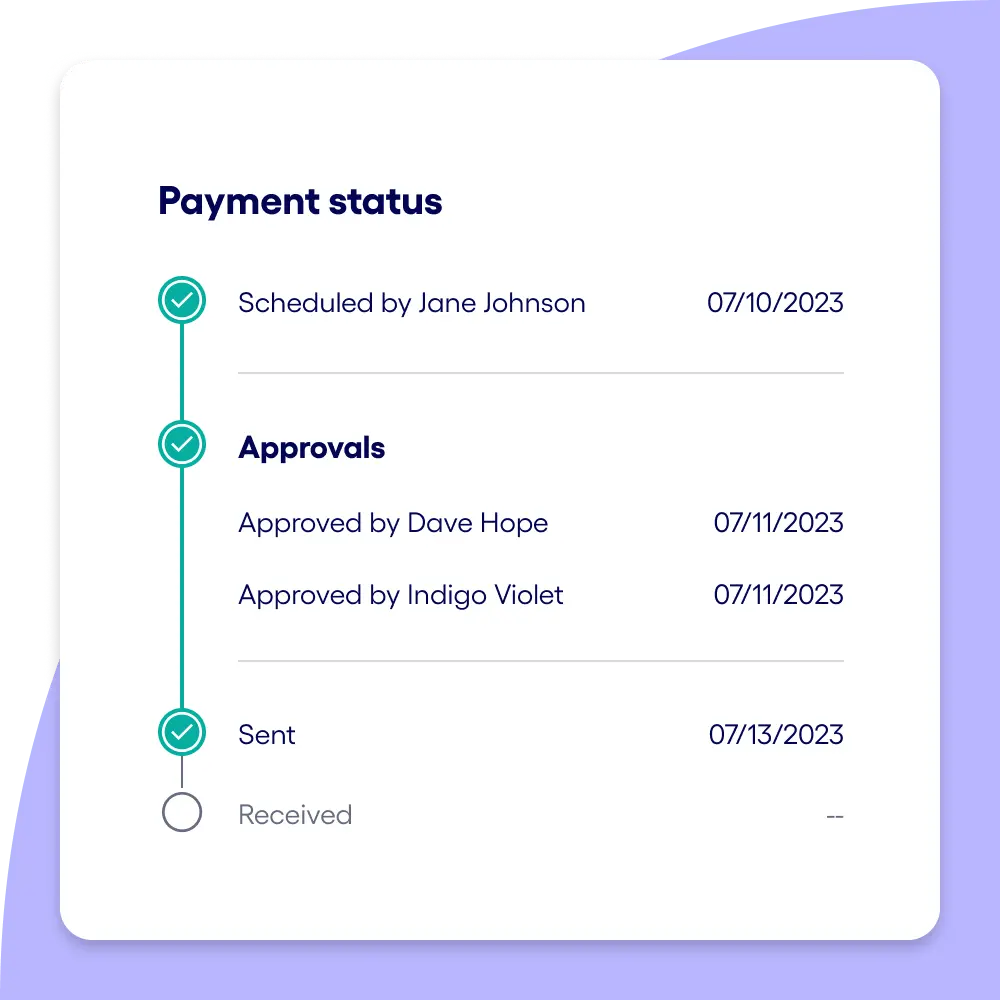

Track status of payments from your dashboard and see when paper checks arrive at their destinations. Plus, view year-to-date payment histories by simply clicking on a payee’s name, instead of having to search and filter your transactions.

Prevent

unauthorized

transactions.

Use secure ACH debit controls to block ACH debits from your main account and sub-accounts—

protecting you from unauthorized debits.

Automated

accounts payable.

Managing a high volume of bills every month? Streamline your accounts payable processes with automation that helps you digitize bills, approve payments with your team, and simplify reconciliation.

Choose the business checking plan

that’s right for you.

You could save even more with our Plus and Premier

plans—with up to 50% off most Standard payment fees.

FAQs about online bill payments.

Online payments empower you to electronically and securely pay vendors without having to manually write out a check and mail it. Bluevine lets you make or schedule payments in a variety of ways, streamlining the process so you can save time and focus more on growing your business.

The fastest way to pay your vendors is to add them as a payee on your Bluevine dashboard. If your payee is one of our 40,000+ pre-verified payees—which we call “registered payees”—you can choose them from our list. If your payee isn’t registered, all you need is their zip code and your account number with the payee to send an ePayment via ACH. Learn more about adding a payee.

You can also send check payments if you have your payee’s address, or ACH and wire transfers if you have their bank details. However, if you don’t add your payee to your Bluevine dashboard, you’ll have to manually enter their information each time you make a payment.

From your Bluevine dashboard, you can pay bills via your Bluevine Business Checking account.BVSUP-00074 You can have your domestic payment delivered via free standard ACH, $10 same-day ACH, $15 wire transfer, or $1.50 check.BVSUP-00078

International payments are also available for $25 per payment, plus 1.5% of the payment amount (as converted to USD) for non-USD payments.BVSUP-00081

Instant payments via Bluevine Pay are available to payees with a Bluevine Checking account.

Processing times vary based on funding source and payment method. For more information on payment processing times, please read our support article.

Ready to save time

paying your bills?

Manage and pay all your bills in one place.