Grow your

business with

a line of credit.

Get instant funding,BVSUP-00127 competitive rates,

and credit lines up to $250,000.BVSUP-00020 Apply

with no impact to your credit score.BVSUP-00008

Bluevine is a financial technology company, not a bank.

The Bluevine Line of Credit is issued by Celtic Bank.

A line of credit that’s there

when you need it.

Get the funds you need quickly and easily at a competitive rate.

Instant access to

funds

Get instant access to approved draws with a complimentary Bluevine Business Checking account.

Credit lines up to

$250K

Apply for credit lines up to $250,000 and only pay for what you use, with competitive rates and no maintenance fees.BVSUP-00020

Access to

ongoing capital

Draw funds when you need to cover big expenses, improve cash flow, and take advantage of growth opportunities.BVSUP-00127

$14B+

working capital

deliveredBVSUP-00052

Join the growing community of 500K+

businesses across the U.S. we’ve helped

access the funding and banking

solutions they need.

Get started with your line of credit.

Apply online in minutes.

Provide basic info about your business, and get a decision in as fast as five minutes. Plus, applying won’t impact your credit score.BVSUP-00008

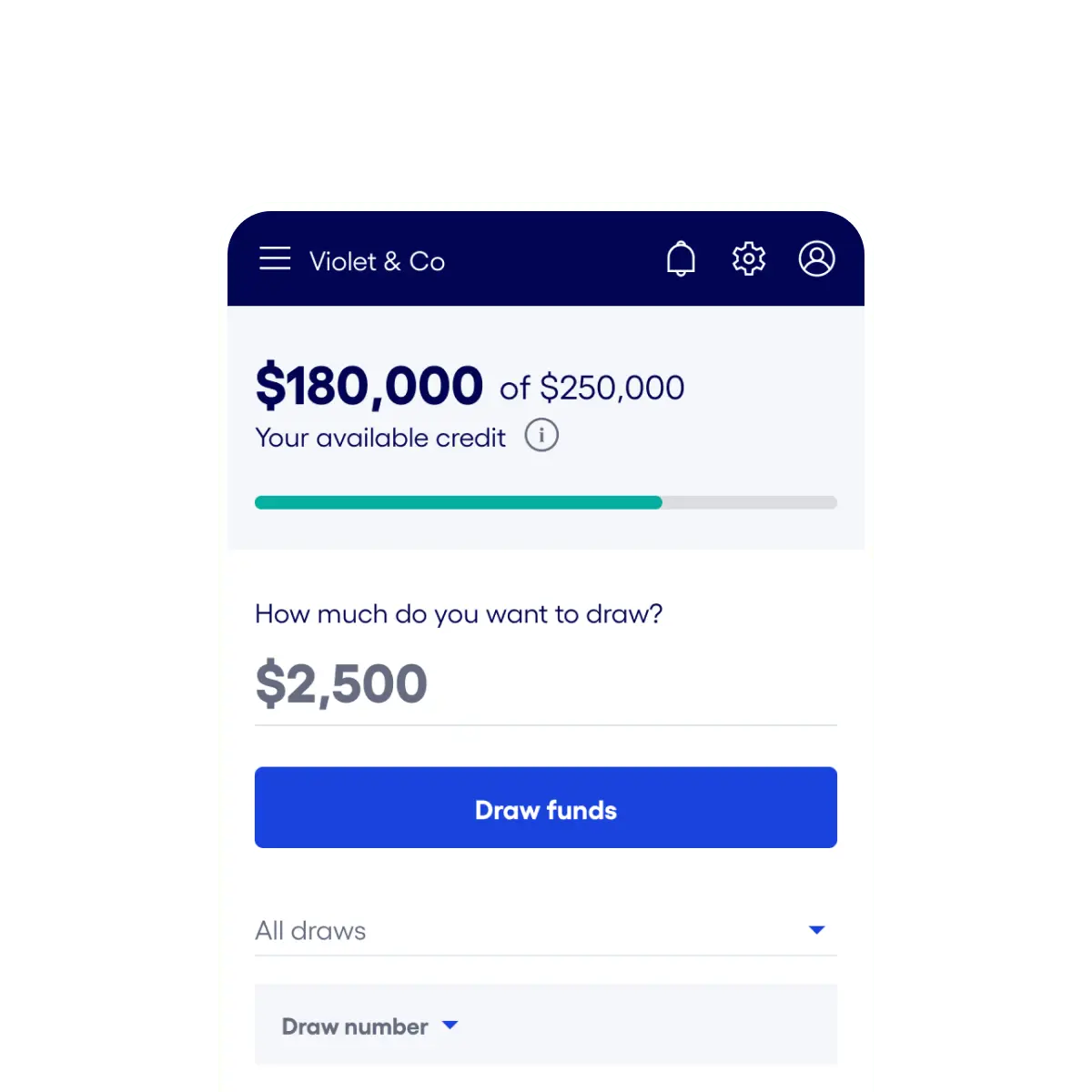

Access funds in a click

Request funds in a click, and see approved draws in your account in as fast as 24 hours—or instantly with a Bluevine Business Checking account.BVSUP-00008

Make automatic repayments

Repay automatically on a fixed schedule, plus make additional payments manually without prepayment fees. Your credit line replenishes as you make repayments.

Build business credit

We report repayment history to business credit bureaus which may help build your business credit as you make on time payments.

Business checking

that works with your

line of credit.

Enjoy even more exclusive benefits by pairing

your Bluevine Line of Credit with a Bluevine

Business Checking account, available when you

set up your account.

Discounted rates on your line

Instant access to approved draws

High-yield interest on your

checking balancesBVSUP-00118FDIC insurance up to $3MBVSUP-00108

Expert support when

you need it.

The personalized support you need is just a message or phone call away, with real people ready to help.

You can also explore self-guided resources any time in our Help Center.

Line of credit FAQs

A business line of credit gives you access to funding when you want it, up to your credit limit. Unlike traditional one-time loans, a Bluevine Line of Credit is “revolving credit,” meaning your available credit replenishes as you make repayments, so you can draw additional funds without having to fully re-apply. Though, all draws are subject to review and approval.BVSUP-00127

Once approved for a credit line, you can request funds directly from your Bluevine dashboard. We’ll deposit funds in your account as soon as a few hours, pending review and approval. Depending on which repayment plan you qualified for, we’ll automatically debit your account for weekly or monthly repayments. As you pay off your balance, the amount of available credit you can request automatically replenishes. Because your repayments are calculated with simple interest, you can save on interest when you pay early. We don’t charge early repayment fees.

You can apply for a Bluevine Line of Credit on our website. We’ll ask you for some basic information about you and your business. Once your application is submitted, you could get a decision in as little as five minutes.

Just make sure you meet these minimum qualifications:

- Just make sure you meet these minimum qualifications:

- $40,000 in monthly revenue

- 625+ personal FICO credit score

- In business for 24+ months

- Corporation or LLC

- No bankruptcies in the past year

- In good standing with your Secretary of State

- Business is operating or incorporated in an eligible U.S. state

- Ineligible states include: Nevada, North Dakota, South Dakota

- An active bank connection or statements from the last 3 months (a connected account makes it faster and easier to confirm your information).

It’s even easier to apply for a line of credit if you already have a Bluevine Business Checking account.

You can apply for a Bluevine Line of Credit as long as your business meets the minimum qualifications and does not operate in one of the following ineligible industries or states:

Ineligible industries

- Illegal gambling

- Pornography and paraphernalia

- Political campaigns

- Firearms and paraphernalia

- Other controlled substances (including medicinal marijuana, marijuana, cannabis, and hemp) and paraphernalia

- Financial institutions and lenders (including insurance, penny auction companies, and cryptocurrency)

- Auto dealerships

Ineligible states

- Nevada

- North Dakota

- South Dakota

- U.S. territories

Yes! If approved, your Bluevine Line of Credit comes with a complimentary Bluevine Business Checking account, which you'll be able to set up during onboarding. This allows you to conveniently manage your business checking account and line of credit from one easy-to-use dashboard. Plus, you can instantly access approved draws from your line of credit in your business checking account.

While applying and reviewing an offer will not impact your personal credit score, accepting an offer may result in a hard inquiry. Further, if you default on a Bluevine Line of Credit you may be subject to negative business reporting and personal credit reporting in your role as guarantor.

With funds in as fast as 24 hours, simple interest rates, and no prepayment penalties, a Bluevine Line of Credit lets you take advantage of growth opportunities early.BVSUP-00127

You could use a line of credit to cover payroll, hire full-time or seasonal employees as you need them, stock up on extra inventory during a sales rush, or buy materials or equipment for your next big project. You could also renovate your office, warehouse, or storefront, or lease a larger one. Learn how to make the most out of your line of credit.

Explore helpful guides.

Learn how to make the most of your Bluevine account with these in-depth product guides and resources.

Ready to apply for a

line of credit?

Submit your application in just a few minutes with no impact to your credit score.BVSUP-00008