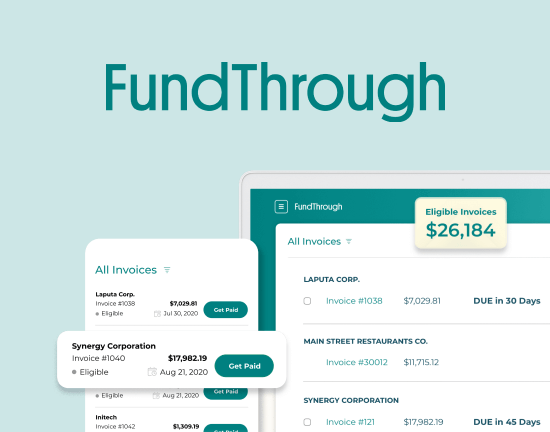

Bluevine has partnered with FundThrough for invoice factoring

Free up your cash flow and apply for invoice funding on FundThrough’s website.

Apply now

Getting paid late by your clients can be a source of frustration for small business owners. Your clients may be habitually late for all of their payments. So while it seems tough to entirely change their patterns, you can help them make adjustments with a bit of strategic coaxing and polite boundary setting. Bluevine.com is always there to help you get your invoices paid when your clients need longer terms, or are simply always late. But sometimes, customers delay payment even with generous invoice terms. To avoid missed payments and help your clients make a habit of paying on time, check out these seven tactics.

Charge in Advance

When possible, always send an invoice as soon as you’ve signed on to work with a new client. And if the client offers to pay you the day your contract has been signed, take it! It’s always better to get payment up front, especially with new relationships, because you never know how their accounts payable department works or whether they can be trusted to pay on time.

Even if they take a couple weeks to pay, you’ll have already had the conversation about payment, which makes it much easier to enforce, especially if the project has taken a wrong turn.

Pick Up the Phone

Face time is something that today’s businesses are often lacking. With email, instant messaging, and social media taking over, the value of human connection is more important than ever.

The second your client is late on their payment, give them a call. Let them you wanted to give them a heads up and that you really enjoy working with them. Since tone can often be misinterpreted over email, this personal interaction is very important when you’re dealing with sensitive subjects like payment.

Offer Multiple Payment Options

As more and more companies move to digital systems, credit card and Paypal payments are easier for some clients to process. Unless you have a strict accounting system that only allows checks (and if you do, it might be time to re-think your system), you should always allow and encourage credit card payments. This ensures that you will accommodate every kind of client and avoids any awkward conversations about a bounced check.

Stick to Your Terms

The payment terms in your contracts must be clear so that there’s no question from your client (or their lawyers) about when and what they need to pay. It’s worthwhile to get a lawyer’s opinion on contractual terms before you send contracts to a single client. Then, when your terms are in place, it’s extremely important to stick to them for every client. If payments are due within 30 days and you charge a late fee after 45 days, for example, make sure you send the invoice for the late fee on the 45th day. Don’t let certain clients squeeze past the terms that they signed into just because you like them. And be consistent. Pick a day to send your invoices, and stick to it. If your clients get used to seeing your name pop up in their inbox on a certain day of the month, they can make a habit of getting payment processed as part of their own internal system.

Remember to Send Reminders

Sometimes clients aren’t late on purpose – they just forgot. Set up a system whereby client receive automatic reminders the second their invoice is late. This might be just what they need to send you prompt payments. Over time, clients may want to avoid reminders, which will only help encourage them to pay on time!

Use a Cloud-Based Software

Just like paper checks are a thing of the past, so are tedious spreadsheets and ledgers. Try using a software solution for your invoicing so you can keep clients updated via email while allowing them to see their outstanding invoices and payment history. An online software solution can also handle some of the aforementioned points, like reminders and online payment.

Seek Legal Advice

Your business needs to have a legal person you trust, and it’s best to get a lawyer on board BEFORE you need them. This way, you can spend time helping them understand your business and building a high level of trust in case you do need your lawyer to fight for you. It’s important to hire someone with a track record of success, so ask your trusted friends and colleagues for a recommendation. You can also use a service like FindLaw for detailed profiles on lawyers and their specialties.

Finally, while this may not work with your business, you may consider offering a small reward for clients that pay on time. Even something as simple as a personal visit, a consultation, or a small gift basket can go a long way when encouraging habitual on-time payments. Plus, sending personalized gifts will help build the relationship between you and your clients and ultimately keep them on board with your company for years to come.

This article was posted with amendments and originally written by Meredith Wood, Director of Community Relations at Funding Gates. Funding Gates’ tools help organize and manage accounts receivables and make collections easier.