Banking

beyond expectations.

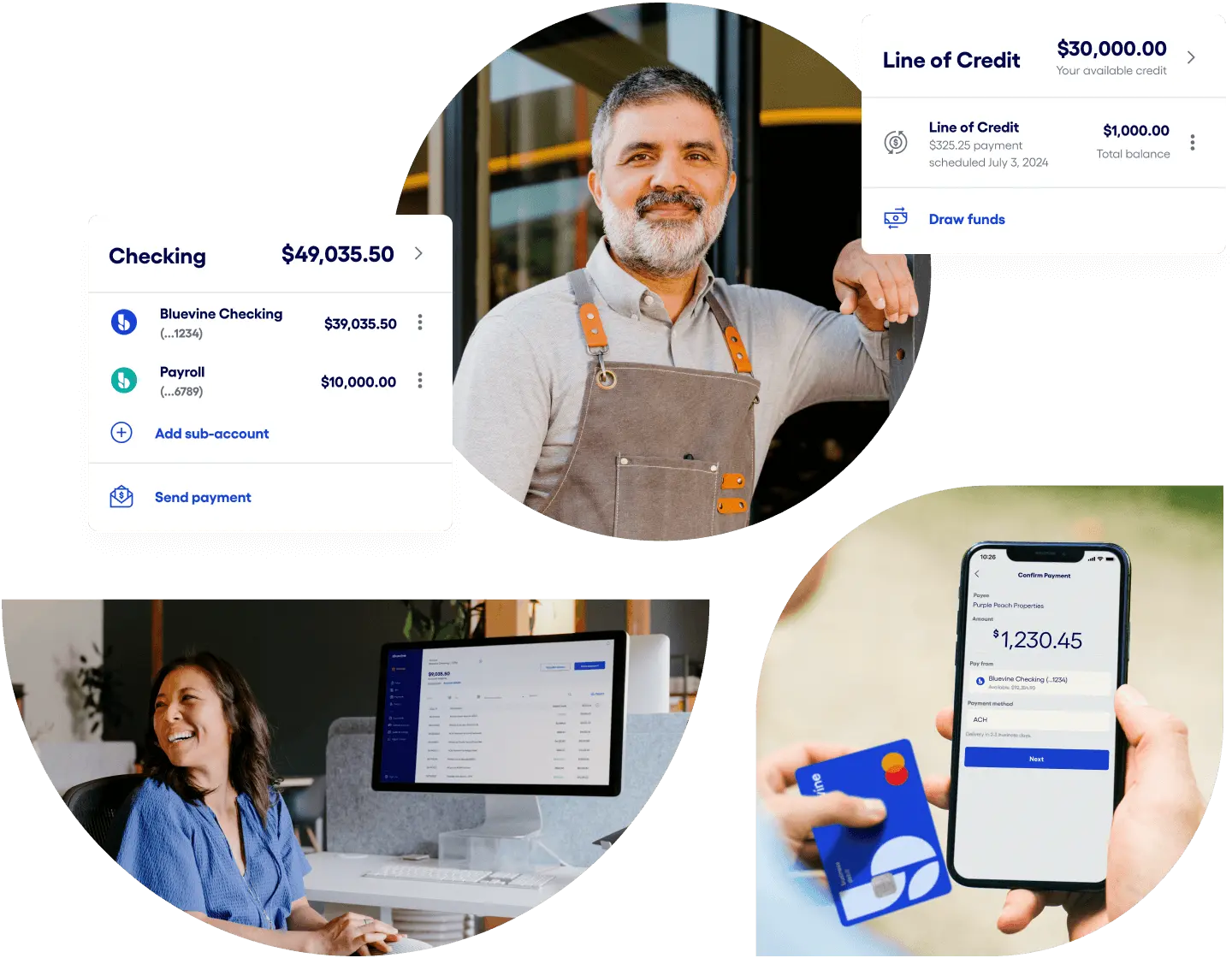

A powerful business banking platform built for where you

are and where you’re going—with lower fees, effortless

money movement, and access to working capital.

Bluevine is a financial technology company, not a bank.

Bluevine deposits are FDIC-insured through Coastal Community Bank, Member FDIC,

and our program banks.

Join the largest small business banking platform in the U.S.BVSUP-00186

10+years in business

750K+businesses helpedBVSUP-00052

$1.4B+on deposit

$16Bbusiness loansBVSUP-00052

Everything you need

to run your business.

Fully integrated business checking, lending, invoicing, and credit card—easily accessible

from one powerful platform.

Business checking that

gets you more for your money.

Take advantage of advanced money movement

options, accounts payable automation, and live

support without waiting in line at the bank.

- 1.5% APY for eligible customersBVSUP-00005 with a

Standard plan or more with an upgraded

plan - No monthly fees, unlimited transactions,BVSUP-00043

and free standard ACH - FDIC insurance up to $3MBVSUP-00108

Choose the business checking plan that’s right for you.

You could earn and save even more with our upgraded Plus and Premier plans —

with up to 3.7% APY and discounts on most Standard payment fees.BVSUP-00118

Business financing to

fuel your growth.

Apply for a Bluevine Line of Credit up to

$250,000, or a business term loan up to $500,000 through our partners—all from one application.BVSUP-00126

- Competitive pricing and repayment terms

- Submit an application without impacting

your credit scoreBVSUP-00008 - Get a decision in as fast as 24 hours

Invoicing and payment

links that make it easy to

get paid.

Manage, track, and accept customer payments

directly in your Bluevine dashboard.

- Unlimited, free, professional invoices with

your company logo - Simple, secure payment links powered by

StripeBVSUP-00180 - Affordable, transparent pricing for

processing credit cards and more

Business credit card with unlimited cash back and

no annual fee.

Sync to your financial tools and build business

credit with consistent, on-time repayments.

- Unlimited 1.5% cash back on all business purchasesBVSUP-00086

- Advanced security and fraud protection

- Exclusive Mastercard perks and benefitsBVSUP-00101

Bank with confidence.

Two-factor authentication

Make sure only you and your trusted team

members can access your account.Data encryption

Keep your personal and business

information safe with advanced encryption.Text alerts

Get alerts to your phone if we notice any

suspicious activity or transactions.BVSUP-00084

Awards and recognition.

- Best SMB Checking AccountCNBC 2025

- Best Banking Platform

for SMBsTearsheet 2023 - Power Partner AwardInc. Magazine 2023

- Best Free Small Business Checking AccountNerdwallet 2025

- America’s Best Startup EmployersForbes 2023

Ready to apply?

Want to learn more?

Explore our Resources and Guides.