Small Business Checking Account

Business checking

built for you.

Empower your small business with up to

3.25% APY,BVSUP-00147 FDIC protection up to $3 million,BVSUP-00108

and no monthly fees.BVSUP-00122

Bluevine is a financial technology company, not a bank.

Bluevine deposits are FDIC-insured through Coastal Community Bank,

Member FDIC, and our program banks.

A business checking account that

gets you more for your money.

Save on fees, protect your money, and earn high-yield interest on your checking balances—

no need to move cash around.

Save with no

monthly fees.

Enjoy no monthlyBVSUP-00122 or overdraft fees, no minimum balance, free standard ACH, and unlimited transactions.BVSUP-00043 Our most active customers save $500/year in fees.BVSUP-00080

Earn high interest

on checking.

Get 1.3% APY with our Standard plan if you meet a monthly

activity goal. Or, earn up to 3.25%

APY with an upgraded plan.BVSUP-00147 Plus, get even more out of your money with Treasury services.§

FDIC insurance up to $3M.

Your account is FDIC-insured up

to $3 million per depositor

through Coastal Community

Bank, Member FDIC and our program banks.BVSUP-00108

Sign up for our Plus or Premier checking plans to get up to

3.25% APY and discounts on most Standard payment fees.

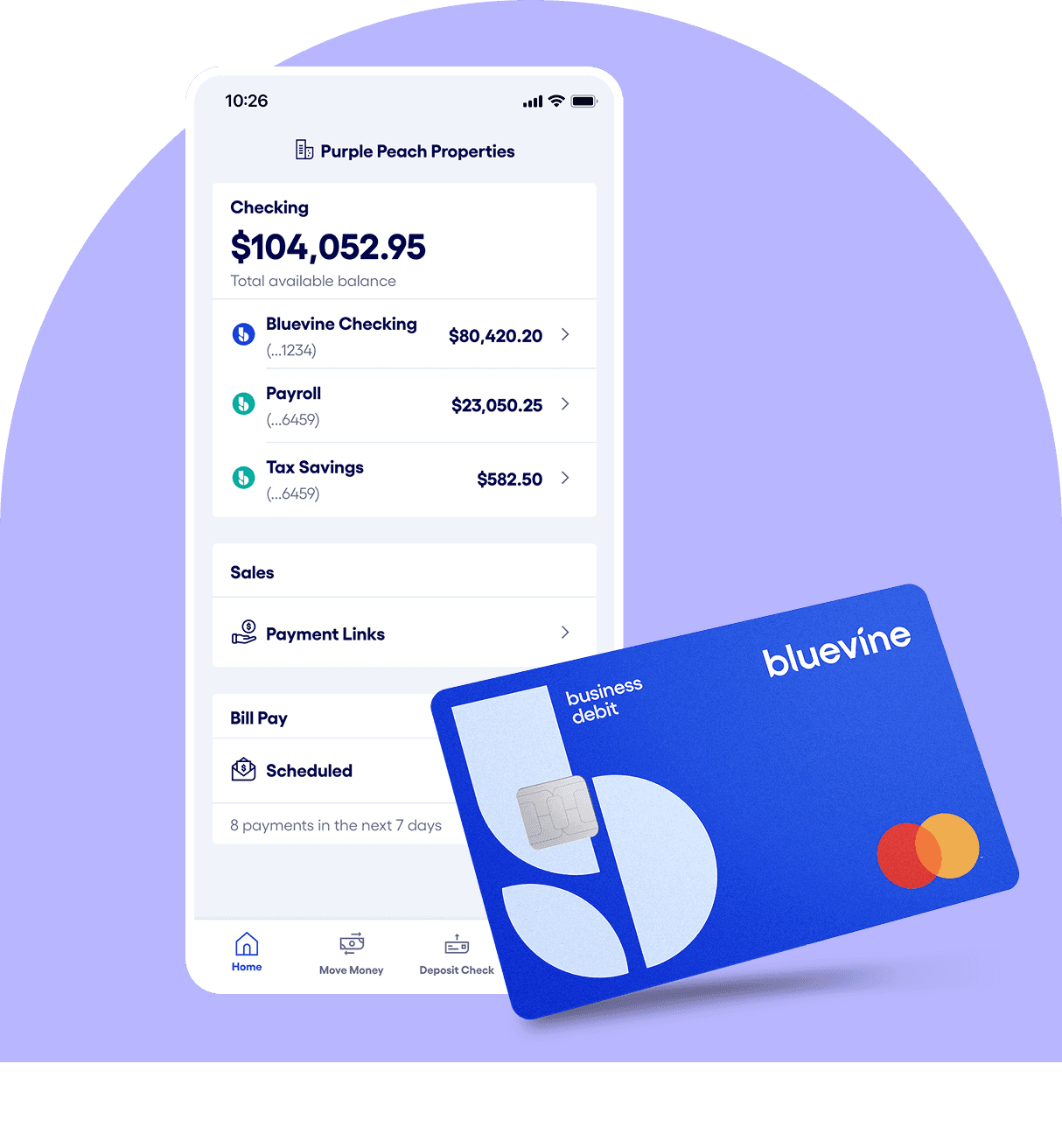

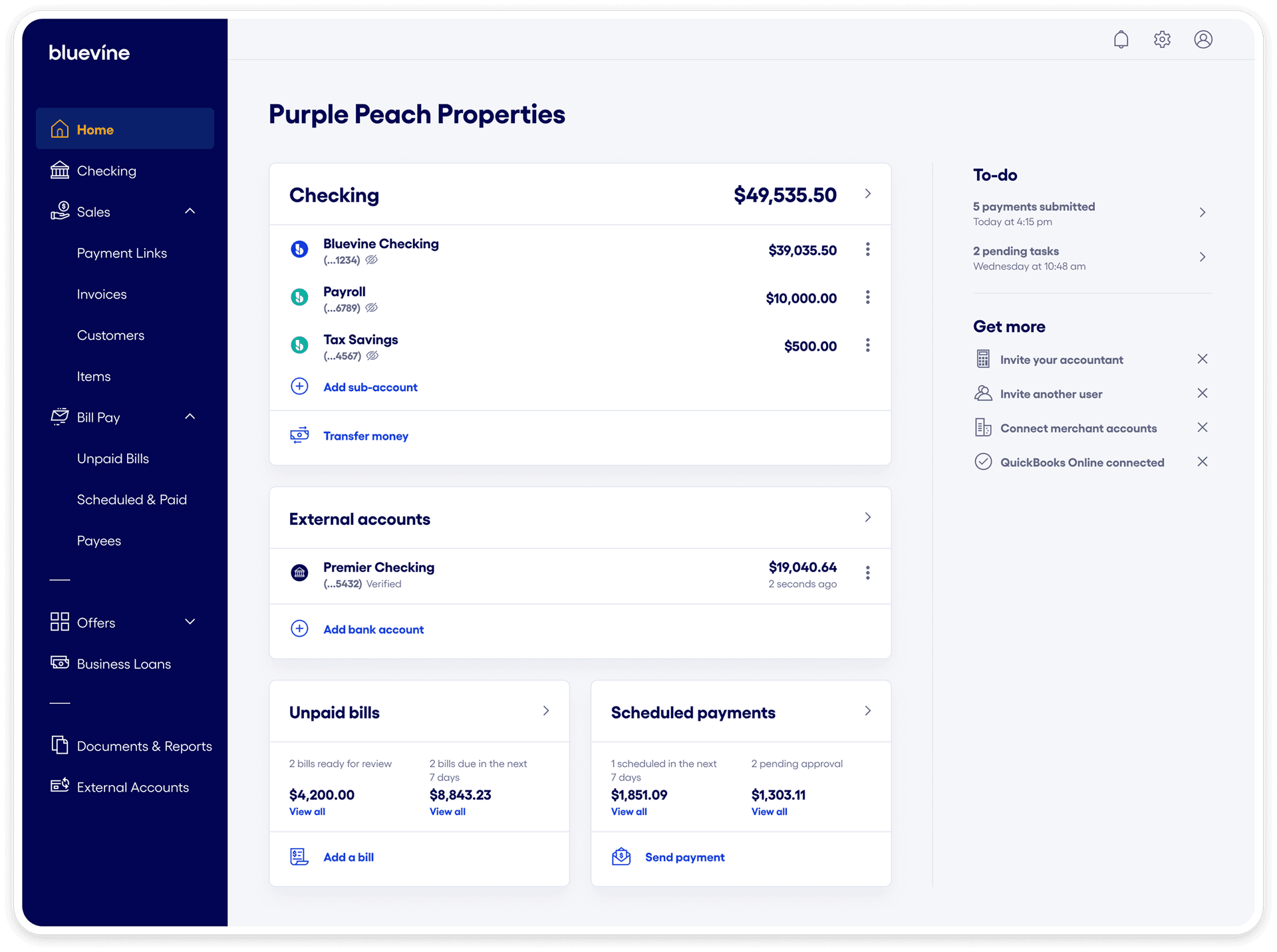

Run your business from anywhere.

Never step foot in a bank again with easy-to-use digital banking tools.

Invoicing and payment links

Accept customer payments directly into your Bluevine account with easy, professional invoicing and secure payment links.

Mobile banking

and check depositSkip a trip to the bank and easily deposit checks from your phone

when you’re at home, in the office,

or on the go.Automated accounts

payableManage bills from one online platform and send money via same-day ACH, free standard ACH, check, and domestic or international wire.BVSUP-00137

Account access

for your teamSecurely share access with your

team or accountant by giving each

a dedicated login for a smooth

online banking experience.BVSUP-00076Sub-accounts for

easier budgetingOrganize your money the way you

want by adding multiple sub-accounts. Plus, set automatic transfer rules to help manage cash flow.Debit cards for you

and your teamIssue physical and virtual debit

cards with daily and monthly

spending limits to trusted

employees, and earn 4% cash back

on business purchases through Mastercard Easy Savings®.BVSUP-00083ACH fraud protection

Block ACH debits from your main account and sub-accounts, or from specific payees. Plus and Premier customers can also preauthorize specific payees to debit from

blocked accounts.

Ready to apply for

business checking?

Submit your application in just a few minutes.BVSUP-00006